The U.S. Economy And The Rollback Of Tariffs On Chinese Goods

Table of Contents

Impact on Consumer Prices

The rollback of tariffs on Chinese goods is expected to have a direct impact on consumer prices, influencing purchasing power and overall economic activity.

Reduced Costs for Consumers

The most immediate effect of the tariff reduction is likely to be lower prices for a wide range of consumer goods.

- Decreased prices on electronics, clothing, and household items: Consumers can expect to see savings on everyday purchases, from smartphones and laptops to clothing and home furnishings. The magnitude of these savings will vary depending on the specific product and the extent of the tariff reduction.

- Increased consumer spending power and potential boost to retail sales: With more disposable income, consumers may increase spending on other goods and services, potentially stimulating economic growth and boosting retail sales. This increased consumer confidence could have a positive ripple effect throughout the economy.

- Analysis of specific product categories affected by tariff reductions: A detailed analysis of tariff reductions across different product categories reveals varying degrees of impact. For instance, the impact on the price of furniture imported from China might be more substantial than that on certain types of electronics.

Inflationary Pressures and the Federal Reserve

While lower prices are generally beneficial, the impact on overall inflation needs careful consideration. The rollback of tariffs could influence the Federal Reserve's monetary policy decisions.

- Discussion of the interplay between tariff reductions, inflation, and interest rates: Lower import prices could contribute to lower inflation, potentially giving the Federal Reserve more flexibility in its monetary policy. However, other economic factors could offset this effect.

- Analysis of the Federal Reserve's response to changing economic conditions: The Federal Reserve closely monitors inflation and adjusts interest rates accordingly. The impact of the tariff rollback on inflation will be a key factor in their decision-making.

- Potential for unexpected inflationary effects due to other economic factors: It's crucial to remember that inflation is a complex phenomenon influenced by numerous factors beyond tariff reductions. Supply chain disruptions, energy prices, and other economic conditions can also impact inflation.

Effects on U.S. Businesses

The rollback of tariffs on Chinese goods creates a complex situation for U.S. businesses, impacting both importers and domestic manufacturers.

Increased Competitiveness for Importers

Companies importing Chinese goods are likely to see improved profitability margins due to the reduced tariff burden.

- Case studies of specific businesses benefiting from tariff reductions: Analyzing specific businesses that heavily rely on Chinese imports can reveal the extent of the positive impact of tariff rollbacks on their profitability and competitiveness.

- Analysis of the competitive landscape and impact on market share: This change could lead to a reshuffling of market share, with importers gaining a competitive edge over domestic manufacturers.

- Potential for increased investment and job creation in import-related sectors: Increased profitability may lead to increased investments in import-related sectors, potentially creating jobs in logistics, distribution, and retail.

Challenges for Domestic Manufacturers

Domestic producers of goods that compete with Chinese imports may face increased competition due to lower prices.

- Examination of the challenges faced by U.S. manufacturers: Domestic manufacturers will need to adapt to compete with lower-priced imports. This may involve innovations, cost reductions, or a shift in focus towards specialized products.

- Discussion of strategies for domestic manufacturers to maintain competitiveness: Strategies may include improving efficiency, focusing on higher-value products, or seeking government support.

- Potential government support programs for domestic industries: Government policies aimed at supporting domestic manufacturers, such as tax incentives or investment subsidies, could play a vital role in mitigating the negative effects of the tariff rollback.

Geopolitical Implications

The rollback of tariffs on Chinese goods has significant geopolitical implications, impacting the U.S.-China relationship and broader global trade.

US-China Trade Relations

The tariff adjustment signals a potential shift in the trade relationship between the U.S. and China, potentially indicating a move towards de-escalation.

- Analysis of the broader geopolitical implications of this policy change: The change could be seen as a step towards improved trade relations between the two economic superpowers.

- Discussion of potential future trade negotiations and agreements: This move may pave the way for future negotiations and agreements on trade and other economic issues.

- The impact on global supply chains and international trade: The adjustment could affect global supply chains and reshape the dynamics of international trade.

Impacts on Other Countries

The changes in U.S.-China trade will have a ripple effect on other countries involved in global trade.

- Examination of the impacts on other major economies: Countries that are major exporters or importers to either the US or China may experience significant impacts, leading to shifts in global trade flows.

- Discussion of potential disruptions to global supply chains: The change could lead to adjustments in global supply chains, impacting businesses worldwide.

- Analysis of the responses from other nations to the policy changes: Other countries are likely to observe and react to the U.S. policy changes, potentially impacting international trade relations.

Conclusion

The rollback of tariffs on Chinese goods presents a complex economic scenario with far-reaching consequences. While consumers may enjoy lower prices, U.S. businesses face a changing competitive landscape. The geopolitical implications are substantial, influencing U.S.-China relations and global trade dynamics. Understanding the long-term effects of this policy change is vital for businesses, policymakers, and consumers alike. To stay informed about the evolving implications of the rollback of tariffs on Chinese goods and related policy adjustments, continue to research and follow the latest economic news and analysis.

Featured Posts

-

Alexander And The Terrible Horrible No Good Very Bad Day Eva Longorias Side Splitting Road Trip

May 13, 2025

Alexander And The Terrible Horrible No Good Very Bad Day Eva Longorias Side Splitting Road Trip

May 13, 2025 -

Scarlett Johansson Vs Open Ai Unlawful Use Of Voice Data

May 13, 2025

Scarlett Johansson Vs Open Ai Unlawful Use Of Voice Data

May 13, 2025 -

Ostapenko Triumphs At Stuttgart Open

May 13, 2025

Ostapenko Triumphs At Stuttgart Open

May 13, 2025 -

The Landman Debate Billy Bob Thornton Addresses Backlash Against Ali Larter And Angela Norris

May 13, 2025

The Landman Debate Billy Bob Thornton Addresses Backlash Against Ali Larter And Angela Norris

May 13, 2025 -

Lywnardw Dy Kapryw W Adryn Brwdy Dr Aywl Knywl Jzyyat Mdhakrat Bray Fylm Zndgy Namh Ay

May 13, 2025

Lywnardw Dy Kapryw W Adryn Brwdy Dr Aywl Knywl Jzyyat Mdhakrat Bray Fylm Zndgy Namh Ay

May 13, 2025

Latest Posts

-

Safety First Walmart Recall Of Electric Ride On Toys And Chargers

May 14, 2025

Safety First Walmart Recall Of Electric Ride On Toys And Chargers

May 14, 2025 -

Consumer Alert Walmart Recalls Several Products Including Orvs And Electric Scooters

May 14, 2025

Consumer Alert Walmart Recalls Several Products Including Orvs And Electric Scooters

May 14, 2025 -

Consumer Alert Walmart Recalls Electric Ride Ons And Portable Power Banks

May 14, 2025

Consumer Alert Walmart Recalls Electric Ride Ons And Portable Power Banks

May 14, 2025 -

Fda Issues Recall On Walmart Canned Beans Causes And Impact

May 14, 2025

Fda Issues Recall On Walmart Canned Beans Causes And Impact

May 14, 2025 -

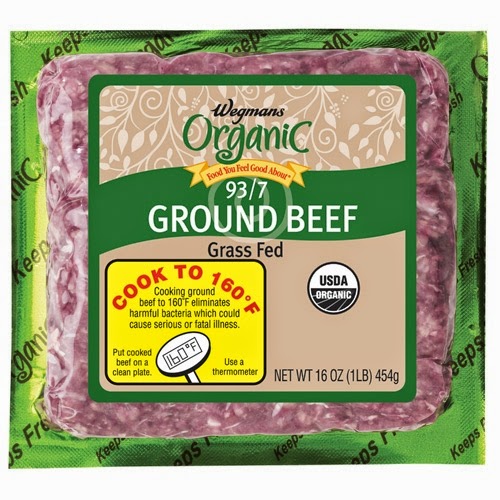

Recall Alert Wegmans Braised Beef With Vegetables Important Information

May 14, 2025

Recall Alert Wegmans Braised Beef With Vegetables Important Information

May 14, 2025