Trump's Decision: Impact Of The Nippon-U.S. Steel Deal On The Global Market

Table of Contents

The Nippon-U.S. Steel Deal: A Detailed Overview

While a specific, formally titled "Nippon-U.S. Steel Deal" may not exist as a singular, comprehensively documented agreement, the impact of President Trump's trade policies on the relationship between Japanese steel producers like Nippon Steel and U.S. steel manufacturers like U.S. Steel is significant and warrants analysis. His administration implemented various tariffs and trade restrictions on imported steel, directly affecting the flow of steel between the U.S. and Japan. These actions, while not a formal "deal" in the traditional sense, functioned as a significant agreement-in-effect.

- Key players involved: Nippon Steel, U.S. Steel, the Trump administration (specifically, Robert Lighthizer, then-United States Trade Representative).

- Specific aspects of the deal (implied): The key aspect was the imposition of significant tariffs on steel imports into the U.S., leading to a reduction in the volume of Japanese steel entering the American market. This indirectly affected Nippon Steel's market share and profitability. Exact tariff rates varied depending on the type of steel and fluctuated over time.

- Concessions made: While no explicit concessions were publicly negotiated between Nippon Steel and the U.S. government, the imposition of tariffs effectively forced a reduction in Japanese steel exports to the U.S., acting as an implicit concession to protect the domestic steel industry.

Immediate Impact on the U.S. Steel Industry

The immediate impact on the U.S. steel industry was multifaceted. The tariffs initially aimed to protect domestic producers from foreign competition and potentially boost domestic production and employment.

- Changes in domestic steel prices: Domestic steel prices saw a temporary increase due to reduced imports and increased demand for domestically produced steel.

- Impact on U.S. steel company profits: Companies like U.S. Steel experienced a short-term boost in profits as a result of higher prices and reduced competition.

- Job creation/loss data: While some jobs were potentially saved or created within the U.S. steel sector, it's crucial to note that this impact might have been offset by job losses in industries that rely on imported steel as a raw material. Precise data on net job creation or loss requires further detailed analysis.

- Effects on competitiveness: The long-term impact on the competitiveness of U.S. steel manufacturers remains a subject of debate. Increased prices could make U.S. steel less competitive in the global market.

Global Ramifications of Trump's Steel Tariffs

The Trump administration's steel tariffs had far-reaching consequences beyond the U.S. and Japan. These actions triggered retaliatory measures from other steel-producing nations and exacerbated existing trade tensions.

- Impact on global steel prices: Global steel prices fluctuated significantly as a result of shifting supply and demand dynamics triggered by the tariffs.

- Reactions from other steel-producing countries: Countries like China and those within the European Union reacted with their own tariffs and trade restrictions, escalating trade tensions and creating uncertainty in the global steel market.

- Effects on international trade relationships: The steel tariffs strained relationships between the U.S. and several of its major trading partners, negatively impacting broader international trade relations.

- Potential for retaliatory tariffs and trade wars: The tariffs initiated a cycle of retaliatory measures, further increasing trade tensions and highlighting the risks of protectionist policies.

Long-Term Economic Consequences of the Nippon-U.S. Steel Deal (implied)

The long-term economic consequences of the implied Nippon-U.S. steel deal are complex and still unfolding. Initial short-term gains for the U.S. steel industry could be outweighed by broader negative effects on the U.S. and global economies.

- Long-term impact on U.S. economic growth: Protectionist measures can distort market forces and hinder long-term economic growth. The increased cost of steel could negatively affect various downstream industries.

- Effects on global inflation and consumer prices: Higher steel prices could lead to increased inflation and higher consumer prices across a wide range of goods.

- Potential shifts in global steel production and supply chains: Companies may have shifted production and supply chains to avoid the tariffs, leading to restructuring of global steel markets.

- Long-term impacts on international trade relations: The trade tensions created could negatively impact international trade relations for years to come.

Conclusion

Understanding the ramifications of President Trump's trade policies, especially their effect on the implied Nippon-U.S. steel deal, requires a nuanced understanding of complex economic interactions. While some short-term benefits for the U.S. steel industry may have been observed, the long-term consequences, including global trade tensions and economic distortions, warrant careful consideration. The increase in steel prices and the retaliatory tariffs created uncertainty in the global steel market, impacting both producers and consumers. Understanding the intricacies of Trump's decision and its impact on the implied Nippon-U.S. steel deal is crucial for navigating the complexities of the global steel market. Continue to research the ongoing effects of this landmark trade agreement to stay informed.

Featured Posts

-

Update Klasemen Moto Gp Analisis Menyeluruh Usai Kemenangan Marquez Di Argentina 2025

May 26, 2025

Update Klasemen Moto Gp Analisis Menyeluruh Usai Kemenangan Marquez Di Argentina 2025

May 26, 2025 -

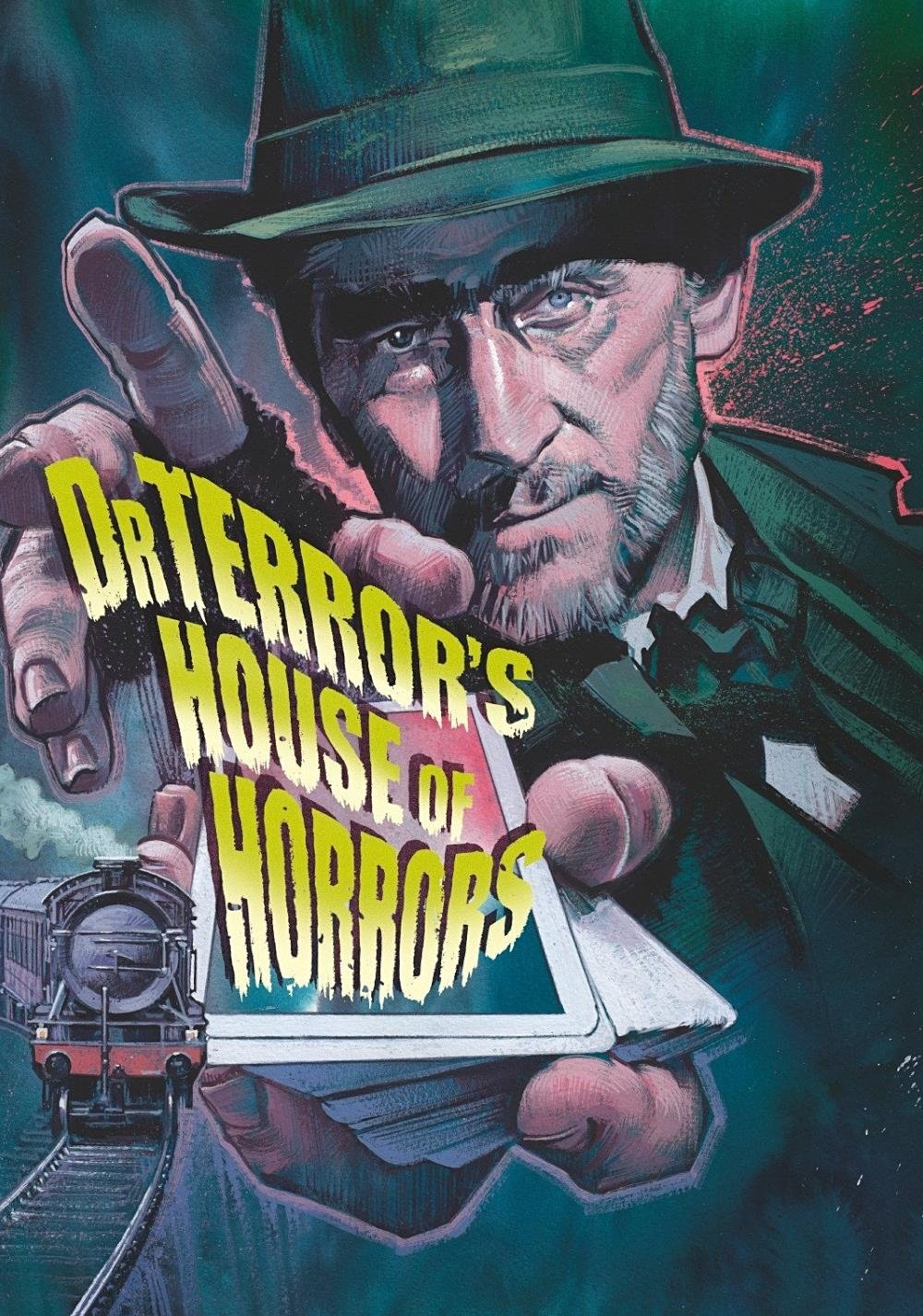

Dr Terrors House Of Horrors What To Expect On Your Frightening Visit

May 26, 2025

Dr Terrors House Of Horrors What To Expect On Your Frightening Visit

May 26, 2025 -

How Sarah Vines Whats App Gaffe Highlights Online Communication Risks

May 26, 2025

How Sarah Vines Whats App Gaffe Highlights Online Communication Risks

May 26, 2025 -

Live Streaming Moto Gp Inggris 2025 Trans7 Spotv Jadwal And Update Klasemen

May 26, 2025

Live Streaming Moto Gp Inggris 2025 Trans7 Spotv Jadwal And Update Klasemen

May 26, 2025 -

The Doomed Destiny Of Eldorado A Bbc Soaps Pre Production Collapse

May 26, 2025

The Doomed Destiny Of Eldorado A Bbc Soaps Pre Production Collapse

May 26, 2025

Latest Posts

-

Kylian Mbappe Real Madrid Ambitions And The Quest For All The Trophies

May 29, 2025

Kylian Mbappe Real Madrid Ambitions And The Quest For All The Trophies

May 29, 2025 -

Kroos Influence On Fede Valverdes Career

May 29, 2025

Kroos Influence On Fede Valverdes Career

May 29, 2025 -

Valverdes Inspiration Learning From Toni Kroos

May 29, 2025

Valverdes Inspiration Learning From Toni Kroos

May 29, 2025 -

Fede Valverde Names Toni Kroos As His Idol

May 29, 2025

Fede Valverde Names Toni Kroos As His Idol

May 29, 2025 -

Fede Valverde Toni Kroos My Idol

May 29, 2025

Fede Valverde Toni Kroos My Idol

May 29, 2025