Trump's Tariff Increase Sends Amsterdam Stock Exchange Down 2%

Table of Contents

The Immediate Impact on the AEX Index

The immediate impact of the Trump tariff increase was a palpable jolt to the AEX index, the benchmark index of the Amsterdam Stock Exchange. Following the announcement, the AEX experienced a swift 2.1% drop, wiping billions of euros off the market capitalization. This decline wasn't just a superficial blip; it reflected a significant shift in market dynamics.

- Sharp Decline: The AEX index plummeted by 2.1% within hours of the tariff announcement, marking its most significant single-day drop in several months.

- Increased Trading Volume: Trading volume spiked considerably, indicating a surge in investor activity driven by panic selling and attempts to adjust portfolios in response to the news. The increased volatility underscores the uncertainty surrounding the future economic landscape.

- Blue-Chip Impact: Several blue-chip companies listed on the AEX, including prominent names in the technology, financial, and industrial sectors, suffered significant share price drops. For example, [Insert example of a specific company and its percentage drop].

- Negative Investor Sentiment: The market reaction clearly demonstrated a shift in investor sentiment. Increased selling pressure overwhelmed buying, reflecting a prevailing sense of risk aversion and uncertainty about the future.

- Analyst Commentary: Financial analyst [Name of Analyst] at [Name of Financial Institution] stated, "The market's response reflects a deep concern about the potential for further escalation of trade tensions and the unpredictable nature of these protectionist measures. The impact on Dutch businesses, particularly those heavily reliant on international trade, could be severe."

Sector-Specific Impacts of the Tariff Increase

The impact of Trump's tariff increase wasn't evenly distributed across all sectors. Export-oriented industries and import-dependent businesses felt the brunt of the shock, with supply chains disrupted and profitability threatened. The Dutch economy, heavily reliant on international trade, is particularly vulnerable.

- Export-Oriented Sectors Hit Hard: Sectors like technology, manufacturing, and agriculture, which heavily rely on exports, experienced the most significant negative impacts. Tariffs increase costs, making Dutch goods less competitive in global markets.

- Disrupted Supply Chains: The tariff increase disrupted established supply chains, forcing companies to re-evaluate sourcing strategies and potentially increasing costs. This added layer of complexity further dampened investor confidence.

- Potential Job Losses: The uncertainty surrounding the tariffs has led to concerns about potential job losses and reduced investment in affected sectors. Businesses are hesitant to commit to expansion plans in an environment of heightened economic risk.

- Examples of Affected Companies: [Insert examples of specific Dutch companies in affected sectors and describe their challenges]. This demonstrates the widespread nature of the negative impact.

Wider Economic Implications and Global Market Reactions

The impact of Trump's tariff increase wasn't confined to the Amsterdam Stock Exchange. Global markets reacted negatively, reflecting a broader concern about escalating trade tensions and the potential for a full-blown trade war.

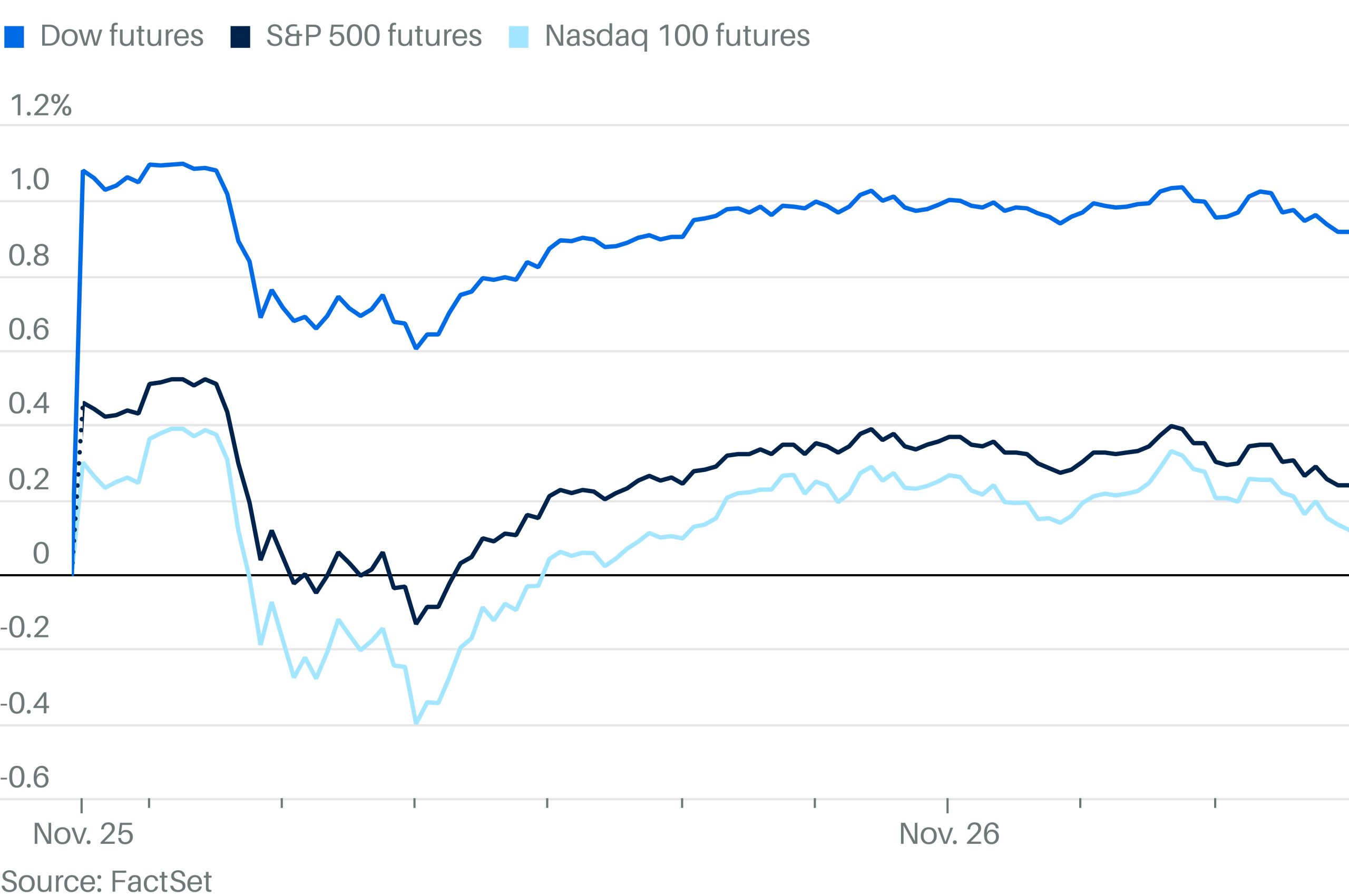

- Global Market Volatility: The Dow Jones Industrial Average and other major European indices also experienced declines, though not as dramatic as the AEX, highlighting the interconnectedness of global financial markets. The market volatility is a clear indicator of investor unease.

- Investor Confidence Eroded: The tariff increase further eroded investor confidence, prompting a shift towards risk aversion. Investors are seeking safer havens for their capital, leading to a flight to quality.

- Knock-on Effects: The ripple effects are likely to be felt across various economies and industries, impacting global growth prospects. Supply chain disruptions and decreased consumer spending could further exacerbate the situation.

- Potential Retaliation: The EU and other trading partners may respond with retaliatory measures, further escalating trade tensions and potentially triggering a downward spiral in global trade.

The Role of Uncertainty and Investor Sentiment

The market reaction wasn't solely driven by the direct economic impact of the tariffs; it was significantly influenced by uncertainty and investor sentiment. The psychological impact of trade uncertainty on investor behavior plays a crucial role.

- Uncertainty Aversion: Investors inherently dislike uncertainty. The unpredictable nature of trade policies increases risk and makes it harder to forecast future returns, leading to risk aversion.

- Speculation and Fear: Speculation and fear often amplify market reactions. Negative news about tariffs tends to be amplified, contributing to panic selling and market volatility.

- Media Influence: Media coverage and analyst predictions significantly influence investor sentiment. Negative narratives can exacerbate market declines, while optimistic outlooks can help to mitigate the impact.

Conclusion

Trump's recent tariff increase has undeniably shaken the Amsterdam Stock Exchange, leading to a significant 2% drop in the AEX index and highlighting the vulnerability of global markets to escalating trade tensions. The immediate impact was a sharp decline across multiple sectors, with export-oriented businesses facing the brunt of the blow. The uncertainty caused by these protectionist policies is likely to continue impacting investor sentiment and global market stability. The wider implications of these Trump tariffs extend far beyond the immediate market fluctuations, affecting global trade, investor confidence, and the overall economic outlook.

Call to Action: Stay informed about the evolving situation and its potential long-term consequences. Continue monitoring the impact of Trump's tariffs on the Amsterdam Stock Exchange and other global markets for critical updates on this developing economic story. Understand the implications of Trump's tariffs on your investment portfolio and engage in informed decision-making.

Featured Posts

-

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025 -

Presidential Seals Luxury Watches And Marriott Afterparties Investigating The Details

May 25, 2025

Presidential Seals Luxury Watches And Marriott Afterparties Investigating The Details

May 25, 2025 -

Post Roe America How Otc Birth Control Is Reshaping Reproductive Healthcare

May 25, 2025

Post Roe America How Otc Birth Control Is Reshaping Reproductive Healthcare

May 25, 2025 -

Joy Crookes New Track I Know You D Kill A Deeper Dive

May 25, 2025

Joy Crookes New Track I Know You D Kill A Deeper Dive

May 25, 2025 -

Is The Glastonbury 2025 Lineup A Winner Charli Xcx Neil Young And Other Highlights

May 25, 2025

Is The Glastonbury 2025 Lineup A Winner Charli Xcx Neil Young And Other Highlights

May 25, 2025

Latest Posts

-

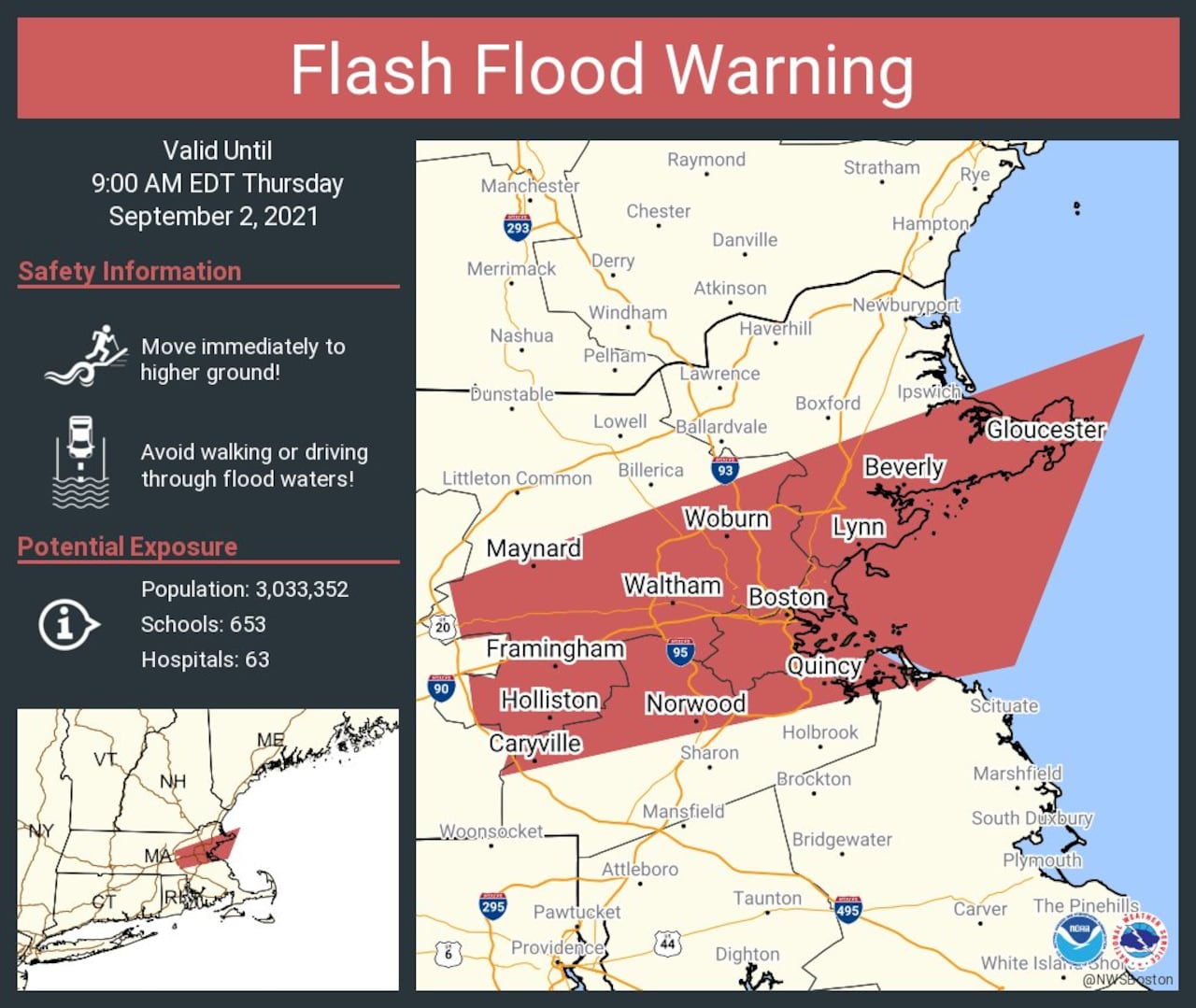

Flash Flood Watch Issued For Hampshire And Worcester Thursday Night Storms

May 25, 2025

Flash Flood Watch Issued For Hampshire And Worcester Thursday Night Storms

May 25, 2025 -

Significant Downpours Cause Flash Flood Warning In Pennsylvania

May 25, 2025

Significant Downpours Cause Flash Flood Warning In Pennsylvania

May 25, 2025 -

Severe Weather Alert Flash Flood Threat In Parts Of Pennsylvania

May 25, 2025

Severe Weather Alert Flash Flood Threat In Parts Of Pennsylvania

May 25, 2025 -

Pennsylvania Flash Flood Warning Thursday Morning

May 25, 2025

Pennsylvania Flash Flood Warning Thursday Morning

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025