The $TRUMP Coin Short Seller: A White House Dinner Story

Table of Contents

The Genesis of the $TRUMP Coin

Trump's Cryptocurrency Entry

The launch of $TRUMP Coin sent shockwaves through the cryptocurrency market. Fueled by the immense name recognition of Donald Trump and the fervent support of his followers, the Initial Coin Offering (ICO) was a phenomenon. Early investors, drawn by the promise of quick riches, piled in, driving the price to dizzying heights. News outlets touted it as the next big thing, further fueling the hype.

- Initial Coin Offering (ICO) details (fictional): The $TRUMP Coin ICO raised a staggering $1 billion in its first 24 hours, promising investors a share in a new social media platform and exclusive access to Trump-branded merchandise.

- Early market hype and price surges: Within weeks, the price of $TRUMP Coin surged by over 500%, attracting both seasoned investors and enthusiastic retail traders.

- Regulatory uncertainty surrounding the coin: However, the lack of clear regulatory oversight surrounding the coin raised concerns among financial experts, who warned of potential scams and market manipulation.

Identifying the Risk

While the potential for profit was undeniable, the inherent risks associated with $TRUMP Coin were equally significant. Its price was intrinsically linked to the unpredictable actions and public image of Donald Trump, making it a highly volatile and speculative investment.

- Price manipulation possibilities: The concentrated ownership of the coin and the potential for Trump's pronouncements to significantly impact its value raised concerns about price manipulation.

- Lack of transparency and potential scams: The lack of transparency surrounding the project's development and the potential for fraudulent activities presented a major risk to investors.

- Dependence on Trump's public image and political actions: Any negative news or controversial statements made by Trump could trigger a significant price drop, potentially wiping out investors' holdings.

The Short Seller's Strategy

The Short Sell Decision

Our protagonist, recognizing the inherent risks and volatility, decided to employ a high-risk, high-reward strategy: short selling $TRUMP Coin. This involved borrowing the coin, selling it at the current market price, and hoping to buy it back at a lower price in the future, pocketing the difference.

- Borrowing the coin and selling it at the current market price: He secured a loan of a substantial number of $TRUMP Coins from a brokerage firm, immediately selling them at the prevailing high price.

- Buying it back at a lower price to return it, pocketing the difference: His strategy hinged on the belief that the coin's price would eventually fall due to its inherent volatility and the risks outlined above.

- Leverage and margin calls—exploring the amplified risks and rewards: To maximize potential profits, he used leverage, amplifying both his potential gains and his exposure to losses. This also meant facing the threat of margin calls if the price moved against him.

Hedging Strategies

Aware of the significant risks, the short seller implemented several hedging strategies to mitigate potential losses:

- Diversification across different asset classes: He spread his investments across various asset classes, including stocks, bonds, and other cryptocurrencies, to reduce his overall risk.

- Use of stop-loss orders to limit potential losses: He set stop-loss orders to automatically sell his short position if the price of $TRUMP Coin rose above a certain threshold, preventing potentially catastrophic losses.

- Monitoring market sentiment and news related to Trump and the cryptocurrency: He closely monitored news related to Trump, market sentiment towards $TRUMP Coin, and overall cryptocurrency market trends to anticipate potential price movements.

The White House Dinner and its Implications

The Unexpected Twist

The unexpected twist arrived during a high-profile White House dinner. Our protagonist found himself seated next to a key advisor to the former President, involved in the creation and promotion of $TRUMP Coin. A casual conversation revealed previously unknown details about a significant upcoming announcement related to the coin – an announcement that would boost its value dramatically.

- A conversation with a key figure influencing the coin's price: The conversation, seemingly innocent at first, offered a glimpse into the inner workings of the $TRUMP Coin project and hinted at a surprising development.

- Revelation of insider information (fictional): The advisor inadvertently revealed information about a planned partnership with a major tech company, a fact that would undoubtedly send the price of $TRUMP Coin skyrocketing.

- A sudden shift in market sentiment: The short seller immediately understood the implications: his carefully calculated short position was now facing a massive threat.

Navigating the Market Volatility

Faced with this unexpected development, the short seller had to act fast. The information he’d received was highly sensitive and could have severe legal implications if he acted on it improperly. He had to navigate the treacherous waters of the market with his short position now threatened.

- Adjusting their position based on new information: He partially covered his short position, limiting his potential losses but also sacrificing potential profits if the price ultimately did fall.

- Managing margin calls and potential losses: He braced himself for the inevitable margin calls as the price of $TRUMP Coin surged, needing to quickly provide more collateral to maintain his position.

- The emotional toll of high-stakes investing: The stress of managing a high-risk investment, coupled with the pressure of navigating this unexpected turn of events, took a significant toll on him.

Conclusion

This fictional account of a $TRUMP Coin short seller illustrates the incredible risks and rewards—and the unpredictable nature—of investing in cryptocurrencies, especially those associated with high-profile figures. The story highlights the importance of thorough research, risk management, and a clear understanding of the market before engaging in high-stakes trading. The unpredictable nature of the $TRUMP Coin market, amplified by the involvement of a polarizing public figure, underscores the crucial need for caution. Before investing in $TRUMP Coin or any other cryptocurrency, understand the risks associated with short selling and consider the volatility of the $TRUMP Coin market. Remember, high-risk investments can lead to significant losses. Proceed with caution.

Featured Posts

-

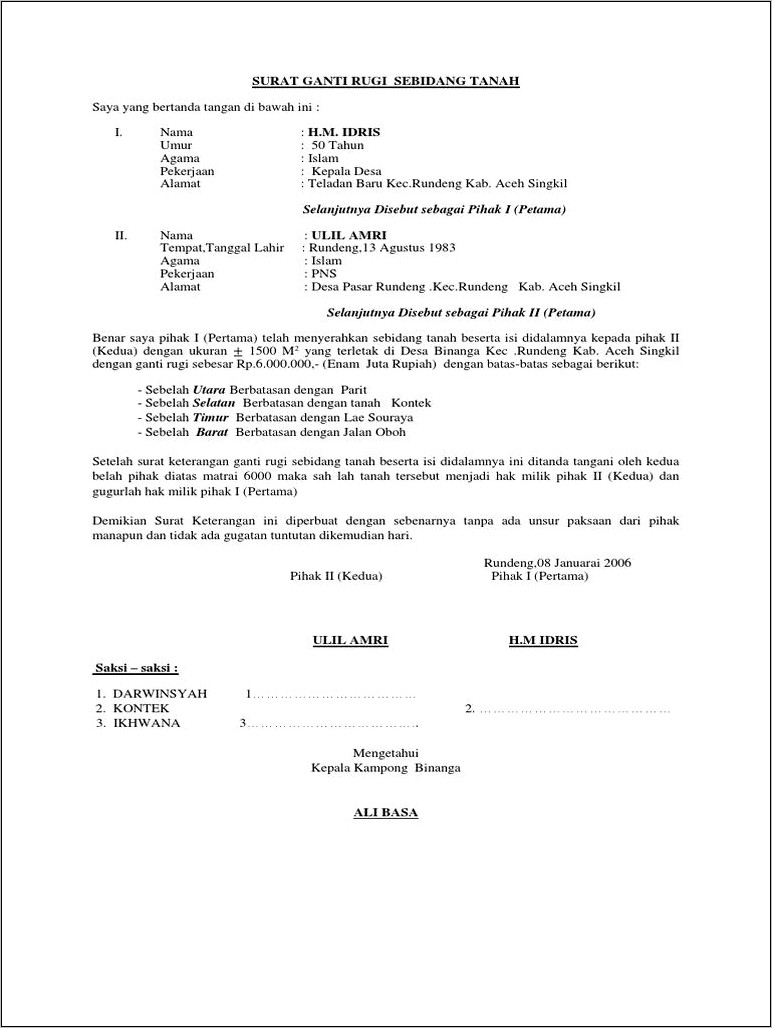

Kasus Hukum Nft Nike Pembeli Menuntut Ganti Rugi Rp 84 Miliar

May 29, 2025

Kasus Hukum Nft Nike Pembeli Menuntut Ganti Rugi Rp 84 Miliar

May 29, 2025 -

Downtown Pcc Reopening As A Reimagined Corner Store

May 29, 2025

Downtown Pcc Reopening As A Reimagined Corner Store

May 29, 2025 -

Canadas Economic Sovereignty Strategies To Reduce U S Investment Dominance

May 29, 2025

Canadas Economic Sovereignty Strategies To Reduce U S Investment Dominance

May 29, 2025 -

Bandung Hujan Hingga Sore Prakiraan Cuaca Jawa Barat 23 April

May 29, 2025

Bandung Hujan Hingga Sore Prakiraan Cuaca Jawa Barat 23 April

May 29, 2025 -

Space X Starship Flight 9 Launch Go Ahead Public Safety Precautions In Place

May 29, 2025

Space X Starship Flight 9 Launch Go Ahead Public Safety Precautions In Place

May 29, 2025

Latest Posts

-

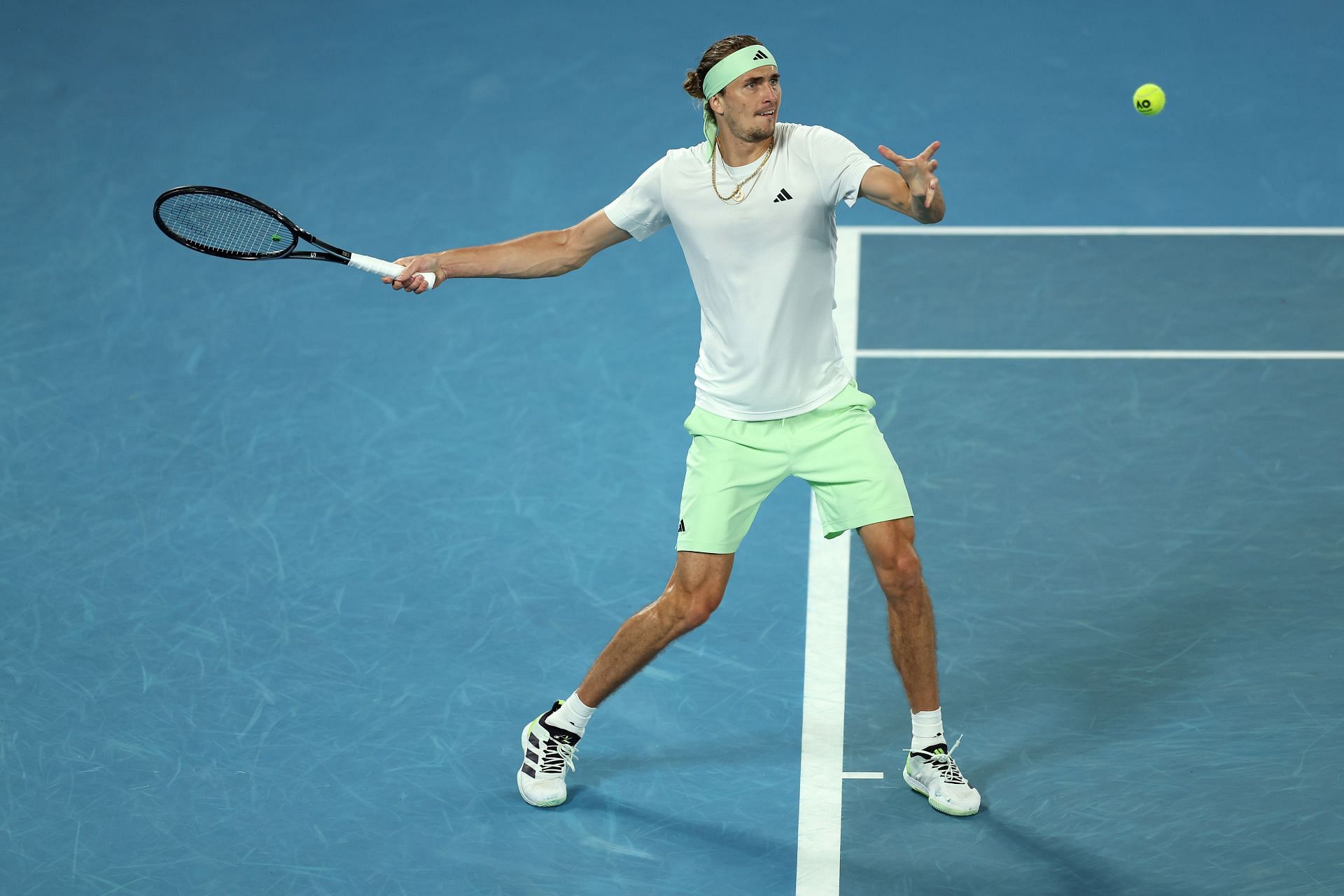

Zverevs Indian Wells Loss A Griekspoor Masterclass

May 31, 2025

Zverevs Indian Wells Loss A Griekspoor Masterclass

May 31, 2025 -

Upset In The Desert Griekspoor Defeats Top Seeded Zverev At Indian Wells

May 31, 2025

Upset In The Desert Griekspoor Defeats Top Seeded Zverev At Indian Wells

May 31, 2025 -

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025 -

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025 -

Indian Wells 2024 Zverevs Early Exit After Griekspoor Defeat

May 31, 2025

Indian Wells 2024 Zverevs Early Exit After Griekspoor Defeat

May 31, 2025