Trump Tariffs And Fintech IPOs: The Devastating Effect On Affirm Holdings (AFRM)

Table of Contents

The Ripple Effect of Trump Tariffs on the US Economy

The Trump administration's imposition of tariffs on various imported goods, particularly from China, sent shockwaves through the US economy. These tariffs, intended to protect domestic industries, ultimately fueled inflation and dampened consumer spending. The increased cost of imported goods, ranging from electronics to clothing, directly translated to higher prices for consumers. This surge in inflation significantly impacted consumer discretionary spending – a crucial element for the success of BNPL companies like Affirm.

- Increased cost of goods imported from China: Tariffs raised the price of numerous consumer goods, reducing purchasing power.

- Reduced consumer confidence and purchasing power: Higher prices led to decreased consumer confidence and a reduction in overall spending.

- Impact on supply chain disruptions: Tariffs exacerbated existing supply chain issues, leading to further price increases and product shortages.

This economic downturn created a perfect storm for businesses reliant on consumer spending, making it harder for people to afford even essential items, let alone optional purchases facilitated by BNPL services.

How Tariffs Indirectly Impacted Affirm's Business Model

Affirm's business model hinges on facilitating consumer purchases through installment loans. A decline in consumer spending directly translates to reduced demand for these loans. As inflation rose and disposable income shrank due to the ripple effects of the tariffs, fewer consumers utilized Affirm's services. Furthermore, increased economic uncertainty led to higher default rates on existing loans, squeezing Affirm's profit margins. The increased inflation also likely forced Affirm to tighten its lending criteria, further impacting its revenue streams.

- Reduced transaction volumes: Fewer consumers making purchases meant fewer transactions processed through Affirm.

- Increased loan defaults: Economic hardship increased the likelihood of borrowers defaulting on their Affirm loans.

- Pressure on profit margins: The combination of reduced transaction volumes and increased defaults severely impacted Affirm's profitability.

The Fintech IPO Market and the Added Pressure on Affirm

The Fintech IPO market, already volatile, faced added pressure during this period of economic uncertainty. Increased interest rates, a common response to inflation, negatively impacted investor sentiment toward growth stocks like Affirm. Investors became more risk-averse, demanding higher returns and scrutinizing Fintech companies more closely. Simultaneously, Affirm faced intense competition within the burgeoning BNPL sector, battling for market share against established players and new entrants.

- Increased scrutiny from investors: Investors carefully evaluated the risk associated with investing in growth stocks during times of economic instability.

- Difficulty securing funding: Securing additional funding became challenging for Affirm as investor confidence waned.

- Competitive pressures: The competitive BNPL landscape intensified the pressure on Affirm to maintain market share and profitability.

Analyzing Affirm's Financial Performance Post-IPO in Relation to Tariffs

Analyzing Affirm's financial performance post-IPO reveals a clear correlation with the implementation and impact of Trump's tariffs. While it's impossible to isolate the tariffs as the sole cause of Affirm's struggles, the timing and trajectory of its stock price, revenue, and earnings closely mirror the economic downturn triggered by these trade policies. (Charts and graphs showcasing Affirm's stock price and financial performance alongside a timeline of tariff implementation would be included here). Reports from credible financial news sources like the Wall Street Journal and Bloomberg could be cited to support the data presented.

- Specific examples of financial metrics impacted: Highlight specific declines in key metrics like revenue growth, net income, and stock price.

- Comparison to competitors' performance: Compare Affirm's performance to its competitors to demonstrate the impact of the economic slowdown relative to the sector as a whole.

- Correlation between tariff implementation and Affirm's financial indicators: Visually demonstrate a clear correlation between the timing of tariff implementation and the negative trends in Affirm's financial data.

The Lasting Impact of Trump Tariffs and Fintech IPOs on Affirm Holdings (AFRM)

In conclusion, the Trump-era tariffs significantly contributed to the economic slowdown that negatively impacted consumer spending, ultimately harming Affirm's performance following its IPO. The increased inflation, reduced consumer confidence, and supply chain disruptions created a challenging environment for BNPL companies reliant on strong consumer spending. This case study underscores the crucial interconnectedness between macroeconomic factors and the seemingly insulated world of Fintech. The impact of Trump Tariffs and Fintech IPOs extends beyond Affirm, serving as a cautionary tale for investors and entrepreneurs alike. Further research into the long-term effects of trade policies on the Fintech sector is crucial for making informed investment decisions and understanding the complex interplay between global trade and financial markets. Investigate the lasting consequences of these tariffs on Affirm and similar companies to better understand the intricate relationship between trade policy and financial markets.

Featured Posts

-

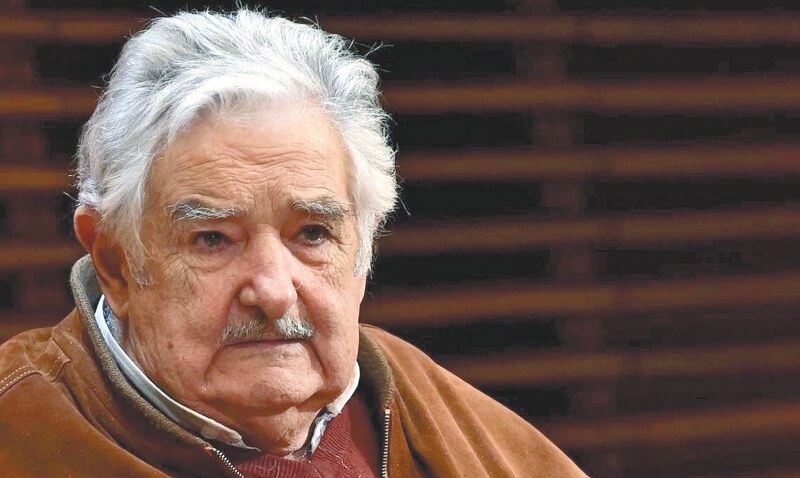

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025 -

Saechsische Schweiz Osterzgebirge Hohburkersdorf Entwarnung Und Aktuelle Informationen

May 14, 2025

Saechsische Schweiz Osterzgebirge Hohburkersdorf Entwarnung Und Aktuelle Informationen

May 14, 2025 -

Tommy Fury Receives Speeding Ticket Days After Molly Mae Relationship News

May 14, 2025

Tommy Fury Receives Speeding Ticket Days After Molly Mae Relationship News

May 14, 2025 -

Is A Stand Up Comedian Hosting Eurovision 2025

May 14, 2025

Is A Stand Up Comedian Hosting Eurovision 2025

May 14, 2025 -

Muere A Los 89 Anos Jose Mujica Expresidente De Uruguay

May 14, 2025

Muere A Los 89 Anos Jose Mujica Expresidente De Uruguay

May 14, 2025