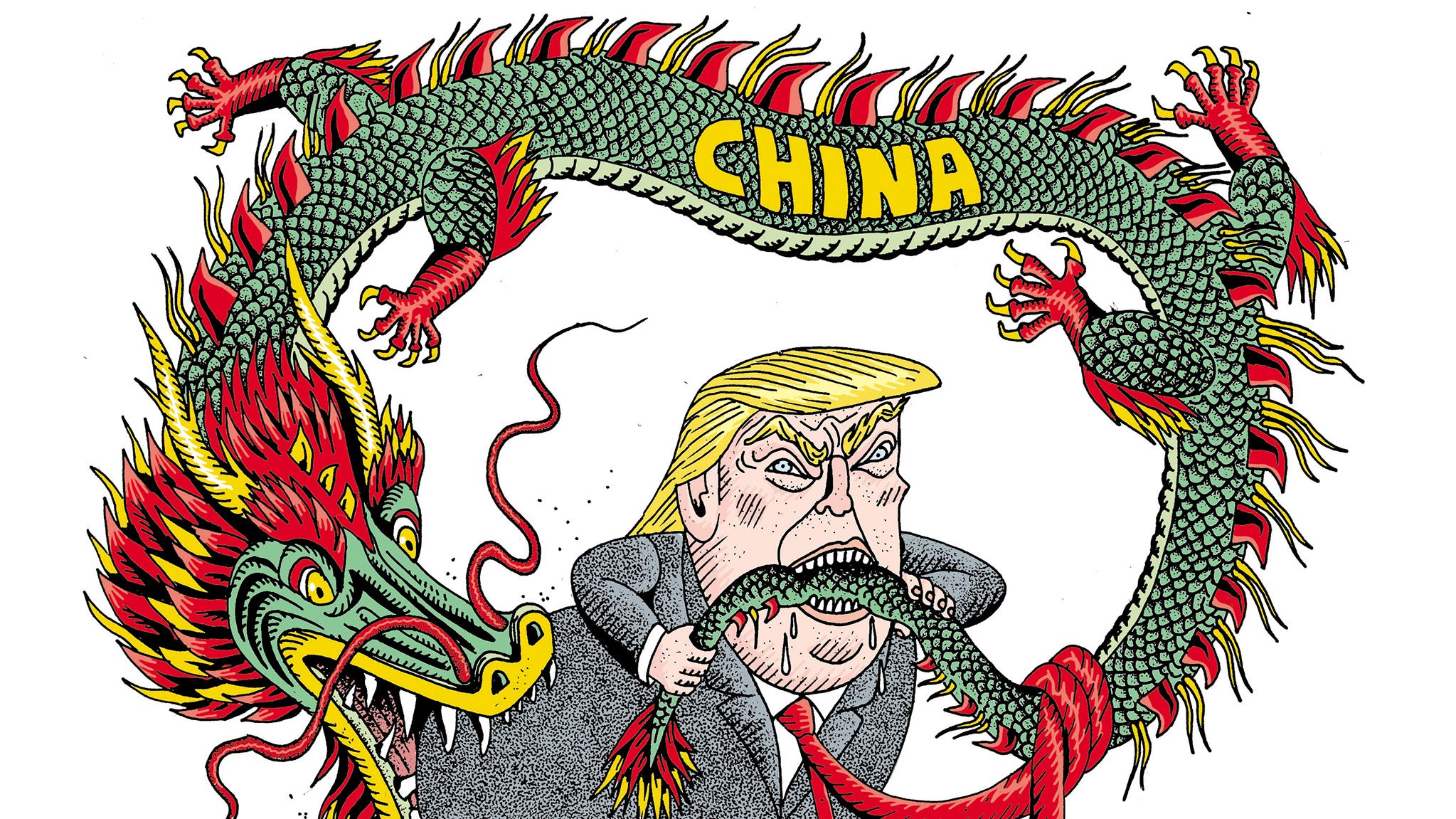

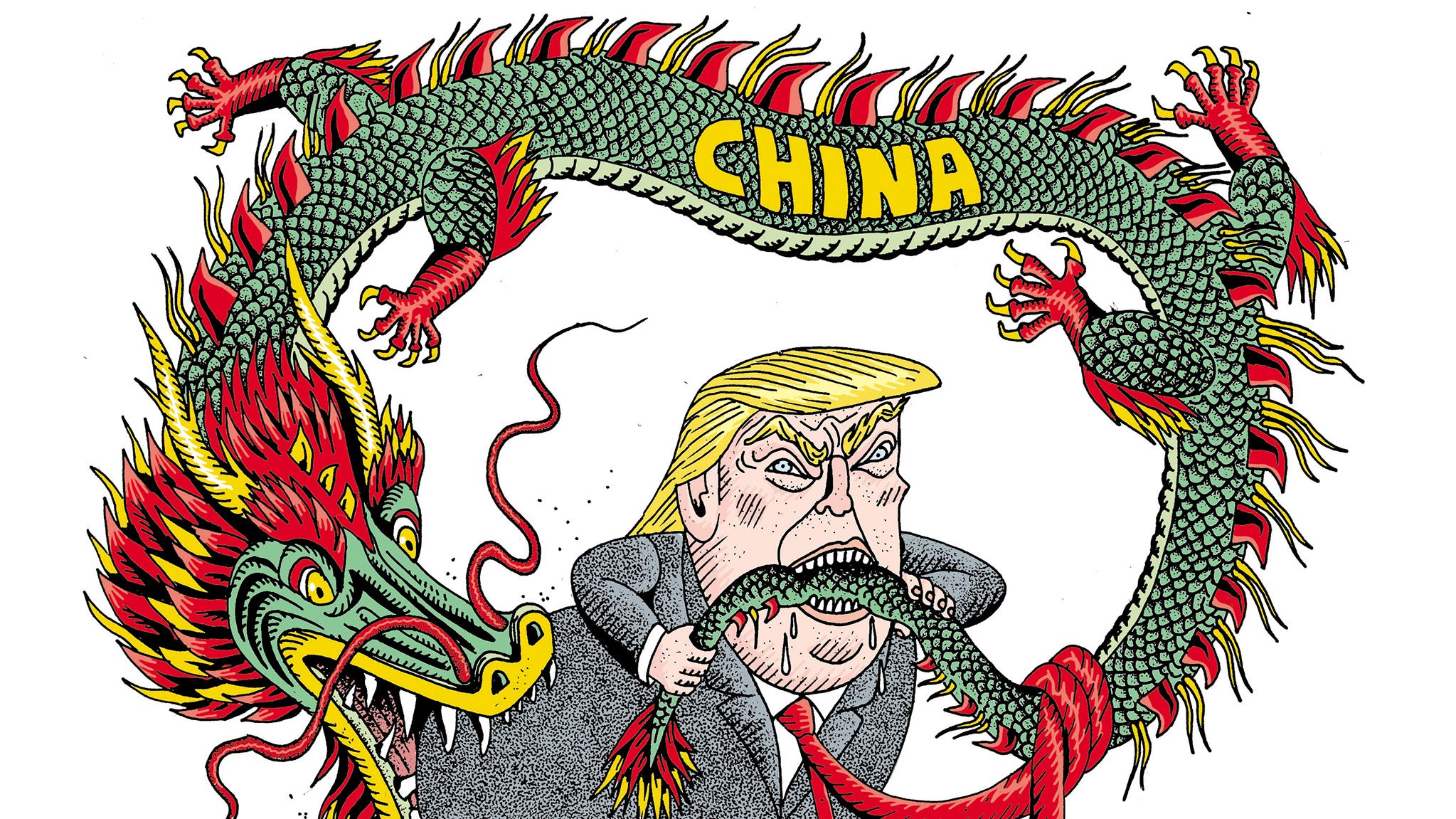

Trump's China Trade Push: Focusing On Tariff Cuts And Rare Earth Supply

Table of Contents

The Tariff War: An Overview of Trump's Approach

The Trump administration initiated a trade war with China, imposing significant tariffs on a wide range of Chinese goods. This section will examine the initial tariff impositions, subsequent negotiations, and the long-term effects of these policies.

Initial Tariff Impositions

The Trump administration implemented a series of tariffs, beginning in 2018, targeting various sectors of the Chinese economy. These tariffs aimed to address concerns about unfair trade practices, intellectual property theft, and the trade deficit.

- Steel and Aluminum Tariffs: Tariffs of 25% were imposed on steel and 10% on aluminum imports from China, impacting the construction and manufacturing sectors.

- Consumer Goods Tariffs: Tariffs ranging from 10% to 25% were levied on billions of dollars worth of consumer goods, impacting various retail sectors and increasing prices for American consumers.

- Technology Tariffs: Specific tariffs targeted technologically advanced goods, aiming to curb China's technological advancement in areas such as semiconductors and telecommunications.

The economic impact was multifaceted. While some argue the tariffs protected domestic industries and jobs, others point to increased prices for consumers, supply chain disruptions, and retaliatory tariffs from China that harmed American businesses. Accurate quantification of the net economic effect remains a subject of ongoing debate.

Negotiations and Trade Deals

Despite the escalating tariff war, negotiations between the US and China continued. The most significant outcome was the "Phase One" trade deal signed in January 2020.

- Phase One Deal: This deal included commitments from China to purchase a significant amount of US agricultural products and reduce certain tariffs. It also addressed some intellectual property concerns.

- Tariff Reductions: While some tariffs were reduced under the Phase One deal, many remained in place, leaving a significant portion of bilateral trade subject to increased tariffs.

The effectiveness of the Phase One deal remains contested. While it temporarily eased trade tensions, it did not resolve the underlying structural issues driving the trade conflict.

Long-Term Effects of Tariff Policies

The long-term effects of Trump's tariff policies are still unfolding. However, several key impacts are already evident:

- Inflation: Tariffs contributed to increased prices for consumers, impacting inflation rates in both the US and China.

- Job Creation/Loss: The impact on job creation and loss is complex, with some sectors benefiting from protectionist measures while others suffered due to reduced exports and supply chain disruptions.

- Changes in Trade Patterns: The tariff war led to a shift in global trade patterns, with some companies relocating production to avoid tariffs.

The long-term impact on specific industries, such as manufacturing and agriculture, will continue to be analyzed for years to come, highlighting the complex ripple effects of Trump's trade policies.

Rare Earth Minerals: Securing Supply Chains

The Trump administration also focused on securing US access to rare earth minerals, acknowledging China's near-monopoly in their production and processing.

The Importance of Rare Earths

Rare earth minerals are critical components in a wide array of technologies:

- Electronics: Smartphones, computers, and other electronic devices rely heavily on rare earth minerals.

- Defense: Military technologies, including guided missiles and radar systems, utilize these minerals.

- Renewable Energy: Wind turbines, electric vehicles, and other renewable energy technologies also require rare earth minerals.

China's dominance in rare earth mining and processing presents a significant geopolitical vulnerability for countries reliant on these materials.

Trump Administration's Initiatives

The Trump administration took some steps to address US reliance on China for rare earth minerals:

- Government Funding: Some funding was allocated towards research and development in rare earth mineral extraction and processing.

- Incentives: Limited incentives were offered to encourage domestic rare earth mining and processing.

- Policy Initiatives: Efforts were made to identify and secure alternative supply chains for rare earth minerals.

However, these initiatives were relatively limited in scope and scale compared to the magnitude of China's dominance in the sector.

The Geopolitical Implications

China's control over rare earth minerals has significant geopolitical implications:

- National Security: Dependence on China for these critical materials poses a risk to national security, particularly for countries with advanced military technologies.

- Technological Advancement: Control over rare earth minerals can influence technological advancement and innovation globally.

- International Relations: The issue of rare earth minerals has become a key point of contention in US-China relations and broader geopolitical dynamics.

The long-term sustainability of any strategy to diversify rare earth supply chains remains a crucial challenge.

Conclusion: Assessing Trump's Legacy on China Trade

Trump's approach to China trade, characterized by significant tariffs and efforts to secure rare earth mineral supply chains, yielded mixed results. While some tariffs may have provided short-term protection to specific domestic industries, the overall economic impact was complex and the long-term consequences are still being assessed. Initiatives to diversify rare earth supplies remain underdeveloped. The interconnectedness of these two aspects – tariffs and rare earth dependence – highlights the multifaceted nature of US-China trade relations. To gain a deeper understanding of this complex topic, further research into "Trump's China trade war," "rare earth supply chain security," "US-China trade relations," and "tariff impacts" is strongly encouraged. Consult reputable academic journals, government reports, and think tank publications for in-depth analyses.

Featured Posts

-

Ofilis 100 000 Grand Slam Track Debut A Strong Third Place Showing

May 11, 2025

Ofilis 100 000 Grand Slam Track Debut A Strong Third Place Showing

May 11, 2025 -

Knicks Resilience Shines Through In Overtime Win Over Bulls

May 11, 2025

Knicks Resilience Shines Through In Overtime Win Over Bulls

May 11, 2025 -

New Baseball Exhibit At East Tennessee History Center Precedes Covenant Health Park Debut

May 11, 2025

New Baseball Exhibit At East Tennessee History Center Precedes Covenant Health Park Debut

May 11, 2025 -

Bayern Munichs Mueller Departure Analyzing The Impact And Fan Sentiment

May 11, 2025

Bayern Munichs Mueller Departure Analyzing The Impact And Fan Sentiment

May 11, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

May 11, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

May 11, 2025