Today's Stock Market: 1000-Point Dow Rally Fueled By Tariff News

Table of Contents

Tariff News as the Catalyst for the Rally

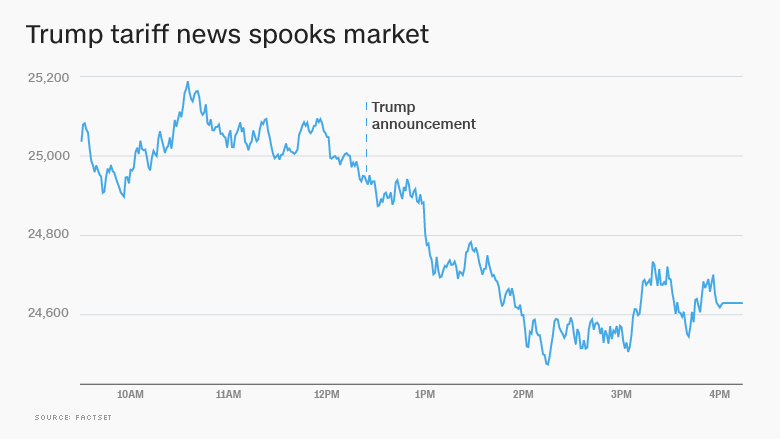

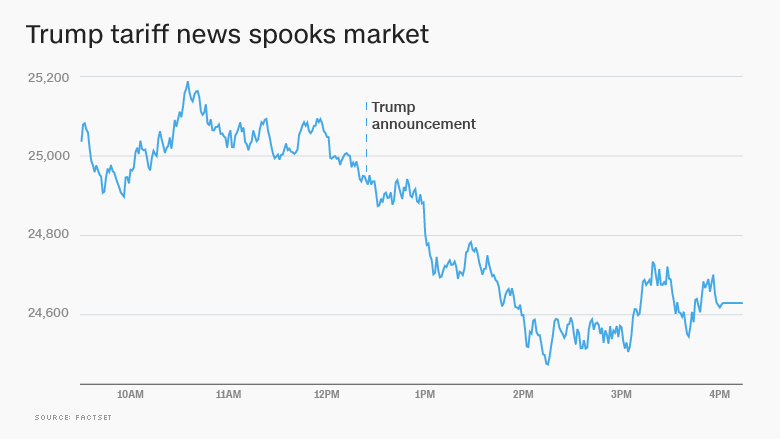

The primary catalyst for today's impressive 1000-point rally was the announcement of a significant easing of trade tensions. Specifically, the administration announced a temporary suspension of planned tariffs on certain imported goods from a major trading partner. This unexpected development significantly calmed market anxieties that had been fueled by prolonged trade uncertainty.

- Specific details of the tariff news: The suspension impacts approximately $X billion worth of goods, primarily within the technology and consumer goods sectors. This represents a significant retreat from previously announced trade actions.

- Impact on key economic indicators: This positive news is expected to boost consumer confidence, potentially leading to increased spending and a reduction in the trade deficit. Early indicators suggest a positive shift in consumer sentiment.

- Mention of any related political statements or agreements: Statements from government officials indicate a willingness to continue negotiations and find a mutually beneficial long-term trade agreement. This hints at a possible de-escalation of trade conflict.

Investor Sentiment and Market Volatility

The shift in investor sentiment following the tariff news was palpable. After months of uncertainty and volatility, the market reacted with relief, triggering a surge in buying activity. This positive sentiment fueled the rapid increase in the Dow and other major indices.

- Changes in market indices: The S&P 500 also saw significant gains, closing up by X%, while the Nasdaq experienced a similar surge.

- Analysis of trading volume and its significance: Trading volume increased dramatically, indicating a high level of investor participation and confidence in the positive news. This suggests that many investors had been waiting on the sidelines for a clearer indication of the trade situation.

- Mention of any significant investor behavior changes: Analysts noted a shift away from defensive stocks and towards more growth-oriented sectors, reflecting a renewed optimism about the economic outlook.

Economic Indicators and their Influence

While the tariff news was the primary driver, other positive economic indicators contributed to the market's bullish performance. Stronger-than-expected employment data released earlier in the week, coupled with robust consumer spending figures, further bolstered investor confidence.

- Specific economic data points and their influence on the market: The positive jobs report showed a significant increase in employment, indicating a healthy labor market. Strong consumer spending figures suggest continued economic growth.

- Correlation between the economic indicators and stock market performance: The combination of positive tariff news and strong economic fundamentals created a perfect storm for a significant market rally.

- Expert opinions on the interplay of economic factors: Market analysts are largely positive about the interplay of these factors, suggesting that the market may be entering a period of sustained growth.

Analyzing the Sustainability of the Rally

While today's 1000-point rally is undeniably impressive, its long-term sustainability remains to be seen. While the easing of trade tensions is positive, various factors could still impact future market performance.

- Potential downside risks: Geopolitical uncertainty, potential inflation pressures, and the possibility of unforeseen economic shocks could all threaten the upward trend.

- Expert predictions regarding future market performance: Many analysts are cautiously optimistic, suggesting that while a sustained rally is possible, continued monitoring of key economic indicators is essential.

- Factors that could sustain the positive trend: Continued positive trade negotiations, sustained economic growth, and stable geopolitical environments are crucial for maintaining the current positive momentum.

Conclusion

Today's stock market witnessed an extraordinary 1000-point surge in the Dow, primarily driven by positive tariff developments and supportive economic indicators. While this rally is encouraging, its long-term sustainability depends on several factors. To stay informed about today's stock market and its fluctuations, regularly check reliable financial news sources for updates on market analysis and daily stock market updates. Understanding these dynamics is key for navigating the complexities of the market and making informed investment decisions. Stay informed – your financial future depends on it!

Featured Posts

-

Warriors Dominant Performance Extends Hornets Losing Streak To Seven

Apr 24, 2025

Warriors Dominant Performance Extends Hornets Losing Streak To Seven

Apr 24, 2025 -

How Middle Management Drives Employee Engagement And Business Results

Apr 24, 2025

How Middle Management Drives Employee Engagement And Business Results

Apr 24, 2025 -

B And B Recap April 3 Liams Collapse Bills Departure And Hopes New Living Arrangement

Apr 24, 2025

B And B Recap April 3 Liams Collapse Bills Departure And Hopes New Living Arrangement

Apr 24, 2025 -

7

Apr 24, 2025

7

Apr 24, 2025 -

Report Nba Opens Investigation Into Another Ja Morant Incident

Apr 24, 2025

Report Nba Opens Investigation Into Another Ja Morant Incident

Apr 24, 2025

Latest Posts

-

Rich Kids Cribs A Modern Day Look At Mtv Cribs Extravagance

May 12, 2025

Rich Kids Cribs A Modern Day Look At Mtv Cribs Extravagance

May 12, 2025 -

Inside The Cribs Of Todays Wealthy Youth An Mtv Cribs Perspective

May 12, 2025

Inside The Cribs Of Todays Wealthy Youth An Mtv Cribs Perspective

May 12, 2025 -

Mtv Cribs Rich Kids Cribs Opulence And Excess On Display

May 12, 2025

Mtv Cribs Rich Kids Cribs Opulence And Excess On Display

May 12, 2025 -

Mtv Cribs Exploring The Luxurious Mansions Of The Wealthy Young

May 12, 2025

Mtv Cribs Exploring The Luxurious Mansions Of The Wealthy Young

May 12, 2025 -

Mtv Cribs A Look Inside The Homes Of Rich Kids

May 12, 2025

Mtv Cribs A Look Inside The Homes Of Rich Kids

May 12, 2025