Trump Effect On Ripple: XRP Price Surge Explained

Table of Contents

Trump's Regulatory Approach and its Impact on Cryptocurrencies

Trump's presidency witnessed a period of evolving regulatory scrutiny for cryptocurrencies. Understanding the SEC's stance and the broader economic climate is crucial to assessing any potential "Trump effect on Ripple."

The SEC's Stance Under Trump

The Securities and Exchange Commission (SEC), under Chair Jay Clayton, took a cautious approach to crypto regulation during the Trump administration. This stance significantly influenced investor sentiment and, consequently, the price of many cryptocurrencies, including XRP.

- July 2018: Clayton's public statements emphasized the SEC's focus on classifying certain digital assets as securities. This heightened uncertainty for many projects.

- Multiple Enforcement Actions: The SEC initiated several enforcement actions against various ICOs (Initial Coin Offerings), creating a climate of regulatory risk.

- Lack of Clear Regulatory Framework: The absence of a comprehensive regulatory framework for cryptocurrencies during this period contributed to market volatility.

This regulatory uncertainty fostered a climate of both fear and opportunity. While some investors hesitated, others saw potential in navigating the evolving landscape, leading to significant price fluctuations. The SEC's actions, or lack thereof, regarding Ripple specifically, were a key factor shaping investor perception and XRP's price trajectory.

Trump's Economic Policies and Their Ripple Effect on XRP

Trump's economic policies, such as tax cuts and trade wars, indirectly influenced the broader macroeconomic environment, impacting investor sentiment towards riskier assets like cryptocurrencies.

- Tax Cuts: The 2017 Tax Cuts and Jobs Act potentially increased disposable income, which could have indirectly fueled investment in speculative assets like XRP.

- Trade Wars: The trade disputes with China created global economic uncertainty, potentially influencing risk appetite and affecting investment in cryptocurrencies, including XRP.

- Dollar Strength: Fluctuations in the US dollar's value also affected the cryptocurrency market, impacting XRP's price expressed in USD.

Understanding these macroeconomic factors is crucial for a complete analysis of XRP price movements during this period. It's difficult to isolate the impact of these policies specifically on XRP, but their influence on overall market sentiment cannot be ignored.

Market Sentiment and Speculation surrounding XRP

Market sentiment, driven by media narratives and speculation, played a significant role in XRP's price fluctuations. Analyzing this aspect is crucial to understanding the potential "Trump effect on Ripple."

The Role of Social Media and News Coverage

News coverage and social media discussions surrounding Trump's administration and its policies undoubtedly influenced investor perceptions of the broader economic climate and, by extension, the cryptocurrency market.

- Negative News: Negative news cycles regarding Trump's policies could have negatively impacted investor confidence, potentially leading to XRP price dips.

- Positive News: Conversely, positive economic indicators or perceived policy successes might have boosted investor confidence, contributing to price increases.

- Social Media Sentiment: Social media platforms became significant drivers of market sentiment, with discussions surrounding Trump's actions often influencing investor decisions regarding XRP.

The interplay between news cycles, social media narratives, and investor psychology is a powerful force in shaping cryptocurrency prices.

Trump's Tweets and their Potential (Indirect) Influence on XRP

Trump's frequent use of Twitter sometimes directly influenced financial markets. While he rarely mentioned XRP directly, his pronouncements on economic policy or the regulatory landscape could have had indirect consequences. Identifying any such correlation, however, requires meticulous analysis of tweet timing relative to XRP price movements and careful consideration of other market forces. A detailed study examining this potential connection would be needed to draw definitive conclusions.

Alternative Factors Influencing XRP Price

It's vital to acknowledge factors unrelated to Trump's presidency that significantly influenced XRP's price.

Technological Developments within Ripple

Ripple's internal developments played a crucial role in shaping XRP's price. Technological advancements, partnerships, and product launches independently influenced investor sentiment and market valuation.

- Partnerships: Strategic partnerships with financial institutions fueled positive investor sentiment and price increases.

- Product Launches: New product releases and technological improvements contributed to XRP's perceived value proposition.

- Adoption Rate: Increased adoption of Ripple's technology by financial institutions positively influenced XRP's price.

These factors were often independent of the political climate and should be considered separately when analyzing XRP's performance.

Overall Cryptocurrency Market Trends

The broader cryptocurrency market's trends heavily influenced XRP's price trajectory. Bitcoin's performance, along with significant market events, often overshadowed any potential "Trump effect."

- Bitcoin's Price: Bitcoin's price movements often correlated with XRP's, highlighting the interconnectedness of the cryptocurrency market.

- Market-Wide Events: Major events like significant hacks, regulatory announcements, or technological breakthroughs in other cryptocurrencies profoundly impacted the overall market sentiment, thus affecting XRP's price.

Understanding these market-wide trends is essential for accurately assessing XRP's price fluctuations.

Conclusion: Understanding the Complex Relationship Between Trump and XRP

While Trump's presidency undoubtedly influenced the broader regulatory and economic landscape, directly attributing specific XRP price surges to a "Trump effect" is overly simplistic. Analyzing the Trump effect on Ripple requires a nuanced understanding of the intricate interplay of regulatory changes, macroeconomic factors, market sentiment, and Ripple's internal developments. The data suggests that while the regulatory environment under Trump's administration undoubtedly created uncertainty impacting the crypto market generally, other factors – technological advancements within Ripple and overall cryptocurrency market trends – played a significantly larger role in determining XRP's price. Investigating the impact of regulatory changes on XRP, along with analyzing the broader market trends, remains crucial for a comprehensive understanding of this dynamic asset. Continue researching the factors influencing XRP price and the intricacies of the cryptocurrency market to gain a more complete picture.

Featured Posts

-

Fortnite Down Check Server Status Update 34 21 And Downtime

May 02, 2025

Fortnite Down Check Server Status Update 34 21 And Downtime

May 02, 2025 -

Doctor Who Star Defends Show Amidst Woke Backlash

May 02, 2025

Doctor Who Star Defends Show Amidst Woke Backlash

May 02, 2025 -

Is That Christina Aguilera Fans Question Singers Changed Appearance

May 02, 2025

Is That Christina Aguilera Fans Question Singers Changed Appearance

May 02, 2025 -

Louisiana School Desegregation Justice Departments Final Order And Its Implications

May 02, 2025

Louisiana School Desegregation Justice Departments Final Order And Its Implications

May 02, 2025 -

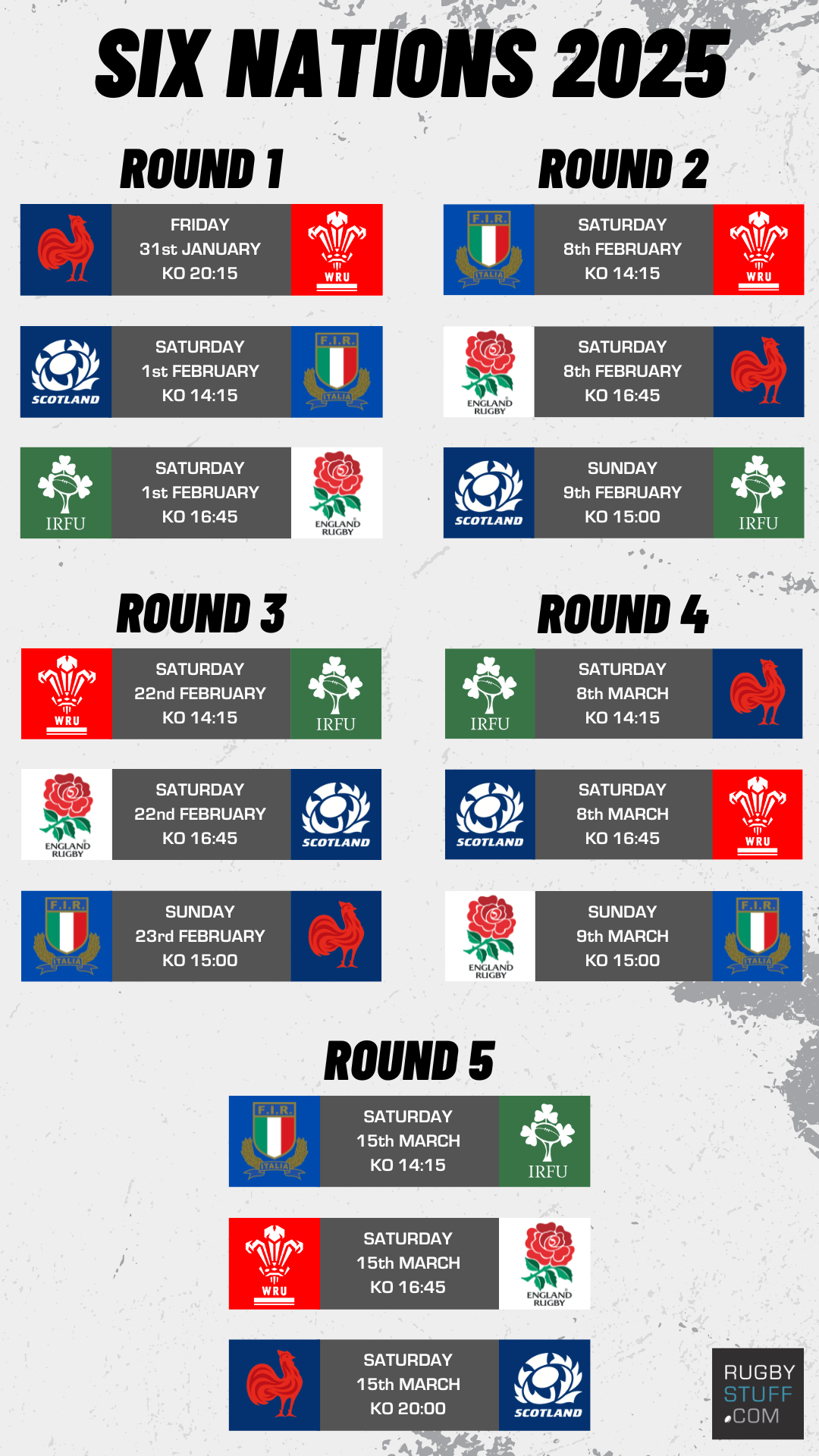

Six Nations 2025 Can France Continue Its Success

May 02, 2025

Six Nations 2025 Can France Continue Its Success

May 02, 2025