Toronto Company's Pursuit Of Hudson's Bay: Expected To Be A Difficult Battle

Table of Contents

Hudson's Bay Company, a venerable institution with a history stretching back centuries, currently holds a significant, albeit challenged, market share in the Canadian retail sector. The Toronto company, whose name remains undisclosed at this stage, is reportedly driven by a desire to expand its market footprint and capitalize on HBC's extensive real estate portfolio and established brand recognition. The company's financial strength is believed to be substantial, suggesting a serious commitment to this retail takeover. However, the reality is this will not be an easy feat.

The Financial Hurdles

Securing the Hudson's Bay acquisition presents formidable financial challenges. The sheer scale of the undertaking demands significant capital investment.

Asset Valuation Challenges

One of the primary obstacles lies in the complex process of valuing HBC's assets. Accurately assessing the worth of its sprawling real estate portfolio, along with the valuation of its retail operations, is a monumental task. Disagreements on acquisition price between the buyer and seller are almost inevitable, potentially leading to protracted negotiation difficulties. Determining the true retail valuation and the asset valuation of each component of HBC will be crucial for a successful transaction.

Securing Financing

Securing the necessary acquisition financing for such a substantial undertaking is another critical hurdle. The Toronto company will need to navigate complex loan agreements and potentially seek assistance from investment banks to obtain the necessary debt financing and/or equity financing.

- The sheer size of Hudson's Bay necessitates a significant capital injection, potentially exceeding billions of dollars.

- Obtaining favorable loan agreements from banks, especially given the inherent risks of a large retail acquisition, may prove difficult.

- The company might need to seek additional funding through private equity investments or other sources of capital.

Regulatory and Legal Obstacles

Beyond the financial aspects, the Toronto company faces significant regulatory and legal obstacles.

Antitrust Scrutiny

The Hudson's Bay acquisition will undoubtedly face intense antitrust scrutiny from the Competition Bureau of Canada. Mergers of this magnitude often trigger thorough reviews to ensure that the deal doesn't lead to reduced competition or harm consumers. Past examples of major retail mergers in Canada illustrate the rigorous process and potential delays involved in securing regulatory approval. Concerns regarding competition concerns and market dominance will need to be addressed effectively.

Legal Battles

Furthermore, the Toronto company may encounter various legal challenges. Minority shareholders might launch shareholder lawsuits to challenge the acquisition terms. Existing contracts and employment agreements could lead to litigation risk, further complicating the process.

- The acquisition might necessitate a lengthy and potentially expensive regulatory review process, delaying the completion of the deal.

- Potential legal challenges may arise from disputes over employment contracts, supplier agreements, and other existing contractual obligations.

- Navigating the intricacies of Canadian regulations related to mergers and acquisitions will require considerable legal expertise.

Strategic and Operational Challenges

Even if the financial and legal hurdles are overcome, significant strategic and operational challenges remain.

Integrating Two Businesses

Merging two large retail companies, such as HBC and the Toronto company, is an extremely complex undertaking. Integrating diverse supply chain management systems, aligning disparate IT integration processes, and ensuring smooth employee retention are all critical concerns. Achieving operational synergies will require careful planning and execution.

Maintaining Brand Identity

Preserving customer loyalty requires a thoughtful brand management strategy. Balancing the distinct brand identities of both companies and developing a coherent post-merger marketing strategy to maintain customer loyalty will be critical for the success of the Hudson's Bay takeover.

- The integration process will likely lead to temporary disruptions in operations, potentially impacting sales and customer satisfaction.

- The Toronto company will need to devise strategies to retain valuable employees from both organizations.

- Establishing a clear, consistent brand message and developing effective marketing campaigns will be key to sustaining customer loyalty.

Conclusion

The Toronto company's pursuit of Hudson's Bay is shaping up to be a tremendously challenging undertaking. The Hudson's Bay takeover faces steep financial hurdles, significant regulatory and legal obstacles, and complex strategic and operational challenges. This challenging acquisition highlights the complexities of retail industry consolidation in Canada. This promises to be a difficult battle, and the ultimate outcome remains uncertain. Follow further developments in this high-stakes Hudson's Bay acquisition and stay informed about the Toronto company's efforts and the eventual outcome of this intense struggle. [Link to relevant news source here]

Featured Posts

-

Priscilla Pointer Amy Irvings Mother And Carrie Star Passes Away At 100

May 02, 2025

Priscilla Pointer Amy Irvings Mother And Carrie Star Passes Away At 100

May 02, 2025 -

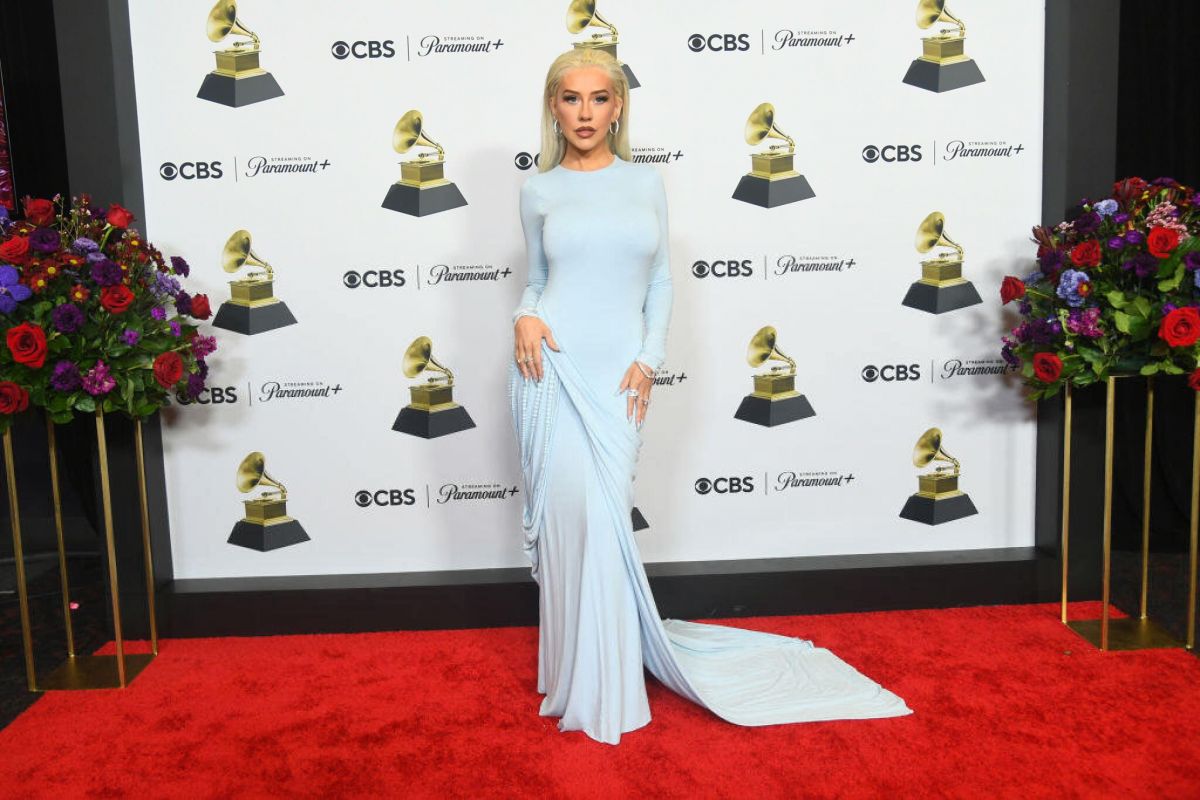

Christina Aguileras Altered Image A Discussion On Body Image And Photo Manipulation

May 02, 2025

Christina Aguileras Altered Image A Discussion On Body Image And Photo Manipulation

May 02, 2025 -

Ywm Ykjhty Kshmyr Mzahrwn Awr Tqrybat Se Kshmyrywn Ky Hmayt Ka Aelan

May 02, 2025

Ywm Ykjhty Kshmyr Mzahrwn Awr Tqrybat Se Kshmyrywn Ky Hmayt Ka Aelan

May 02, 2025 -

Every Minute Matters Barrow Afc Fans Cycling Relay For Charity

May 02, 2025

Every Minute Matters Barrow Afc Fans Cycling Relay For Charity

May 02, 2025 -

Riot Fest 2025 Full Lineup Announced Green Day And Weezer Lead The Charge

May 02, 2025

Riot Fest 2025 Full Lineup Announced Green Day And Weezer Lead The Charge

May 02, 2025