Trump's Tariff Hike Sends Amsterdam Stock Exchange Down 2%

Table of Contents

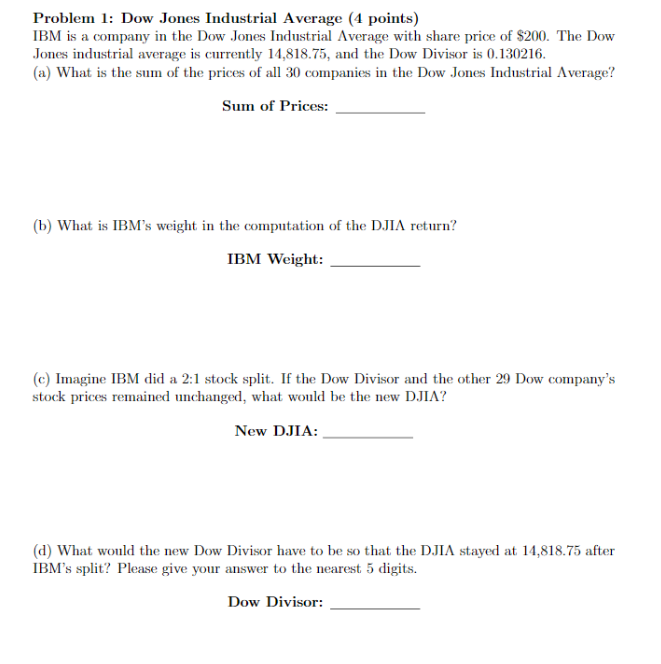

The Immediate Impact of Trump's Tariff Hike on Amsterdam's AEX Index

Trump's tariff hike, specifically targeting [insert specific goods and percentages affected, e.g., certain steel and aluminum imports with a 25% increase], immediately impacted the AEX index. The AEX experienced a rapid 2% drop within [insert timeframe, e.g., the first hour of trading] following the announcement, with trading volume [insert data, e.g., significantly exceeding the daily average]. This swift reaction underscores the market's sensitivity to protectionist trade policies.

- Sectors Hit Hardest: The technology and financial sectors suffered the most significant losses, mirroring the global trend. Import-dependent industries also felt the immediate sting.

- Companies Showing Substantial Decreases: [Insert examples of specific companies and the percentage drop in their stock value. E.g., ASML Holding, a major semiconductor equipment manufacturer, saw its stock price fall by X%].

- Comparison to Previous Reactions: This downturn is comparable in severity to [mention similar past market reactions to protectionist measures, providing links to relevant news articles or reports]. However, the specific impact on the AEX might be amplified due to [mention specific reasons, e.g., the Netherlands' heavy reliance on international trade].

Underlying Economic Factors Contributing to the Market Volatility

The market volatility wasn't solely due to the tariff hike. Pre-existing economic anxieties in the Netherlands, including [mention specific concerns like rising inflation or slowing economic growth], contributed to the severity of the AEX's decline. The broader global economic climate, already susceptible to trade tensions between major powers, exacerbated the situation.

- Rising Inflation: Increased import costs, a direct consequence of the tariffs, are expected to fuel inflation, further impacting consumer spending and business confidence.

- Investor Uncertainty: The uncertainty surrounding future trade relations significantly undermines investor confidence, leading to capital flight and reduced investment in the Dutch market.

- Euro's Reaction: The Euro [explain the reaction of the Euro against other major currencies, providing context and relevant links]. This reaction reflects the broader European concern about the implications of escalating trade disputes.

Expert Opinions and Market Predictions Following the Downturn

Financial analysts and economists offer varied perspectives on the situation. [Insert quotes from prominent financial experts, linking to their sources]. The consensus, however, points towards short-term market instability.

- Short-Term Forecasts: Most analysts predict a continued period of volatility in the short term, with the AEX potentially experiencing further fluctuations.

- Long-Term Forecasts: Long-term predictions are more varied, with some suggesting a gradual recovery contingent on de-escalation of trade tensions, while others foresee prolonged economic uncertainty.

- Recommendations for Investors: Experts advise investors to [mention recommended strategies, e.g., diversify their portfolios, consider hedging strategies, and closely monitor global economic developments]. Risk mitigation is paramount during this turbulent period.

The Broader Implications for Global Trade and Economic Stability

Trump's tariff increase has far-reaching implications for global trade and economic stability. It could trigger retaliatory measures from the European Union and other countries, escalating the trade war and causing further disruptions.

- Impact on Supply Chains: Disruptions to global supply chains are likely, leading to shortages of certain goods and increased production costs.

- Increased Consumer Prices: Consumers worldwide can expect to see increased prices for various goods due to higher import costs and potential shortages.

- Geopolitical Ramifications: The escalating trade dispute could strain international relations and create further geopolitical instability.

Conclusion

Trump's tariff hike has undeniably caused a significant 2% drop in the Amsterdam Stock Exchange, highlighting the vulnerability of global markets to protectionist trade policies. The immediate impact has been felt across various sectors, with longer-term consequences remaining uncertain. Experts warn of potential inflation, investor uncertainty, and broader geopolitical ramifications.

Call to Action: Understanding the implications of such significant market events is crucial for investors and businesses alike. Stay informed about further developments regarding Trump's tariff hikes and their impact on the Amsterdam Stock Exchange and the global economy to effectively manage your investments and navigate this period of uncertainty. Monitor the AEX index closely and consider diversifying your portfolio to mitigate risk. Staying abreast of the latest developments concerning Trump's tariffs and their effect on the AEX is vital for informed decision-making.

Featured Posts

-

Understanding And Interpreting The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding And Interpreting The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

French Presidents Party Seeks To Ban Hijabs For Minors In Public Areas

May 25, 2025

French Presidents Party Seeks To Ban Hijabs For Minors In Public Areas

May 25, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Debate

May 25, 2025

The Kyle And Teddi Dog Walker Incident A Heated Debate

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 25, 2025 -

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 25, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 25, 2025

Latest Posts

-

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025 -

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025 -

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025 -

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025 -

Ignoring The Hype Bof As Argument Against Stock Market Valuation Concerns

May 25, 2025

Ignoring The Hype Bof As Argument Against Stock Market Valuation Concerns

May 25, 2025