The Unaffordable Dream: Examining High Down Payments In The Canadian Housing Market

Table of Contents

H2: The Growing Burden of High Down Payments

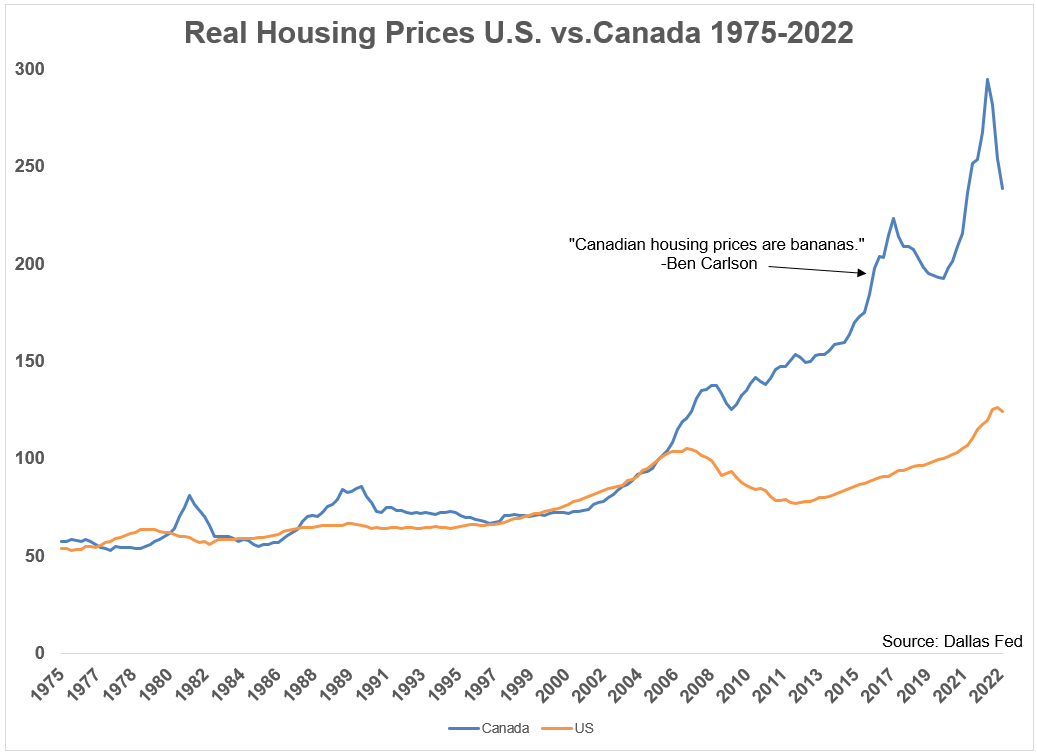

The escalating cost of housing in Canada places an immense burden on prospective homeowners, particularly first-time buyers. The required down payment, often a significant percentage of the home's value, acts as a major barrier to entry for many.

H3: Impact on First-Time Homebuyers

The impact of high down payments is disproportionately felt by younger generations and lower-income individuals. Saving for a large down payment often requires years of diligent saving, delaying other important life milestones.

- Financial Strain: The pressure to save a substantial down payment can lead to significant financial strain, limiting spending on other necessities and delaying investments in education or retirement.

- Delayed Life Milestones: Many young Canadians postpone marriage, starting a family, or pursuing further education due to the overwhelming financial commitment of purchasing a home.

- Statistics: Recent reports indicate that a significant percentage (insert statistic if available) of first-time homebuyers in Canada struggle to meet the minimum down payment requirements, even with substantial savings.

H3: Regional Variations in Down Payment Requirements

The challenge of affording a home varies significantly across Canada. While major metropolitan areas like Toronto and Vancouver experience exorbitant house prices demanding substantial down payments, smaller cities and towns often present a more attainable, albeit still challenging, market.

- Regional Disparities: A map visualizing average house prices and required down payments across different provinces and cities would clearly illustrate these variations (consider inserting a relevant image or chart here).

- Contributing Factors: Population density, economic activity, and local market dynamics all play a crucial role in determining house prices and subsequently, the required down payment.

H2: The Role of Mortgage Stress Tests and Interest Rates

The Canadian government's mortgage stress tests and fluctuating interest rates significantly influence the required down payment. These factors make it considerably harder for potential homebuyers to secure a mortgage.

H3: The Impact of Stricter Lending Regulations

The stress test, designed to ensure borrowers can handle higher interest rates, effectively increases the amount of down payment needed to qualify for a mortgage. The test simulates a higher interest rate scenario, requiring borrowers to prove they can still afford their mortgage payments under these conditions.

- Stress Test Calculation: The stress test assesses affordability by simulating mortgage payments at a rate significantly higher than the current rate.

- Interest Rate Impact: A small increase in interest rates can dramatically increase the required down payment, potentially pushing a home out of reach for many. For example, (insert example illustrating the difference in required down payments with varying interest rates).

H3: The Influence of Bank of Canada Policies

The Bank of Canada's monetary policy significantly impacts mortgage rates. Interest rate hikes, aimed at controlling inflation, can make mortgages more expensive and increase the required down payment.

- Interest Rate and Down Payment Relationship: Higher interest rates directly translate to higher monthly mortgage payments, requiring a larger down payment to qualify for a loan.

- Future Policy Implications: Any future changes in the Bank of Canada's policies will have a direct and potentially significant impact on the affordability of housing and the required down payment amounts for prospective buyers.

H2: Potential Solutions and Government Initiatives

Addressing the challenge of high down payments in the Canadian housing market requires a multi-faceted approach involving government intervention and alternative financing options.

H3: Government-backed programs

The Canadian government has introduced several programs aimed at assisting first-time homebuyers. The First-Time Home Buyers' Incentive, for example, helps reduce the required down payment by offering shared equity with the government.

- Eligibility and Benefits: Details on eligibility criteria and the benefits offered by government programs should be clearly outlined.

- Program Effectiveness: An assessment of how effective these programs have been in easing the burden of high down payments is crucial.

H3: Alternative Financing Options

Exploring alternative financing options can make homeownership more attainable for some. Shared equity mortgages, for instance, allow buyers to share ownership with a lender, reducing their required down payment.

- Shared Equity Mortgages: These mortgages involve a lender contributing a portion of the down payment in exchange for a share of the home's equity.

- Alternative Lending Models: Other options include alternative lending models that may offer more flexible terms and lower down payment requirements, though they may come with higher interest rates.

3. Conclusion

High down payments in the Canadian housing market present a significant obstacle to homeownership for many Canadians, particularly first-time buyers. Stricter lending regulations, fluctuating interest rates, and regional variations in house prices exacerbate this affordability crisis. While government-backed programs and alternative financing options offer some relief, a comprehensive and sustained effort is needed to make the Canadian dream of homeownership more attainable for all. Don't let the high down payments in the Canadian housing market deter your dreams! Explore your options today, research government programs, and consider alternative financing solutions to find a path towards homeownership that works for you. Further research and discussion are crucial to navigating this complex issue and ensuring a more equitable and accessible housing market in Canada.

Featured Posts

-

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 09, 2025

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 09, 2025 -

2025 A Good Year For Stephen King Regardless Of The Monkeys Reception

May 09, 2025

2025 A Good Year For Stephen King Regardless Of The Monkeys Reception

May 09, 2025 -

Madeleine Mc Cann Case Polish Woman Julia Wandelt Arrested In Uk For False Claims

May 09, 2025

Madeleine Mc Cann Case Polish Woman Julia Wandelt Arrested In Uk For False Claims

May 09, 2025 -

Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy Daty Matchey I Gde Smotret

May 09, 2025

Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy Daty Matchey I Gde Smotret

May 09, 2025 -

Greenlands Autonomy Under Pressure Examining The Role Of Trumps Policy

May 09, 2025

Greenlands Autonomy Under Pressure Examining The Role Of Trumps Policy

May 09, 2025