Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF is a type of UCITS (Undertakings for Collective Investment in Transferable Securities) ETF. UCITS ETFs are regulated investment funds designed to provide investors with exposure to a specific market index or asset class, in this case, the iconic Dow Jones Industrial Average (DJIA). The key benefits of investing in a UCITS ETF include regulatory oversight ensuring investor protection and the ease of trading on major exchanges.

The ETF's underlying asset, the DJIA, is a price-weighted average of 30 large, publicly owned companies representing a broad spectrum of the US economy. Its composition is carefully selected to reflect the performance of leading sectors. The ETF's investment objective is to track the performance of the DJIA, providing investors with a simple and efficient way to gain exposure to this benchmark index.

- Diversification benefits: Exposure to 30 leading US companies reduces individual stock risk.

- Low expense ratio: UCITS ETFs generally have low management fees compared to actively managed funds.

- Transparent investment strategy: The ETF’s holdings and investment strategy are publicly disclosed.

- Accessibility for retail investors: Easy to buy and sell through most brokerage accounts.

Why Tracking the NAV is Crucial

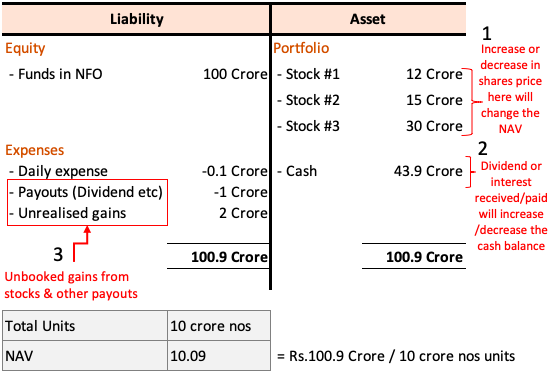

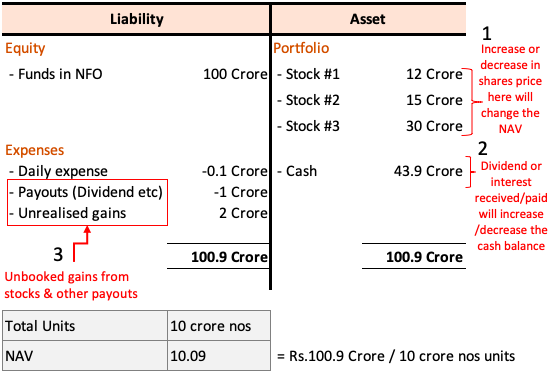

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of the 30 DJIA component stocks, adjusted for any expenses. Changes in the NAV directly indicate the ETF's performance and are essential for making informed investment decisions. A rising NAV suggests positive performance, while a falling NAV indicates negative performance.

Monitoring the NAV allows investors to:

- Real-time market insights: Track the immediate impact of market events on the ETF's value.

- Accurate performance evaluation: Compare the ETF's performance against its benchmark and other similar investments.

- Informed investment strategies: Make buy, sell, or hold decisions based on current NAV and market trends.

- Comparison with other ETFs: Evaluate the Amundi Dow Jones Industrial Average UCITS ETF's performance relative to competitors tracking the same index.

Methods for Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several methods exist to track the Amundi Dow Jones Industrial Average UCITS ETF NAV:

- Amundi website resources: The official Amundi website usually provides daily or even intraday NAV data for their ETFs.

- Reliable financial data providers: Websites like Google Finance, Yahoo Finance, Bloomberg, and others offer real-time or delayed NAV quotes for many ETFs.

- Brokerage account features: Most brokerage platforms display the current NAV of ETFs held in your portfolio, often with historical data.

- Using APIs for programmatic access: For sophisticated investors, financial data APIs allow automated NAV tracking and integration into investment management systems. This provides real-time data streams for more active monitoring.

Interpreting NAV Changes and Their Implications

Interpreting NAV changes requires understanding the factors influencing them. A positive change signifies an increase in the value of the underlying assets, driven primarily by positive market movements in the DJIA component stocks. Conversely, a negative change reflects a decrease in underlying asset value.

Factors impacting NAV fluctuations include:

- Market trends impact: Overall market performance is the biggest driver of NAV changes.

- Dividend reinvestment effect: Dividends paid by the underlying companies can positively influence the NAV, especially when reinvested.

- Currency fluctuations (if applicable): If the ETF is denominated in a currency different from your base currency, exchange rate movements will impact your NAV.

- Understanding trading volume influence: While not directly impacting NAV, high trading volume might reflect increased market interest and can lead to price discrepancies between NAV and market price.

Using NAV to Make Informed Investment Decisions

The NAV is a vital tool for evaluating ETF performance. By comparing the NAV to the ETF's market price, investors can identify potential arbitrage opportunities. Furthermore, monitoring long-term NAV trends provides crucial context for strategic investment decisions.

- Benchmark comparison: Regularly compare the ETF's NAV performance to the DJIA to assess tracking effectiveness.

- Identifying potential discrepancies: Significant differences between the NAV and the market price can signal arbitrage opportunities or market inefficiencies.

- Long-term investment strategy: Focus on long-term NAV trends to understand the ETF's overall performance and make informed long-term investment decisions.

Conclusion

Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV is essential for informed investment decisions. By utilizing the various methods outlined above – from checking the Amundi website to using brokerage platforms and financial APIs – investors can gain valuable insights into the ETF's performance and make strategic choices. Start tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV today to make well-informed investment choices and maximize your returns! Learn more about efficient Amundi Dow Jones Industrial Average UCITS ETF NAV tracking strategies to optimize your investment portfolio.

Featured Posts

-

Amsterdam Exchange Plunges 7 As Trade War Concerns Rise

May 24, 2025

Amsterdam Exchange Plunges 7 As Trade War Concerns Rise

May 24, 2025 -

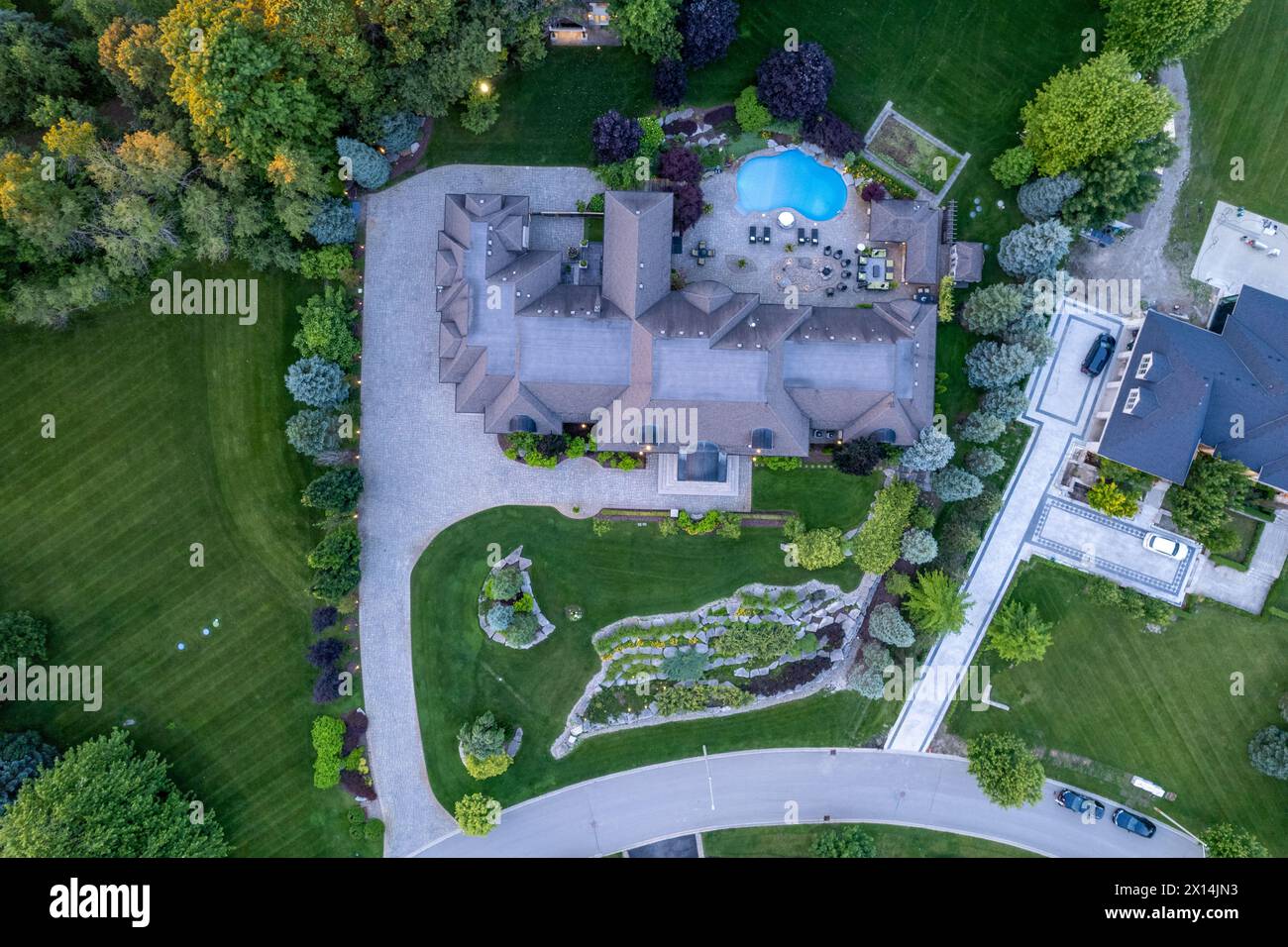

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Escape To The Country Dream Homes Under 1 Million

May 24, 2025 -

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025 -

Onrust Op Wall Street Maar Aex In De Plus Experts Geven Commentaar

May 24, 2025

Onrust Op Wall Street Maar Aex In De Plus Experts Geven Commentaar

May 24, 2025 -

Demnas Gucci Designs Kering Reports Lower Sales Figures

May 24, 2025

Demnas Gucci Designs Kering Reports Lower Sales Figures

May 24, 2025

Latest Posts

-

Will Ronan Farrow Orchestrate Mia Farrows Entertainment Industry Return

May 24, 2025

Will Ronan Farrow Orchestrate Mia Farrows Entertainment Industry Return

May 24, 2025 -

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025