The Simplest Dividend Strategy: Maximizing Your Returns

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's earnings distributed to those who own its stock. Unlike other investments like bonds, which offer fixed interest payments, dividend payouts can vary depending on the company's performance and its dividend policy. Dividend-paying stocks offer a potential for both capital appreciation (the increase in the stock's price) and regular income streams.

- How Dividends Work: Companies decide on a dividend payout per share, and this is distributed to shareholders of record on a specific date.

- Benefits of Dividend Investing:

- Passive Income: Regular cash flow from dividends can supplement your income.

- Potential for Capital Appreciation: The value of your dividend stocks can increase over time.

- Risks of Dividend Investing:

- Dividend Cuts: Companies can reduce or eliminate dividends if their financial situation deteriorates.

- Market Volatility: The price of dividend stocks fluctuates with the overall market.

Choosing the Right Dividend Stocks

Selecting high-quality dividend stocks is crucial for a successful strategy. Consider these factors:

- Dividend Yield: The annual dividend payment relative to the stock price (higher yield doesn't automatically mean better).

- Payout Ratio: The percentage of earnings paid out as dividends (a sustainable payout ratio is essential).

- Company Stability: Choose financially sound companies with a consistent history of dividend payments and strong earnings.

Researching company financials is paramount. Analyze financial statements, assess debt levels, and understand the company's business model and competitive landscape. Utilize online resources and stock screeners to filter stocks based on your criteria.

- Online Resources: Many websites offer free stock screeners and financial data.

- Types of Dividend Stocks:

- Blue-chip stocks: Established, large-cap companies with a history of consistent dividend payments.

- Growth stocks: Companies reinvesting heavily in growth, often paying smaller dividends.

- High-yield stocks: Offer higher dividend yields but may carry higher risk.

Building Your Simple Dividend Portfolio

Diversification is Key

Diversification is crucial to mitigate risk. Don't put all your eggs in one basket! Spread your investments across different sectors and industries to reduce the impact of any single company's underperformance.

- Sector Diversification: Invest in different sectors (technology, healthcare, consumer goods, etc.) to balance your portfolio.

- Risk Tolerance: Adjust your portfolio based on your risk tolerance. A more conservative approach involves fewer, more established companies.

The Power of Reinvestment (DRIP)

Dividend Reinvestment Plans (DRIPs) allow you to automatically reinvest your dividend payments to purchase more shares. This powerful strategy accelerates wealth building through compounding.

- Compounding Growth: Reinvesting dividends generates more dividends, creating a snowball effect.

- DRIP Benefits: Simplified investing, automatic purchasing of shares, and potential tax advantages in some cases.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market high.

- DCA and Market Risk: DCA helps to average out the cost of your investment over time.

- Practical Application: Invest a fixed amount each month or quarter into your chosen dividend stocks.

Monitoring and Managing Your Dividend Portfolio

Regularly Review Your Holdings

Regularly review your portfolio's performance. Track dividend payouts, monitor stock prices, and identify underperforming assets. Be prepared to adjust your portfolio based on changes in the market or your personal financial goals.

- Portfolio Tracking: Use online brokerage tools or spreadsheets to monitor your investments.

- Underperforming Stocks: Don't be afraid to sell underperforming stocks and reinvest in more promising opportunities.

Tax Implications of Dividend Income

Dividends are taxable income. Understanding the tax implications is vital for effective financial planning.

- Tax Rates: Dividend tax rates vary depending on your income bracket and the type of account.

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts like 401(k)s or IRAs to reduce your tax burden on dividend income.

- Professional Advice: Consult a tax advisor for personalized guidance on optimizing your tax strategy.

Conclusion

This simple dividend strategy emphasizes diversification, reinvestment through DRIPs, dollar-cost averaging, and consistent monitoring to maximize your returns. By carefully selecting dividend-paying stocks and employing these strategies, you can build a passive income stream and grow your wealth steadily over time. Remember, a well-planned approach to dividend investing is crucial for long-term financial success. Start building your own simple dividend portfolio today! Learn more about finding the best dividend stocks and optimizing your investment strategy for maximum returns. Successful dividend investing requires research, patience, and a long-term perspective.

Featured Posts

-

Is Young Thugs Back Outside Album Finally Dropping Soon

May 10, 2025

Is Young Thugs Back Outside Album Finally Dropping Soon

May 10, 2025 -

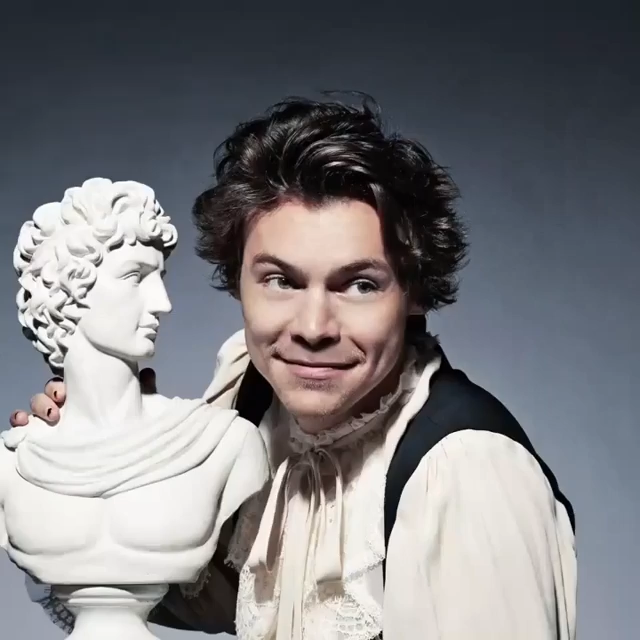

Harry Styles Response To A Subpar Snl Impression

May 10, 2025

Harry Styles Response To A Subpar Snl Impression

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025 -

Presidential Politics 2025 Examining The Trump Administrations Day 109 May 8th

May 10, 2025

Presidential Politics 2025 Examining The Trump Administrations Day 109 May 8th

May 10, 2025