Tracking The Billions: Musk, Bezos, And Zuckerberg's Post-Trump Inauguration Losses

Table of Contents

In the days following the Trump inauguration, the combined wealth of Elon Musk, Jeff Bezos, and Mark Zuckerberg experienced a staggering decline – a loss estimated in the tens of billions of dollars. This article delves into the complex factors behind this significant financial shift, exploring how policy changes, market fluctuations, and public perception impacted these tech titans in the post-inauguration landscape. We will be tracking the billions lost and analyzing the long-term implications for these influential figures and the global economy.

<h2>Elon Musk's Post-Inauguration Financial Trajectory</h2>

<h3>Impact of Trump Administration Policies on Tesla and SpaceX</h3>

The Trump administration's policies significantly impacted Elon Musk's ventures. Specific policy changes created both opportunities and challenges.

- Tax Cuts and Jobs Act: While the corporate tax cuts initially boosted profits, the long-term effects on Tesla's investment strategy and expansion plans remain a subject of debate.

- Environmental Regulations: The administration's relaxed approach to environmental regulations, while potentially beneficial for SpaceX's space exploration endeavors, presented mixed signals for Tesla, a company heavily invested in electric vehicles and renewable energy. This ambiguity led to stock market volatility.

- Trade Wars: The imposition of tariffs on imported goods impacted Tesla's supply chain and manufacturing costs, affecting profitability and shareholder confidence. This is evident in Tesla stock performance charts showing significant fluctuations during this period.

Tesla's stock price experienced considerable volatility throughout the Trump presidency, reflecting the complex interplay of these policy shifts.

<h3>Public Perception and Brand Influence under the Trump Presidency</h3>

Elon Musk's outspoken nature and sometimes controversial statements on social media often clashed with the political climate. His public pronouncements directly impacted investor confidence and Tesla's brand image.

- Controversial Tweets: Musk's frequent and often unpredictable tweets significantly affected Tesla's stock price, leading to investigations by the Securities and Exchange Commission (SEC).

- Media Coverage: Negative media coverage surrounding Musk's actions amplified the uncertainty surrounding Tesla, potentially deterring investors. Numerous news articles from this era highlight the correlation between Musk's public persona and Tesla's stock performance. (Example link to relevant news article could be inserted here).

- Shifting Investor Sentiment: The combination of policy uncertainty and Musk's public image created a volatile environment, impacting Tesla's valuation and overall investor sentiment.

<h2>Jeff Bezos and Amazon's Response to the Post-Inauguration Landscape</h2>

<h3>Antitrust Scrutiny and Regulatory Changes</h3>

The Trump administration increased antitrust scrutiny on large tech companies, placing Amazon under significant pressure.

- Antitrust Investigations: Amazon faced several investigations concerning its business practices, particularly its dominance in e-commerce and its treatment of third-party sellers.

- Regulatory Uncertainty: This regulatory uncertainty impacted Amazon's investment decisions and its ability to expand into new markets. Potential antitrust lawsuits and investigations loomed large, affecting Amazon's market valuation. (Example link to relevant legal analysis could be inserted here).

- Impact on Stock Price: The threat of regulatory action contributed to fluctuations in Amazon's stock price, reflecting investor concerns about potential fines or restrictions.

<h3>E-commerce Trends and Shifting Consumer Behavior</h3>

The post-inauguration period saw shifts in consumer spending patterns, influencing Amazon's performance.

- Economic Conditions: Economic growth and consumer confidence influenced online spending habits.

- Competition: Increased competition in the e-commerce sector also impacted Amazon's market share and profitability.

- Data Analysis: Examining data on Amazon's sales and profitability during this period reveals the effects of these economic and competitive forces.

<h2>Mark Zuckerberg and Facebook's Challenges in the Post-Trump Era</h2>

<h3>Scrutiny over Data Privacy and Misinformation</h3>

Facebook faced heightened scrutiny over its data privacy practices and the spread of misinformation on its platform.

- Cambridge Analytica Scandal: The Cambridge Analytica scandal further damaged Facebook's reputation and intensified concerns about data security.

- GDPR and other Regulations: The implementation of the General Data Protection Regulation (GDPR) and other data privacy regulations significantly impacted Facebook's operations and revenue. These legal frameworks imposed substantial costs and operational changes. (Example link to relevant legislation could be inserted here)

- Impact on Advertising Revenue: Increased regulatory pressure and growing public distrust affected Facebook's advertising revenue streams.

<h3>Political Polarization and Advertising Revenue</h3>

The increasing political polarization in the US created unique challenges for Facebook.

- Content Moderation: Facebook struggled to effectively moderate content, grappling with the challenge of balancing free speech with the need to remove harmful or misleading information.

- Impact on User Engagement: Political polarization affected user engagement and the overall health of the Facebook ecosystem.

- Advertising Revenue Fluctuations: The volatile political climate impacted advertising revenue, as advertisers adjusted their strategies in response to the changing social and political landscape. Data on user growth and advertising revenue reveals these trends clearly.

<h2>Analyzing the Billions Lost: A Deeper Dive into Post-Inauguration Impacts</h2>

Following the Trump inauguration, Elon Musk, Jeff Bezos, and Mark Zuckerberg experienced significant financial shifts. These losses, totaling billions of dollars, resulted from a complex interplay of factors. Policy changes, increased regulatory scrutiny, shifting consumer behavior, and public perception played crucial roles in shaping their financial trajectories. Understanding these interconnected factors is crucial for analyzing the long-term consequences of these events.

Key Takeaways: The post-inauguration period presented significant challenges for these tech giants. Policy uncertainty, regulatory pressures, evolving consumer behavior, and public perceptions dramatically influenced their financial performance.

Call to Action: To further explore the intricacies of these financial shifts, we encourage you to delve deeper into the topic. Research papers, news archives, and financial analyses focusing on “Tracking the Billions,” “Post-Inauguration Market Shifts,” and related keywords offer valuable insights. The long-term implications of these financial changes on the global tech landscape are far-reaching and deserve continued investigation.

Featured Posts

-

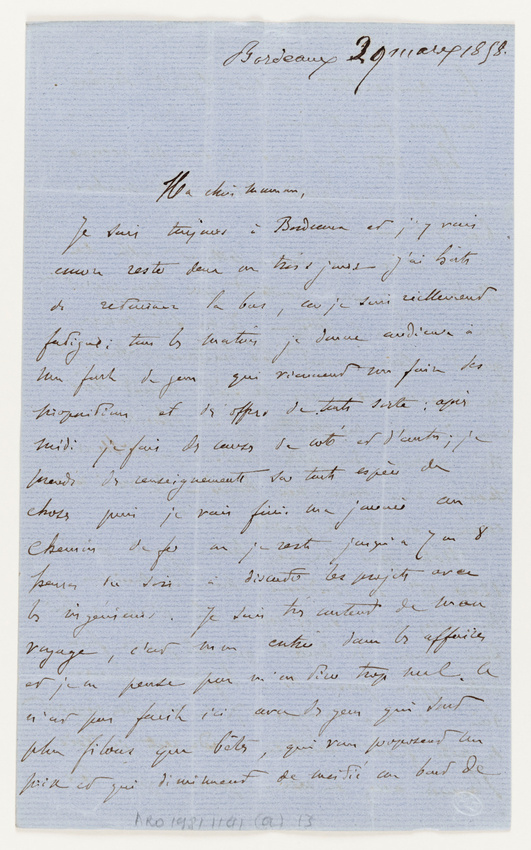

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 10, 2025

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 10, 2025 -

Trump Issues 10 Tariff Warning Exceptional Deals Only Exempt

May 10, 2025

Trump Issues 10 Tariff Warning Exceptional Deals Only Exempt

May 10, 2025 -

Greater Edmonton Federal Riding Changes An Analysis Of Voter Impact

May 10, 2025

Greater Edmonton Federal Riding Changes An Analysis Of Voter Impact

May 10, 2025 -

Operation Sindoor And Its Devastating Effect On The Pakistan Stock Exchange

May 10, 2025

Operation Sindoor And Its Devastating Effect On The Pakistan Stock Exchange

May 10, 2025 -

Zayavi Stivena Kinga Pro Trampa Ta Maska Pislya Yogo Povernennya Na X

May 10, 2025

Zayavi Stivena Kinga Pro Trampa Ta Maska Pislya Yogo Povernennya Na X

May 10, 2025