Trump Demands Powell's Removal: Escalating Tensions Over Monetary Policy

Table of Contents

The Roots of the Conflict: Trump's Criticism of Powell's Monetary Policy

Former President Trump consistently criticized Jerome Powell's monetary policy decisions, particularly the interest rate hikes implemented to combat inflation. Trump believed these actions unnecessarily stifled economic growth and ultimately harmed his chances of reelection. He viewed Powell's approach as overly cautious and detrimental to the robust economic expansion he had overseen during his presidency. This clash fundamentally stemmed from differing economic philosophies.

- Specific instances of Trump's criticism:

- June 2018: Trump publicly expressed his displeasure with Powell's rate hikes, stating they were moving "too fast."

- November 2019: Following another rate cut, Trump tweeted, "The Fed is making a mistake!"

- Numerous other public statements and interviews throughout his presidency echoed this sentiment.

- Economic data points used by Trump: Trump often pointed to slowing economic growth indicators and potential job losses as evidence to support his criticism.

- Analysis of Trump’s economic philosophy: Trump favored lower interest rates to stimulate economic activity and boost the stock market, prioritizing short-term growth over long-term stability. This directly contrasted with Powell's focus on controlling inflation and maintaining the long-term health of the US economy.

Powell's Stance: Maintaining the Fed's Independence

In the face of relentless criticism, Chairman Powell steadfastly maintained the Federal Reserve's independence from political influence. He consistently emphasized that the Fed's primary mandate is to maintain price stability and promote maximum employment, independent of political considerations or pressure. The interest rate hikes, Powell argued, were necessary to curb inflation and prevent a more severe economic downturn in the long run.

- Quotes from Powell emphasizing the Fed's independence: Powell repeatedly reiterated the importance of the Fed's autonomy in numerous press conferences and public statements.

- Explanation of the economic theory behind the Fed's actions: Powell's actions were rooted in the understanding that uncontrolled inflation erodes purchasing power and can destabilize the economy.

- Analysis of the potential consequences of political interference: Political interference in monetary policy risks undermining the credibility of the Fed and potentially leading to erratic economic decisions based on short-term political goals rather than long-term economic stability.

The Implications of Political Pressure on the Federal Reserve

Trump's actions had significant implications for the Federal Reserve's credibility and independence. Openly attacking the Chair of the Fed, a traditionally apolitical institution, raised concerns about the potential for future presidents to exert undue political pressure on monetary policy decisions.

- Potential effects on long-term inflation expectations: If the public perceives the Fed as susceptible to political pressure, it could lead to higher inflation expectations, making it harder for the Fed to control inflation effectively.

- Risk of politicizing monetary policy decisions: This politicization could lead to less effective and potentially harmful monetary policy decisions driven by political expediency rather than sound economic principles.

- Comparison to historical instances of political pressure on the Fed: While not unprecedented, the level and intensity of Trump’s attacks on Powell represent a significant challenge to the Fed's long-standing tradition of independence. Historical examples demonstrate that such interference can have severe negative consequences.

The Long-Term Effects on US Economic Policy

The conflict between Trump and Powell left a lasting mark on the relationship between the President and the Federal Reserve. It highlighted the fragility of the Fed's independence and raised concerns about the potential for future presidents to attempt similar actions. This necessitates a renewed focus on greater transparency and public understanding of the Fed's decision-making processes to foster trust and ensure its ability to effectively manage the US economy.

Conclusion

The highly publicized episode of "Trump Demands Powell's Removal" underscores the significant tensions between the executive branch and the Federal Reserve over monetary policy. Trump's persistent criticism of Powell's interest rate hikes stemmed from differing economic philosophies and a desire for short-term economic gains, potentially at the expense of long-term stability. Powell's steadfast defense of the Fed's independence highlighted the critical need to protect this crucial institution from political interference. Understanding the ongoing impact of "Trump Demands Powell's Removal" is crucial for navigating the complexities of the US economy. The potential for future presidents to exert similar pressure necessitates a continued focus on transparency and a deeper public understanding of the Federal Reserve's crucial role in maintaining economic stability. We encourage readers to stay informed about further developments in this critical area and delve deeper into the intricacies of monetary policy and the Federal Reserve's function through additional research and reputable sources.

Featured Posts

-

11 1 Royals Complete Domination In Brewers Home Opener

Apr 23, 2025

11 1 Royals Complete Domination In Brewers Home Opener

Apr 23, 2025 -

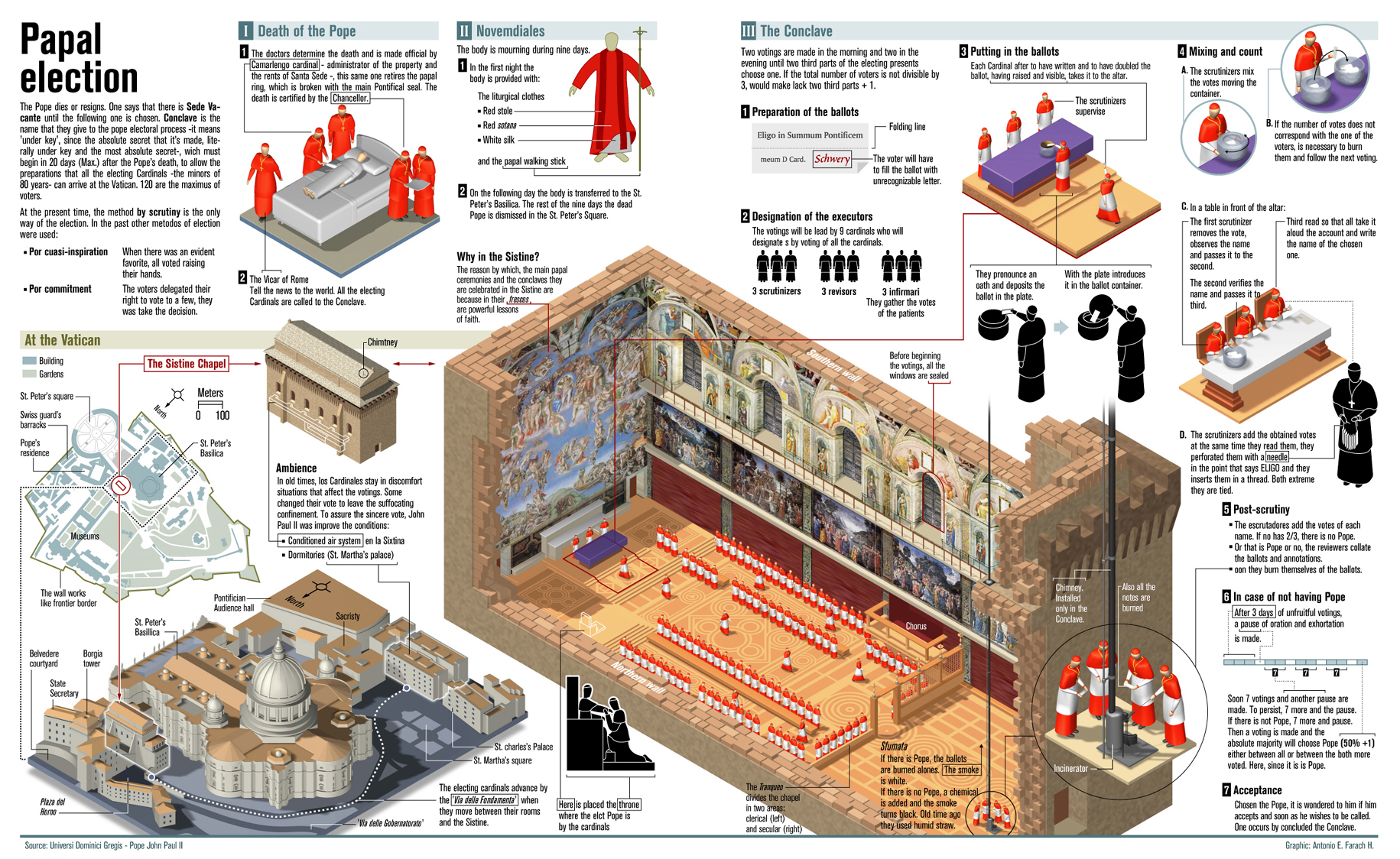

Analyzing The Next Papal Election 10 Potential Successors

Apr 23, 2025

Analyzing The Next Papal Election 10 Potential Successors

Apr 23, 2025 -

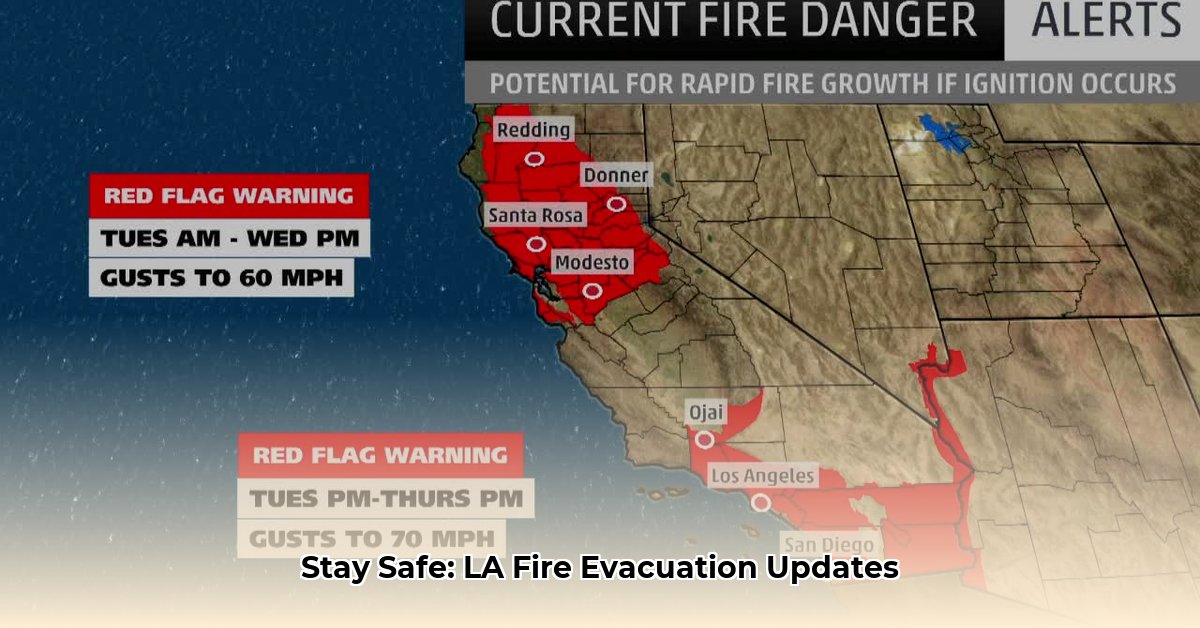

Wildfire Wagers Exploring The Growing Market For Los Angeles Wildfire Bets

Apr 23, 2025

Wildfire Wagers Exploring The Growing Market For Los Angeles Wildfire Bets

Apr 23, 2025 -

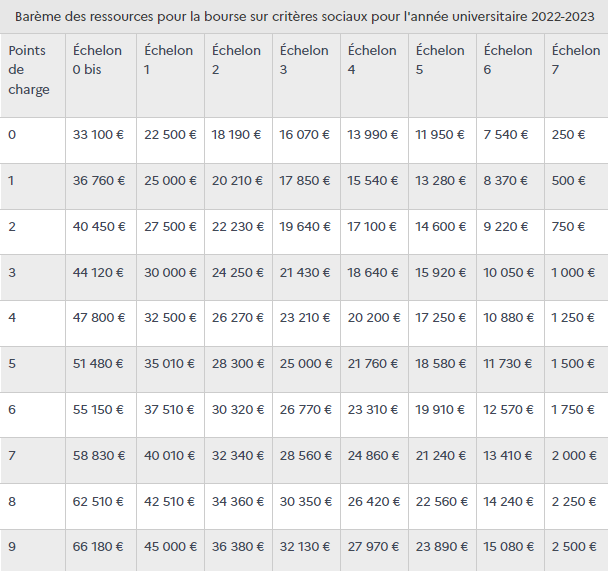

Bfm Bourse Informations Et Analyse Du 17 Fevrier 15h 16h

Apr 23, 2025

Bfm Bourse Informations Et Analyse Du 17 Fevrier 15h 16h

Apr 23, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Increase Concerns At And T

Apr 23, 2025

Broadcoms V Mware Acquisition A 1 050 Price Increase Concerns At And T

Apr 23, 2025