Treasury Market Reaction: Analysis Of The April 8th Events

Table of Contents

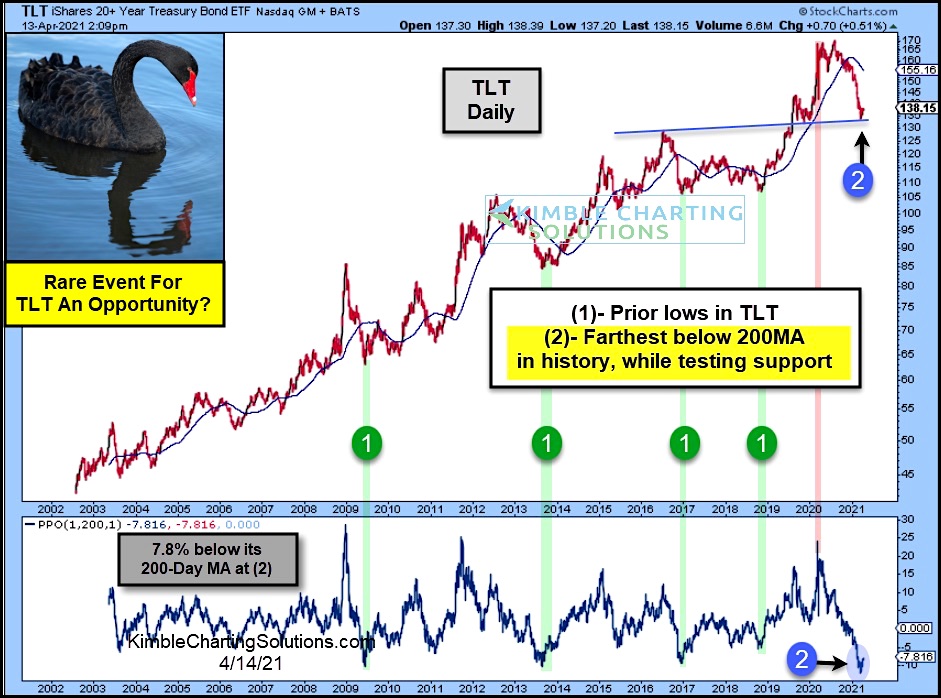

Pre-April 8th Market Conditions

Several factors laid the groundwork for the heightened volatility observed on April 8th. Understanding these pre-existing conditions is crucial to interpreting the market's reaction.

Debt Ceiling Concerns

The ongoing debate surrounding the US debt ceiling significantly impacted investor confidence leading up to April 8th. The uncertainty surrounding whether Congress would raise the debt limit created a palpable sense of risk.

- Rising uncertainty: The protracted negotiations fueled speculation about a potential US default, a scenario with severe consequences for the global economy.

- Potential default risk: The possibility of a default, even a temporary one, sent shockwaves through the financial markets, increasing the perceived risk associated with US Treasury securities.

- Impact on Treasury yields: The increased risk premium led to a rise in Treasury yields as investors demanded higher returns to compensate for the added uncertainty. This was particularly evident in short-term Treasury yields, reflecting the immediate concerns about a potential default. The Treasury market reaction to this risk was a key factor in the subsequent volatility.

Inflationary Pressures

Persistent inflationary pressures and the Federal Reserve's response further contributed to the volatile market environment.

- Inflation data releases: Prior to April 8th, several inflation data releases fueled concerns about the Fed's ability to control inflation without triggering a recession.

- Interest rate expectations: Market participants were anticipating further interest rate hikes from the Federal Reserve to combat inflation, impacting the attractiveness of Treasury bonds relative to other assets.

- Impact on bond prices: The expectation of higher interest rates generally leads to lower bond prices, as existing bonds become less attractive compared to newly issued bonds offering higher yields. This dynamic played a role in the pre-April 8th Treasury market reaction.

Events of April 8th

The events unfolding on April 8th itself exacerbated the pre-existing tensions and triggered the sharp volatility observed in the Treasury market.

Specific News and Announcements

While the exact details may vary depending on the specific news sources, several key announcements likely influenced the market.

- Economic data: The release of key economic indicators (e.g., employment data, consumer price index) could have significantly impacted investor sentiment and trading activity. Unexpectedly strong or weak data often leads to sharp shifts in market expectations.

- Political developments: Further developments in the debt ceiling negotiations, or other unexpected political events, could have influenced market participants' risk appetite.

- Unexpected market events: An unexpected event, such as a significant corporate default or geopolitical development, could have triggered a sell-off in the Treasury market, further amplifying the existing volatility. Understanding the interplay of these factors is key to comprehending the Treasury market reaction.

Intraday Price Movements and Volatility

[Insert Graph Here: A graph illustrating the price fluctuations of key Treasury securities (e.g., 10-year Treasury note) throughout April 8th. Clearly label the axes and highlight significant price swings.]

- Sharp price swings: The graph will vividly demonstrate the dramatic price swings experienced by various Treasury securities throughout the day.

- Increased trading volumes: High trading volumes typically accompany periods of heightened volatility, reflecting the intensified buying and selling activity.

- Unusual market behavior: The graph should highlight any unusual patterns or spikes in price movements that deviated from typical market behavior. These anomalies offer clues into the drivers of the market’s extreme Treasury market reaction.

Analysis of the Market Reaction

Analyzing the specific impact on different Treasury securities and investor behavior provides a clearer picture of the April 8th events.

Impact on Different Treasury Securities

The Treasury market reaction wasn't uniform across all maturities.

- Yield curve shifts: The volatility likely led to shifts in the yield curve, the graphical representation of yields across different Treasury maturities. For instance, a flight to safety might steepen the curve, while other events could flatten or invert it.

- Flight to safety: Investors often seek the safety of short-term Treasury securities during periods of uncertainty, leading to increased demand and lower yields in these maturities. Conversely, longer-term Treasuries might experience greater price volatility.

- Sector-specific impacts: The impact wasn't uniform across all Treasury securities; some might have been more susceptible to specific news events or investor sentiment shifts.

Investor Sentiment and Trading Strategies

Understanding investor behavior is key to understanding the market's Treasury market reaction.

- Increased hedging activity: Investors might have engaged in increased hedging strategies to protect their portfolios from potential losses.

- Changes in portfolio allocations: Some investors may have shifted their portfolio allocations away from riskier assets and into safer havens, including Treasury securities.

- Speculation: Market speculation often plays a significant role during periods of heightened volatility, exacerbating price swings.

Conclusion

The April 8th volatility in the Treasury market highlighted the interplay of pre-existing concerns (debt ceiling, inflation) and unexpected news events. This analysis demonstrates how these factors converged to create a significant Treasury market reaction, emphasizing the interconnectedness of macroeconomic factors and the Treasury market. The dramatic price swings and increased trading volume underscore the importance of continuous monitoring and informed decision-making.

Understanding the intricacies of the Treasury market is crucial for informed investment decisions. Stay informed about the latest developments affecting the Treasury market reaction by subscribing to our newsletter and regularly checking our website for further analysis and insights on future market fluctuations. We will continue to provide detailed analysis of significant Treasury market reactions to help you navigate this dynamic landscape.

Featured Posts

-

Premier Leagues Fifth Champions League Spot Virtually Inevitable

Apr 29, 2025

Premier Leagues Fifth Champions League Spot Virtually Inevitable

Apr 29, 2025 -

Will The Premier League Secure An Extra Champions League Spot A Closer Look

Apr 29, 2025

Will The Premier League Secure An Extra Champions League Spot A Closer Look

Apr 29, 2025 -

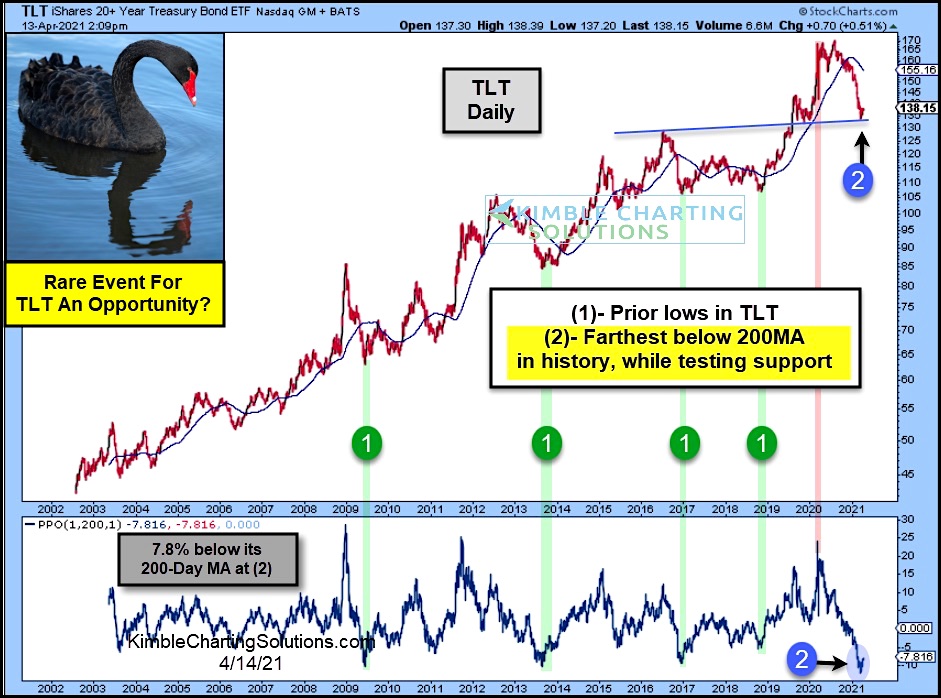

Chinas Nuclear Power Push 10 Reactor Approvals Signal Major Growth

Apr 29, 2025

Chinas Nuclear Power Push 10 Reactor Approvals Signal Major Growth

Apr 29, 2025 -

American Airlines And Black Hawk Crash Report A Comprehensive Analysis Of Failures

Apr 29, 2025

American Airlines And Black Hawk Crash Report A Comprehensive Analysis Of Failures

Apr 29, 2025 -

The Ccp United Fronts Influence A Minnesota Case Study

Apr 29, 2025

The Ccp United Fronts Influence A Minnesota Case Study

Apr 29, 2025

Latest Posts

-

A Tremor Series On Netflix Exploring The Possibilities

Apr 29, 2025

A Tremor Series On Netflix Exploring The Possibilities

Apr 29, 2025 -

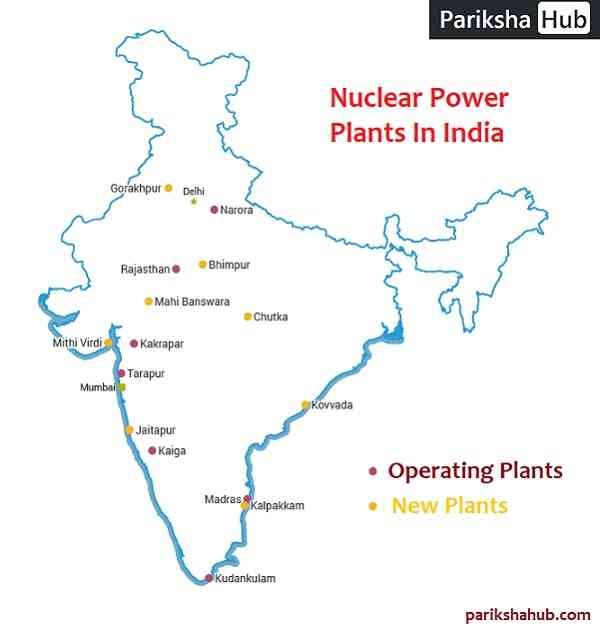

Trumps Potential Full Pardon Of Rose Implications And Analysis

Apr 29, 2025

Trumps Potential Full Pardon Of Rose Implications And Analysis

Apr 29, 2025 -

The Pete Rose Pardon Debate Analyzing Trumps Potential Decision And Its Impact On Mlb

Apr 29, 2025

The Pete Rose Pardon Debate Analyzing Trumps Potential Decision And Its Impact On Mlb

Apr 29, 2025 -

Will Netflix Get A Tremor Series What We Know So Far

Apr 29, 2025

Will Netflix Get A Tremor Series What We Know So Far

Apr 29, 2025 -

Will Trump Pardon Pete Rose Examining The Implications Of A Potential Presidential Pardon

Apr 29, 2025

Will Trump Pardon Pete Rose Examining The Implications Of A Potential Presidential Pardon

Apr 29, 2025