Treasury Official: US Debt Limit Measures Could Expire In August

Table of Contents

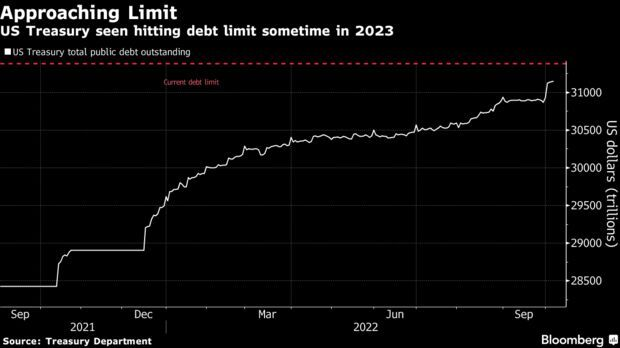

Understanding the Current US Debt Ceiling Situation

The US debt ceiling is a legal limit on the total amount of money the US government can borrow to meet its existing obligations. This mechanism is designed to control government spending and debt accumulation. However, the current situation involves temporary measures implemented to prevent a default, which are set to expire as early as August. These temporary measures, enacted earlier this year, provided a short-term reprieve, but the looming deadline necessitates immediate action from Congress.

- Definition of the debt ceiling: The debt ceiling is a limit on the total amount of money the U.S. Treasury can borrow to finance the government's obligations. Exceeding this limit would prevent the government from paying its bills.

- How the debt ceiling impacts government spending: Reaching the debt ceiling doesn't limit the government's ability to spend money already authorized by Congress. However, it prevents the government from borrowing additional funds to meet its existing commitments.

- Details about the temporary measures and their limitations: These measures, often involving accounting maneuvers or suspending certain debt limits, only provide temporary relief. They don't address the underlying issue of the debt ceiling itself.

- Treasury official's warning: [Insert name and title of Treasury official] recently issued a stark warning regarding the August deadline, highlighting the urgency of the situation.

Potential Consequences of Reaching the Debt Limit

Failing to raise or suspend the debt ceiling by the August deadline would have catastrophic economic consequences. A potential government shutdown would halt essential government services, impacting everything from national security to social programs. More significantly, a US debt default would trigger a global financial crisis, eroding investor confidence and potentially leading to a recession.

- Potential impacts on government services: A shutdown would halt or severely limit the operation of numerous government agencies, impacting everything from national defense to social security payments.

- Potential increase in interest rates: A default would dramatically increase US borrowing costs, impacting individuals, businesses, and the government's ability to fund critical programs.

- Risks of recession or economic downturn: The resulting financial instability could easily trigger a global recession, with widespread job losses and economic hardship.

- Damage to US global reputation and influence: A default would severely damage the US's reputation and credibility on the world stage, impacting its ability to lead and influence international affairs.

Possible Solutions and Congressional Actions

The primary solution lies in Congress raising or suspending the debt ceiling. This requires a bipartisan agreement, presenting a significant political challenge given the current partisan divide. Swift Congressional action is crucial to avoid a crisis.

- Potential options for raising or suspending the debt ceiling: Congress could either raise the debt ceiling to a higher number or temporarily suspend it for a specific period.

- Challenges presented by political polarization: The deeply divided political landscape in Washington makes reaching a consensus on this crucial issue incredibly difficult.

- Timeline for Congressional action to prevent the deadline: The August deadline necessitates immediate action from Congress, leaving little room for delay or political maneuvering.

- Proposed legislation: [Mention any relevant bills or proposals currently under consideration in Congress].

Market Reactions and Investor Sentiment

The looming US debt limit deadline is already causing significant market volatility. Investors are increasingly concerned about the potential consequences, leading to fluctuations in bond yields and stock prices. The uncertainty surrounding the situation is fueling market instability.

- Current trends in bond yields and stock prices: [Describe recent market trends, including any significant changes in bond yields or stock prices reflecting investor sentiment].

- Reactions from credit rating agencies: Credit rating agencies are closely monitoring the situation and may downgrade US credit ratings if a default occurs.

- Statements from financial institutions and analysts: [Include quotes or summaries of statements from leading financial institutions and analysts regarding the situation].

- Impact on international markets: The US debt ceiling crisis is not an isolated issue; it will have ripple effects across global financial markets.

The Urgent Need for Action on the US Debt Limit

The August deadline for the US debt limit is rapidly approaching. The potential consequences—a government shutdown, a US debt default, and a global economic crisis—are far too severe to ignore. Congress must act swiftly to raise or suspend the debt ceiling to avert disaster. Keep an eye on the upcoming US debt limit deadline and understand the implications of the US debt ceiling debate. Contact your representatives regarding the US debt limit crisis and urge them to prioritize this critical issue. Failing to resolve the debt limit issue before August could have irreversible and devastating consequences for the United States and the global economy.

Featured Posts

-

Semeyniy Otdykh Borisa Dzhonsona I Ego Zheny V Tekhase Eksklyuzivnye Foto

May 11, 2025

Semeyniy Otdykh Borisa Dzhonsona I Ego Zheny V Tekhase Eksklyuzivnye Foto

May 11, 2025 -

Calvin Kleins New Campaign Lily Collins Striking Photos 5133602

May 11, 2025

Calvin Kleins New Campaign Lily Collins Striking Photos 5133602

May 11, 2025 -

Semana Santa Vs Semana De Turismo En Uruguay Un Reflejo De Su Identidad Nacional

May 11, 2025

Semana Santa Vs Semana De Turismo En Uruguay Un Reflejo De Su Identidad Nacional

May 11, 2025 -

Celtics Clinch Division A Decisive Victory

May 11, 2025

Celtics Clinch Division A Decisive Victory

May 11, 2025 -

Zayavlenie Putina Dzhonsonu O Rossiyskikh Atomnykh Submarinakh

May 11, 2025

Zayavlenie Putina Dzhonsonu O Rossiyskikh Atomnykh Submarinakh

May 11, 2025