Trade War Intensifies: Amsterdam Stock Market Suffers 7% Drop

Table of Contents

Causes of the Amsterdam Stock Market Drop

The 7% plunge in the Amsterdam Stock Market is a multifaceted issue stemming from various interconnected factors related to the intensifying trade war.

Impact of Tariffs and Trade Restrictions

The imposition of tariffs and trade restrictions by major global players has directly impacted Dutch businesses and the Amsterdam Stock Exchange (AEX). These measures disrupt established trade routes, increase the cost of goods, and reduce competitiveness.

- Affected Sectors: The technology and agricultural sectors have been particularly hard hit, with companies reliant on global supply chains facing significant challenges. For example, [insert name of a Dutch tech company] reported a 15% drop in quarterly profits due to increased import tariffs on their components. Similarly, Dutch agricultural exporters have faced reduced demand and higher costs due to trade barriers.

- Specific Company Losses: [Insert names of specific companies and quantifiable data on their losses]. These losses illustrate the direct impact of the trade war on individual businesses listed on the AEX.

- Trade Volume Changes: Data indicates a [quantifiable percentage] decrease in trade volume between the Netherlands and [relevant countries], highlighting the disruption caused by trade restrictions. This reduction directly impacts the revenue and profitability of numerous Dutch companies.

Global Market Uncertainty and Investor Sentiment

Beyond the direct impact on Dutch businesses, the broader global economic uncertainty fueled by the trade war has significantly impacted investor sentiment. This uncertainty creates a climate of fear and reluctance to invest, leading to a sell-off in the Amsterdam Stock Market.

- Declining Investor Confidence: The ongoing trade tensions have eroded investor confidence, prompting a flight of capital to safer assets like government bonds.

- Capital Flight: Investors are pulling funds out of riskier markets, including the Amsterdam Stock Market, in anticipation of further economic downturns.

- Impact on Market Sentiment: Negative news headlines and uncertain economic forecasts contribute to a pessimistic market sentiment, leading to further price drops. The consumer confidence index in the Netherlands has also fallen, reflecting a general sense of unease among consumers.

Geopolitical Tensions and their Ripple Effects

Geopolitical tensions, often intertwined with trade disputes, further contribute to market instability. The escalating trade war is not occurring in a vacuum; it's part of a larger complex of international relations that impacts investor risk appetite.

- Exacerbating Events: [Mention specific geopolitical events, e.g., increased tensions in a particular region, political instability in a key trading partner]. These events add to the overall uncertainty, making investors more risk-averse.

- Impact on Investor Risk Appetite: The combination of trade war uncertainty and geopolitical instability dramatically reduces investor risk appetite, leading to increased selling pressure on the Amsterdam Stock Market.

- Analyst Reports: Multiple analyst reports from reputable firms like [mention financial institutions] have cited the combined effect of trade wars and geopolitical tensions as major contributors to the recent market downturn.

Consequences for the Dutch Economy

The sharp drop in the Amsterdam Stock Market has far-reaching consequences for the Dutch economy, impacting businesses, employment, and the overall economic outlook.

Impact on Dutch Businesses and Employment

The market downturn threatens to trigger job losses and business closures across various sectors of the Dutch economy.

- Struggling Industries: Industries heavily reliant on exports or global supply chains, such as [mention specific industries], are especially vulnerable.

- Predicted Economic Growth Slowdown: The decline in the Amsterdam Stock Market suggests a slowdown in economic growth, potentially leading to a contraction in the coming quarters.

- Unemployment and Bankruptcies: The Netherlands may see a rise in unemployment rates and business bankruptcies as a result of the ongoing economic challenges. [Insert data on unemployment predictions, if available].

Government Response and Economic Policies

The Dutch government is likely to respond to the market crash with various economic policies aimed at mitigating the impact.

- Economic Stimulus Packages: The government might implement stimulus packages to boost economic activity and support struggling businesses.

- Tax Cuts: Tax cuts for businesses could incentivize investment and job creation.

- Government Initiatives: [Mention any specific measures the Dutch government is taking or planning to take]. Quotes from government officials regarding their response are crucial here.

Long-Term Implications for the Dutch Economy

The long-term implications of the current situation remain uncertain, with both potential for recovery and risks of prolonged recession.

- Potential for Recovery: A swift resolution to the trade disputes and effective government intervention could lead to a relatively quick economic recovery.

- Risks of Prolonged Recession: If the trade war continues and global economic conditions worsen, the Netherlands could face a prolonged recession with lasting economic consequences.

- Long-Term Investment Strategies: Investors need to adapt their strategies to account for the increased risk and uncertainty in the current environment.

Strategies for Investors

Navigating the current market volatility requires a proactive and informed approach to investment strategies.

Diversification and Risk Management

Diversification and robust risk management strategies are crucial for investors during times of uncertainty.

- Diversification Across Asset Classes: Investors should diversify their portfolios across various asset classes (stocks, bonds, real estate, etc.) to reduce their overall risk exposure.

- Hedging Against Market Volatility: Strategies such as hedging with derivatives can help mitigate losses during periods of high market volatility.

Opportunities Amidst Uncertainty

While the current climate presents challenges, opportunities may also arise for shrewd investors.

- Undervalued Stocks: The market downturn could create opportunities to acquire undervalued stocks with strong long-term growth potential.

- Potential for Long-Term Growth: Certain sectors, less susceptible to trade war disruptions, might offer long-term growth prospects.

Seeking Professional Financial Advice

Consulting with a qualified financial advisor is strongly recommended during times of market uncertainty.

- Personalized Investment Strategies: A financial advisor can help develop a personalized investment strategy aligned with your risk tolerance and financial goals.

- Understanding Individual Risk Tolerance: It’s essential to understand your own risk tolerance before making any investment decisions in this volatile environment.

Conclusion

The 7% drop in the Amsterdam Stock Market, fueled by the intensifying trade war, signals significant challenges for the Dutch economy. The consequences for businesses, employment, and long-term economic growth are substantial. Understanding the interconnected nature of global trade and geopolitical events is paramount for investors.

Call to Action: Stay informed about the evolving situation and consider adjusting your investment strategy to navigate the uncertainties of the ongoing trade war. Monitor the Amsterdam Stock Market closely and consult with a financial professional to make informed decisions about your investments. Understanding the complexities of the Amsterdam Stock Market and the global trade war is crucial for mitigating risks and capitalizing on potential opportunities.

Featured Posts

-

West Hams Kyle Walker Peters Transfer Bid Latest News And Analysis

May 25, 2025

West Hams Kyle Walker Peters Transfer Bid Latest News And Analysis

May 25, 2025 -

Philips 2025 Agm Shareholder Information And Updates

May 25, 2025

Philips 2025 Agm Shareholder Information And Updates

May 25, 2025 -

De Toekomst Van Europese Aandelen Wat Betekent De Recente Marktdraai

May 25, 2025

De Toekomst Van Europese Aandelen Wat Betekent De Recente Marktdraai

May 25, 2025 -

Gucci Under Demna A Fashion Analysis

May 25, 2025

Gucci Under Demna A Fashion Analysis

May 25, 2025 -

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 25, 2025

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 25, 2025

Latest Posts

-

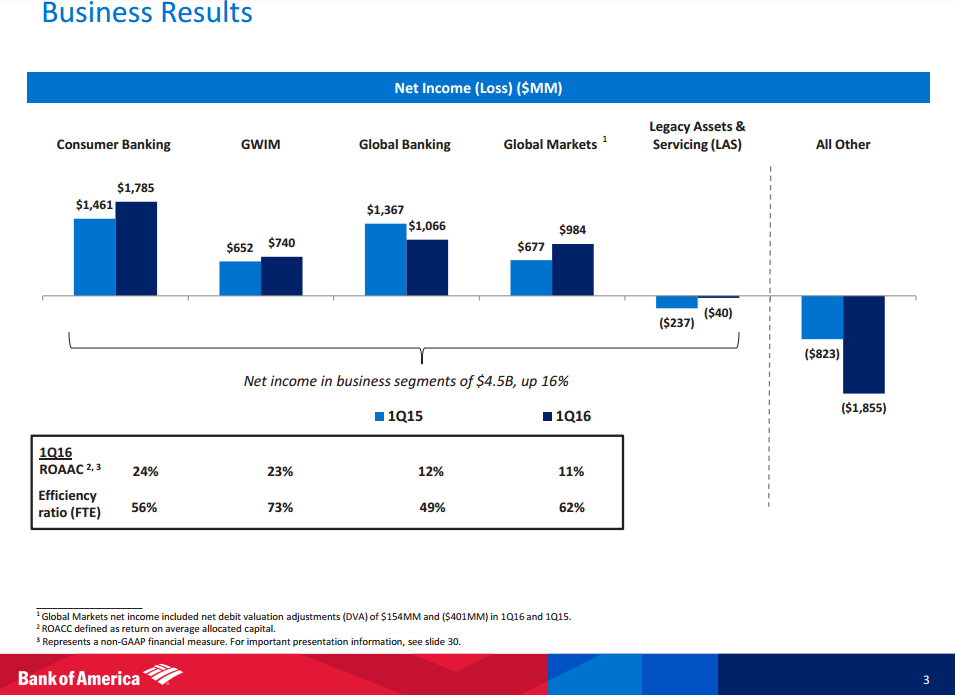

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025 -

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025 -

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025 -

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025 -

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025