The Unexpected Rise In Bitcoin Mining: Exploring The Causes

Table of Contents

Technological Advancements Fueling Bitcoin Mining Growth

The explosive growth in Bitcoin mining isn't just about luck; it's largely due to significant leaps in technology. More efficient and profitable mining is now a reality thanks to several key advancements.

Improved Mining Hardware

The development of increasingly sophisticated Application-Specific Integrated Circuits (ASICs) has revolutionized Bitcoin mining. These specialized chips are designed solely for Bitcoin mining, offering unparalleled efficiency and hash rate compared to general-purpose hardware.

- Examples of new ASIC models: Bitmain Antminer S19j Pro, MicroBT WhatsMiner M30S++

- Improvements in energy efficiency: Newer ASICs consume significantly less energy per unit of hash rate, making mining more profitable and environmentally sustainable (relatively speaking).

- Decreased manufacturing costs: Economies of scale and advancements in manufacturing processes have led to lower production costs for ASICs, making them more accessible to miners.

Enhanced Mining Software and Algorithms

Software plays a crucial role in optimizing mining processes. Improved mining software and algorithms continuously evolve to enhance efficiency and profitability.

- Examples of improved mining pools: AntPool, F2Pool, BTC.com – these pools aggregate the computing power of many miners, increasing their chances of solving a block and earning rewards.

- Algorithm updates: While Bitcoin's underlying algorithm (SHA-256) remains unchanged, improvements in software optimize how miners interact with the network and manage their resources.

- Effect on profitability: These software advancements directly translate to higher returns for miners, further incentivizing participation.

Cloud Mining Services

Cloud mining has democratized access to Bitcoin mining. This service allows individuals to purchase mining power without owning or managing the physical hardware.

- Advantages of cloud mining: Lower upfront costs, easier setup, and reduced maintenance hassles.

- Disadvantages of cloud mining: Potential for scams, dependence on a third-party provider, and often lower profitability compared to individual mining operations.

- Impact on the overall hash rate: Cloud mining contributes significantly to the overall network hash rate, adding to the overall computational power securing the Bitcoin network.

Geopolitical and Regulatory Factors Influencing Bitcoin Mining

The location of Bitcoin mining operations is significantly impacted by geopolitical factors and regulatory environments.

Regulatory Shifts in Favorable Jurisdictions

Several countries have embraced a more crypto-friendly regulatory approach, attracting miners seeking favorable conditions.

- Examples of countries with supportive regulatory environments: El Salvador, Kazakhstan (previously), parts of the United States. These jurisdictions often offer clear legal frameworks and potentially tax advantages.

- Attracting miners: Favorable regulations reduce uncertainty and risk, making these locations attractive for large-scale mining operations.

Energy Costs and Availability

Energy costs are a major factor influencing Bitcoin mining profitability. Regions with abundant and cheap energy sources have a significant advantage.

- Examples of regions with low-cost energy: Hydroelectric regions, areas with geothermal energy sources. These locations offer significant cost savings, crucial for profitability in a competitive market.

- Impact on Bitcoin mining centralization: Access to cheap energy can lead to the centralization of Bitcoin mining in specific geographic areas.

Government Crackdowns in Other Regions

Conversely, government crackdowns in some regions force miners to relocate, shifting the global distribution of mining activity.

- Examples of countries with stricter regulations: China's 2021 crackdown significantly impacted the global hash rate, as many miners relocated to other jurisdictions.

- Impact on the global Bitcoin mining landscape: These crackdowns cause disruptions, leading to shifts in mining power distribution across the globe.

Economic Incentives Driving Bitcoin Mining Expansion

Economic factors play a significant role in driving the expansion of Bitcoin mining.

Bitcoin Price Volatility and its Impact

Bitcoin's price is a primary driver of mining profitability. High prices incentivize increased mining activity, while low prices can lead to miners shutting down operations.

- Correlation between Bitcoin price and mining activity: A direct correlation exists—higher prices lead to more miners entering the market, increasing the hash rate.

- The role of price speculation: Speculation about future price increases can also motivate miners to invest in new equipment and expand operations.

Increased Institutional Investment

Institutional investors' growing interest in Bitcoin indirectly boosts mining activity through increased demand and higher prices.

- Examples of institutional investors: MicroStrategy, Tesla (previously), several large investment firms. Their involvement legitimizes Bitcoin and drives demand, indirectly impacting mining profitability.

- Influence on Bitcoin's price and mining: Increased institutional buying pressure generally leads to higher prices, making mining more lucrative.

Halving Events and Their Influence

Bitcoin's halving events, which occur roughly every four years, reduce the block reward miners receive for successfully validating transactions.

- Impact of halvings on mining profitability: Halvings initially reduce profitability, but this often leads to innovation and efficiency improvements within the mining industry.

- Subsequent adjustments in the mining industry: Miners respond to halvings by adopting more efficient hardware and software, increasing their competitiveness.

Conclusion

The unexpected rise in Bitcoin mining is a result of a complex interaction of technological advancements, geopolitical shifts, and economic incentives. Improved ASICs, enhanced software, cloud mining services, favorable regulations, cheap energy, institutional investment, and even the cyclical nature of halving events all contribute to this surge. Understanding these multifaceted drivers is crucial to comprehending the evolving landscape of Bitcoin mining. Stay informed on the latest developments to make informed decisions regarding Bitcoin and its future.

Featured Posts

-

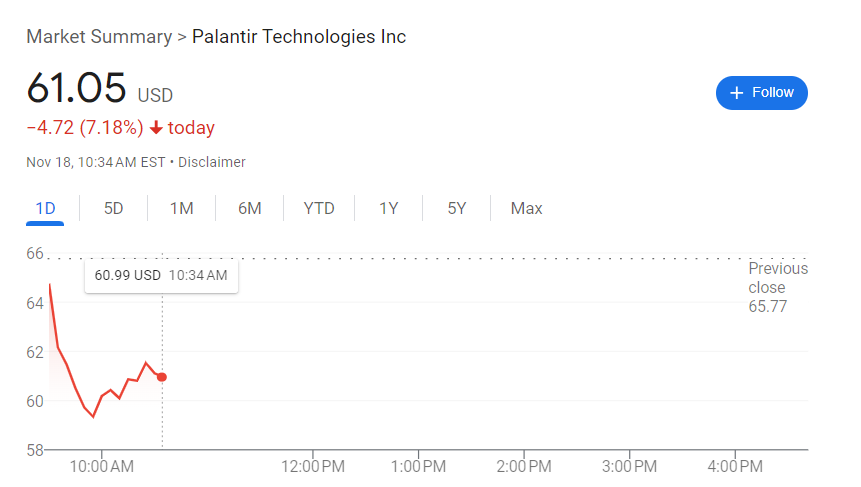

Buy Palantir Stock Before May 5th The Wall Street Verdict

May 09, 2025

Buy Palantir Stock Before May 5th The Wall Street Verdict

May 09, 2025 -

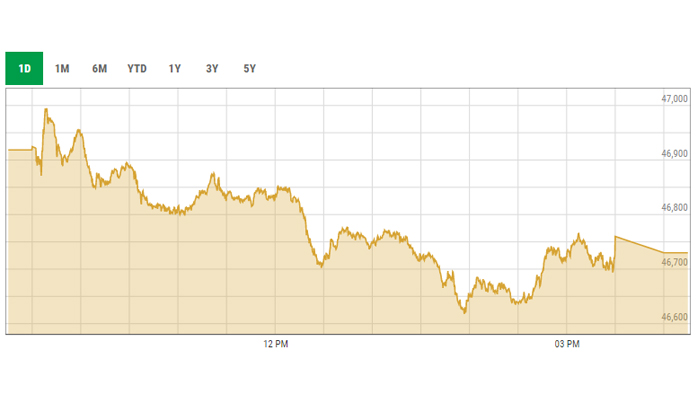

Sharp Decline In Kse 100 Operation Sindoors Effect On Pakistan Stock Market

May 09, 2025

Sharp Decline In Kse 100 Operation Sindoors Effect On Pakistan Stock Market

May 09, 2025 -

How Jazz Cash And K Trade Are Democratizing The Stock Market

May 09, 2025

How Jazz Cash And K Trade Are Democratizing The Stock Market

May 09, 2025 -

Bitcoin Madenciligi Sonu Mu Yaklasiyor Yeni Bir Doenem Mi Basliyor

May 09, 2025

Bitcoin Madenciligi Sonu Mu Yaklasiyor Yeni Bir Doenem Mi Basliyor

May 09, 2025 -

Hear Their Voices Nottingham Attack Survivors Break Their Silence

May 09, 2025

Hear Their Voices Nottingham Attack Survivors Break Their Silence

May 09, 2025