Tim Cook's Tariff Warning Triggers Apple Stock Sell-Off

Table of Contents

Tim Cook's Statement and its Market Impact

Tim Cook's statement regarding escalating tariffs directly impacted Apple's stock price. His words, effectively a warning about the increasing costs of manufacturing and importing Apple products, immediately triggered a wave of selling.

- Key quote from Tim Cook (replace with actual quote if available): “[Insert direct quote from Tim Cook expressing concern about tariffs and their impact on Apple’s business]”

- Apple Stock Price Drop: Following the announcement, Apple's stock price experienced a [insert percentage]% drop, showcasing the market's immediate negative reaction.

- Market Reaction and Sentiment: The overall market sentiment reflected concern not only about Apple's specific situation but also about the broader implications of the escalating trade war. Investor confidence in the tech sector, and the market as a whole, took a noticeable hit. This sell-off underscores the significant influence Tim Cook and his pronouncements have on investor behavior and the broader market.

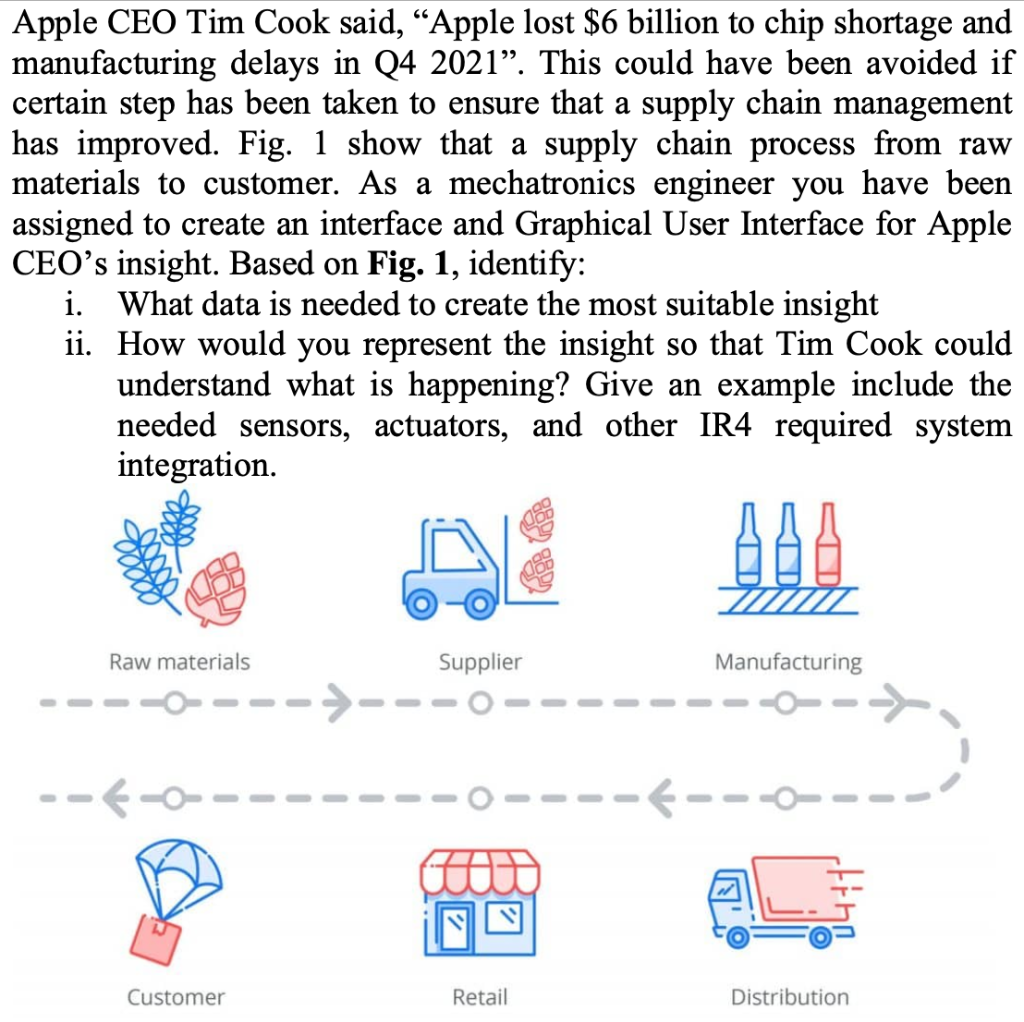

The Impact of Tariffs on Apple's Supply Chain

Tariffs significantly increase the cost of manufacturing and importing Apple products. This is because tariffs are essentially taxes imposed on imported goods, increasing the price of components and finished products.

- Geographical Distribution of Apple's Supply Chain: Apple's supply chain is globally dispersed, with manufacturing and assembly happening in various countries, primarily in China. This global network makes the company particularly vulnerable to trade wars and tariff increases.

- Specific Components and Products Affected: Components like displays, processors, and memory chips, sourced from various international suppliers, are heavily affected by tariffs. The resulting increase in manufacturing costs directly impacts the final price of iPhones, iPads, and other Apple products.

- Increased Prices for Consumers: The increased cost of production due to tariffs is likely to lead to higher prices for consumers, potentially impacting demand for Apple products. This price increase could negatively impact sales figures and further erode investor confidence.

Alternative Strategies for Apple to Mitigate Tariff Impacts

Apple is likely exploring several strategies to mitigate the negative impacts of tariffs. These strategies involve a complex balancing act between cost management, consumer price sensitivity, and geopolitical considerations.

- Relocating Manufacturing: Shifting manufacturing away from tariff-affected regions, potentially to countries like Vietnam or India, could be considered, although this is a complex and costly undertaking.

- Absorbing Increased Costs: Apple might absorb some of the increased costs associated with tariffs to maintain competitive pricing, impacting profit margins.

- Lobbying and Trade Negotiations: Apple may engage in lobbying efforts to influence trade policy and negotiate with governments to secure favorable tariff arrangements. This involves complex negotiations and influencing trade agreements at the highest level of government.

The Broader Economic Context of the Trade War

The ongoing trade war casts a long shadow over global markets, and the tech industry is not immune. The ripple effect of these tariffs extends beyond Apple, affecting numerous companies and industries.

- Ripple Effect on Other Companies and Industries: The escalating trade tensions create uncertainty and hinder global trade, impacting companies across various sectors beyond just technology.

- Potential Long-Term Economic Consequences: Prolonged trade wars can lead to significant negative economic consequences, including reduced global growth and increased inflation. The uncertainty surrounding these tariffs makes long-term investment planning exceptionally challenging.

- Retaliatory Measures: Other countries may adopt retaliatory measures, further intensifying the trade conflict and exacerbating the negative effects on global supply chains and international trade.

Conclusion

Tim Cook's tariff warning serves as a stark reminder of the significant challenges posed by the ongoing trade war. The resulting Apple stock sell-off highlights the market's sensitivity to these geopolitical risks. The impact extends beyond Apple's bottom line, affecting its supply chain, consumer prices, and the broader global economy. Understanding these complex interdependencies is crucial for investors and businesses alike.

Call to Action: Stay informed about the evolving situation regarding tariffs and their impact on Apple and other tech companies. Follow the latest news on Tim Cook's statements and the continuing Apple stock performance to make informed investment decisions. Understanding the implications of the ongoing trade war and Tim Cook's tariff warnings is crucial for investors navigating this complex market. Analyzing the long-term impact of tariffs and potential mitigation strategies is essential for a comprehensive investment strategy.

Featured Posts

-

Traffic Congestion On M6 Southbound 60 Minute Delays

May 24, 2025

Traffic Congestion On M6 Southbound 60 Minute Delays

May 24, 2025 -

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 24, 2025

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 24, 2025 -

Aex Stijgt Na Uitstel Trump Positieve Resultaten Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Uitstel Trump Positieve Resultaten Voor Alle Fondsen

May 24, 2025 -

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025 -

Decouvrez Les Personnes Derriere Le Brest Urban Trail

May 24, 2025

Decouvrez Les Personnes Derriere Le Brest Urban Trail

May 24, 2025

Latest Posts

-

The Impact Of La Fires On Rental Prices Price Gouging Allegations

May 24, 2025

The Impact Of La Fires On Rental Prices Price Gouging Allegations

May 24, 2025 -

Post Fire Price Gouging In La The Reality For Renters

May 24, 2025

Post Fire Price Gouging In La The Reality For Renters

May 24, 2025 -

Impact Of Economic Slowdown Sse Announces 3 Billion Spending Cut

May 24, 2025

Impact Of Economic Slowdown Sse Announces 3 Billion Spending Cut

May 24, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Growing Concern

May 24, 2025

La Fires Fuel Landlord Price Gouging Claims A Growing Concern

May 24, 2025 -

Are Thames Waters Executive Bonuses Acceptable A Critical Examination

May 24, 2025

Are Thames Waters Executive Bonuses Acceptable A Critical Examination

May 24, 2025