Trump's Remarks Boost Canadian Dollar Against US Dollar

Table of Contents

Trump's Statement and Market Reaction

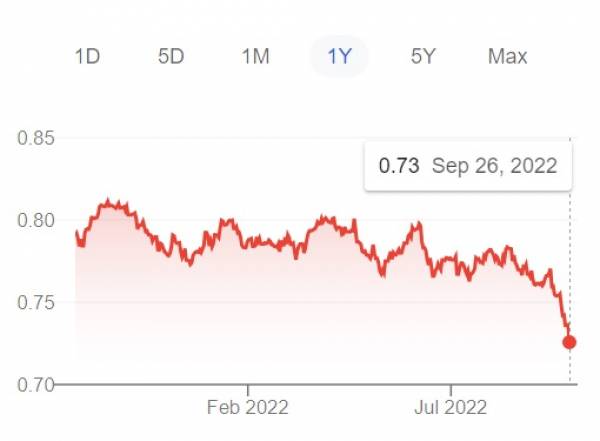

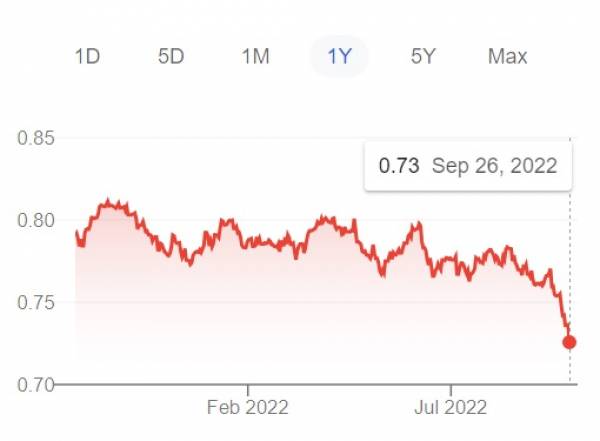

A specific statement made by Donald Trump on [Insert Date and Time of Statement] sent ripples through the forex market. [Insert exact quote or paraphrase of Trump's statement]. This seemingly innocuous comment triggered an immediate and significant reaction. The USD/CAD exchange rate experienced a rapid appreciation of the CAD, with the pair falling from [Insert initial exchange rate] to [Insert exchange rate after statement] within [Insert timeframe]. This represents a [Insert percentage change]% shift.

This dramatic reaction highlights the sensitivity of the currency market to political statements, particularly those made by influential global figures. The market's swift response underscores the interconnectedness of global politics and financial markets. The increased trading volume immediately following the statement further emphasizes the impact of Trump's words.

- Exact quote or paraphrase of Trump's statement: [Insert quote]

- Specific time and date of the statement: [Insert date and time]

- Percentage change in USD/CAD exchange rate immediately following the statement: [Insert Percentage]

- Mention of any significant trading volume spikes: [Insert Data on volume spikes]

Underlying Economic Factors Contributing to the Shift

While Trump's remarks played a significant role, several underlying economic factors amplified the impact on the USD/CAD exchange rate. The relative strength of the Canadian and US economies played a crucial role. Canada's robust performance in [mention specific sector, e.g., natural resources], coupled with a relatively stable banking sector, contributed to investor confidence in the CAD.

Conversely, concerns about [mention current challenges in the US economy, e.g., inflation, debt ceiling] might have weakened the USD. Furthermore, the divergence in interest rate policies between the Bank of Canada and the Federal Reserve also influenced the exchange rate. Canada's [mention current interest rate policy] contrasts with the US's [mention current interest rate policy], making the CAD more attractive to investors seeking higher returns.

Oil prices, a critical component of the Canadian economy, also played a part. A [rise/fall] in oil prices would [positively/negatively] impact the CAD, further influencing the USD/CAD exchange rate. Finally, the overall state of trade relations between Canada and the US continues to shape the currency market. Any shifts in trade agreements or negotiations can significantly influence investor sentiment and the exchange rate.

- Comparison of recent economic indicators for Canada and the US: [Insert relevant economic data comparison, e.g., GDP growth, inflation rates, unemployment rates]

- Analysis of current interest rate policies in both countries: [Compare interest rate policies and their implications]

- Discussion on the current state of the oil market and its influence on the CAD: [Analyze the impact of oil prices on the Canadian economy and the CAD]

- Mention any recent trade agreements or negotiations between Canada and the US: [Highlight any relevant trade agreements or ongoing negotiations]

Implications for Investors and Traders

The recent volatility in the USD/CAD exchange rate presents both opportunities and challenges for investors and traders. Investors holding US dollar-denominated assets might consider hedging strategies to mitigate potential losses. On the other hand, traders can leverage this volatility to potentially profit from the price fluctuations. However, it’s crucial to remember that currency trading inherently involves significant risk.

For those seeking to capitalize on USD/CAD movements, careful analysis of market trends and the application of appropriate risk management strategies are paramount. This includes diversifying investments, setting stop-loss orders, and employing technical analysis tools. Futures contracts and options can also be used as hedging instruments to manage risk associated with currency fluctuations.

- Advice for investors holding US dollar assets: [Recommend hedging strategies and diversification]

- Strategies for traders looking to capitalize on the USD/CAD movement: [Suggest trading strategies based on technical analysis and market trends]

- Discussion of potential risks associated with currency trading: [Highlight the inherent risks of forex trading]

- Mention of relevant hedging strategies (e.g., using futures contracts or options): [Explain the use of futures and options for hedging]

Conclusion

The appreciation of the Canadian dollar against the US dollar following Trump's remarks is a compelling illustration of how political events can significantly impact currency markets. While Trump's statement served as a catalyst, underlying economic factors, including interest rate differentials, oil prices, and the overall health of both economies, further amplified the effect. This volatility underscores the need for investors and traders to constantly monitor political and economic developments and adapt their strategies accordingly. Understanding these dynamics is crucial for successful navigation of the forex market.

Call to Action: Stay informed on how future political statements and economic shifts impact the USD/CAD exchange rate and leverage these insights for informed investment decisions. Monitor the Trump's impact on the Canadian dollar for future trading opportunities. By understanding the interplay between politics and economics, you can make better-informed decisions in the dynamic world of currency trading.

Featured Posts

-

Heartbreaking Farewell Family Mourns Young Manchester United Supporter Poppy

May 03, 2025

Heartbreaking Farewell Family Mourns Young Manchester United Supporter Poppy

May 03, 2025 -

Could Boris Johnson Return To Power A Tory Party Resurgence

May 03, 2025

Could Boris Johnson Return To Power A Tory Party Resurgence

May 03, 2025 -

Il Discorso Di Medvedev Missili Nucleare E La Percezione Della Russofobia In Europa

May 03, 2025

Il Discorso Di Medvedev Missili Nucleare E La Percezione Della Russofobia In Europa

May 03, 2025 -

Makron Ubedil S Sh A Usilit Davlenie Na Rossiyu Po Ukraine

May 03, 2025

Makron Ubedil S Sh A Usilit Davlenie Na Rossiyu Po Ukraine

May 03, 2025 -

Joseph Tf 1 Decryptage De La Creme De La Crim

May 03, 2025

Joseph Tf 1 Decryptage De La Creme De La Crim

May 03, 2025

Latest Posts

-

The Future Of Reform Uk Five Potential Pitfalls For Nigel Farage

May 03, 2025

The Future Of Reform Uk Five Potential Pitfalls For Nigel Farage

May 03, 2025 -

Understanding Reform Uks Rise Nigel Farages Leadership And Strategy

May 03, 2025

Understanding Reform Uks Rise Nigel Farages Leadership And Strategy

May 03, 2025 -

Reform Uk Nigel Farages Impact And Future Prospects

May 03, 2025

Reform Uk Nigel Farages Impact And Future Prospects

May 03, 2025 -

The Farage Factor Assessing Reform Uks Current Political Standing

May 03, 2025

The Farage Factor Assessing Reform Uks Current Political Standing

May 03, 2025 -

Reform Uk On The Brink Five Key Threats To Nigel Farages Party

May 03, 2025

Reform Uk On The Brink Five Key Threats To Nigel Farages Party

May 03, 2025