The Steepening Yield Curve In Japan: Implications For Investors And Economic Policy

Table of Contents

Understanding the Steepening Yield Curve in Japan

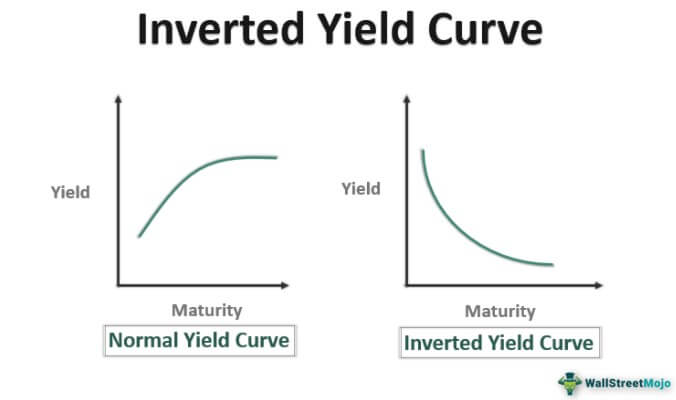

A yield curve graphically represents the relationship between the interest rates (or yields) and the time to maturity of debt securities with the same credit quality. It's a crucial indicator of economic health and future interest rate expectations. A steepening yield curve signifies a growing difference between short-term and long-term interest rates. In Japan, this trend has become increasingly prominent in recent months, impacting the Japanese Government Bonds (JGBs) market significantly.

The recent steepening trend in Japan's yield curve is primarily due to a combination of factors. We've seen a gradual increase in inflation expectations, departing from the prolonged deflationary environment Japan previously experienced. Furthermore, the Bank of Japan (BOJ)'s adjustments to its monetary policy, including subtle shifts away from its yield curve control (YCC) policy, have played a pivotal role. Global interest rate hikes by major central banks, such as the Federal Reserve, have also exerted upward pressure on Japanese long-term interest rates, contributing to the interest rate differential. Finally, increased demand for long-term bonds from both domestic and international investors has further fueled this trend.

- Factors contributing to the steepening:

- Increased inflation expectations

- Bank of Japan (BOJ) policy adjustments (gradual shift away from YCC)

- Global interest rate hikes

- Increased demand for long-term Japanese Government Bonds (JGBs)

Visualizing this evolution requires examining data from sources such as the Ministry of Finance (MOF) and the Bank of Japan. A comparison with yield curves in other developed economies, such as the United States and Germany, reveals a divergence, highlighting the unique dynamics at play in the Japanese bond market.

Implications for Investors

Bond Market Strategies

The steepening yield curve significantly impacts JGB returns for investors with varying investment horizons. Short-term bond holders might see lower returns compared to longer-term investors, who benefit from the higher yields on longer-maturity bonds. This presents both opportunities and risks in the fixed income space.

-

Strategies for capitalizing on the steepening curve:

- Barbell strategy: Investing in both short-term and long-term JGBs to balance risk and return.

- Laddered portfolio: Diversifying across maturities to reduce interest rate risk.

-

Potential challenges:

- Increased volatility in bond prices due to fluctuating interest rates. Careful risk management is essential.

- The need for diversification within the fixed-income portfolio to mitigate risk.

Equity Market Effects

A steepening yield curve influences corporate borrowing costs and, consequently, equity valuations. Higher long-term interest rates translate to increased borrowing costs for Japanese companies, potentially impacting corporate earnings and impacting stock market valuations. This effect varies across different sectors.

-

Impact on different sectors:

- Sectors heavily reliant on debt financing might face reduced profitability.

- Companies with strong balance sheets and high cash reserves could be better positioned.

-

Potential effects on the stock market:

- Relationship between interest rates and company profitability will be crucial in determining stock valuations.

- Potential for higher equity risk premiums as investors demand higher returns for increased risk.

Implications for Economic Policy

The Bank of Japan's Response

The BOJ's recent policy decisions, particularly the subtle adjustments to its yield curve control (YCC) policy, have directly influenced the steepening yield curve. The BOJ faces a significant challenge in balancing its inflation control objectives with the need to maintain economic growth. The effectiveness of its interventions in managing the yield curve and inflation remains a subject of ongoing debate.

- Challenges for the BOJ:

- Balancing inflation control with economic growth.

- Managing expectations in the bond market.

- Potential for future policy adjustments depending on economic data.

Fiscal Policy Considerations

The steepening yield curve impacts Japan's government debt and fiscal sustainability. Higher long-term interest rates increase the government's borrowing costs, potentially exacerbating its already substantial fiscal deficit. The government needs to consider various options to manage its borrowing costs and ensure fiscal sustainability.

- Challenges for fiscal policy:

- Increased borrowing costs for the government.

- Potential need for fiscal reforms to address the growing debt burden.

- Long-term implications for Japan's sovereign debt and credit rating.

Conclusion

The steepening yield curve in Japan presents a complex interplay of factors impacting investors and economic policy. Understanding the nuances of this trend is crucial for navigating the evolving Japanese financial landscape. Investors must adapt their strategies to capitalize on opportunities while mitigating risks associated with increased volatility. Meanwhile, policymakers face the challenge of balancing inflation control with sustainable economic growth. Staying informed on the developments surrounding the steepening yield curve in Japan is essential for making informed investment decisions and comprehending the country's evolving economic trajectory. Further research into the intricacies of Japanese monetary policy and its impact on Japanese Government Bonds will provide a more comprehensive perspective.

Featured Posts

-

Florida School Safety Lockdown Protocols And The Experiences Of Multiple Generations

May 17, 2025

Florida School Safety Lockdown Protocols And The Experiences Of Multiple Generations

May 17, 2025 -

Addressing The Rift Thibodeau And Bridges On Recent Contrasting Opinions

May 17, 2025

Addressing The Rift Thibodeau And Bridges On Recent Contrasting Opinions

May 17, 2025 -

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025 -

Angel Reese Wnba Players Deserve Higher Pay Strike Possible

May 17, 2025

Angel Reese Wnba Players Deserve Higher Pay Strike Possible

May 17, 2025 -

Konkurentsiya V Industrialnykh Parkakh Vyzovy I Vozmozhnosti

May 17, 2025

Konkurentsiya V Industrialnykh Parkakh Vyzovy I Vozmozhnosti

May 17, 2025

Latest Posts

-

Elaekeyhtioeiden Osakesijoitusten Heikko Alkuvuosi

May 17, 2025

Elaekeyhtioeiden Osakesijoitusten Heikko Alkuvuosi

May 17, 2025 -

Alkuvuoden Osakesijoitukset Painoivat Elaekeyhtioeitae

May 17, 2025

Alkuvuoden Osakesijoitukset Painoivat Elaekeyhtioeitae

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitukset Alkuvuosi Toi Tappioita

May 17, 2025

Elaekeyhtioeiden Osakesijoitukset Alkuvuosi Toi Tappioita

May 17, 2025 -

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitukset Tappiolla Alkuvuonna

May 17, 2025

Elaekeyhtioeiden Osakesijoitukset Tappiolla Alkuvuonna

May 17, 2025