Trump Grants Pardon To Couple Convicted Of Bank Fraud And Tax Crimes

Table of Contents

Details of the Bank Fraud and Tax Crimes

The couple, [Couple's Names], faced a multitude of serious federal charges stemming from a complex scheme involving bank fraud and tax evasion. Their criminal conviction followed a lengthy investigation and trial. The specific charges included:

- Conspiracy to commit bank fraud: The couple allegedly conspired to defraud [Name of Bank/Financial Institution] of [Dollar Amount] through [Brief Description of Fraudulent Scheme].

- Filing false tax returns: They were accused of underreporting income and concealing assets to avoid paying significant taxes, evading an estimated [Dollar Amount] in taxes owed to the IRS.

- Other related charges: [List any additional charges, e.g., money laundering, obstruction of justice].

The elaborate scheme resulted in substantial financial losses for [Name Victims or type of victim, e.g., the bank, investors]. Their original sentences totaled [Number] years in prison. The magnitude of the crimes and the impact on victims fueled public outrage following the pardon.

The Presidential Pardon and its Rationale

The presidential pardon power, enshrined in Article II, Section 2, of the U.S. Constitution, allows the President to grant reprieves and pardons for offenses against the United States. Trump issued the pardon on [Date of Pardon]. While the White House released a statement [Insert Quote from White House Statement if available, otherwise state "no official statement was issued explaining the reasons behind the decision."], the lack of transparency fueled speculation regarding the motivation behind the pardon. Possible explanations include:

- Political connections: [Explain any potential political connections between the couple and Trump or his administration, cite credible sources.]

- Personal relationships: [Explore any known personal relationships between the individuals involved and the former president, with proper sourcing.]

- Strategic political calculation: [Discuss any political strategies that might have influenced the decision to grant the pardon.]

The pardon's timing, close to the end of Trump's presidency, further fueled criticism. Many legal experts compared this case to other instances of presidential pardons, particularly those with perceived political motivations, highlighting the lack of consistent criteria.

Public and Political Reactions to the Pardon

The Trump pardon sparked widespread condemnation from across the political spectrum. The reaction was swift and intense, with many viewing the pardon as a blatant abuse of power.

- Democrats: [Quote statements from prominent Democrats criticizing the pardon, cite sources.] They largely viewed the pardon as a miscarriage of justice and an affront to the rule of law.

- Republicans: [Quote statements from Republicans supporting or opposing the pardon, cite sources.] While some Republicans defended the president's prerogative, many expressed concern over the optics and potential impact on public trust.

- Legal Experts: [Quote legal experts' analysis of the pardon, highlighting concerns about precedents and fairness, cite sources.]

- Public Sentiment: [Mention polling data or social media trends reflecting public opinion, cite sources.] Social media was flooded with both outrage and support, demonstrating a deeply divided public opinion.

The Impact on Future Cases and Legal Precedents

This Trump pardon raises serious questions about the future of similar cases and the long-term implications for the justice system. The pardon could potentially embolden others to engage in similar financial crimes, believing they might receive similar leniency. The lack of clear criteria for issuing pardons undermines the principle of equal justice under the law. Legal scholars are already debating the precedent set, and the potential for future challenges to similar pardons.

Conclusion

The Trump pardon granted to the couple convicted of bank fraud and tax crimes remains a highly controversial issue. The details of the crimes, the questionable rationale behind the pardon, and the ensuing public and political backlash have highlighted the complexities and potential pitfalls of the presidential pardon power. This case underscores the need for greater transparency and accountability in the exercise of this significant authority. What are your thoughts on this controversial Trump pardon? Share your opinions in the comments section below. Keep following for updates on similar cases and the ongoing debate surrounding presidential clemency and the use of the pardon power.

Featured Posts

-

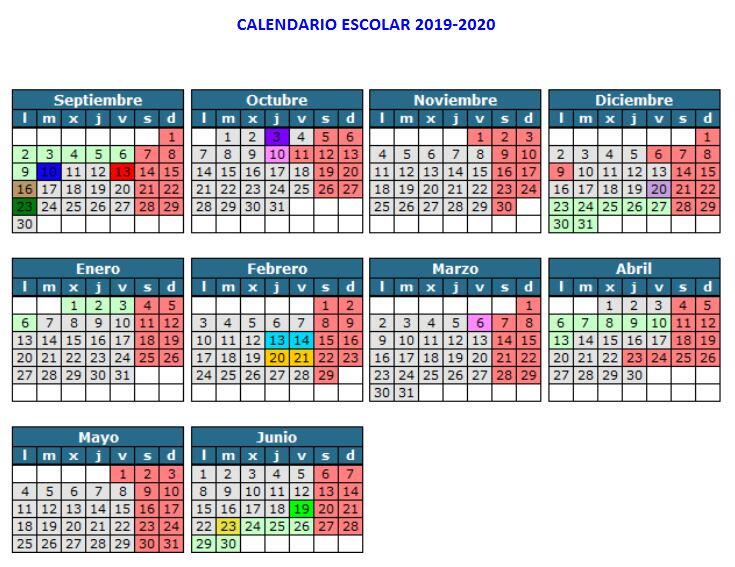

Sobredemanda Escolar En Aragon 58 Colegios Sin Plazas Suficientes

May 29, 2025

Sobredemanda Escolar En Aragon 58 Colegios Sin Plazas Suficientes

May 29, 2025 -

Heitinga Topkandidaat Voor Ajax Trainerschap

May 29, 2025

Heitinga Topkandidaat Voor Ajax Trainerschap

May 29, 2025 -

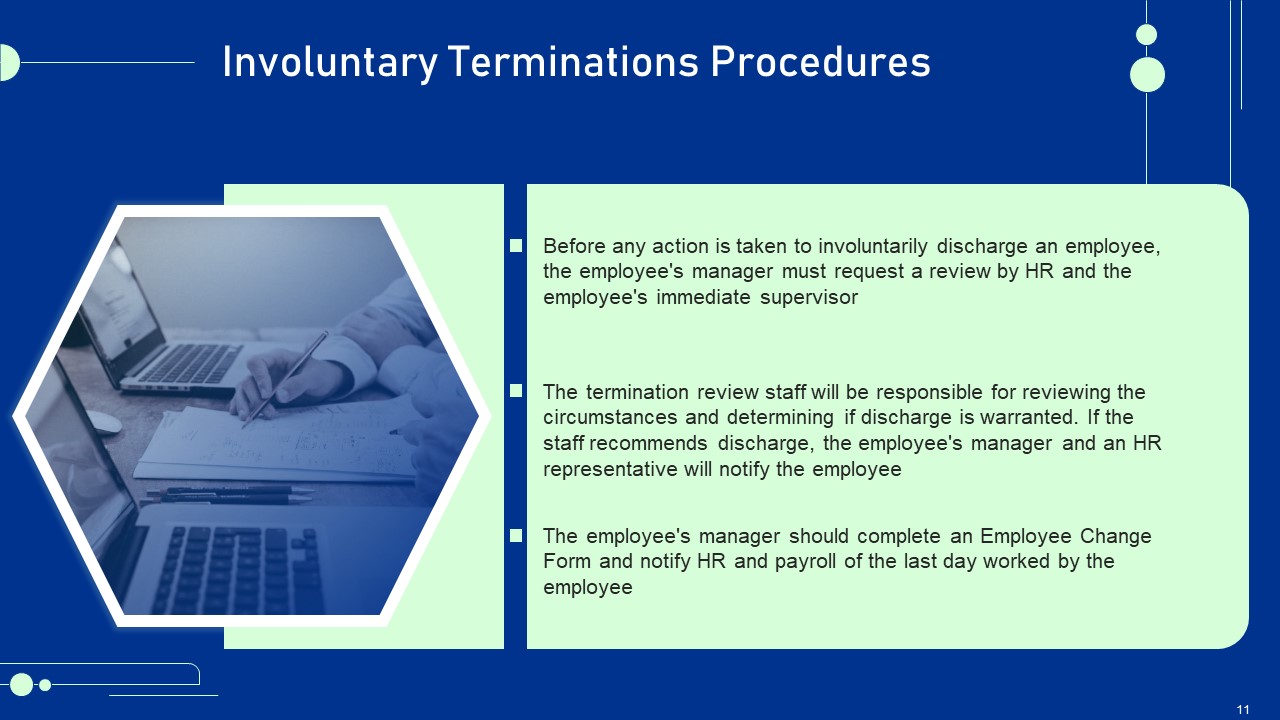

Urgent Update Hudsons Bays Complete Store Closure And Staff Termination

May 29, 2025

Urgent Update Hudsons Bays Complete Store Closure And Staff Termination

May 29, 2025 -

New York Rangers Announce Laviolette Firing Following Playoff Absence

May 29, 2025

New York Rangers Announce Laviolette Firing Following Playoff Absence

May 29, 2025 -

Get Ready Horror Film Sinners Filmed In Louisiana Hits Theaters

May 29, 2025

Get Ready Horror Film Sinners Filmed In Louisiana Hits Theaters

May 29, 2025

Latest Posts

-

Boxing Munguias Revenge A Closer Look At The Surace Rematch

May 31, 2025

Boxing Munguias Revenge A Closer Look At The Surace Rematch

May 31, 2025 -

Jaime Munguia And The Vada Adverse Finding A Career Crossroads

May 31, 2025

Jaime Munguia And The Vada Adverse Finding A Career Crossroads

May 31, 2025 -

Horoscope May 27 2025 Christine Haas

May 31, 2025

Horoscope May 27 2025 Christine Haas

May 31, 2025 -

Munguias Rematch Victory Analysis Of His Performance Against Surace

May 31, 2025

Munguias Rematch Victory Analysis Of His Performance Against Surace

May 31, 2025 -

Drug Test Controversy Munguias Positive Result And Suraces Appeal

May 31, 2025

Drug Test Controversy Munguias Positive Result And Suraces Appeal

May 31, 2025