Thousands Lost: The Dangers Of Fake Steven Bartlett Investment Schemes

Table of Contents

How Fake Steven Bartlett Investment Schemes Operate

Fraudsters employ sophisticated and deceptive tactics to lure unsuspecting investors into their traps. Understanding these methods is crucial in protecting yourself from becoming a victim.

Deceptive Marketing Tactics

Scammers utilize a range of deceptive marketing tactics to build trust and entice investment. These often include:

- Fake Endorsements: Using manipulated images or fabricated quotes to suggest Steven Bartlett is endorsing the scheme.

- Manipulated Images and Videos: Altering images or videos to create a false impression of success and legitimacy.

- Fabricated Success Stories: Sharing fake testimonials from supposedly satisfied investors, often using stolen identities or fabricated accounts.

- Unrealistic Returns: Promising incredibly high returns with little or no risk – a major red flag for any investment opportunity. These schemes often boast unbelievable profits in short periods.

- High-Pressure Sales Tactics: Creating a sense of urgency, pressuring potential victims to invest quickly before the "opportunity disappears." This leaves no time for proper due diligence.

Sophisticated Scamming Techniques

Beyond basic deception, these schemes often employ advanced techniques:

- Fake Websites: Creating websites that closely mimic Steven Bartlett's official branding and design, making them appear legitimate at first glance.

- Cloned Social Media Accounts: Using cloned social media accounts to impersonate Steven Bartlett or his associates, interacting with potential victims and building trust.

- Deepfake Videos: Using sophisticated technology to create realistic videos of Steven Bartlett endorsing the scheme, making it harder to identify as fake.

- Exploiting Trust: Leverage the public's trust in Steven Bartlett's entrepreneurial success and reputation to make the scheme appear trustworthy.

Identifying Red Flags of Fake Investment Schemes

Recognizing red flags is crucial in protecting yourself. Be wary of these warning signs:

Warning Signs to Watch Out For

- Unrealistic promises of high returns with little or no risk. No investment guarantees high returns without any risk.

- High-pressure sales tactics and requests for immediate investment decisions. Legitimate investments allow time for careful consideration.

- Lack of transparency and regulation. Always check for proper licensing and regulatory oversight.

- Anonymous or untraceable operators. Legitimate businesses will be open and transparent about their operations.

- Suspicious websites or social media profiles. Check for poorly designed websites, grammatical errors, and a lack of contact information.

Due Diligence: Steps to Verify Legitimacy

Before investing, take these steps to verify legitimacy:

- Independent Research: Conduct thorough research on the investment opportunity and the individuals involved. Use reputable sources and cross-reference information.

- Check Official Websites and Regulatory Registrations: Verify whether the investment opportunity and the company behind it are registered with the appropriate regulatory bodies.

- Seek Advice from Independent Financial Advisors: Consult with a qualified financial advisor before making any investment decisions. They can provide unbiased guidance.

Protecting Yourself from Fake Steven Bartlett Investment Schemes

Safeguarding your finances requires vigilance and a proactive approach:

Safeguarding Your Finances

- Be wary of unsolicited investment offers. Legitimate investment opportunities rarely come through unsolicited contact.

- Never invest money you can't afford to lose. Only invest what you're prepared to lose completely.

- Verify the identity and legitimacy of any investment opportunity. Thoroughly research before committing your funds.

- Report suspicious activity to the relevant authorities. Don't hesitate to report anything that seems fraudulent.

Reporting Fraudulent Activity

If you suspect a scam, report it immediately to:

- The police: File a report with your local law enforcement agency.

- Financial regulators: Contact the relevant financial regulatory body in your jurisdiction.

- Online platforms and social media: Report suspicious accounts and websites to the platforms where they are operating.

Conclusion

Fake Steven Bartlett investment schemes represent a significant threat, causing substantial financial and emotional distress to victims. The deceptive tactics employed by fraudsters highlight the importance of due diligence and vigilance. Remember, unrealistic promises of high returns are a major red flag. Protect yourself from fake Steven Bartlett investment schemes by conducting thorough research, verifying information, and reporting any suspicious activity. Avoid becoming a victim of investment fraud by understanding the warning signs and taking proactive steps to safeguard your finances. Learn how to identify fraudulent investment opportunities and never hesitate to seek advice from qualified financial professionals. Protect your investments and your future. Report scams to the relevant authorities immediately. For further resources on reporting fraud and financial advice, please consult [link to relevant resource 1] and [link to relevant resource 2].

Featured Posts

-

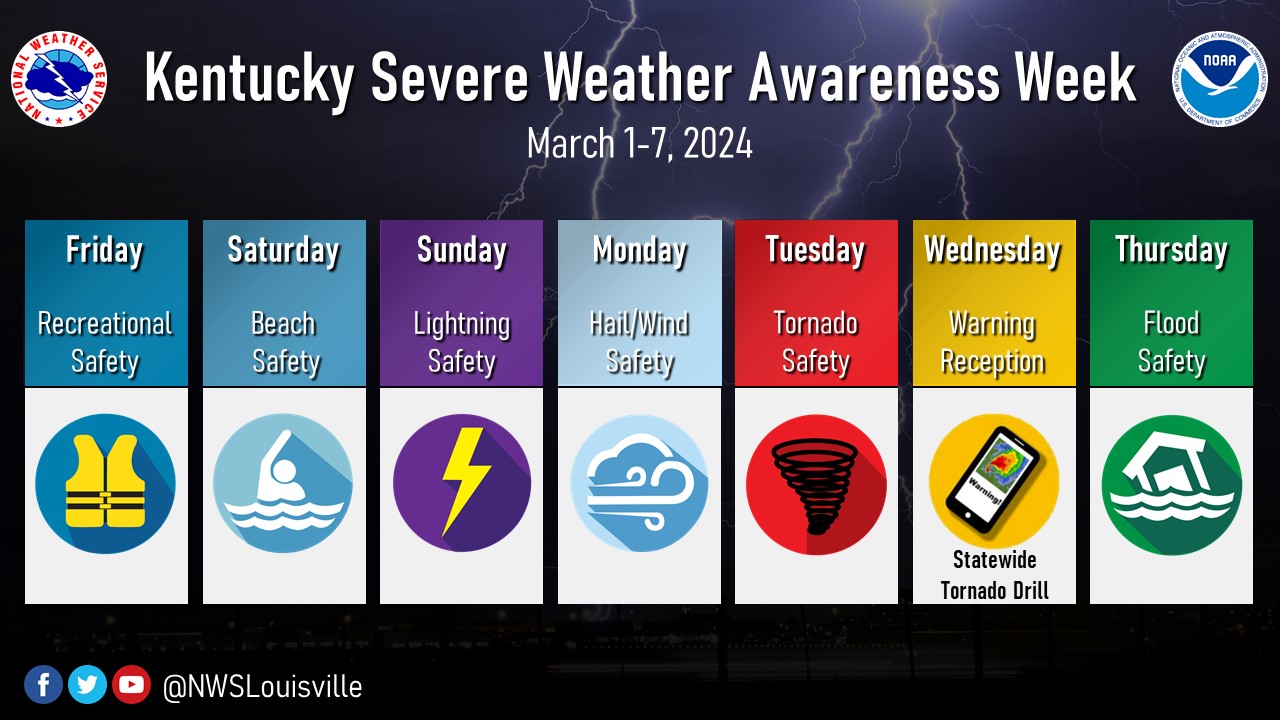

Kentucky Severe Weather Awareness Week Nws Preparations

May 01, 2025

Kentucky Severe Weather Awareness Week Nws Preparations

May 01, 2025 -

Cap Nhat Lich Thi Dau Moi Nhat Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025

Cap Nhat Lich Thi Dau Moi Nhat Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025 -

Guardians Rally Past Yankees Bibees Resilience After Early Homer

May 01, 2025

Guardians Rally Past Yankees Bibees Resilience After Early Homer

May 01, 2025 -

Celtics Vs Cavaliers Expert Picks And Predictions For Fridays Game

May 01, 2025

Celtics Vs Cavaliers Expert Picks And Predictions For Fridays Game

May 01, 2025 -

Cavaliers Vs Heat Game 2 Where To Watch The Nba Playoffs Online And On Tv

May 01, 2025

Cavaliers Vs Heat Game 2 Where To Watch The Nba Playoffs Online And On Tv

May 01, 2025