Top India Fund Manager DSP Sounds Warning Bell On Stocks

Table of Contents

DSP's Concerns Regarding Current Market Valuation

DSP Mutual Fund has expressed concerns about the valuation of certain sectors within the Indian stock market. They believe that some sectors are currently overvalued, potentially setting the stage for a market correction. This overvaluation is primarily reflected in high Price-to-Earnings (P/E) ratios, which indicate that investors are paying a premium for current earnings.

The potential risks associated with these high valuations are significant. A market correction, characterized by a sharp decline in prices, could wipe out substantial investor wealth. The concern stems from whether future earnings growth will justify the current lofty valuations. Unforeseen circumstances, both domestic and global, could impact earnings, leading to a downward price adjustment.

- High Price-to-Earnings (P/E) ratios in specific sectors: Certain high-growth sectors might be exhibiting inflated P/E ratios, indicating a potential bubble.

- Concerns about future earnings growth justifying current valuations: DSP's caution highlights the uncertainty surrounding whether projected growth will materialize, potentially making current prices unsustainable.

- Potential impact of global economic uncertainty on Indian markets: Global factors like inflation, interest rate hikes, and geopolitical instability can significantly influence the Indian stock market, impacting valuations and potentially triggering a correction.

Recommendations from DSP for Investors

In light of these concerns, DSP Mutual Fund has provided several recommendations to help investors navigate the current market conditions. These recommendations emphasize a cautious, diversified approach tailored to different risk profiles.

DSP suggests a strategic approach prioritizing risk management and long-term growth. This means focusing less on short-term gains and more on building a resilient portfolio. This strategy is particularly important given the current market uncertainty.

- Diversification of investment portfolios: Spreading investments across different asset classes (equities, debt, gold, etc.) reduces the overall portfolio risk.

- Focus on undervalued or fundamentally strong companies: Identifying companies with strong fundamentals and attractive valuations can help mitigate the risk associated with overvalued sectors. Thorough due diligence is crucial.

- Gradual investment approach rather than lump-sum investments: Instead of investing a large sum at once, a phased approach allows investors to average their cost and reduce the impact of market fluctuations. Dollar-cost averaging is a popular strategy.

- Consideration of debt instruments to balance risk: Incorporating debt instruments into the portfolio can provide stability and reduce overall portfolio volatility, particularly during market corrections.

Analysis of Macroeconomic Factors Influencing DSP's Outlook

DSP Mutual Fund's cautious outlook is underpinned by several significant macroeconomic factors, both domestic and global. These factors contribute to the increased uncertainty and warrant a conservative investment strategy.

The interplay of global and domestic economic forces creates a complex scenario. Careful analysis of these factors is crucial for informed decision-making.

- Impact of rising interest rates: Global interest rate hikes impact borrowing costs, potentially slowing economic growth and impacting corporate earnings.

- Global inflation and its effect on Indian markets: High inflation erodes purchasing power and can lead to reduced consumer spending, negatively affecting corporate profits and market valuations.

- Geopolitical risks and their potential impact: Geopolitical events create uncertainty and volatility in the markets, impacting investor sentiment and asset prices.

- Domestic economic growth projections: While India's economy is generally strong, slower-than-expected growth could negatively impact market performance.

Market Reactions and Expert Opinions on DSP's Warning

The market's reaction to DSP Mutual Fund's warning has been varied. While some investors have taken a cautious stance, others remain optimistic about the long-term prospects of the Indian stock market. Other financial institutions and analysts have also weighed in on the situation, offering a range of perspectives.

Analyzing the responses from different quarters provides a comprehensive understanding of the situation.

- Stock market performance following the warning: The immediate impact on the stock market has been varied, with some sectors experiencing minor corrections.

- Reactions from other financial institutions: Other financial institutions have offered similar warnings, further underscoring the concerns raised by DSP Mutual Fund.

- Expert opinions supporting or contradicting DSP's assessment: While some experts concur with DSP's assessment, others hold more optimistic views, highlighting the diversity of opinions in the market.

Conclusion: Navigating the Indian Stock Market with Caution

DSP Mutual Fund's warning serves as a crucial reminder of the inherent risks in the Indian stock market. Their concerns regarding overvaluation, coupled with the analysis of macroeconomic factors, highlight the need for a cautious and well-diversified investment strategy. Their recommendations – emphasizing diversification, focusing on fundamentally strong companies, and adopting a gradual investment approach – are valuable for investors of all risk profiles. Considering the DSP Mutual Fund warning, it's imperative to conduct thorough research, seek professional financial advice, and develop a robust investment strategy tailored to your risk tolerance before investing in Indian equities. Make informed investment decisions based on the insights from DSP Mutual Fund and other experts. Remember, a well-planned approach is key to navigating the complexities of the Indian stock market successfully.

Featured Posts

-

Price Gouging In La A Real Estate Agent Exposes Post Fire Exploitation

Apr 29, 2025

Price Gouging In La A Real Estate Agent Exposes Post Fire Exploitation

Apr 29, 2025 -

Contempt Of Legislature Yukon Politicians Confront Mine Managers Silence

Apr 29, 2025

Contempt Of Legislature Yukon Politicians Confront Mine Managers Silence

Apr 29, 2025 -

Debunking Ais Thinking A Closer Examination Of Current Capabilities

Apr 29, 2025

Debunking Ais Thinking A Closer Examination Of Current Capabilities

Apr 29, 2025 -

Khazna Data Centers Saudi Arabia Expansion Plans After Silver Lake Deal

Apr 29, 2025

Khazna Data Centers Saudi Arabia Expansion Plans After Silver Lake Deal

Apr 29, 2025 -

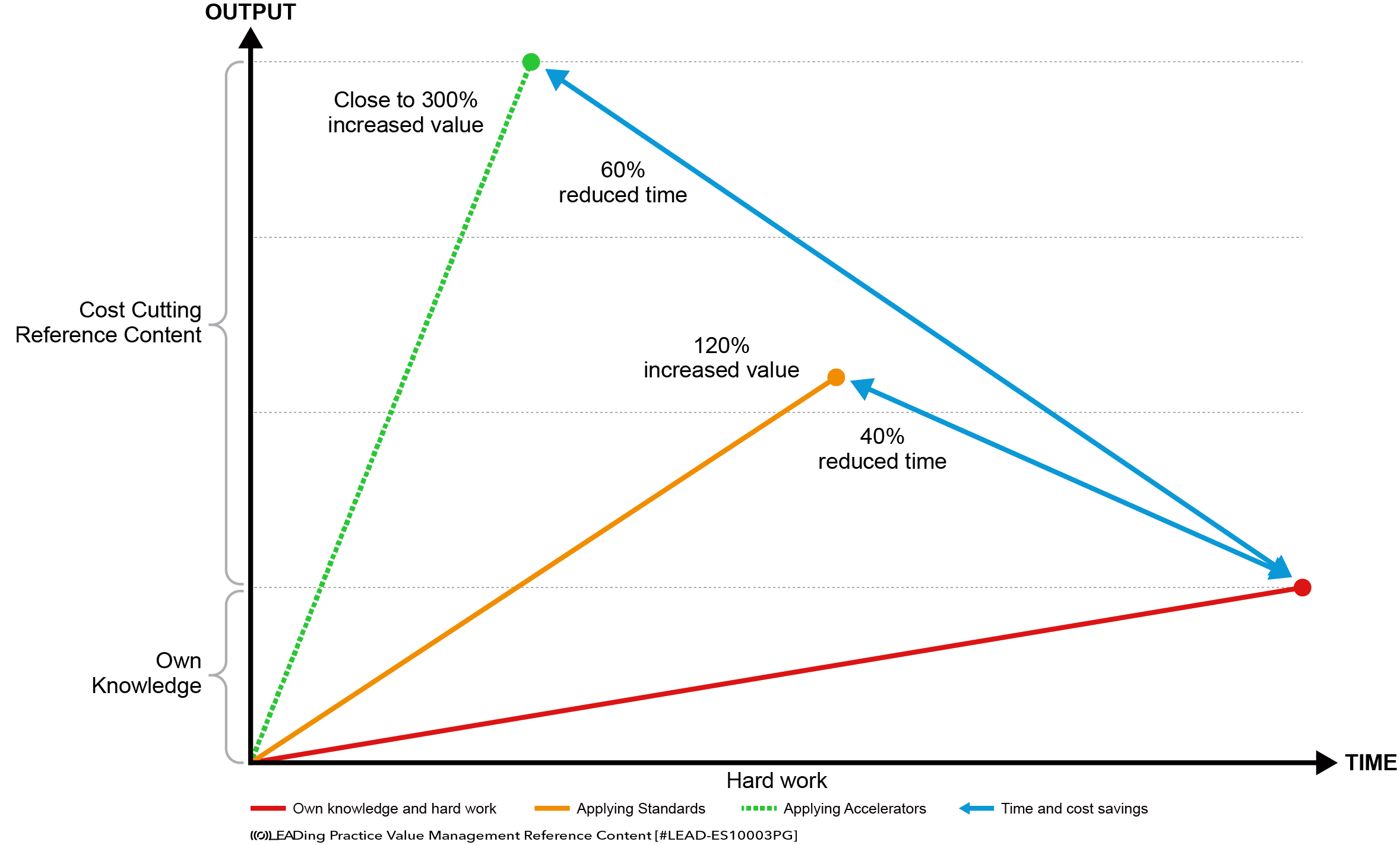

Cost Cutting Measures Surge In The U S As Tariffs Remain Unclear

Apr 29, 2025

Cost Cutting Measures Surge In The U S As Tariffs Remain Unclear

Apr 29, 2025

Latest Posts

-

Shop Now Hudsons Bays Closing Stores 70 Off

Apr 29, 2025

Shop Now Hudsons Bays Closing Stores 70 Off

Apr 29, 2025 -

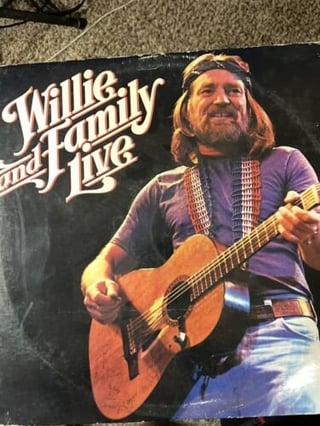

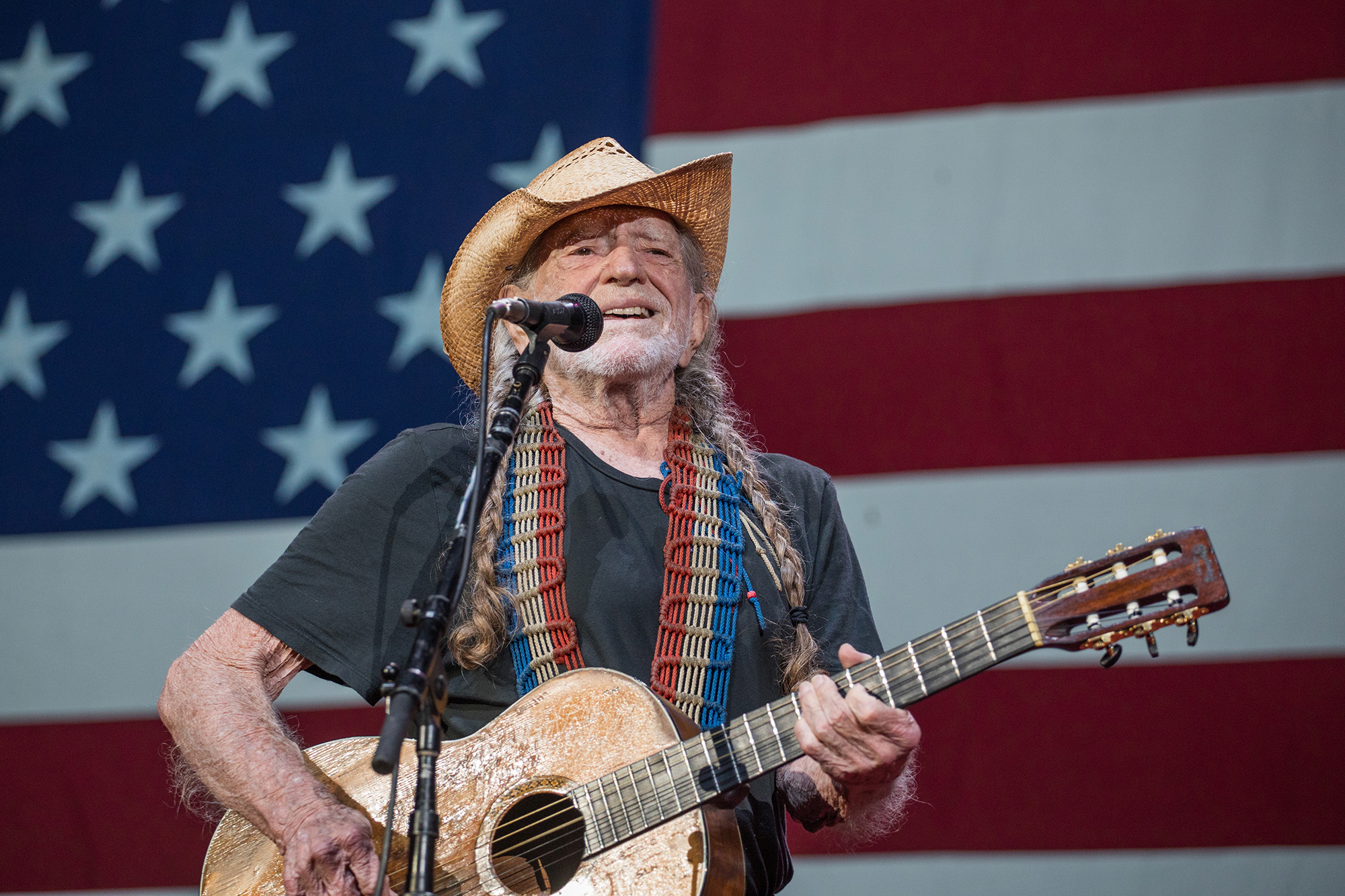

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025 -

Willie Nelsons 154th Album Release Amidst Family Dispute

Apr 29, 2025

Willie Nelsons 154th Album Release Amidst Family Dispute

Apr 29, 2025 -

Wife Of Willie Nelson Addresses Media Misreporting

Apr 29, 2025

Wife Of Willie Nelson Addresses Media Misreporting

Apr 29, 2025 -

Experience Willie Nelson And Family Live At Austin City Limits A Fans Guide

Apr 29, 2025

Experience Willie Nelson And Family Live At Austin City Limits A Fans Guide

Apr 29, 2025