Trump Appointee's Bold Bitcoin Prediction After Market Surge

Table of Contents

The Appointee's Prediction and its Context

The prediction originates from [Appointee's Name], a former [Appointee's Position] during the Trump administration. [He/She] is known for [brief description of their relevant financial experience and expertise, e.g., a strong background in financial regulation and a history of insightful market analysis]. On [Date], [Appointee's Name] predicted that the price of Bitcoin would reach [Predicted Price] within [Timeframe]. [He/She] based this prediction on [briefly explain the reasoning behind the prediction, citing any supporting factors mentioned].

- The appointee's previous stances on cryptocurrencies: [Detail any past statements or actions related to cryptocurrencies, indicating whether this prediction aligns with their previous views.]

- The current market conditions leading to this prediction: [Describe the current state of the Bitcoin market, including factors such as recent price movements, trading volume, and overall market sentiment.]

- Specific events or news that may have influenced the prediction: [Mention any recent events, news articles, or regulatory developments that might have informed the appointee's prediction, e.g., growing institutional adoption, regulatory clarity in a specific jurisdiction, or significant technological upgrades].

Analyzing the Prediction's Validity

While [Appointee's Name]'s prediction has generated excitement, it's crucial to analyze its validity. Several factors could support this bullish outlook:

- Growing institutional adoption: The increasing involvement of large financial institutions in the Bitcoin market lends credence to the prediction. This influx of institutional capital can significantly boost demand and drive price increases.

- Regulatory clarity (or progress towards it): More defined regulatory frameworks in certain jurisdictions could reduce uncertainty and attract further investment.

- Technological advancements: Continued development and improvements in Bitcoin's underlying technology can enhance its scalability, security, and overall appeal.

However, several counterarguments and potential risks must be considered:

- Regulatory uncertainty: The lack of consistent global regulation remains a significant risk, with potential for sudden shifts in policy that could negatively impact Bitcoin's price.

- Market volatility: Bitcoin's inherent volatility means price fluctuations are frequent and substantial. This unpredictability makes it difficult to accurately predict long-term price movements.

- Technological challenges: Scalability issues and potential vulnerabilities in the Bitcoin network could hinder its growth and adoption.

Several cryptocurrency analysts offer alternative perspectives. [Mention specific analysts and their views on the prediction, including any differing opinions and their reasoning].

- Potential catalysts for Bitcoin's price increase: [List potential events that could lead to a price surge, e.g., mass adoption by a major retailer, positive regulatory news, a significant technological breakthrough].

- Factors that could hinder Bitcoin's price growth: [List factors that could negatively impact Bitcoin's price, e.g., a major security breach, a significant regulatory crackdown, a broader market downturn].

- Alternative perspectives from cryptocurrency analysts: [Summarize different opinions from experts, highlighting the range of potential outcomes.]

Implications for Bitcoin Investors

[Appointee's Name]'s prediction has significant implications for Bitcoin investment strategies. Investors should carefully consider:

-

Potential impact on investment strategies: The prediction may encourage some investors to adopt a more aggressive approach, while others might choose a more cautious strategy.

-

Risk management and diversification: Diversification is crucial in the volatile crypto market. Investors should not over-allocate their portfolios to Bitcoin alone.

-

Opportunities and challenges for short-term and long-term investors: Short-term investors might be tempted by quick profits, while long-term investors may see this as an opportunity for long-term growth, but both need to understand the associated risks.

-

Strategies for navigating market volatility: Employing strategies like dollar-cost averaging or setting stop-loss orders can help mitigate risk.

-

Importance of due diligence before investing in Bitcoin: Thorough research is crucial before making any investment decisions. Understand the underlying technology, market trends, and associated risks.

-

Advice for both risk-averse and risk-tolerant investors: Risk-averse investors should allocate only a small portion of their portfolio to Bitcoin, while risk-tolerant investors might consider a larger allocation, but always within their risk tolerance.

The broader impact on the crypto market

The prediction's impact extends beyond Bitcoin.

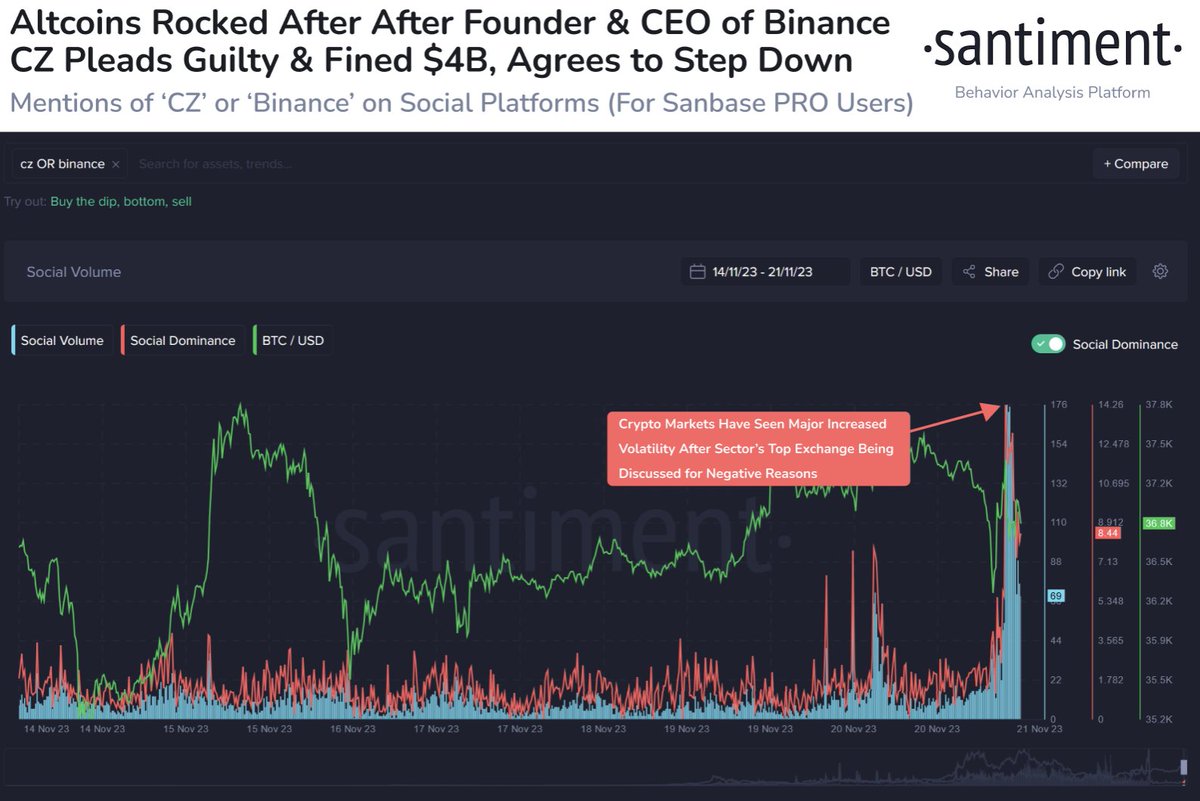

- Correlation between Bitcoin's price and altcoin performance: Bitcoin's price often influences the performance of other cryptocurrencies (altcoins). A significant Bitcoin price increase could trigger a broader market rally.

- Potential for increased investment in the broader crypto market: The prediction might encourage investors to explore other cryptocurrencies beyond Bitcoin.

- Potential for increased regulatory scrutiny following the prediction: Increased attention from regulators might follow, leading to stricter regulations or greater oversight.

Conclusion

[Appointee's Name]'s bold Bitcoin prediction, while potentially exciting, necessitates careful consideration. The prediction's validity depends on various factors, including growing institutional adoption, regulatory clarity, and continued technological advancements. However, risks such as regulatory uncertainty and market volatility remain significant. The implications for investors are substantial, requiring a thorough understanding of risk management and diversification strategies. This prediction underscores the potential, and the inherent risks, of investing in Bitcoin. Conduct thorough research, understand your risk tolerance, and carefully consider your investment strategy before entering the volatile world of Bitcoin and other cryptocurrencies. Stay informed about the latest developments in the Bitcoin market and consult with a financial advisor before making any investment decisions. Remember, investing in Bitcoin involves significant risk, and you could lose money.

Featured Posts

-

Arsenal V Psg Champions League Semi Final Preview

May 08, 2025

Arsenal V Psg Champions League Semi Final Preview

May 08, 2025 -

Dwps Surge In Home Visits Examining The Impact On Benefit Claimants

May 08, 2025

Dwps Surge In Home Visits Examining The Impact On Benefit Claimants

May 08, 2025 -

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025 -

11 Million Eth Accumulated Implications For Ethereum Price

May 08, 2025

11 Million Eth Accumulated Implications For Ethereum Price

May 08, 2025 -

Eid Ul Fitr In Lahore A 2 Day Punjab Weather Report

May 08, 2025

Eid Ul Fitr In Lahore A 2 Day Punjab Weather Report

May 08, 2025