Trade War Weighs On Eurozone: ECB's Simkus Suggests Two Additional Rate Cuts

Table of Contents

The Trade War's Impact on Eurozone Growth

The ongoing trade war is significantly impacting Eurozone growth through various channels. The imposition of tariffs and retaliatory measures disrupts global supply chains, increasing input costs for businesses and reducing export opportunities for Eurozone companies. This trade war impact on Europe is particularly acute in sectors heavily reliant on international trade, such as the automotive and manufacturing industries. The resulting Eurozone economic slowdown is evident in several key indicators.

- Declining business investment due to uncertainty: The uncertainty surrounding future trade policies discourages businesses from investing in expansion and modernization.

- Weakening consumer confidence impacting spending: Concerns about job security and economic stability lead to reduced consumer spending, further dampening economic activity.

- Increased input costs for businesses: Tariffs and trade barriers inflate the cost of imported goods, squeezing profit margins and limiting competitiveness.

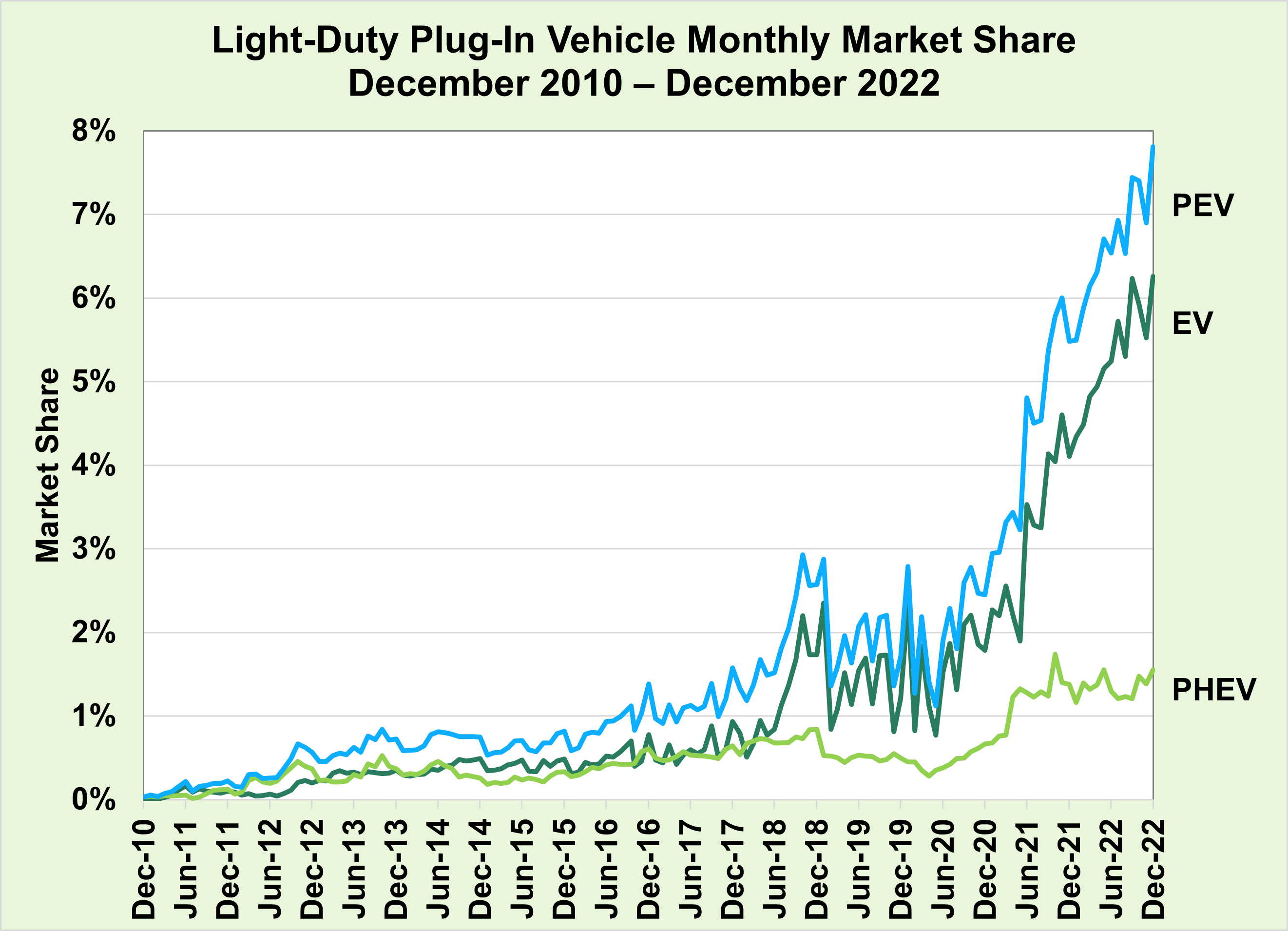

Data from Eurostat reveals a significant decline in export growth, particularly to key trading partners affected by the trade war. GDP growth forecasts for the Eurozone have been revised downwards, reflecting the negative impact of global trade uncertainty.

ECB's Current Monetary Policy and Challenges

The ECB currently employs a monetary policy characterized by negative interest rates and quantitative easing (QE). However, the effectiveness of current stimulus measures in countering the trade war's impact is questionable. Negative interest rates, while intended to encourage lending and investment, have reached their limits, and concerns persist regarding their long-term efficacy. QE, involving the ECB purchasing government bonds to inject liquidity into the market, faces challenges in significantly stimulating economic growth amidst significant uncertainty. Keywords: ECB monetary policy, negative interest rates Eurozone, quantitative easing effectiveness.

- Challenges of further negative interest rates: Pushing rates further into negative territory could have unintended consequences, potentially harming bank profitability and hindering lending.

- Limitations of quantitative easing in stimulating growth: QE's effectiveness is reduced when businesses are hesitant to invest due to trade war-related uncertainty.

- Concerns about the effectiveness of current stimulus measures: The current policy might not be sufficient to offset the considerable negative impact of the trade war.

Simkus' Proposal: Two Additional Rate Cuts

Gediminas Šimkus's suggestion of two further ECB rate cuts represents a significant consideration within the ECB. This move aims to reduce borrowing costs for businesses and consumers, potentially stimulating investment and spending. However, such aggressive monetary policy response carries risks. Keywords: ECB rate cuts, Eurozone interest rates, monetary policy response.

- Potential impact on borrowing costs for businesses and consumers: Lower interest rates could make borrowing cheaper, encouraging investment and consumption.

- Potential risks of further weakening the Euro: Reduced interest rates can weaken the Euro's exchange rate, potentially increasing import costs.

- Possible unintended consequences of aggressive monetary easing: Excessive monetary easing could lead to inflation or asset bubbles down the line.

Alternative Policy Options and Outlook for the Eurozone

Alongside rate cuts, the ECB could explore alternative policy options to address the challenges posed by the trade war. This includes advocating for coordinated fiscal stimulus Europe among Eurozone member states and promoting structural reforms to enhance the long-term growth potential of the region. Keywords: Eurozone economic outlook, fiscal stimulus Europe, structural reforms Eurozone.

- Importance of coordinated fiscal policies among Eurozone members: A concerted fiscal stimulus effort could significantly amplify the impact of monetary policy.

- The role of structural reforms in boosting long-term growth: Addressing labor market rigidities and improving productivity can enhance the Eurozone's resilience to external shocks.

- Predictions for Eurozone GDP growth in the near future: Economic forecasts will depend heavily on the evolution of the trade war and the effectiveness of policy responses.

Conclusion: Navigating the Trade War's Impact on the Eurozone

The trade war weighs on Eurozone economies significantly, creating challenges for the ECB's monetary policy. While Simkus's proposal for additional rate cuts offers a potential stimulus, it also carries risks. The effectiveness of monetary policy alone remains questionable without complementary fiscal measures and structural reforms. To effectively navigate this complex situation, coordinated action involving fiscal stimulus, structural reforms, and carefully calibrated monetary policy is crucial. Stay informed about ongoing developments in the Eurozone economy, the trade war, and the ECB's monetary policy for updates on the impact of this situation. Visit the ECB website [link to ECB website] and reputable financial news sources for further information.

Featured Posts

-

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Middle Management A Critical Link In Organizational Effectiveness And Employee Satisfaction

Apr 27, 2025

Middle Management A Critical Link In Organizational Effectiveness And Employee Satisfaction

Apr 27, 2025 -

The Zuckerberg Trump Dynamic Implications For The Future Of Social Media

Apr 27, 2025

The Zuckerberg Trump Dynamic Implications For The Future Of Social Media

Apr 27, 2025 -

Teslas Canadian Price Hike Pre Tariff Vehicle Sales Strategy

Apr 27, 2025

Teslas Canadian Price Hike Pre Tariff Vehicle Sales Strategy

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Latest Posts

-

Cybercriminals Office365 Scheme Millions Gained From Executive Inbox Breaches

Apr 28, 2025

Cybercriminals Office365 Scheme Millions Gained From Executive Inbox Breaches

Apr 28, 2025 -

Federal Investigation Millions Made From Executive Office365 Account Hacks

Apr 28, 2025

Federal Investigation Millions Made From Executive Office365 Account Hacks

Apr 28, 2025 -

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025 -

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025