Today's Stock Market: Trump's China Tariffs And The UK Trade Deal

Table of Contents

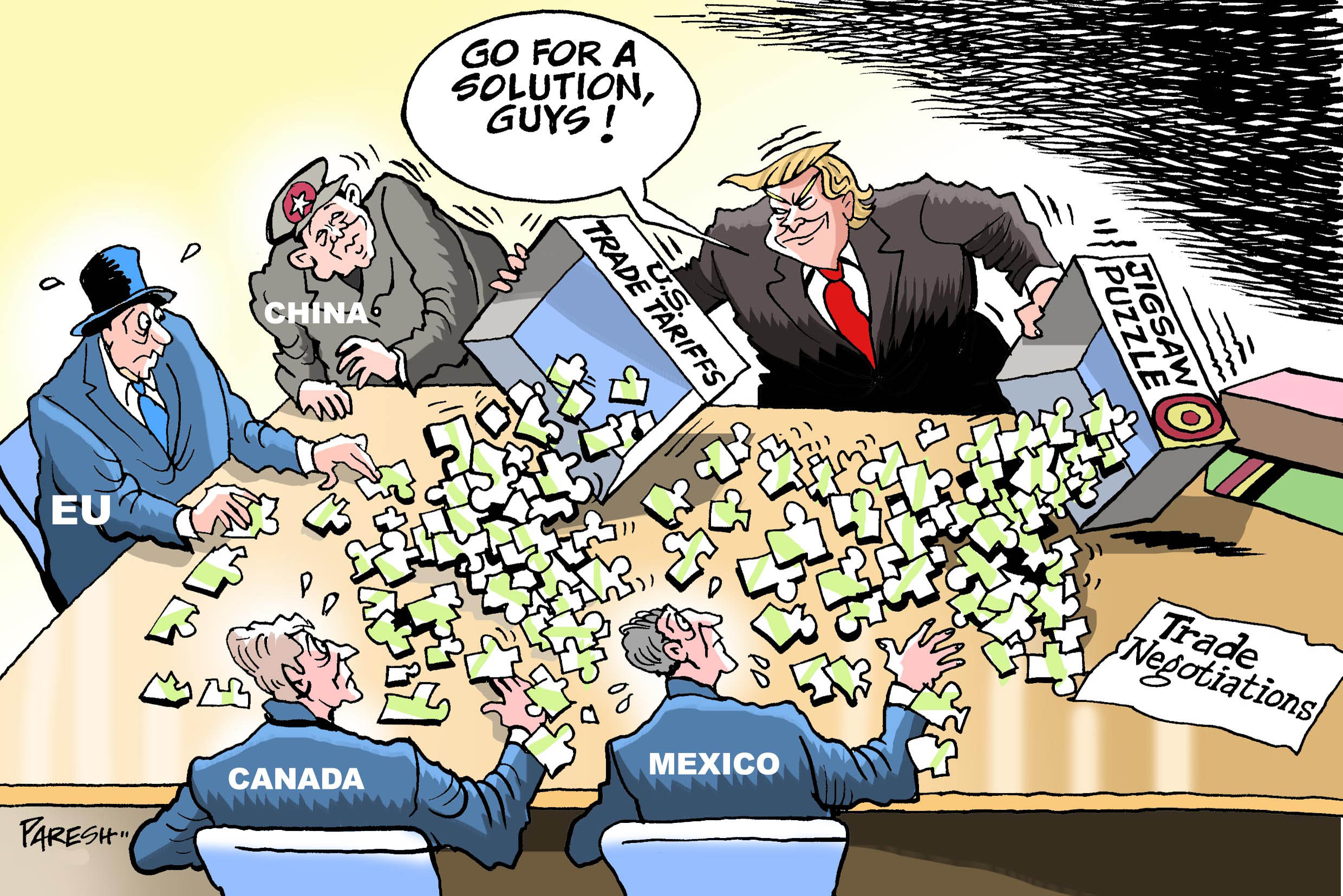

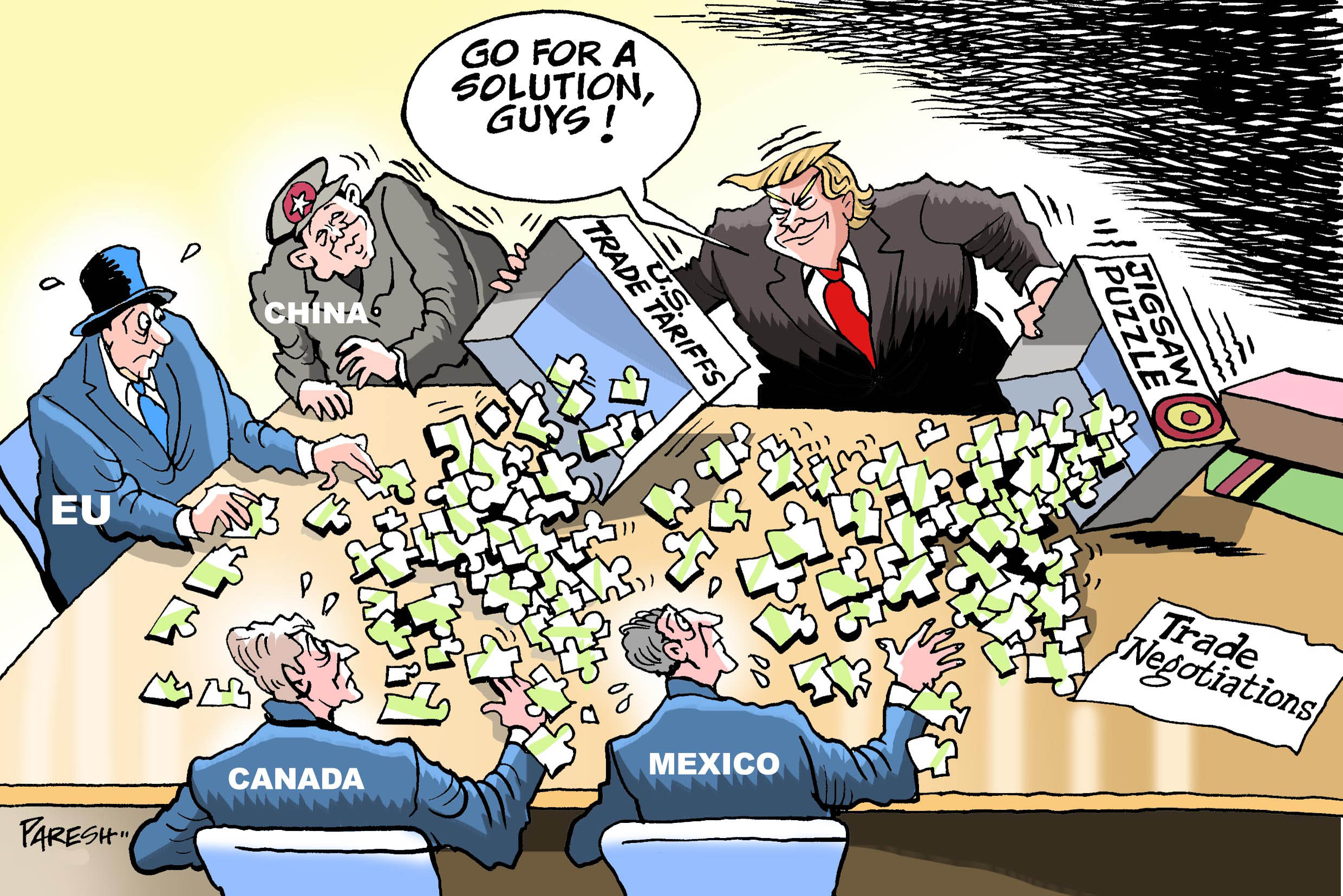

Trump's China Tariffs: A Lingering Shadow on Global Trade

The Initial Impact of the Tariffs:

The initial imposition of Trump's tariffs on Chinese goods triggered immediate and significant market reactions. Specific sectors, such as technology and agriculture, bore the brunt of the impact.

- Technology: Companies reliant on Chinese manufacturing or supply chains experienced substantial stock price drops. For example, some tech giants saw their share prices decline by 5-10% in the immediate aftermath of the tariff announcements.

- Agriculture: The agricultural sector, particularly soybean farmers, faced considerable hardship due to retaliatory tariffs imposed by China. Export volumes plummeted, leading to significant financial losses for many farmers.

China responded with its own retaliatory tariffs, further escalating the trade war and contributing to global market uncertainty. This tit-for-tat exchange created a ripple effect, impacting various industries and international trade relationships.

Long-Term Consequences and Ripple Effects:

The long-term consequences of these tariffs extend far beyond the initial shock. They have fundamentally reshaped global trade patterns, impacted supply chains, and fueled inflationary pressures.

- Supply Chain Disruptions: Companies have been forced to diversify their supply chains, moving manufacturing away from China and seeking alternative sourcing options, often leading to increased costs.

- Inflation and Consumer Prices: The tariffs contributed to increased production costs, which were passed onto consumers in the form of higher prices for various goods. This inflationary pressure has impacted consumer spending and overall economic growth.

- Shifting Manufacturing Strategies: Businesses adapted by investing in automation, nearshoring, or onshoring, resulting in a significant shift in global manufacturing landscapes.

While some proponents argued the tariffs protected domestic industries, evidence of significant positive outcomes remains largely inconclusive.

Assessing the Current Situation:

While the intensity of the trade war has subsided, the lasting impact of Trump's tariffs continues to influence current market conditions.

- US-China Relations: Although some trade tensions remain, both countries have undertaken steps towards de-escalation. Ongoing negotiations and agreements reflect a shift towards a more nuanced, though still volatile, trade relationship.

- Market Volatility: The lingering uncertainty surrounding the complete resolution of trade issues contributes to ongoing market volatility. Investors remain cautious, constantly assessing the potential implications of any new developments.

The UK Trade Deal: Navigating Post-Brexit Market Dynamics

Opportunities Presented by the UK Trade Deal:

The post-Brexit UK trade deal presented both opportunities and challenges for the global market. Certain sectors stand to benefit significantly.

- Financial Services: The deal aims to facilitate continued access to the EU market for certain financial services, although considerable regulatory complexities remain.

- Pharmaceuticals: The deal aims to maintain streamlined trade in pharmaceuticals, ensuring continued access to essential medicines.

The deal, in theory, reduces certain trade barriers, expands market access, and creates potential for economic growth for specific sectors within the UK and the EU.

Challenges and Uncertainties:

Despite potential benefits, the UK trade deal presents various challenges and uncertainties.

- Regulatory Complexities: Navigating the new regulatory landscape post-Brexit has proven complex for businesses, leading to increased administrative burdens and compliance costs.

- Supply Chain Disruptions: The new trade agreements introduced new customs procedures, potentially leading to delays and increased costs for goods crossing the UK-EU border. This has impacted certain industries.

The long-term economic effects of Brexit and the trade deal remain to be fully realized.

The Deal's Impact on the Broader Global Market:

The UK's trade deal has broader implications beyond its bilateral relationships with the EU.

- Global Trade Agreements: The deal's terms and conditions have set a precedent, influencing negotiations in other global trade agreements.

- Implications for Other Nations: The UK's experience with Brexit and its trade negotiations can serve as a case study, offering lessons for other countries considering similar trade policies or leaving existing alliances.

Interplay Between Trump's Tariffs and the UK Trade Deal:

These two significant global trade events have interacted and influenced one another, creating further complexity for investors.

Combined Market Effects:

The combined impact of Trump's tariffs and the UK trade deal has generated significant market volatility.

- Investor Sentiment: Investors respond cautiously to such intertwined global uncertainties, leading to shifts in investment strategies and increased risk aversion.

- Market Fluctuations: The interconnectedness of global markets means that events in one region can trigger ripples across other regions, amplifying market fluctuations.

Future Outlook and Potential Scenarios:

Predicting the future is inherently difficult. However, several potential scenarios emerge based on the resolution of these trade issues.

- Optimistic Scenario: A period of greater global trade stability, characterized by reduced trade barriers and increased cooperation, resulting in increased economic growth and reduced market volatility.

- Pessimistic Scenario: Continued protectionist policies, escalating trade disputes, and further geopolitical uncertainty leading to increased market volatility and slower economic growth.

Conclusion: Understanding Today's Stock Market Landscape

Trump's China tariffs and the UK trade deal have significantly influenced today's stock market, highlighting the importance of understanding geopolitical events when making investment decisions. The complexities of global trade necessitate careful analysis of interconnected factors, and the lingering impacts of these events underscore the need for diversified portfolios and thorough due diligence.

Stay informed about the latest developments in today's stock market by regularly consulting reputable financial news sources and seeking professional investment advice. Understanding the impacts of events like Trump's China tariffs and the UK trade deal is crucial for making sound investment decisions.

Featured Posts

-

The Rise Of Samuel Dickson A Canadian Lumber Industry Pioneer

May 10, 2025

The Rise Of Samuel Dickson A Canadian Lumber Industry Pioneer

May 10, 2025 -

Elizabeth Stewarts Spring Collection With Lilysilk Effortless Elegance

May 10, 2025

Elizabeth Stewarts Spring Collection With Lilysilk Effortless Elegance

May 10, 2025 -

Oilers Even Series Against Kings With Overtime Victory

May 10, 2025

Oilers Even Series Against Kings With Overtime Victory

May 10, 2025 -

Violacion De Derechos Universitaria Transgenero Arrestada Por Acceso A Bano Femenino

May 10, 2025

Violacion De Derechos Universitaria Transgenero Arrestada Por Acceso A Bano Femenino

May 10, 2025 -

Pam Bondis Alleged Plan To Kill American Citizens Fact Check And Analysis

May 10, 2025

Pam Bondis Alleged Plan To Kill American Citizens Fact Check And Analysis

May 10, 2025