Trump Tax Plan Unveiled: Key Details From House Republicans

Table of Contents

Individual Income Tax Changes under the Trump Tax Plan

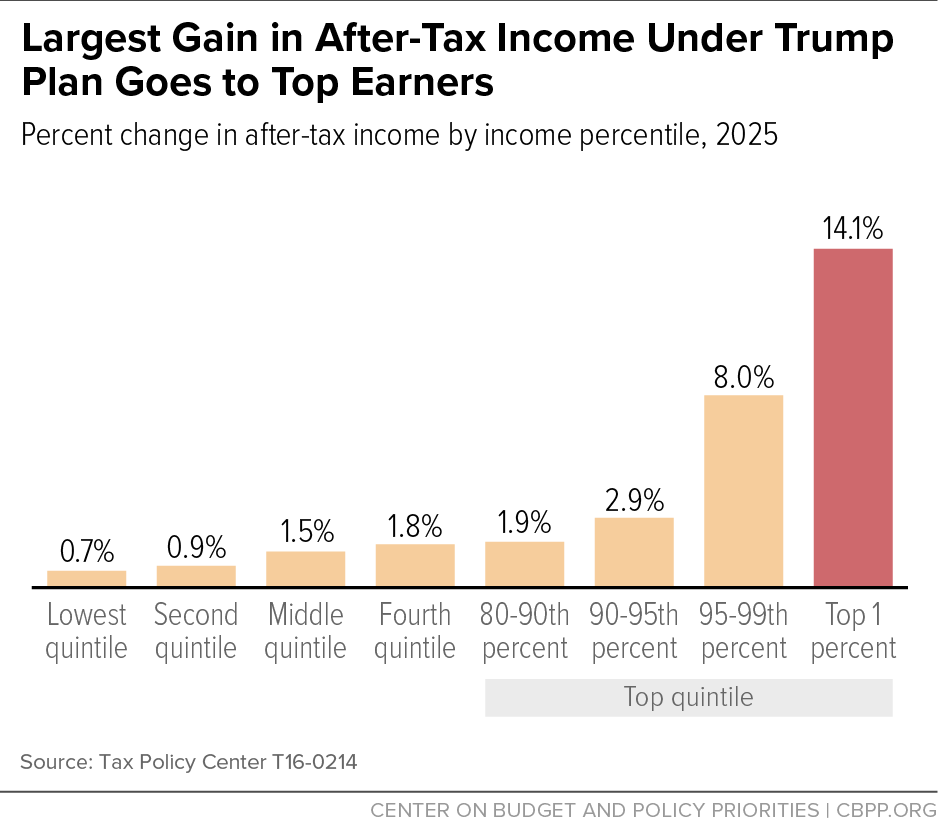

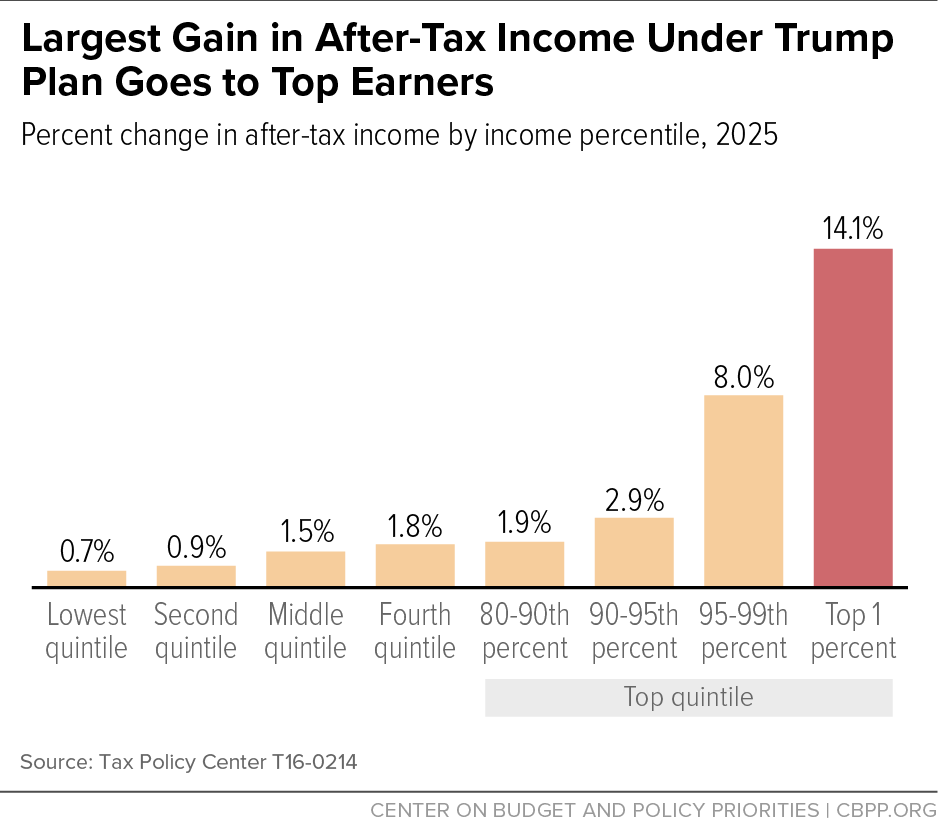

The Trump Tax Plan proposed substantial alterations to the individual income tax system, aiming to simplify the code and provide tax relief for many Americans.

Proposed Tax Rate Changes

The plan suggested significant changes to individual income tax brackets. While specific numbers varied across different versions of the proposed legislation, the general aim was to reduce the number of tax brackets and lower the overall tax rates. For example, some proposals suggested consolidating the seven existing brackets into three or four, with lower rates across the board.

- Example: A hypothetical proposal might reduce the highest tax bracket from 37% to 35%, while simultaneously lowering rates for lower income brackets.

- Impact: This would result in tax savings for most taxpayers, with higher-income earners experiencing more substantial reductions.

- Standard Deduction: Many proposals also included increases to the standard deduction, further reducing the taxable income for many individuals and families.

Impact on Itemized Deductions

The Trump Tax Plan also proposed modifications to itemized deductions. This is a key aspect of understanding the overall impact on taxpayers.

- Mortgage Interest Deduction: Some proposals suggested retaining the mortgage interest deduction, while others proposed limiting the amount deductible or altering eligibility requirements.

- State and Local Taxes (SALT): The deductibility of state and local taxes was a major point of contention. Some versions of the plan proposed eliminating or significantly capping the SALT deduction, potentially impacting taxpayers in high-tax states.

- Charitable Contributions: The deductibility of charitable contributions was generally retained but changes to the limits were considered in some versions of the plan. The impact on charitable giving would need careful consideration.

Child Tax Credit Modifications

The Child Tax Credit (CTC) was another area targeted for change under the Trump Tax Plan. Proposals sought to expand the credit or make it more accessible to families.

- Increased Credit Amount: Several proposals suggested significantly increasing the amount of the Child Tax Credit.

- Eligibility Expansion: Some plans aimed to expand eligibility for the credit, making it available to more families.

- Refundability: The proposals considered whether to make the CTC fully refundable, meaning families could receive a refund even if the credit exceeded their tax liability. This is a significant change for low-income families.

Corporate Tax Rate Reductions in the Trump Tax Plan

A central component of the Trump Tax Plan involved significant reductions in the corporate tax rate.

Proposed Corporate Tax Rate

The plan proposed a dramatic reduction in the corporate tax rate, aiming to boost economic growth and investment.

- Rate Reduction: The proposed rate was significantly lower than the previous rate, potentially attracting more business investment in the United States.

- Impact on Corporate Profits: The reduced rate would boost after-tax profits for corporations, potentially leading to increased investment, job creation, and higher shareholder returns.

- International Competitiveness: The lower rate was intended to improve the US's international competitiveness by making it more attractive for businesses to locate and operate in the country.

Pass-Through Business Taxation

The plan addressed the taxation of pass-through businesses, such as S corporations, partnerships, and LLCs.

- Deductions and Rates: Various proposals suggested different methods for taxing pass-through income, such as allowing deductions or adjusting tax rates specifically for these types of businesses.

- Impact on Small Businesses: The modifications could have a significant effect on small business owners, potentially impacting their profitability and ability to invest in growth.

- Investment Incentives: The aim was to encourage investment and expansion by offering beneficial tax treatment to pass-through entities.

Other Key Provisions of the Trump Tax Plan

Beyond individual and corporate tax rates, the Trump Tax Plan included several other significant provisions.

Estate Tax Changes

The plan proposed significant modifications or potential repeal of the estate tax.

- Repeal or Modification: Different versions of the plan suggested either completely repealing the estate tax or substantially raising the exemption amount.

- Impact on Wealth Transfer: The changes would have a major effect on high-net-worth individuals and families, altering the dynamics of wealth transfer across generations.

- Impact on Inheritance: A complete repeal would eliminate the tax on inherited wealth, while modifications to the exemption would affect a narrower group of high-wealth individuals.

International Tax Implications

The Trump Tax Plan also included provisions designed to address international taxation.

- Multinational Corporations: Changes were proposed regarding how the profits of multinational corporations are taxed, aiming to encourage them to bring profits back to the US.

- Foreign Investment: The changes might influence foreign investment into the US, depending on the specific provisions of the plan.

- Tax Avoidance: The proposed changes also targeted international tax avoidance schemes and loopholes.

Conclusion

The Trump Tax Plan represented a significant attempt to overhaul the US tax code, promising substantial changes for both individuals and corporations. The proposed reductions in individual income tax rates, corporate tax rates, and modifications to deductions and credits had the potential to significantly impact the economy. The changes to the estate tax and international taxation further highlight the comprehensive nature of the proposed legislation. Understanding these changes is crucial for both individuals and businesses to effectively plan for the future.

Call to Action: Stay informed about the evolving details of the Trump Tax Plan and its potential consequences. Research further to understand how these proposed changes may affect your personal finances and business strategy. Continue following the latest news and updates on the Trump Tax Plan and its potential impact on your tax liability.

Featured Posts

-

Yankees Vs Padres Prediction San Diegos 7 Game Winning Streak On The Line

May 16, 2025

Yankees Vs Padres Prediction San Diegos 7 Game Winning Streak On The Line

May 16, 2025 -

Jimmy Butler Injury Update Is He Playing For The Warriors Today

May 16, 2025

Jimmy Butler Injury Update Is He Playing For The Warriors Today

May 16, 2025 -

Pei Legislature Reviews 500 000 Bill For Nhl Face Off Event

May 16, 2025

Pei Legislature Reviews 500 000 Bill For Nhl Face Off Event

May 16, 2025 -

Ayk Mdah Ne Tam Krwz Ke Jwte Pr Pawn Rkha Kya Hwa

May 16, 2025

Ayk Mdah Ne Tam Krwz Ke Jwte Pr Pawn Rkha Kya Hwa

May 16, 2025 -

Everton Vina Vs Coquimbo Unido 0 0 Resultado Resumen Y Goles

May 16, 2025

Everton Vina Vs Coquimbo Unido 0 0 Resultado Resumen Y Goles

May 16, 2025

Latest Posts

-

Biden Vance Ukraine Clash A Detailed Policy Analysis

May 16, 2025

Biden Vance Ukraine Clash A Detailed Policy Analysis

May 16, 2025 -

Trump Vs Biden A Clash Of Words And Policies

May 16, 2025

Trump Vs Biden A Clash Of Words And Policies

May 16, 2025 -

Ukraine Policy Debate Jd Vances Effective Rebuttal Of Biden

May 16, 2025

Ukraine Policy Debate Jd Vances Effective Rebuttal Of Biden

May 16, 2025 -

Full Interview Joe And Jill Biden On The View

May 16, 2025

Full Interview Joe And Jill Biden On The View

May 16, 2025 -

Vances Sharp Response Countering Bidens Ukraine Attack

May 16, 2025

Vances Sharp Response Countering Bidens Ukraine Attack

May 16, 2025