Trump Tariffs And Apple: Assessing The Risks To Buffett's Portfolio

Table of Contents

The Impact of Trump Tariffs on Global Supply Chains

Trump's tariffs, implemented as part of his "America First" trade policy, dramatically disrupted global supply chains. These tariffs, primarily targeting goods from China, significantly impacted the manufacturing and component sourcing strategies of technology companies like Apple. The ripple effects were far-reaching:

- Increased production costs: Tariffs on imported components directly increased the cost of manufacturing Apple products. This squeezed profit margins and forced difficult decisions about pricing strategies.

- Potential delays in product launches: Supply chain disruptions caused by tariffs led to delays in securing essential components, potentially impacting product launch timelines and revenue projections.

- Shift in manufacturing locations: To mitigate the impact of tariffs, many companies, including Apple, were forced to explore shifting manufacturing operations to countries outside of tariff-affected regions, a costly and time-consuming endeavor.

- Impact on consumer prices and demand: Ultimately, the increased production costs stemming from Trump tariffs were often passed on to consumers, potentially impacting demand for Apple products.

Apple's Specific Vulnerability to Tariffs

Apple, with its intricate global supply chain heavily reliant on manufacturing in China and other tariff-affected regions, was particularly vulnerable. Several key factors amplified this vulnerability:

- High percentage of manufacturing in China: A significant portion of Apple's products were, and still are, manufactured in China, making the company directly exposed to tariffs imposed on Chinese goods.

- Specific components impacted: Many components crucial to Apple's products, such as displays, processors, and other specialized parts, were subject to tariffs, compounding the cost pressures.

- Mitigation strategies: Apple implemented various strategies to mitigate the tariff impacts, including diversification of manufacturing locations and negotiating with suppliers, but the process was complex and not without its challenges.

Analyzing the Financial Impact on Buffett's Apple Investment

The Trump tariffs undeniably affected Apple's stock price and profitability. A close analysis reveals:

- Stock price fluctuations: Apple's stock price exhibited noticeable fluctuations correlated with announcements and shifts in Trump's tariff policies, reflecting investor sentiment regarding the impact on the company's future performance.

- Changes in financial reports: Apple's financial reports during this period showed a clear impact of tariff-related costs, affecting profitability and requiring adjustments to financial forecasting.

- Impact on Berkshire Hathaway: While diversification helped cushion the blow, the fluctuations in Apple's stock price and profitability inevitably impacted the overall performance of Berkshire Hathaway's portfolio, although the extent was mitigated by the vastness and diversification of Buffett's holdings.

Diversification and Risk Mitigation Strategies in Buffett's Portfolio

Buffett's legendary long-term investment strategy and his focus on diversification played a crucial role in mitigating the risks associated with Apple and the tariffs.

- Diverse portfolio holdings: Berkshire Hathaway's massive and diverse portfolio, encompassing a wide range of industries and geographical locations, helped to offset the impact of any single investment, including Apple, being affected by the Trump tariffs.

- Resilience to shocks: Buffett's portfolio demonstrates a long-standing history of resilience to various geopolitical and economic shocks, including trade disputes, indicating a well-structured strategy to navigate challenging market conditions.

- Long-term investment horizon: Buffett's long-term investment approach enabled him to weather the short-term volatility caused by the Trump tariffs, focusing on the underlying value and long-term prospects of his investments, rather than reacting to short-term market fluctuations.

Conclusion: Evaluating the Long-Term Effects of Trump Tariffs on Buffett's Apple Investment

The Trump tariffs presented a significant risk assessment challenge to Buffett's Apple investment, impacting Apple's supply chains, production costs, and ultimately stock price. However, the impact was partially mitigated by Apple's own strategies and the broader diversification within Berkshire Hathaway's portfolio. The episode highlights the complexities of global trade and its profound influence on investment portfolios. This case study underscores the importance of understanding the potential impact of trade policies when making investment decisions. Further research into the effects of trade policies on investment strategies, especially examining the continuing evolution of global trade relations and their influence on Trump tariffs and related investment risks affecting companies like Apple within Buffett's portfolio, is crucial for informed decision-making. Explore resources on investment risk assessment and global trade to enhance your understanding of these dynamic forces.

Featured Posts

-

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 25, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 25, 2025 -

When His Son Needed 2 2 Million Treatment This Dad Took Up Rowing

May 25, 2025

When His Son Needed 2 2 Million Treatment This Dad Took Up Rowing

May 25, 2025 -

Extensive Gun Trafficking Investigation Leads To 18 Arrests In Massachusetts

May 25, 2025

Extensive Gun Trafficking Investigation Leads To 18 Arrests In Massachusetts

May 25, 2025 -

Waiting For The Call A Personal Narrative

May 25, 2025

Waiting For The Call A Personal Narrative

May 25, 2025 -

Ilya Ilich I Ego Gryozy Lyubvi Publikatsiya V Gazete Trud

May 25, 2025

Ilya Ilich I Ego Gryozy Lyubvi Publikatsiya V Gazete Trud

May 25, 2025

Latest Posts

-

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025 -

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025 -

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025 -

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025 -

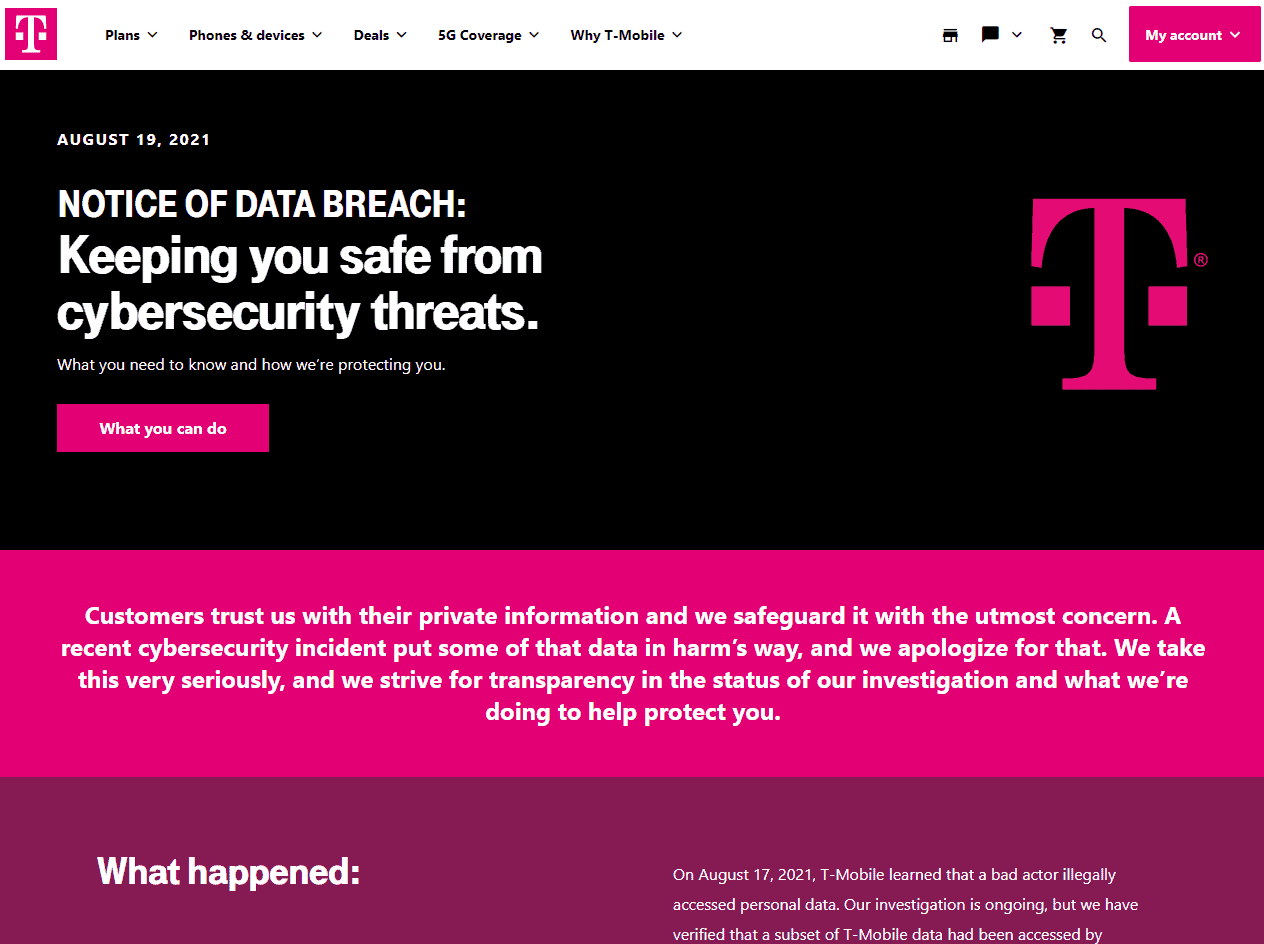

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025