Trump Tax Cuts: Key Details Unveiled By House GOP

Table of Contents

Individual Income Tax Rate Changes under the Proposed Trump Tax Cuts

The House GOP's proposed Trump Tax Cuts aimed for significant changes to the individual income tax system. These changes focused primarily on lowering individual income tax brackets and adjusting tax rates.

Lowering Individual Income Tax Brackets:

The proposed plan suggested a reduction in the number of individual income tax brackets, simplifying the tax code for many. While the exact numbers varied depending on the specific iteration of the proposal, a common thread was a lowering of marginal tax rates across several brackets. Key terms like "tax brackets," "marginal tax rates," and "individual tax relief" were central to the discussion.

- Example: A proposed change might have reduced the highest tax bracket from 39.6% to 35%, while simultaneously adjusting lower brackets as well.

- Standard Deduction: Increases to the standard deduction were often included, potentially offering greater tax savings for many taxpayers.

- Tax Credits: The proposals might have included adjustments to various tax credits, aiming to further alleviate the individual tax burden.

Impact on Taxpayers:

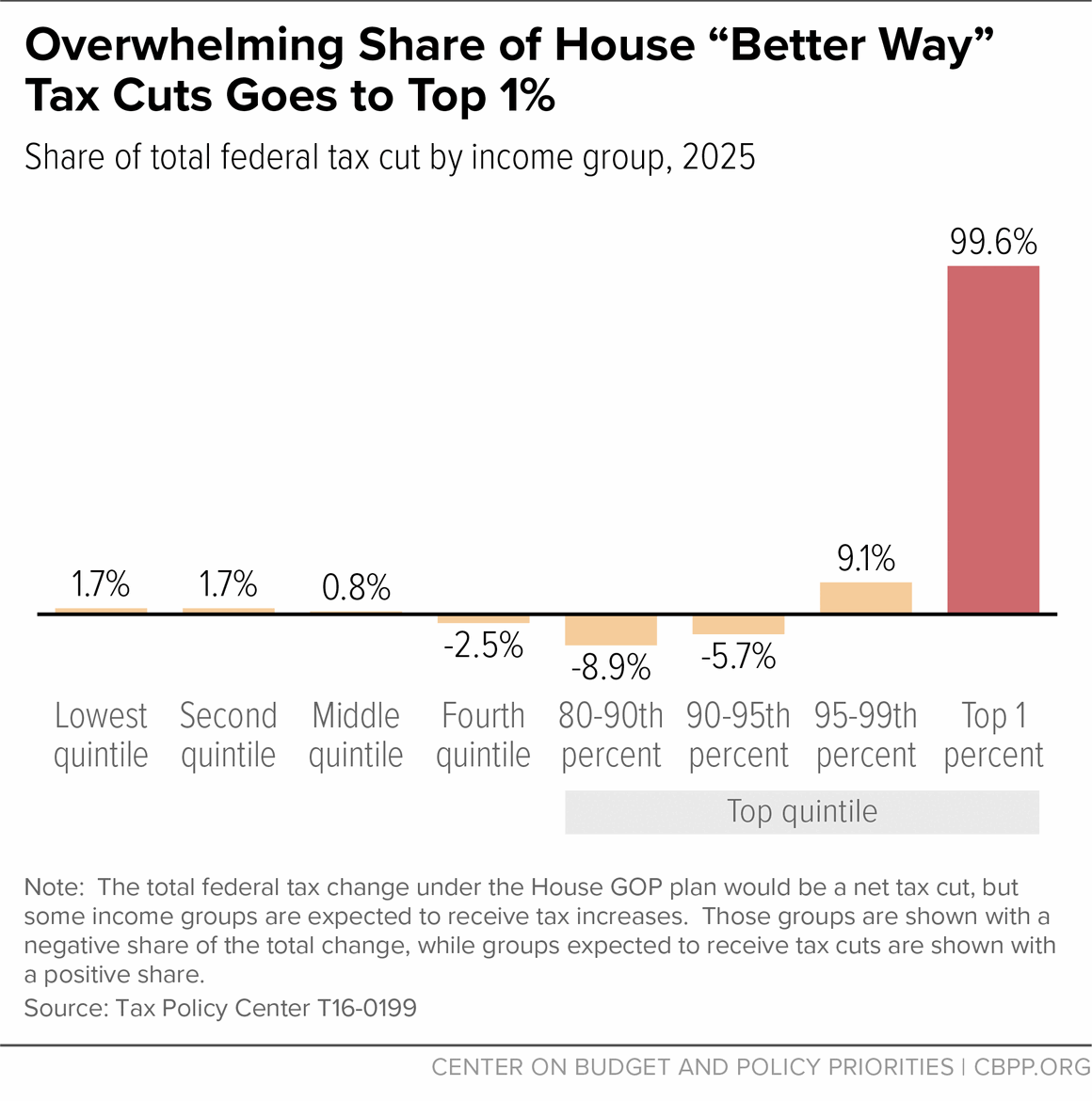

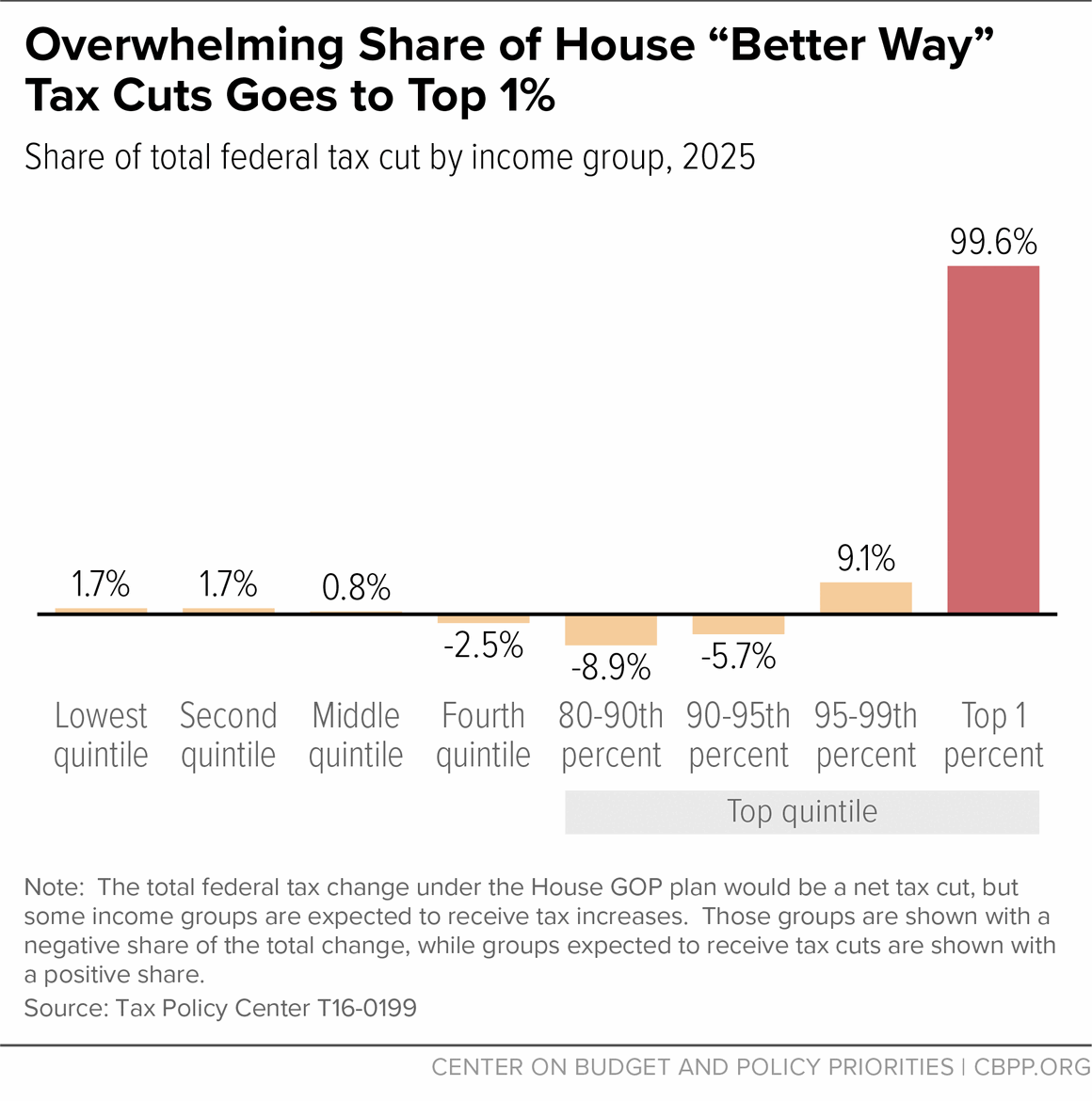

The effects of these proposed Trump Tax Cuts were expected to vary significantly across different income groups.

- Middle Class: Proponents argued the plan would deliver substantial middle-class tax cuts, primarily through increased standard deductions and lower tax rates.

- Wealthy: Critics pointed out that the largest tax savings would likely accrue to high-income earners due to lower rates in higher brackets. This created a debate about the fairness and equity of the proposed tax reform.

- Low-Income Earners: The impact on low-income individuals was a subject of considerable debate, with some arguing that increased standard deductions would benefit them, while others expressed concern that the overall benefits would be minimal.

Corporate Tax Rate Reductions in the House GOP's Plan

A cornerstone of the House GOP's Trump Tax Cuts proposal was a dramatic reduction in the corporate tax rate.

Proposed Corporate Tax Rate:

The proposed corporate tax rate was substantially lower than the existing rate. For example, a proposal may have reduced the rate from 35% to 20%, a significant incentive aimed at stimulating business investment and economic growth. Keywords like "corporate tax rate," "business tax cuts," and "corporate tax reform" dominated the conversation.

- Economic Effects: Proponents argued this reduction would lead to increased business investment, job creation, and a more competitive global marketplace for US businesses.

- Impact on Investment: The lower rate was expected to encourage companies to reinvest profits, spurring economic activity and potentially leading to higher wages.

Implications for Businesses:

The impact of the proposed corporate tax rate reduction was expected to vary across businesses of different sizes and industries.

- Small Businesses: Small businesses, often structured as pass-through entities, were expected to benefit from the overall simplification of the tax code and potentially from reduced tax burdens. This linked to terms like "small business tax relief" and "economic growth."

- Large Corporations: Large corporations were anticipated to realize substantial tax savings, potentially leading to increased stock buybacks, dividends, and reinvestment in their operations.

- International Competitiveness: A lower corporate tax rate aimed to make the US more competitive with other countries, attracting foreign investment and encouraging domestic businesses to expand.

Other Key Aspects of the House GOP's Trump Tax Cuts Proposal

Beyond individual and corporate rates, several other aspects of the House GOP's Trump Tax Cuts plan warrant attention.

Pass-Through Businesses:

The plan included provisions affecting pass-through businesses – those that don't pay corporate income tax but instead pass profits and losses directly to the owners. Keywords such as "pass-through taxation," "sole proprietors," and "small business owners" were relevant here.

- Deductions and Rates: Specific proposals varied, but often included modifications to deductions or preferential tax rates aimed at benefiting these small business owners.

Estate and Gift Taxes:

Changes to the estate and gift tax system were often part of the larger tax reform package, using terms like "estate tax," "inheritance tax," and "gift tax."

- Exemptions and Rates: Proposed changes might have included increasing the estate tax exemption or modifying the tax rates applied to large estates and significant gifts. This directly affected high-net-worth individuals and families.

Potential Budgetary Implications:

The significant tax cuts had considerable implications for the federal budget. Keywords such as "fiscal responsibility," "national debt," and "budget deficit" were pertinent in assessing the long-term effects.

- Debt and Deficit Projections: Official sources provided varying projections on the impact of the tax cuts on the national debt and deficit, with some suggesting a substantial increase.

Conclusion: Evaluating the House GOP's Trump Tax Cuts

The House GOP's proposed Trump Tax Cuts represented a significant overhaul of the US tax code. The plan featured substantial reductions in both individual and corporate tax rates, along with modifications to the treatment of pass-through businesses and estate taxes. While proponents argued these cuts would stimulate economic growth and benefit taxpayers, critics expressed concerns about the distributional effects and potential impact on the national debt. Understanding the complexities of these proposed changes is vital for informed discussion and participation in shaping future tax policy. Stay informed on the Trump tax cuts and learn more about tax reform to understand the implications of the House GOP's plan.

Featured Posts

-

Reyting Filmov Dzherarda Batlera Ot Khudshikh K Luchshim

May 13, 2025

Reyting Filmov Dzherarda Batlera Ot Khudshikh K Luchshim

May 13, 2025 -

Longtime Portola Valley Public Servant Sue Crane Dies At 92

May 13, 2025

Longtime Portola Valley Public Servant Sue Crane Dies At 92

May 13, 2025 -

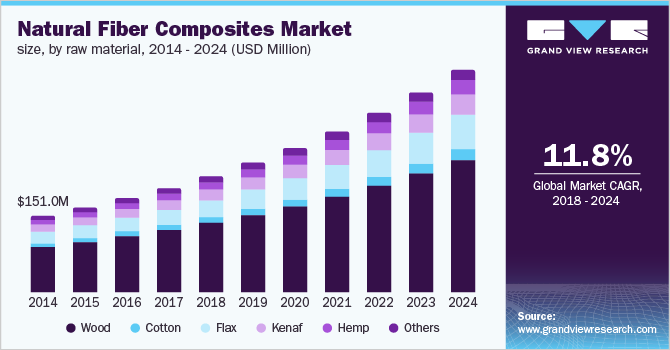

Natural Fiber Composites Market Growth Global Outlook To 2029

May 13, 2025

Natural Fiber Composites Market Growth Global Outlook To 2029

May 13, 2025 -

Mosque Responds To Police Investigation In Muslim Mega City

May 13, 2025

Mosque Responds To Police Investigation In Muslim Mega City

May 13, 2025 -

Billy Bob Thornton Defends Ali Larter And Angela Norris A Landman Controversy

May 13, 2025

Billy Bob Thornton Defends Ali Larter And Angela Norris A Landman Controversy

May 13, 2025

Latest Posts

-

Wegmans Braised Beef Recall Safety Guidelines And Return Process

May 14, 2025

Wegmans Braised Beef Recall Safety Guidelines And Return Process

May 14, 2025 -

Safety First Walmart Recall Of Electric Ride On Toys And Chargers

May 14, 2025

Safety First Walmart Recall Of Electric Ride On Toys And Chargers

May 14, 2025 -

Consumer Alert Walmart Recalls Several Products Including Orvs And Electric Scooters

May 14, 2025

Consumer Alert Walmart Recalls Several Products Including Orvs And Electric Scooters

May 14, 2025 -

Consumer Alert Walmart Recalls Electric Ride Ons And Portable Power Banks

May 14, 2025

Consumer Alert Walmart Recalls Electric Ride Ons And Portable Power Banks

May 14, 2025 -

Fda Issues Recall On Walmart Canned Beans Causes And Impact

May 14, 2025

Fda Issues Recall On Walmart Canned Beans Causes And Impact

May 14, 2025