Trump's Comments On Powell Boost US Stock Futures

Table of Contents

Trump's Criticism of Powell's Monetary Policy

Trump's consistent criticism of Powell's monetary policy has been a recurring theme throughout his presidency. He frequently voiced disapproval of interest rate hikes, arguing they hampered economic growth and unfairly targeted his administration's economic achievements. This ongoing tension between the executive branch and the independent Federal Reserve created considerable political uncertainty.

- Examples of Trump's criticism: Trump repeatedly labeled Powell's actions as "too slow" in lowering interest rates and "too aggressive" in raising them, depending on the prevailing economic climate. He publicly called for lower interest rates on numerous occasions, often tying them directly to his re-election chances. These comments were frequently published in major news outlets and shared extensively on social media.

- Political implications: Trump's criticism highlighted the inherent tension between an administration's economic goals and the central bank's mandate to maintain price stability and full employment. This tension often spilled over into broader political debates, adding another layer of complexity to economic policy discussions. Links to specific news articles and official statements documenting these criticisms can be found through a simple online search.

- Keyword integration: The persistent friction between Trump and Powell regarding monetary policy, interest rate decisions, and their impact on economic growth continues to shape the narrative surrounding the US economy.

The Unexpected Market Reaction

Following Trump's latest comments, US stock futures experienced a significant jump. This unexpected market rally was notable for its speed and intensity.

- Quantifying the increase: The Dow Jones Industrial Average futures saw a percentage increase of [Insert Percentage – replace with actual data from the relevant event], while S&P 500 futures climbed by [Insert Percentage - replace with actual data from the relevant event]. This sharp upward movement surprised many analysts who expected a more muted response.

- Reasons for the positive reaction: The market's positive reaction likely stemmed from investors interpreting Trump's comments as a potential signal for looser monetary policy in the future. This could involve lower interest rates, potentially boosting economic activity and corporate profits. Some analysts also speculated about the possibility of renewed economic stimulus measures.

- Analyst opinions: Many market analysts attributed the sudden surge in investor sentiment to a combination of factors, including the unexpected nature of Trump's statements and lingering hopes for less restrictive monetary policies. Their opinions varied on the sustainability of this rally.

- Keyword integration: The sharp increase in US stock futures and the broader stock market rally highlighted the powerful influence of political statements on investor sentiment and the complex interplay of political and economic factors.

Analyzing the Impact on the Economy

The long-term economic effects of Trump's comments remain uncertain, presenting both opportunities and risks.

- Inflation and interest rates: A sustained period of lower interest rates, as potentially suggested by Trump's comments, could fuel inflation. The Federal Reserve would need to carefully monitor inflation metrics and adjust its policy accordingly to maintain price stability.

- Investor confidence and future investment decisions: The market's initial positive response to Trump’s comments could erode if investors lose confidence in the consistency and predictability of economic policy. Such uncertainty can discourage investment and slow economic growth.

- Risks and uncertainties: The unpredictability of political statements and their impact on market sentiment introduces considerable economic uncertainty. This uncertainty complicates economic forecasting and investment planning.

- Keyword integration: The economic impact of such unpredictable political pronouncements remains a critical area for ongoing analysis and underscores the intertwined nature of politics and economics.

The Role of Political Uncertainty in Market Fluctuations

Political uncertainty is a significant factor influencing market volatility. Trump's comments, and similar pronouncements from political figures, serve as a prime example.

- Political uncertainty and investor behavior: Investors tend to become more risk-averse during periods of political uncertainty, leading to increased market volatility. This can result in both sharp price increases (as seen in this instance) and significant drops.

- Broader impact: The impact of Trump's comments extends beyond the immediate market response. It underscores the broader vulnerability of the financial markets to unpredictable political events and the potential for unforeseen consequences.

- Political news cycles: The influence of political news cycles on market trends is undeniable. Major political announcements or events can trigger significant short-term market fluctuations, impacting investor confidence and investment strategies.

- Keyword integration: Understanding the role of political uncertainty, political risk, and the impact of political news cycles on market trends is crucial for investors navigating today's complex economic landscape.

Conclusion

In summary, former President Trump's comments on Jerome Powell's monetary policy triggered an unexpected surge in US stock futures, highlighting the significant impact of political statements on market sentiment. While the initial market rally was impressive, the long-term economic consequences remain uncertain. The unpredictability of political events and their influence on investor behavior emphasize the crucial need for careful monitoring and analysis of political risks. Stay tuned for further updates on Trump's influence on US stock futures and the economy, as political pronouncements continue to shape the landscape of the US financial markets.

Featured Posts

-

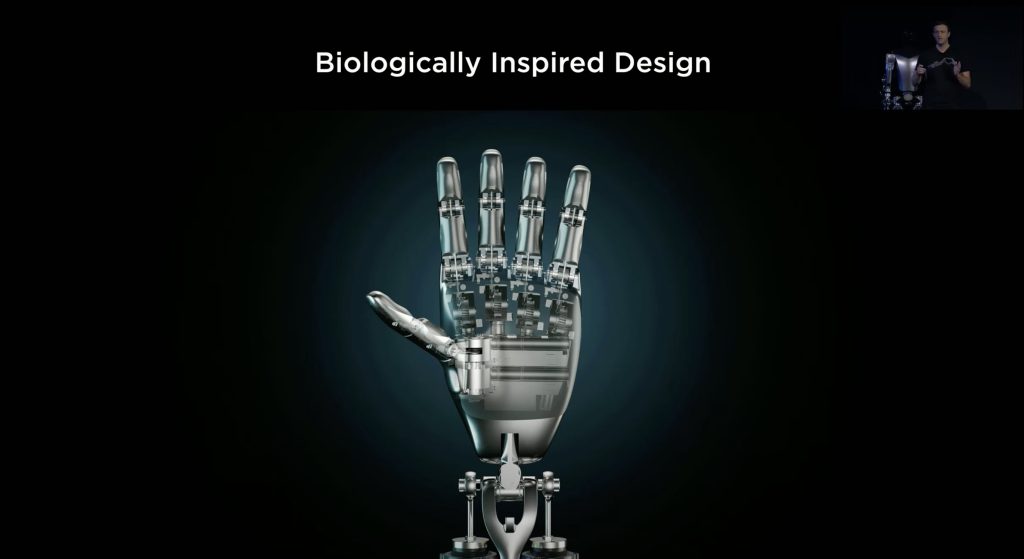

Optimus Robot Production Teslas Challenges Amidst Chinas Rare Earth Policies

Apr 24, 2025

Optimus Robot Production Teslas Challenges Amidst Chinas Rare Earth Policies

Apr 24, 2025 -

A Fathers Remembrance John Travolta Shares Photo To Mark Son Jetts Birthday

Apr 24, 2025

A Fathers Remembrance John Travolta Shares Photo To Mark Son Jetts Birthday

Apr 24, 2025 -

Steffy Comforts Liam Poppy Warns Finn The Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025

Steffy Comforts Liam Poppy Warns Finn The Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025 -

Is The 77 Inch Lg C3 Oled Tv Worth It My Take

Apr 24, 2025

Is The 77 Inch Lg C3 Oled Tv Worth It My Take

Apr 24, 2025 -

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 24, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 24, 2025

Latest Posts

-

Celtics Clinch Division After Magic Blowout Win

May 12, 2025

Celtics Clinch Division After Magic Blowout Win

May 12, 2025 -

Celtics Clinch Division Dominant Victory Over Opponent Name

May 12, 2025

Celtics Clinch Division Dominant Victory Over Opponent Name

May 12, 2025 -

Celtics Division Clinching Win A Blowout Performance

May 12, 2025

Celtics Division Clinching Win A Blowout Performance

May 12, 2025 -

Could Payton Pritchard Win Sixth Man Of The Year Analyzing His Stellar Season

May 12, 2025

Could Payton Pritchard Win Sixth Man Of The Year Analyzing His Stellar Season

May 12, 2025 -

Boston Celtics Clinch Division Magic Blowout Win

May 12, 2025

Boston Celtics Clinch Division Magic Blowout Win

May 12, 2025