Trump's Preferred Oil Price Range: A Goldman Sachs Assessment

Table of Contents

Goldman Sachs' Methodology and Data Sources

Goldman Sachs' analysis of Trump's preferred oil price range likely employed a multifaceted approach, combining quantitative and qualitative methods. While the exact methodology may not be publicly available in detail, it's reasonable to assume they utilized econometric models to forecast oil price impacts based on various policy scenarios. These models probably incorporated historical data, alongside projections based on anticipated policy changes under the Trump administration.

Key data sources likely included:

- Energy Information Administration (EIA) data: The EIA provides comprehensive data on US oil and gas production, consumption, and pricing.

- OPEC reports: The Organization of the Petroleum Exporting Countries (OPEC) publishes regular market reports that influence global crude oil prices.

- Public statements and policy pronouncements: Analysis likely considered Trump's public statements on energy independence, his administration's regulatory actions, and the overall policy environment.

Bullet points:

- Goldman Sachs likely used regression models and time series analysis to correlate oil prices with economic indicators and policy changes under the Trump administration.

- Data reliability hinges on the accuracy and completeness of the sources listed above. The EIA is generally considered a reliable source, while OPEC reports can be subject to political influence.

- Potential biases could stem from the inherent assumptions within the econometric models used, and from the selection of data points. Any focus solely on public statements might miss nuanced policy considerations.

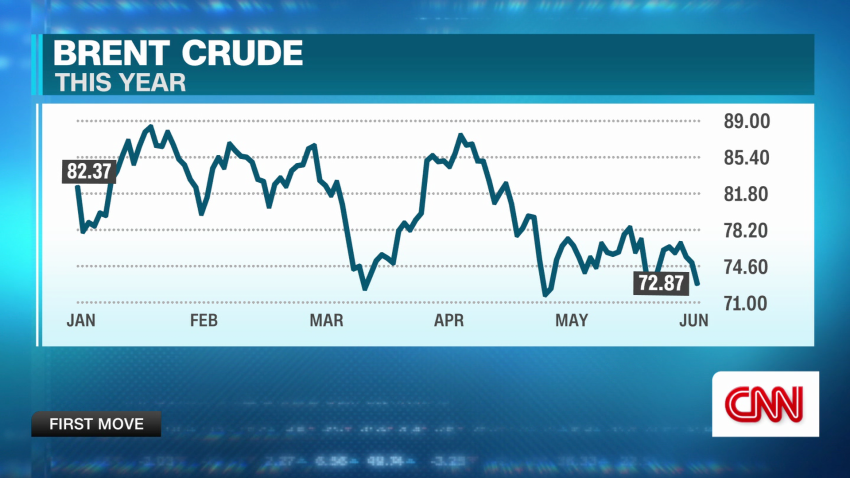

The Estimated Trump Oil Price Range

While Goldman Sachs hasn't published a report explicitly stating "Trump's preferred oil price range," analysts can infer a likely range based on his administration's actions and statements. A reasonable estimate, based on inferences from various analyses, might place the preferred range between $50 and $70 per barrel of West Texas Intermediate (WTI) crude oil.

This range likely represented a balance between several key factors:

- Economic Growth: Higher oil prices can boost energy sector profits and investment, but excessively high prices can stifle economic growth by increasing transportation and manufacturing costs.

- Energy Independence: Trump's emphasis on energy independence favored a price that stimulated domestic oil and gas production, reducing reliance on foreign sources.

Bullet points:

- The $50-$70/barrel range is an approximation; the precise range may vary depending on the specific model and assumptions used.

- The economic impact extends beyond gasoline prices, affecting various manufacturing sectors, consumer spending, and inflation.

- Politically, higher oil prices can be advantageous to energy-producing states, while lower prices might be more favorable to consumers in swing states.

Impact on US Energy Production

Trump's preferred oil price range, if indeed in the $50-$70/barrel range, likely had a significant positive impact on US energy production.

Bullet points:

- Shale Oil Production: This price range is generally considered profitable for many shale oil producers, encouraging increased drilling and production.

- Refinery Operations: Profitability for refineries would be positively affected by this oil price range, stimulating investments and potentially leading to greater refining capacity.

- Employment in the Energy Sector: Increased oil and gas production translates to more jobs across the sector, from extraction to transportation and refining.

International Implications of Trump's Oil Price Preferences

Trump's energy policies and their effect on the global oil market had complex international repercussions.

Bullet points:

- OPEC's Response: OPEC might have responded by adjusting production quotas to maintain oil prices within a range that served their interests. A lower price range could have led to increased OPEC production, potentially creating market volatility.

- Impact on Oil Prices in Other Regions: The influence of US policy on global oil prices is substantial. Changes in US production and demand directly impact the global supply-demand balance, affecting prices worldwide.

- Geopolitical Consequences: The Trump administration's approach to international relations, particularly regarding energy, had geopolitical implications, potentially impacting relationships with oil-producing nations and shaping alliances.

Criticisms and Alternative Perspectives

Goldman Sachs' analysis, like any economic forecast, is subject to criticism and alternative interpretations.

Bullet points:

- Critics might argue that the analysis didn't fully account for the impact of external factors, such as geopolitical instability or unexpected changes in global demand.

- Assumptions made within the models could lead to biased results. For instance, the models may not fully capture the complexities of OPEC's behavior or the unpredictable nature of global events.

- Alternative interpretations could focus on the environmental impact of increased fossil fuel production spurred by the price range or the long-term consequences of energy independence policies.

Conclusion

Goldman Sachs' implied assessment of Trump's preferred oil price range suggests a focus on a balance between economic growth and energy independence, potentially around $50-$70 per barrel. This range likely stimulated US energy production, impacting domestic employment and international relations. However, the analysis is not without limitations, and alternative interpretations exist. The methodology relies on assumptions inherent in econometric models and the reliability of available data.

Call to Action: To further understand the complex interplay between presidential policy and global oil markets, continue your research into the effects of Trump's energy policies and their lasting impact on the price of oil. Search for more in-depth analyses of Trump's preferred oil price range and its continuing consequences.

Featured Posts

-

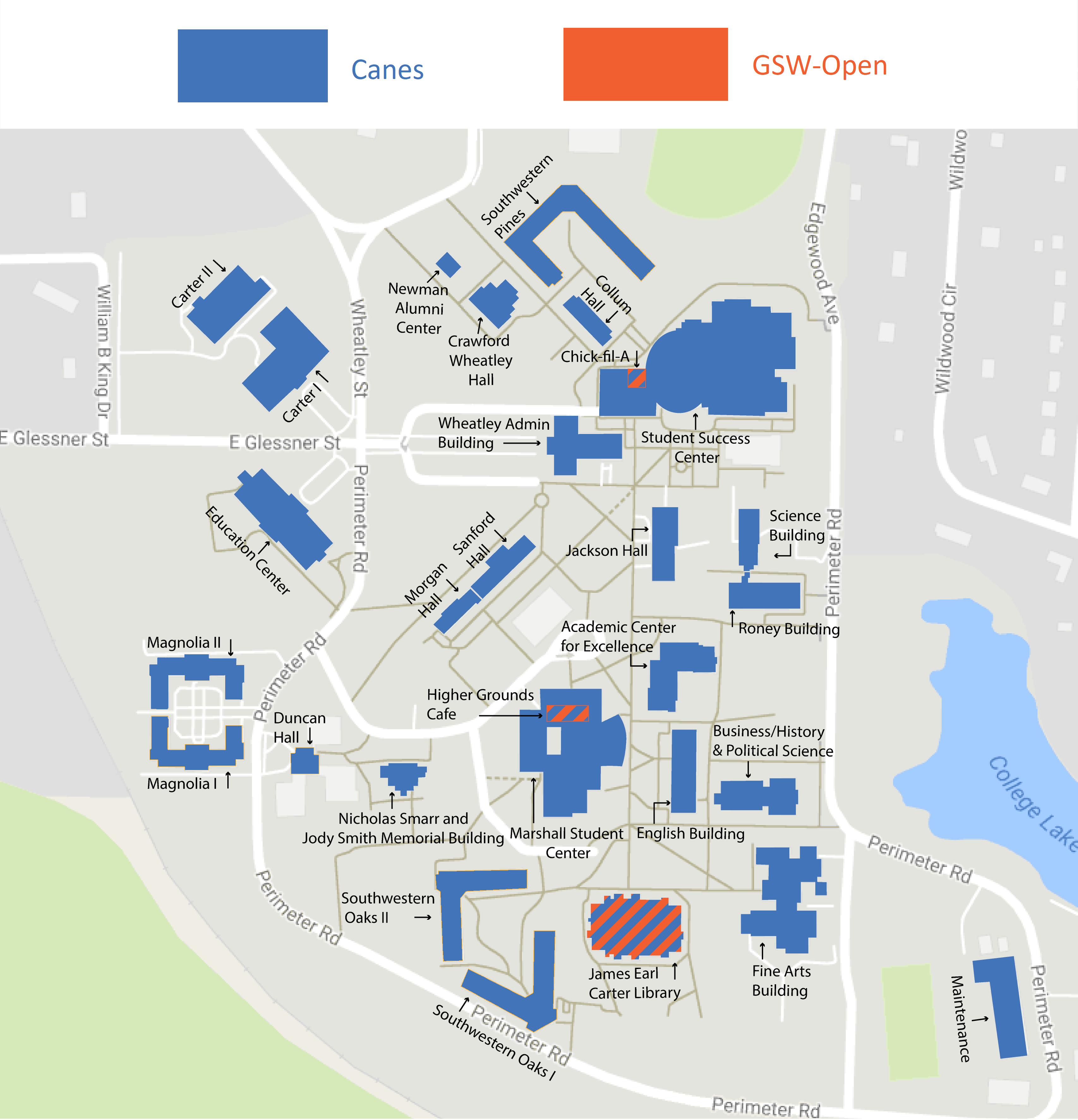

Emergency Lifted Individual In Custody At Gsw Campus

May 16, 2025

Emergency Lifted Individual In Custody At Gsw Campus

May 16, 2025 -

Analyzing The Kim Snell Friendship Implications For Korean Baseball Players In Mlb

May 16, 2025

Analyzing The Kim Snell Friendship Implications For Korean Baseball Players In Mlb

May 16, 2025 -

Padres Vs Pirates Mlb Game Prediction Best Picks And Odds

May 16, 2025

Padres Vs Pirates Mlb Game Prediction Best Picks And Odds

May 16, 2025 -

Skema Kerja Sama Pemerintah Swasta Dalam Pembangunan Giant Sea Wall

May 16, 2025

Skema Kerja Sama Pemerintah Swasta Dalam Pembangunan Giant Sea Wall

May 16, 2025 -

Trumps Oil Price Outlook Goldman Sachs Social Media Analysis

May 16, 2025

Trumps Oil Price Outlook Goldman Sachs Social Media Analysis

May 16, 2025

Latest Posts

-

Maple Leafs 2 1 Win Over Avalanche A Hard Fought Contest

May 16, 2025

Maple Leafs 2 1 Win Over Avalanche A Hard Fought Contest

May 16, 2025 -

Nhl Prediction Maple Leafs Vs Blue Jackets Betting Odds And Expert Picks For Tonight

May 16, 2025

Nhl Prediction Maple Leafs Vs Blue Jackets Betting Odds And Expert Picks For Tonight

May 16, 2025 -

Nba Playoffs Celtics Vs Magic Game 1 Live Stream And Tv Schedule

May 16, 2025

Nba Playoffs Celtics Vs Magic Game 1 Live Stream And Tv Schedule

May 16, 2025 -

Celtics Vs Magic Game 1 Where To Watch The Nba Playoffs Live

May 16, 2025

Celtics Vs Magic Game 1 Where To Watch The Nba Playoffs Live

May 16, 2025 -

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Free Live Stream Options

May 16, 2025

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Free Live Stream Options

May 16, 2025