Trump Tariffs Weigh On Infineon (IFX): Sales Guidance And Market Outlook

Table of Contents

Infineon's Exposure to Trump Tariffs

Direct Impact on Sales

The Trump tariffs directly impacted Infineon's sales, leading to both price increases and reduced demand. This was particularly felt in certain product lines and geographic markets.

- Specific Product Lines Affected: Certain power semiconductors used in industrial automation and automotive applications faced increased tariffs, making them less competitive in some markets.

- Geographic Markets Most Affected: Markets reliant on trade with the US, such as those in Europe and Asia, saw a significant decrease in sales due to increased prices and trade barriers.

- Quantitative Data: While precise figures are difficult to isolate due to the complexity of Infineon's diverse product portfolio, analysts have suggested a measurable percentage decrease in sales for certain product categories in the impacted regions. This decrease directly impacted profit margins, reducing overall profitability.

The increased prices stemming from tariffs squeezed profit margins, forcing Infineon to navigate a challenging pricing environment.

Supply Chain Disruptions

The tariffs significantly complicated Infineon's already complex supply chain, resulting in increased costs and delays.

- Disrupted Supply Chains: The imposition of tariffs disrupted established supply routes and created bottlenecks for sourcing raw materials and components from specific regions.

- Reliance on Specific Geographic Regions: Infineon, like many semiconductor manufacturers, relies on a global network of suppliers. The tariffs disproportionately affected regions with strong trade relationships with the US.

- Increased Logistics Costs: Navigating the tariff landscape added significant complexity and costs to logistics and shipping, impacting overall production expenses.

To mitigate these challenges, Infineon implemented various strategies, including diversifying its supplier base to reduce reliance on specific geographic regions and exploring regional manufacturing capabilities to shorten supply chains. However, these solutions require significant investment and time to fully realize their benefits.

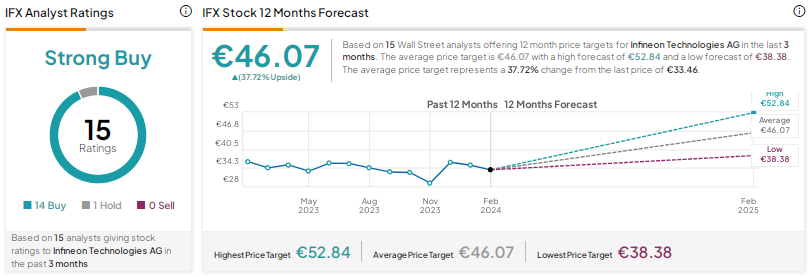

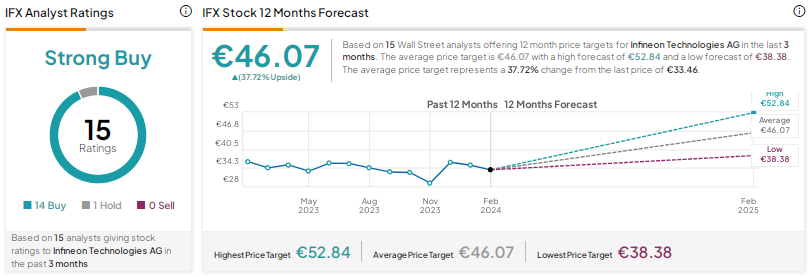

Infineon's Sales Guidance and Recent Performance

Analysis of Recent Financial Reports

Infineon's recent financial reports reveal a mixed picture. While the company remains a significant player in the semiconductor industry, the impact of tariffs is evident in its financial metrics.

- Key Financial Metrics: Revenue growth has been slower than projected in some quarters, and earnings have been affected by the increased costs associated with tariffs and supply chain disruptions.

- Comparison to Previous Quarters/Years: Comparing current performance to pre-tariff figures provides a clear picture of the negative impact on Infineon's financial health.

- Specific Quotes from Management: Statements by Infineon's management concerning the impact of tariffs offer valuable insight into the challenges the company faces.

Future Outlook and Predictions

Infineon's sales guidance reflects a cautious optimism, acknowledging the ongoing challenges but also highlighting opportunities within key markets.

- Factors Influencing Future Sales: Global economic growth, the recovery of the automotive industry (a major market for Infineon), and the continued demand for semiconductors in areas such as 5G and IoT (Internet of Things) will significantly influence future sales.

- Potential Risks and Opportunities: Lingering trade uncertainties, geopolitical risks, and potential shifts in global demand represent risks. Opportunities lie in expanding market share in high-growth sectors like electric vehicles (EVs) and renewable energy.

Market Outlook for Semiconductors and Related Industries

Global Semiconductor Market Trends

The global semiconductor market faces its own set of challenges and opportunities beyond the impact of Trump tariffs.

- Overall Market Growth Rate: The market continues to grow, driven by increasing demand for semiconductors across various applications.

- Demand Drivers: The proliferation of 5G technology, the growth of the Internet of Things (IoT), and the increasing adoption of electric vehicles (EVs) fuel demand.

- Competitive Landscape: The semiconductor industry is highly competitive, with several major players vying for market share.

Impact on Automotive and Industrial Automation Sectors

Infineon’s key markets, automotive and industrial automation, are particularly sensitive to tariff impacts.

- Trends in Automotive and Industrial Automation: The automotive sector is undergoing a significant transformation, with a shift toward electric and autonomous vehicles, increasing the demand for specific types of semiconductors. Industrial automation is also experiencing strong growth driven by industry 4.0 initiatives.

- Infineon's Market Share: Infineon holds a significant market share in these sectors, making it particularly vulnerable to disruptions.

- Strategies to Mitigate Tariff Impacts: Infineon's strategies to mitigate tariff impacts include diversifying its supply chain, investing in regional production, and innovating to reduce its reliance on tariff-affected components.

Conclusion

The Trump tariffs have undeniably impacted Infineon's sales guidance and overall performance. The direct impact on sales, supply chain disruptions, and the resulting pressure on profit margins are significant factors. While the global semiconductor market continues to grow, navigating the complexities of trade policies remains a crucial challenge for Infineon and its competitors. The long-term effects of these trade policies on the semiconductor industry remain uncertain, highlighting the need for constant vigilance and adaptive strategies.

Call to Action: Stay updated on Infineon's response to ongoing trade challenges. Monitor the impact of tariffs on Infineon's future sales projections. Further research into the long-term effects of Trump tariffs on Infineon (IFX) is recommended. Understanding the ongoing impact of tariffs on Infineon and the semiconductor industry is crucial for informed investment decisions and strategic planning.

Featured Posts

-

Dakota Johnson And Family Show Support At Materialist Film Premiere

May 09, 2025

Dakota Johnson And Family Show Support At Materialist Film Premiere

May 09, 2025 -

The Rise Of Elon Musk A Detailed Look At His Financial Journey

May 09, 2025

The Rise Of Elon Musk A Detailed Look At His Financial Journey

May 09, 2025 -

Ev Mandate Opposition Car Dealers Push Back Against Regulations

May 09, 2025

Ev Mandate Opposition Car Dealers Push Back Against Regulations

May 09, 2025 -

Jack Doohan And The Alpine Reserve Driver Situation Palmers Perspective

May 09, 2025

Jack Doohan And The Alpine Reserve Driver Situation Palmers Perspective

May 09, 2025 -

Black Rock Etf Is This The 110 Growth Investment Billionaire Investors Know About

May 09, 2025

Black Rock Etf Is This The 110 Growth Investment Billionaire Investors Know About

May 09, 2025