Trump's Oil Price Policy: Insights From Goldman Sachs' Social Media Review

Table of Contents

Goldman Sachs' Social Media Sentiment Towards Trump's Energy Policies

Goldman Sachs, a leading global investment bank, frequently uses social media to communicate its analyses and perspectives on market trends. Examining their social media sentiment regarding Trump's energy policies provides valuable insight. By analyzing their tweets, Facebook posts, and press releases, we can gauge their overall tone – positive, negative, or neutral – towards specific policy decisions.

- Deregulation: Did Goldman Sachs' social media commentary express optimism about the potential impact of deregulation on oil prices (e.g., increased domestic production)? A review of their posts could reveal their stance on the matter.

- Keystone XL Pipeline: The Keystone XL pipeline was a significant point of contention. Did Goldman Sachs' social media presence reflect a positive or negative outlook on the project's potential effects on oil prices and the energy market? Analyzing their posts during this period provides crucial context.

- Other Policy Initiatives: We can also examine Goldman Sachs' social media reactions to other policies, such as changes to environmental regulations and tax policies affecting the oil and gas industry. This broad analysis helps understand their comprehensive view of Trump's energy policy impact on oil prices.

Keywords: Goldman Sachs sentiment, Trump energy policy impact, social media sentiment analysis, oil price prediction, market analysis.

Key Predictions and Analyses from Goldman Sachs Regarding Oil Price Under Trump

Goldman Sachs' social media activity likely contained numerous predictions and analyses regarding oil price movements during the Trump administration. By reviewing these statements, we can identify:

- Specific Forecasts: What were Goldman Sachs' specific forecasts for oil prices under various scenarios (e.g., continued deregulation, increased production)? Were these predictions consistently optimistic, pessimistic, or neutral?

- Correlation between Policy and Price: Did Goldman Sachs' social media commentary identify any clear correlations between specific policy decisions (such as changes in drilling regulations) and predicted oil price movements?

- Data Visualization: Where possible, we can create charts and graphs illustrating Goldman Sachs' predictions against actual oil price trends to visually represent the accuracy of their forecasts.

Keywords: Goldman Sachs oil price forecast, Trump administration oil outlook, oil price prediction, energy market forecast.

The Role of Social Media in Shaping Goldman Sachs' Public Perception of Trump's Oil Policies

Goldman Sachs' use of social media to communicate its analysis of Trump's oil policies had a significant impact on public perception. This section explores:

- Influence on Market Sentiment: How did Goldman Sachs' social media statements influence overall market sentiment towards Trump's energy policies and the subsequent effect on oil price fluctuations?

- Potential Biases: It's crucial to acknowledge that Goldman Sachs, like any financial institution, may have inherent biases. Analyzing their social media presence helps understand and account for potential biases influencing their commentary.

- Reach and Impact: We can assess the reach and impact of Goldman Sachs' social media communications on the broader oil market and public discourse. Did their views hold significant weight amongst investors and the general public?

Keywords: public perception, media influence, Goldman Sachs influence, oil market sentiment, financial market impact.

Comparing Goldman Sachs' Social Media Insights with Actual Oil Price Trends During Trump's Presidency

This section critically compares Goldman Sachs' social media-based predictions and analysis with actual oil price movements during Trump's presidency. Key aspects of the comparison include:

- Accuracy of Predictions: How accurate were Goldman Sachs' predictions as revealed on their social media channels? What were the margins of error?

- Factors Affecting Discrepancies: We'll explore factors that may have contributed to any discrepancies between their predictions and actual market outcomes (e.g., unforeseen geopolitical events, changes in global demand, etc.).

- Long-Term vs. Short-Term Predictions: Analyzing the accuracy of their short-term versus long-term predictions helps understand the challenges and limitations of forecasting in the volatile oil market.

Keywords: oil price trends, market accuracy, prediction accuracy, actual vs predicted, Trump presidency oil.

Conclusion: Understanding Trump's Legacy on Oil Prices Through the Goldman Sachs Social Media Prism

Analyzing Goldman Sachs' social media activity provides valuable, albeit limited, insights into their perception of Trump's oil price policy and its market impact. While social media offers a glimpse into the institution's public-facing commentary, it's crucial to remember that this is only one piece of the puzzle. Social media posts are often simplified versions of more complex analyses and may lack the nuance found in comprehensive reports.

To gain a deeper understanding of the intricacies of Trump's oil price policy, continue your research using additional resources beyond social media analysis. Consult Goldman Sachs' official reports, academic studies, and other credible sources for a more complete picture of Trump’s oil policy and its long-term impact on the global oil market. Further research into Goldman Sachs' full reports, along with other reputable sources, will provide a more complete picture of Trump's impact on oil prices.

Featured Posts

-

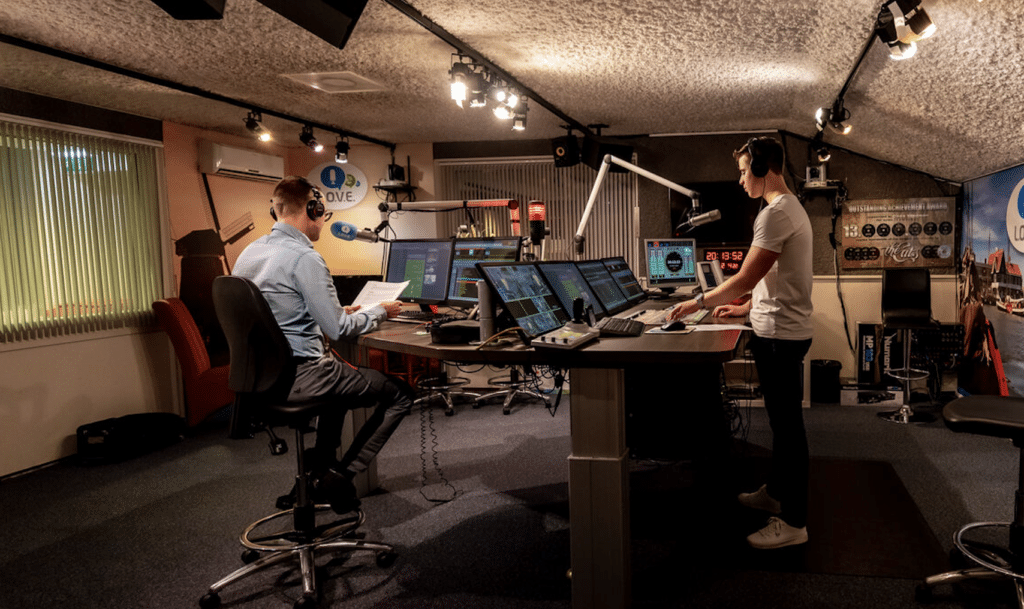

College Van Omroepen Inzet Op Vertrouwensherstel Binnen Npo

May 15, 2025

College Van Omroepen Inzet Op Vertrouwensherstel Binnen Npo

May 15, 2025 -

Trans Master Sergeants Forced Discharge A Story Of Grief And Loss

May 15, 2025

Trans Master Sergeants Forced Discharge A Story Of Grief And Loss

May 15, 2025 -

Microsoft Announces Significant Layoffs 6 000 Jobs Eliminated

May 15, 2025

Microsoft Announces Significant Layoffs 6 000 Jobs Eliminated

May 15, 2025 -

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

San Diego Padres Building Towards The 2025 Home Opener

May 15, 2025

San Diego Padres Building Towards The 2025 Home Opener

May 15, 2025

Latest Posts

-

Anthony Edwards And Ayesha Howard Custody Battle Resolved

May 15, 2025

Anthony Edwards And Ayesha Howard Custody Battle Resolved

May 15, 2025 -

Dodgers Offense Silenced By Cubs Pitching

May 15, 2025

Dodgers Offense Silenced By Cubs Pitching

May 15, 2025 -

Cubs Shut Down Dodgers Offense In Victory

May 15, 2025

Cubs Shut Down Dodgers Offense In Victory

May 15, 2025 -

Dodgers Offense Falters In Loss To Cubs

May 15, 2025

Dodgers Offense Falters In Loss To Cubs

May 15, 2025 -

Nba Disciplinary Action Anthony Edwards Fined For Inappropriate Fan Interaction

May 15, 2025

Nba Disciplinary Action Anthony Edwards Fined For Inappropriate Fan Interaction

May 15, 2025