Tracking The Net Asset Value (NAV) Of The Amundi MSCI World Ex-US UCITS ETF

Table of Contents

Where to Find the Amundi MSCI World ex-US UCITS ETF NAV

Finding the real-time and historical NAV of the Amundi MSCI World ex-US UCITS ETF is straightforward thanks to several reliable sources. Consistent monitoring of the NAV allows you to gauge the performance of your investment and compare it against the market price.

-

Official Amundi Website: The most reliable source is the official Amundi website itself. Look for their ETF section, usually under "Products" or "Funds," where you'll find detailed information on their ETFs including the Amundi MSCI World ex-US UCITS ETF. The specific location of the NAV data may vary, so use their search function if needed.

-

Financial Data Providers: Reputable financial data providers like Bloomberg Terminal, Refinitiv Eikon, and FactSet provide comprehensive data, including real-time and historical NAVs for a wide range of ETFs, including the Amundi MSCI World ex-US UCITS ETF. These services usually come with a subscription fee.

-

Brokerage Platforms: If you hold the Amundi MSCI World ex-US UCITS ETF within your brokerage account, the NAV will typically be displayed alongside the current market price on your account statement or portfolio summary page. This offers convenient and immediate access to the information.

-

ETF Data Aggregators: Several websites specialize in aggregating ETF data from various sources. These sites usually offer free access to basic information but may require a subscription for in-depth historical data and analytics.

Factors Influencing the Amundi MSCI World ex-US UCITS ETF NAV

The daily NAV of the Amundi MSCI World ex-US UCITS ETF fluctuates based on several key factors. Understanding these factors is essential for interpreting NAV changes and managing investment risk.

-

Underlying Asset Performance: The primary driver of NAV changes is the performance of the underlying assets within the ETF. Positive performance in the international equity markets (excluding the US) will generally lead to an increase in the NAV, while negative performance will decrease it. Global economic news and individual company performance significantly impact this.

-

Currency Fluctuations: Because the ETF invests in non-US companies, fluctuations in exchange rates between the currencies of these companies and your base currency (likely EUR or USD) directly influence the NAV. A strengthening of the Euro against other currencies in the portfolio could increase the NAV, while a weakening would have the opposite effect.

-

Dividend Distributions: When the underlying companies in the ETF pay dividends, the ETF receives these distributions. This can lead to a slight drop in the NAV on the ex-dividend date, as the ETF's assets decrease, but it will also reflect the accrued dividend income soon after.

-

Management Fees and Expenses: The operating expenses of the ETF, including management fees, are deducted from the assets, impacting the NAV. These fees, although typically small, contribute to minor fluctuations over time.

Interpreting NAV Changes for Strategic Investment Decisions

Analyzing NAV changes is crucial for informed investment decisions. Using NAV data effectively allows you to monitor performance, assess risk, and make strategic buy and sell choices.

-

Comparing NAV to Market Price: The market price of an ETF can sometimes trade at a slight premium or discount to its NAV. Understanding this difference helps in identifying potential arbitrage opportunities. A significant difference might warrant further investigation.

-

Analyzing NAV Trends: Tracking the NAV over time reveals long-term trends. Upward trends indicate positive performance, while downward trends suggest potential concerns. Analyzing these trends in conjunction with market conditions helps in making informed investment decisions.

-

Using NAV for Performance Evaluation: The NAV provides a clear measure of the ETF's underlying asset performance, excluding the effects of market fluctuations in the ETF's price itself. This allows for a more accurate assessment of the investment strategy's success compared to benchmarks.

-

NAV in Buy/Sell Decisions: While not the sole determining factor, the NAV can influence buy/sell decisions. A significant drop in NAV might indicate an opportunity to buy low, while a substantial increase could suggest a potential time to sell, depending on overall market outlook and investment strategy.

Tools and Resources for Efficient NAV Tracking

Several tools and resources are available to simplify NAV tracking for the Amundi MSCI World ex-US UCITS ETF.

-

Spreadsheet Software: Programs like Microsoft Excel or Google Sheets allow you to manually input and track NAV data over time, facilitating analysis and creating charts to visualize performance.

-

Financial Data APIs: For more advanced users, financial data APIs offer automated data retrieval. These APIs allow you to integrate NAV data into custom applications or dashboards for real-time monitoring.

-

Portfolio Tracking Apps: Many mobile applications offer comprehensive portfolio tracking features, including the ability to add ETFs and monitor their NAVs automatically. These user-friendly apps provide convenient access to your investment information.

-

Dedicated ETF Tracking Websites: Several websites focus on providing ETF data and analysis, often including features to track individual ETFs like the Amundi MSCI World ex-US UCITS ETF and compare their performance with other similar ETFs.

Conclusion: Mastering NAV Tracking for the Amundi MSCI World ex-US UCITS ETF

Understanding and regularly tracking the Net Asset Value (NAV) of the Amundi MSCI World ex-US UCITS ETF is a critical aspect of responsible investment management. We've explored where to find the NAV, the key factors influencing it, how to interpret its changes, and efficient tracking methods. By using the resources outlined above, you can actively monitor your investment, compare it to the market price, and make more informed decisions based on the underlying performance of the ETF. Start tracking the Net Asset Value of your Amundi MSCI World ex-US UCITS ETF holdings today for better investment control!

Featured Posts

-

Finding Your Perfect Country Escape A Practical Guide

May 24, 2025

Finding Your Perfect Country Escape A Practical Guide

May 24, 2025 -

2025 Porsche Cayenne Interior And Exterior Photo Gallery

May 24, 2025

2025 Porsche Cayenne Interior And Exterior Photo Gallery

May 24, 2025 -

Glastonbury Festival Unconfirmed Us Band Performance Sparks Debate

May 24, 2025

Glastonbury Festival Unconfirmed Us Band Performance Sparks Debate

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025 -

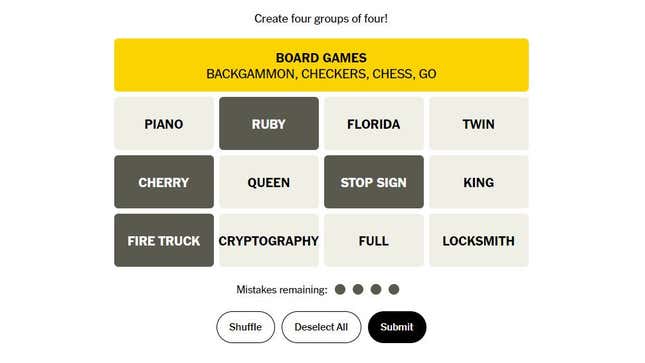

Solutions To New York Times Connections Puzzle 646 March 18 2025

May 24, 2025

Solutions To New York Times Connections Puzzle 646 March 18 2025

May 24, 2025

Latest Posts

-

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025 -

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025 -

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025