The Trump Tariff Effect: How It Changed The Landscape For Fintech IPOs Like Affirm Holdings (AFRM)

Table of Contents

The Trump administration's imposition of tariffs on imported goods sent shockwaves through the global economy, significantly impacting various sectors. This period of trade war and uncertainty created a complex and challenging environment, particularly for companies planning Initial Public Offerings (IPOs). The Fintech sector, with its reliance on global supply chains and sensitive response to economic shifts, felt these effects acutely. This article will examine how the Trump tariff effect reshaped the Fintech IPO landscape, focusing on Affirm Holdings (AFRM) as a prominent case study. We'll explore both the direct and indirect impacts of these tariffs, highlighting the complexities and uncertainties surrounding the IPO process during this turbulent period.

The Direct Impact of Tariffs on Fintech Supply Chains

The Trump tariffs directly increased costs for Fintech companies like Affirm in several ways.

Increased Input Costs

Tariffs on imported components had a direct impact on the bottom line for Fintech firms. These increased input costs threatened profitability and potentially delayed IPO plans.

- Examples of affected components: Many Fintech companies rely heavily on imported electronics for servers, data centers, and other hardware infrastructure. Software licenses and cloud services, often sourced internationally, were also affected. For Affirm, this could have included components for their payment processing systems or server infrastructure.

- Quantification of cost increases: While precise figures for Affirm are unavailable publicly, research indicates that tariffs in certain sectors increased input costs by 10-25% or more, depending on the product and origin. This added significant pressure on profit margins.

- Impact on Affirm's business model: Increased costs forced Affirm to either absorb the higher expenses, potentially reducing profitability, or pass them on to consumers, potentially reducing demand for their buy-now-pay-later services. This pressure on margins could also affect their valuation during the IPO process.

Disruption of Global Partnerships

The imposition of tariffs disrupted international collaborations and partnerships integral to Fintech expansion. These disruptions had the potential to delay or even prevent some IPOs.

- Examples of affected partnerships (relating to Affirm): While specific examples concerning Affirm's partnerships impacted by tariffs are not publicly available, the disruption to global supply chains and increased uncertainty could certainly have impacted negotiations and collaborations.

- Impact on international operations: Tariffs created uncertainty for companies considering international expansion, making strategic planning and forecasting more challenging. This uncertainty could lead to delays in IPOs.

- Impact on access to capital and talent: The trade war created uncertainty in the global financial markets, impacting access to capital for Fintech startups. It could also affect talent acquisition, as uncertainty might deter skilled professionals from joining firms.

The Indirect Impact of Tariffs on the Broader Economic Environment

Beyond direct supply chain impacts, the Trump tariffs had far-reaching indirect consequences that influenced the Fintech IPO market.

Inflationary Pressures

The tariffs contributed significantly to inflationary pressures, affecting investor sentiment and the appeal of Fintech IPOs.

- Correlation between tariffs and inflation: Economists widely agree that tariffs increase the cost of goods and services, contributing to inflation. The trade war exacerbated existing inflationary pressures.

- Investor reaction to inflation: High inflation erodes investor confidence, making them less willing to invest in riskier ventures, including many Fintech IPOs. Investors seek higher returns to compensate for the devaluation of their investments due to inflation.

- Impact on investment decisions regarding Affirm: The inflationary environment during the period leading up to Affirm's IPO likely made investors more cautious, potentially influencing their investment decisions and the final valuation of Affirm.

Interest Rate Volatility

The trade war and resulting economic uncertainty influenced interest rate volatility, affecting the cost of borrowing for Fintech companies and impacting IPO valuations.

- Relationship between tariffs, economic uncertainty, and interest rates: Economic uncertainty resulting from trade wars can trigger changes in interest rates as central banks try to manage inflation and economic growth.

- Impact on Affirm's IPO timing and pricing: Interest rate fluctuations likely impacted Affirm’s decision on the timing of its IPO and the pricing of its shares. Higher interest rates increase the cost of borrowing, making it more expensive for companies to finance operations.

- Impact on investor risk appetite: Rising interest rates can reduce investor risk appetite, making them less willing to invest in higher-risk ventures like many Fintech IPOs.

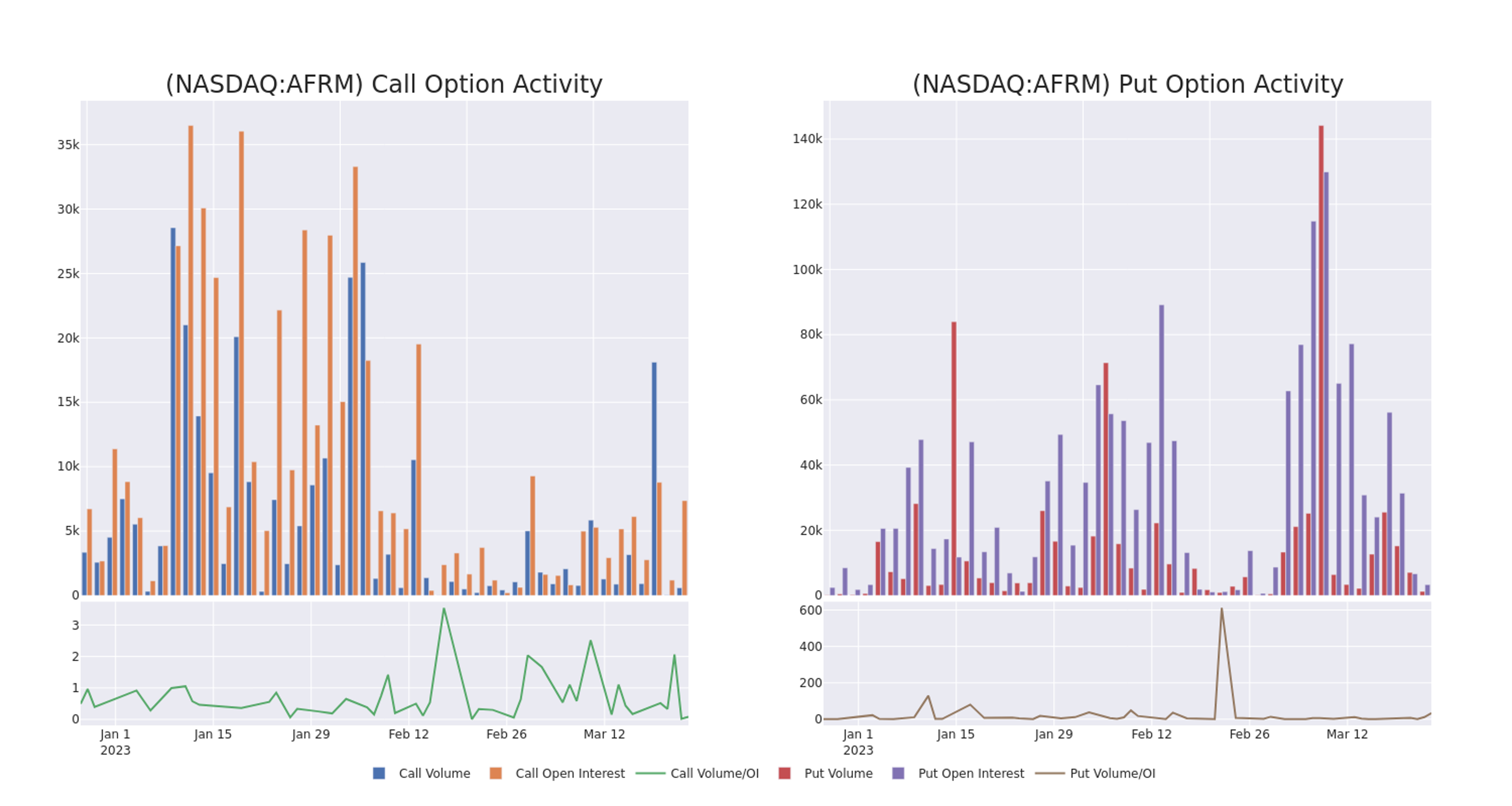

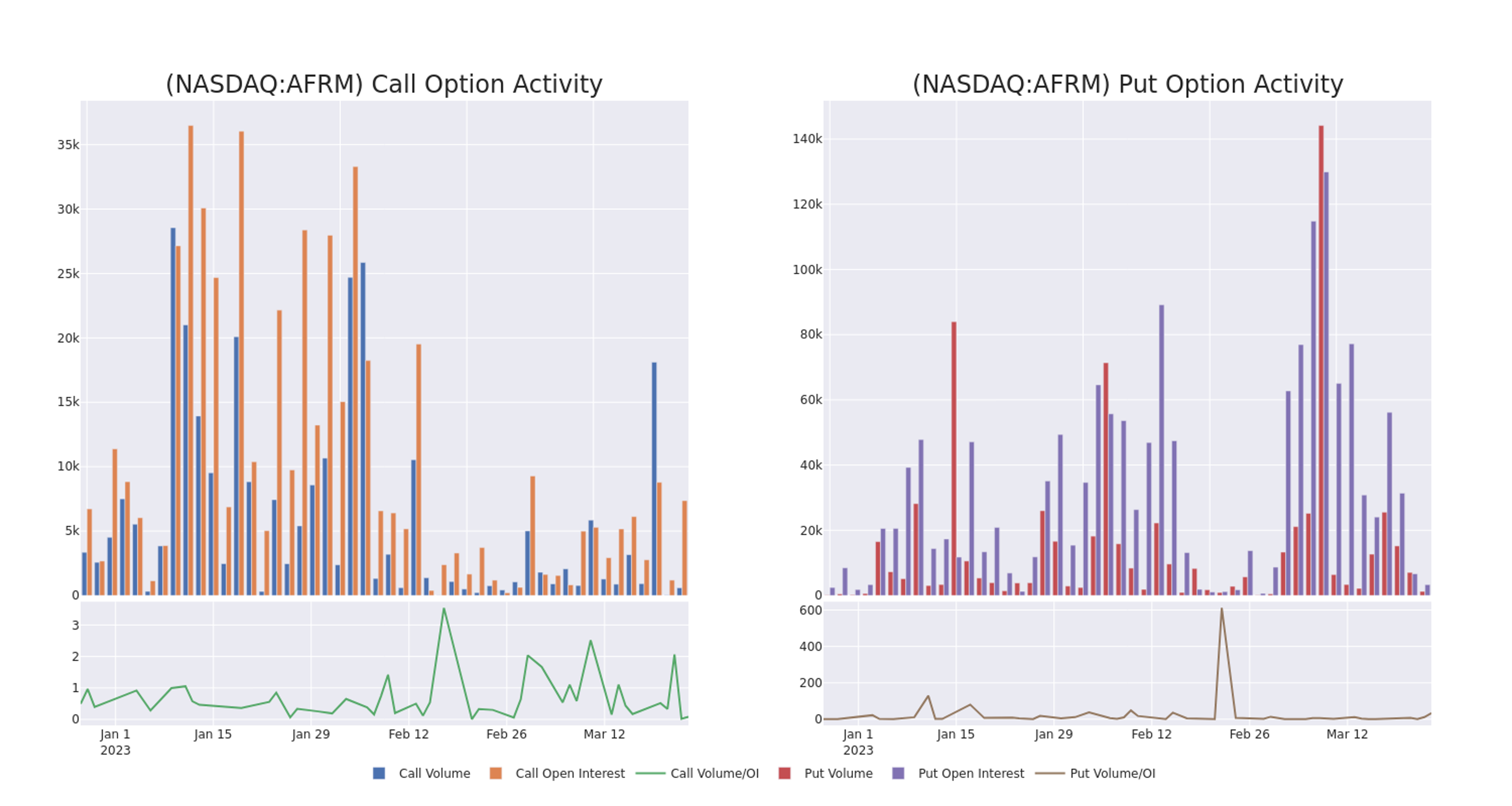

Investor Sentiment and Market Volatility

The overall uncertainty generated by the tariffs significantly impacted investor confidence and the IPO market's performance. This impacted the success and pricing of Fintech IPOs.

- IPO activity during the period: Data from reputable sources (e.g., the SEC EDGAR database) show a decrease in IPO activity in some sectors during periods of high market uncertainty caused by the trade war.

- Performance of other Fintech IPOs: Other Fintech IPOs during this period may have experienced delayed launches or lower valuations due to the market uncertainty. A comparison of their performance to pre-tariff IPOs would be insightful.

- Challenges Affirm faced in this volatile market: Affirm likely faced challenges in attracting investors and securing the desired valuation in a market marked by uncertainty and volatility caused by the tariffs.

Case Study: Affirm Holdings (AFRM) and the Trump Tariff Effect

Analyzing how the Trump tariffs specifically affected Affirm provides a valuable lens for understanding the broader Fintech IPO landscape.

Specific Impacts on Affirm's Business

While precise details of the impact on Affirm are not publicly known in detail, we can infer the effects based on broader trends.

- Detailed examples of specific challenges: Challenges likely included increased costs for hardware, software, and cloud services; difficulties in securing international partnerships; and the need to adjust pricing strategies to offset increased costs.

- How Affirm adapted its strategies: Affirm likely adapted by focusing on cost optimization, negotiating contracts with suppliers, and adjusting its pricing strategies. They may also have prioritized domestic partnerships to mitigate risks associated with the tariff policies.

- Evaluation of the overall success or impact on Affirm's post-IPO performance: While the post-IPO performance of Affirm is a complex issue affected by many factors beyond tariffs, analyzing its performance relative to other Fintech IPOs during the same period could offer insights into the impact of the tariffs.

Conclusion

The Trump tariffs created a complex and challenging environment for Fintech IPOs. The direct impact on supply chains through increased input costs and disrupted partnerships, combined with the indirect effects of inflation, interest rate volatility, and reduced investor confidence, significantly shaped the IPO landscape. Affirm Holdings (AFRM), as a case study, exemplifies the hurdles Fintech companies faced during this period. Understanding the lasting effects of the Trump Tariffs on Fintech IPOs like Affirm is crucial for navigating the complexities of the current market. Learn more about how geopolitical events shape the success of Fintech IPOs by researching the impact of trade policies on other Fintech companies and the broader IPO market. Further analysis of similar cases and ongoing market trends will provide a deeper understanding of these important dynamics.

Featured Posts

-

Eurovision 2025 Former Contestants Demand Israels Exclusion

May 14, 2025

Eurovision 2025 Former Contestants Demand Israels Exclusion

May 14, 2025 -

Wynonna And Ashley Judd Open Up About Family In Powerful Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up About Family In Powerful Docuseries

May 14, 2025 -

Voici Les Titres Seo Optimises

May 14, 2025

Voici Les Titres Seo Optimises

May 14, 2025 -

Wta Austin Open Peyton Stearns Upset Exit

May 14, 2025

Wta Austin Open Peyton Stearns Upset Exit

May 14, 2025 -

Fa Cup Forest And Fulhams Nigerian Players Return

May 14, 2025

Fa Cup Forest And Fulhams Nigerian Players Return

May 14, 2025