Trump Administration Clears Path For Nippon-U.S. Steel Joint Venture

Table of Contents

Regulatory Hurdles Overcome by the Trump Administration

The path to this unprecedented Nippon-U.S. Steel Joint Venture wasn't without obstacles. Significant regulatory hurdles, primarily concerning antitrust concerns and national security reviews, had to be cleared. The merger, representing a consolidation of significant players in the global steel market, raised concerns about potential monopolies and reduced competition.

- Antitrust Scrutiny: The Department of Justice (DOJ) conducted a thorough antitrust review, examining the potential impact on market competition and consumer prices. This involved extensive data analysis and consultations with industry stakeholders.

- National Security Review: Given the strategic importance of steel production for national security, a comprehensive national security review was also undertaken. This assessment focused on ensuring the continued reliable supply of steel for critical infrastructure projects and defense applications.

- Expedited Review Process: The Trump administration, recognizing the potential economic benefits of the joint venture, reportedly expedited the review process, streamlining bureaucratic procedures to ensure a timely decision. [Insert link to relevant official document or news source here, if available]

- Key Figures and Agencies: The DOJ’s Antitrust Division and the Committee on Foreign Investment in the United States (CFIUS) played pivotal roles in the approval process. [Insert names of key individuals involved if available and verifiable].

The Trump administration's active facilitation, through expedited reviews and potentially granted waivers, ultimately paved the way for the venture's approval. This demonstrates a proactive approach to fostering strategic partnerships within the steel industry, even amidst significant regulatory challenges. Keywords: Trump administration, regulatory approval, antitrust review, national security, steel industry regulation

Economic Implications of the Nippon-U.S. Steel Joint Venture

The Nippon-U.S. Steel Joint Venture holds significant economic implications for both the U.S. and Japanese economies. The potential impacts are multifaceted and require careful analysis:

- Employment in the Steel Industry: While job losses in certain sectors are possible due to increased efficiency and consolidation, the joint venture could also create new, higher-skilled jobs in research, development, and management.

- Steel Production and Prices: Increased production capacity and efficiency could lead to lower steel prices for consumers, benefiting various industries reliant on steel. However, there's also the risk of price manipulation if competition is significantly reduced.

- Competition within the Global Steel Market: The combined entity would be a major player in the global steel market, impacting competition and potentially affecting trade relations with other countries.

Potential Positive Economic Consequences: Increased efficiency, lower steel prices, enhanced competitiveness in the global market, potential for technological advancements.

Potential Negative Economic Consequences: Job displacement in specific sectors, potential for price manipulation, increased market concentration.

Keywords: economic impact, steel prices, employment, global steel market, trade relations, economic growth

Geopolitical Significance of the Joint Venture

Beyond economic considerations, the Nippon-U.S. Steel Joint Venture carries significant geopolitical implications. The strengthened partnership between a major U.S. steel company and a leading Japanese producer has ramifications for:

- U.S.-Japan Trade Relations: The venture signifies a deeper economic alliance between the two nations, strengthening their trade ties and potentially influencing future trade negotiations.

- Global Trade Dynamics: The merger could shift the balance of power in the global steel market, influencing trade policies and potentially triggering responses from other steel-producing nations.

- National Security Strategies: Reliable access to steel is critical for national security. This joint venture may enhance the resilience of the U.S. steel supply chain, reducing dependence on foreign suppliers.

The long-term geopolitical effects are complex and will depend on various factors including global market conditions, trade policies, and the strategies of competitors. Keywords: geopolitics, trade relations, national security, U.S.-Japan relations, global trade

Future Outlook for the Nippon-U.S. Steel Joint Venture

The future success of the Nippon-U.S. Steel Joint Venture hinges on several factors:

- Market Competition: The ability of the joint venture to compete effectively against other global steel producers will be crucial.

- Technological Innovation: Investing in research and development to maintain a technological edge will be vital for long-term success.

- Strategic Partnerships: Forming strategic alliances with other companies in related industries could enhance the venture's capabilities and reach.

Potential future scenarios range from expansion into new markets to increased efficiency and technological innovation. The venture’s ultimate success will depend on its adaptation to changing market conditions and its ability to innovate. Keywords: future prospects, strategic partnership, steel industry future, market competition, business strategy

Conclusion: The Lasting Impact of the Trump Administration's Role in the Nippon-U.S. Steel Joint Venture

The Nippon-U.S. Steel Joint Venture, significantly aided by the Trump administration's regulatory facilitation, marks a pivotal moment in the global steel industry. Its economic and geopolitical implications are far-reaching, impacting steel prices, employment, trade relations, and national security strategies. The success of this merger showcases the potential for strategic partnerships to reshape global markets and enhance national competitiveness. To understand the full ramifications of this significant joint venture in the steel industry and its lasting impact on international trade, further research into the specifics of the agreement and its ongoing effects is recommended. Investigate the details of the Nippon-U.S. steel merger, analyzing the long-term impact of the Nippon Steel and U.S. Steel partnership on the global economy.

Featured Posts

-

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025 -

The Crucial Role Of Middle Managers Bridging The Gap In Modern Businesses

May 25, 2025

The Crucial Role Of Middle Managers Bridging The Gap In Modern Businesses

May 25, 2025 -

Uefa Dan Arda Gueler Ve Real Madrid E Sok Karar Sorusturma Basladi

May 25, 2025

Uefa Dan Arda Gueler Ve Real Madrid E Sok Karar Sorusturma Basladi

May 25, 2025 -

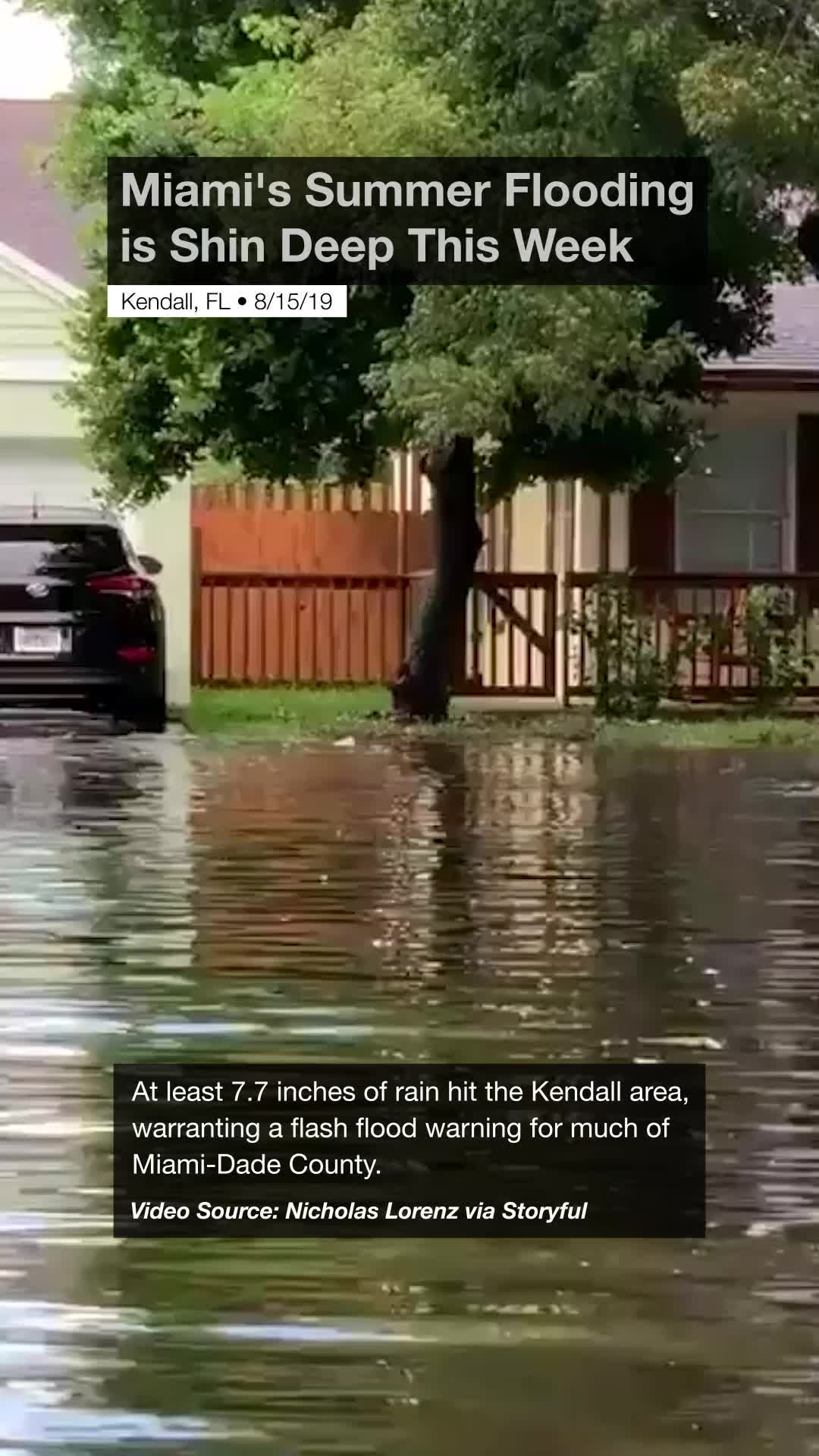

Miami Valley Residents Urged To Prepare For Potential Flooding Amid Severe Weather

May 25, 2025

Miami Valley Residents Urged To Prepare For Potential Flooding Amid Severe Weather

May 25, 2025 -

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Latest Posts

-

I Naomi Kampel Stis Maldives Fotografies Apo Tis Kalokairines Tis Diakopes

May 25, 2025

I Naomi Kampel Stis Maldives Fotografies Apo Tis Kalokairines Tis Diakopes

May 25, 2025 -

Naomi Kempbell I Ee Deti Kak Vyglyadyat Nasledniki Supermodeli

May 25, 2025

Naomi Kempbell I Ee Deti Kak Vyglyadyat Nasledniki Supermodeli

May 25, 2025 -

Naomi Kampel Diakopes Stis Maldives Me Ta Paidia Tis

May 25, 2025

Naomi Kampel Diakopes Stis Maldives Me Ta Paidia Tis

May 25, 2025 -

Naomi Kempbell Otmechaet 55 Letie Fotogalereya

May 25, 2025

Naomi Kempbell Otmechaet 55 Letie Fotogalereya

May 25, 2025 -

55 Letie Naomi Kempbell Redkie I Goryachie Snimki

May 25, 2025

55 Letie Naomi Kempbell Redkie I Goryachie Snimki

May 25, 2025