Today's CoreWeave (CRWV) Stock Rally: Factors Contributing To The Surge

Table of Contents

Strong Q2 Earnings and Revenue Beat

Exceeding Analyst Expectations

CoreWeave's Q2 results significantly exceeded analyst expectations, driving a substantial boost to the CRWV stock price. The company reported impressive figures, exceeding projections across the board. Key figures highlight the extent of this positive surprise. The strong performance underscores the robustness of CoreWeave's business model and its ability to capitalize on the growing demand for its services. This positive "earnings beat" is a key driver of today's rally.

- Revenue: [Insert specific revenue figure] – significantly higher than the predicted [Insert predicted revenue figure].

- EPS (Earnings Per Share): [Insert specific EPS figure] – surpassing the anticipated [Insert predicted EPS figure].

- Comparison to Q1: Revenue and EPS showed a substantial increase compared to the previous quarter, demonstrating strong sequential growth.

- Future Guidance: CoreWeave management provided upwardly revised guidance for the remainder of the year, further bolstering investor confidence and fueling the CoreWeave (CRWV) stock rally. [Insert quote from management, if available].

Growing Demand for AI Infrastructure

CoreWeave's Position in the AI Market

CoreWeave is uniquely positioned to benefit from the explosive growth of the AI market. The company provides crucial AI infrastructure, particularly GPU computing resources, enabling the development and deployment of sophisticated AI applications. This burgeoning demand for GPU-powered cloud computing solutions is a major catalyst for CoreWeave's success.

- Key Partnerships: CoreWeave's strategic partnerships with major players in the AI industry provide access to a large customer base and contribute to its market dominance. [Mention specific partners, if any].

- Client Acquisitions: The company has successfully acquired several high-profile clients requiring significant computing power, further contributing to revenue growth. [Mention specific clients, if any].

- AI Market Growth: The overall growth of the AI market is significantly impacting CoreWeave's performance. The increasing adoption of AI across various sectors translates directly into greater demand for CoreWeave's services. The company's data center capabilities are key to its success in this rapidly expanding sector.

Strategic Partnerships and Investments

Collaborations Fueling Growth

Strategic partnerships and investments are pivotal in driving CoreWeave's growth and influencing investor sentiment. These collaborations provide access to new markets, technologies, and resources, further enhancing the company's competitive advantage.

- Specific Partnerships: [Detail specific partnerships and their benefits, including any technology sharing or market expansion opportunities].

- Investment Rounds: [Mention details of any recent investment rounds and the positive impact on company valuation. This shows investor confidence in CoreWeave's future.]

- Strategic Significance: These partnerships are not merely financial transactions; they are strategic alliances that position CoreWeave for continued growth and leadership within the AI infrastructure market.

Positive Market Sentiment and Investor Confidence

Broader Market Trends and CRWV's Performance

The positive market sentiment surrounding CoreWeave is also influenced by broader market trends and the company's strong relative performance compared to its competitors.

- Market Indices: [Mention relevant market indices and their performance. Relate CoreWeave's performance to these indices, showing it's outperforming the market].

- Competitor Analysis: CoreWeave's robust financial results and growth trajectory distinguish it favorably from its competitors in the cloud computing and AI infrastructure sectors. [Briefly compare CoreWeave's performance against key competitors].

- Analyst Ratings: Positive analyst ratings and upgrades contribute to heightened investor confidence and fuel the demand for CoreWeave (CRWV) stock. [Mention any recent upgrades or positive analyst comments].

Conclusion

In summary, today's CoreWeave (CRWV) stock rally is a result of a confluence of factors: exceptionally strong Q2 earnings that exceeded analyst expectations, the burgeoning demand for AI infrastructure which CoreWeave expertly serves, strategic partnerships that expand its reach and capabilities, and the overall positive market sentiment surrounding the company. The CoreWeave (CRWV) stock price increase reflects investor confidence in the company's future prospects within the rapidly growing AI sector. To stay informed about future developments and the evolution of the CoreWeave (CRWV) stock price, we encourage you to follow reputable financial news sources and conduct further research into the company's financial reports and investor relations materials. Staying abreast of CoreWeave (CRWV) stock developments is crucial for any investor interested in this dynamic sector.

Featured Posts

-

The Gumball Show Now Streaming On Hulu And Disney

May 22, 2025

The Gumball Show Now Streaming On Hulu And Disney

May 22, 2025 -

Ai Mode The Future Of Google Search

May 22, 2025

Ai Mode The Future Of Google Search

May 22, 2025 -

Wisconsin Gas Prices Average 2 98 A 3 Cent Increase

May 22, 2025

Wisconsin Gas Prices Average 2 98 A 3 Cent Increase

May 22, 2025 -

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025 -

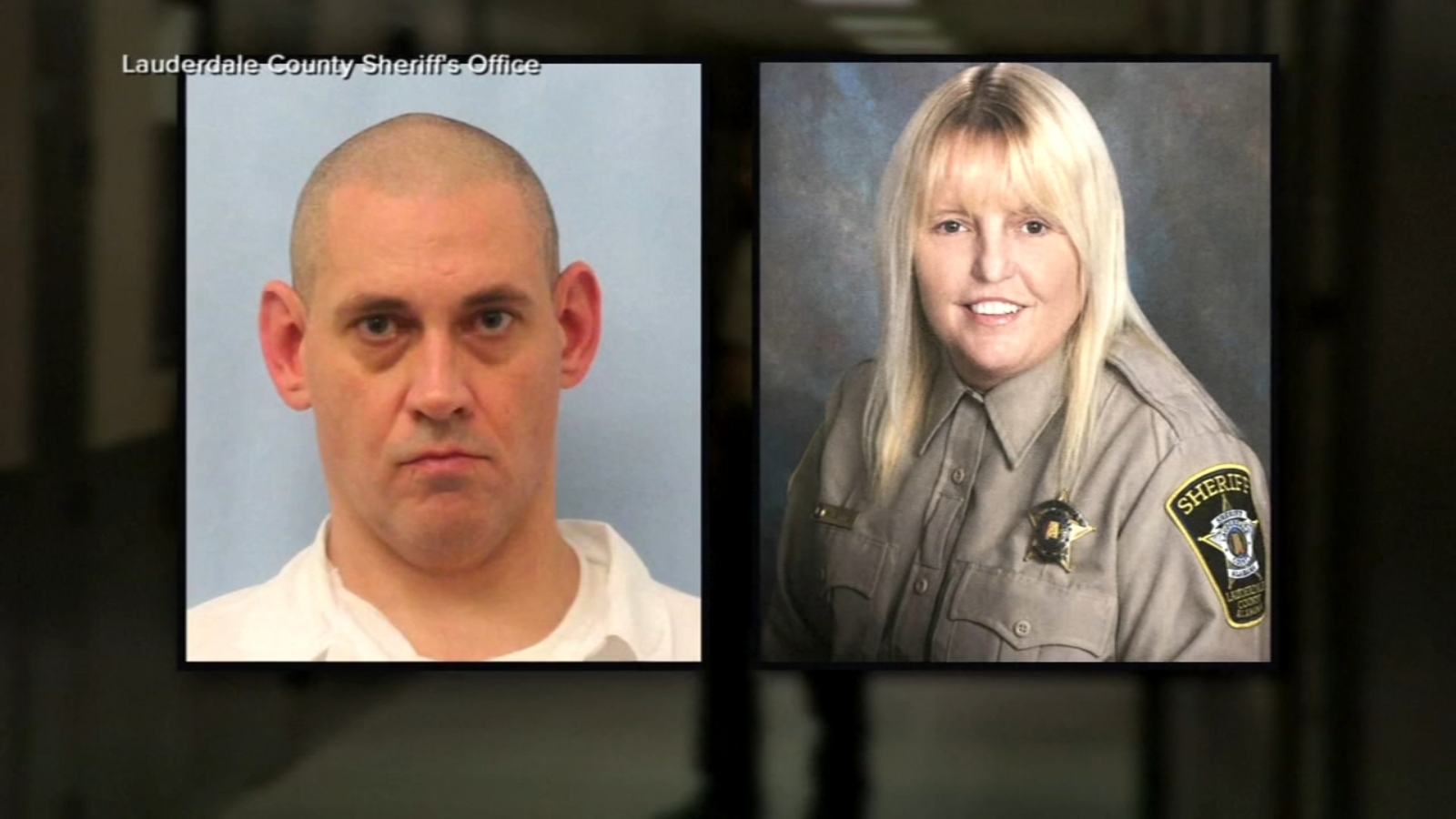

Sheriffs Reelection Campaign Suspended Following Five Inmate Escapes In New Orleans

May 22, 2025

Sheriffs Reelection Campaign Suspended Following Five Inmate Escapes In New Orleans

May 22, 2025

Latest Posts

-

Increased Security Measures At Israeli Embassies Worldwide

May 22, 2025

Increased Security Measures At Israeli Embassies Worldwide

May 22, 2025 -

Suspect Arrested Following Deadly Shooting At Israeli Embassy In Washington

May 22, 2025

Suspect Arrested Following Deadly Shooting At Israeli Embassy In Washington

May 22, 2025 -

Israeli Embassy Confirms Identities Of Couple Killed In Dc Shooting

May 22, 2025

Israeli Embassy Confirms Identities Of Couple Killed In Dc Shooting

May 22, 2025 -

Dc Shooting Israeli Embassy Releases Names Of Victims

May 22, 2025

Dc Shooting Israeli Embassy Releases Names Of Victims

May 22, 2025 -

Tragedy In Dc Israeli Embassy Staff Victims Of Museum Shooting Ap Images

May 22, 2025

Tragedy In Dc Israeli Embassy Staff Victims Of Museum Shooting Ap Images

May 22, 2025