The Simplest Dividend Strategy: Your Path To Maximum Profit

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's earnings distributed to those who own its stock. Understanding dividends is crucial for implementing the simplest dividend strategy.

- Cash Dividends: The most common type, paid directly into your brokerage account.

- Stock Dividends: Instead of cash, you receive additional shares of the company's stock.

- Dividend Yield: Calculated as (Annual Dividend per Share / Stock Price) x 100%. This indicates the percentage return you receive annually based on the current stock price.

- Ex-Dividend Date: The date on or after which you must own the stock to receive the upcoming dividend payment.

Choosing Dividend-Paying Stocks

Selecting the right dividend-paying stocks is vital for the success of your simplest dividend strategy. Focus on companies with a proven track record of consistent payouts and strong financial health.

- Consistent Dividend History: Look for companies with a long history of paying dividends, ideally increasing them over time.

- Strong Financial Health: Analyze companies with low debt levels, high profitability, and a sustainable dividend payout ratio (the percentage of earnings paid out as dividends). Avoid companies with high debt that may jeopardize future dividend payments.

- High-Yield Dividend Stocks: While attractive, ensure high yields are sustainable and not a sign of underlying financial weakness.

- Reliable Dividend Stocks: Prioritize established, reputable companies with a consistent history of delivering on their dividend commitments.

The Simplest Dividend Strategy: A Step-by-Step Guide

This section details the simplest dividend strategy, a practical approach for building long-term wealth.

Step 1: Define Your Investment Goals and Risk Tolerance

Before investing, clearly define your financial goals and risk tolerance.

- Short-Term Goals: Supplemental income, a down payment on a house.

- Long-Term Goals: Retirement income, building generational wealth.

- Risk Tolerance: How much volatility are you comfortable with? Conservative investors may prefer established, large-cap companies with a stable dividend history. More aggressive investors might consider higher-yield, but potentially riskier, stocks.

- Diversification: A crucial component of any investment strategy, diversification helps to mitigate risk by spreading investments across various sectors and asset classes.

Step 2: Diversify Your Portfolio

Diversification is key to mitigating risk within the simplest dividend strategy.

- Multiple Stocks: Don't put all your eggs in one basket. Spread your investments across different companies and sectors.

- Dividend Portfolio Diversification: Consider investing in various sectors (technology, healthcare, consumer staples, etc.) to reduce the impact of any single sector's underperformance.

- ETFs and Mutual Funds: These offer instant diversification by investing in a basket of stocks, making it easier to implement a diversified dividend portfolio.

Step 3: Reinvest Dividends (DRIP)

A dividend reinvestment plan (DRIP) allows you to automatically reinvest your dividend payments into additional shares of the same company.

- How DRIPs Work: Your brokerage will use your dividends to purchase additional shares, often at a discounted price.

- Dividend Reinvestment Plan: This automated process eliminates the need for manual reinvestment and accelerates wealth growth.

- DRIP Investing: This strategy leverages the power of compounding, where your earnings generate more earnings over time.

- Long-Term Wealth Building: DRIP investing is a powerful tool for long-term wealth accumulation.

Step 4: Monitor and Rebalance

Regularly review your portfolio's performance and adjust your holdings as needed.

- Tracking Dividend Payments: Keep track of your dividend income to monitor the performance of your investments.

- Portfolio Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation and risk level. This involves selling some of your better-performing stocks and buying more of those that have underperformed.

- Dividend Portfolio Management: This ongoing process ensures your investment strategy remains aligned with your goals and risk tolerance.

Maximizing Profits with Your Simplest Dividend Strategy

Tax Implications of Dividend Income

Understanding the tax implications of dividend income is crucial for maximizing your profits.

- Qualified vs. Non-Qualified Dividends: Qualified dividends are taxed at lower rates than ordinary income.

- Tax Rates: Tax rates on dividend income vary depending on your income bracket and the type of dividend received.

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts like Roth IRAs to reduce your tax burden on dividend income.

Long-Term Growth vs. Short-Term Gains

Dividend investing is a long-term strategy.

- The Power of Compounding: Reinvesting dividends over the long term amplifies your returns exponentially.

- Avoiding Emotional Decision-Making: Don't panic-sell during market downturns. Stay invested for the long haul.

- Patience: Successful dividend investing requires patience and discipline.

Utilizing Dividend Growth Stocks

Dividend growth stocks offer the potential for enhanced returns.

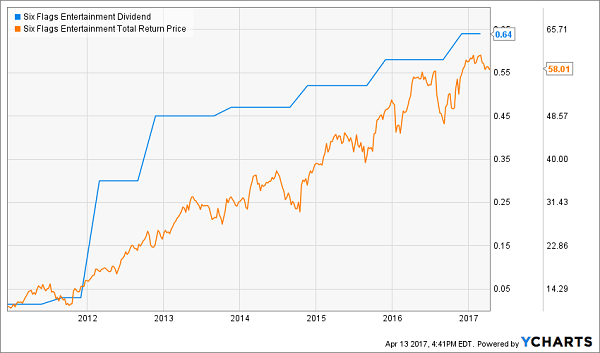

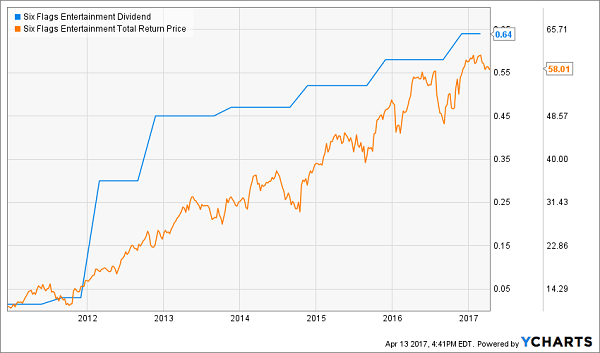

- Companies that Consistently Increase Dividends: Investing in companies with a history of consistently increasing their dividend payments can lead to significant long-term growth.

Conclusion

The simplest dividend strategy involves defining your goals, diversifying your portfolio, reinvesting dividends (DRIP), and regularly monitoring and rebalancing your holdings. This approach offers several key benefits: passive income, long-term growth, and relative simplicity. By focusing on consistent dividend payments, strong financial health, and disciplined reinvestment, you can build significant wealth over time. Start building your wealth today with the simplest dividend strategy! Begin researching high-yield dividend stocks and create your diversified portfolio.

Featured Posts

-

Coachella 2025 Tyla Addresses Britney Spears Outfit Inspiration Claims

May 11, 2025

Coachella 2025 Tyla Addresses Britney Spears Outfit Inspiration Claims

May 11, 2025 -

Prins Andrew Onthullingen Over Contacten Met Chinese Spion En Xi Jinping

May 11, 2025

Prins Andrew Onthullingen Over Contacten Met Chinese Spion En Xi Jinping

May 11, 2025 -

Stevenson Already Planning For Next Ipswich Town Season

May 11, 2025

Stevenson Already Planning For Next Ipswich Town Season

May 11, 2025 -

Jay Kelly I Nea Komodia Me Toys Kloynei Kai Santler

May 11, 2025

Jay Kelly I Nea Komodia Me Toys Kloynei Kai Santler

May 11, 2025 -

Henry Cavill Addresses James Bond Speculation A Cryptic Update

May 11, 2025

Henry Cavill Addresses James Bond Speculation A Cryptic Update

May 11, 2025