Trump's Tax Bill: A Look At Its Prospects For Passage And Economic Impact

Table of Contents

Political Landscape and Prospects for Passage

The success of Trump's tax bill hinges heavily on the political climate and the ability to garner sufficient support in Congress. Navigating the complexities of the legislative process requires careful consideration of both Republican and Democratic viewpoints.

Congressional Support and Opposition

Securing enough votes for passage requires navigating a complex web of political alliances and potential roadblocks.

- Republican Support: While Republicans generally favored tax cuts, internal divisions existed regarding specific provisions and the overall fiscal impact. Differing opinions on the extent of tax cuts for corporations versus individuals often led to disagreements.

- Democratic Opposition: Democrats largely opposed the bill, citing concerns about its potential to exacerbate income inequality and increase the national debt. They argued that the tax cuts disproportionately benefited corporations and wealthy individuals at the expense of the middle class and lower-income earners.

- Potential Deal-breakers: Key sticking points included the fate of certain tax deductions, the corporate tax rate, and the overall budgetary impact. Lobbying efforts from various interest groups also played a significant role in shaping the final bill.

- Committee Hurdles: The bill had to navigate numerous committees in both the House and the Senate, each potentially presenting opportunities for amendments and delays. Securing bipartisan support for any given version proved exceptionally challenging.

Public Opinion and Political Pressure

Public opinion significantly influenced the political maneuvering surrounding Trump's tax bill.

- Polling Data: Public opinion polls showed mixed reactions, with varying levels of support and opposition depending on the specific provisions and how they were framed. The lack of a clear public mandate made the passage uncertain.

- Media Coverage: Media coverage played a crucial role in shaping public perception and influencing political discourse. The portrayal of the bill's potential economic effects often became a highly contested political point.

- Political Pressure: Public protests and support rallies exerted pressure on lawmakers, impacting their decision-making process. The intensity of these demonstrations influenced the overall political climate.

Key Provisions of Trump's Tax Bill

The bill contained several key provisions affecting both individuals and corporations.

Individual Tax Cuts

The proposed changes to individual income taxes were designed to provide tax relief for many Americans.

- Tax Brackets: The bill altered the existing income tax brackets, generally reducing the tax burden for individuals in certain income ranges.

- Standard Deduction: The standard deduction was significantly increased, benefiting those who did not itemize their deductions.

- Child Tax Credit: The child tax credit was expanded, providing greater financial assistance to families with children.

- Itemized Deductions: Some itemized deductions were either capped or eliminated altogether, impacting taxpayers who previously relied on these deductions.

Corporate Tax Cuts

The cornerstone of the bill was a substantial reduction in the corporate tax rate.

- Corporate Tax Rate: The corporate tax rate was significantly lowered, aiming to boost business investment and stimulate economic growth.

- Impact on Investment: Proponents argued that the lower tax rate would incentivize businesses to invest more, creating jobs and boosting economic activity.

- Impact on Jobs: The bill aimed to create jobs by encouraging businesses to expand and hire more employees.

- Repatriation of Overseas Profits: The bill also included provisions designed to incentivize companies to repatriate profits held overseas, potentially leading to increased investment within the United States.

Potential Economic Impact of Trump's Tax Bill

The economic consequences of Trump's tax bill were subject to considerable debate.

Short-Term Economic Effects

In the short term, the bill was projected to have a mixed impact.

- GDP Growth Projections: Some economists predicted a short-term boost in GDP growth due to increased consumer spending and business investment.

- Inflation Forecasts: Concerns were raised about potential inflationary pressures stemming from increased consumer demand.

- Job Market Predictions: The effect on job creation was debated, with varying predictions depending on the underlying economic conditions.

- Consumer Spending: The tax cuts were intended to stimulate consumer spending through increased disposable income.

Long-Term Economic Consequences

The long-term effects of the tax bill were highly uncertain and subject to ongoing debate.

- National Debt Projections: Critics warned that the tax cuts would significantly increase the national debt, leading to potential long-term fiscal challenges.

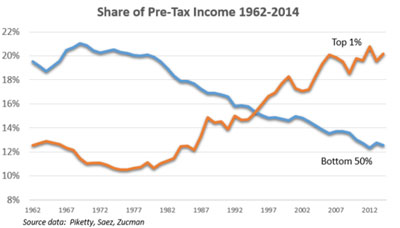

- Impact on Income Inequality: Concerns were raised that the tax cuts disproportionately benefited wealthy individuals and corporations, thereby widening the income gap.

- Effects on International Trade: The bill's impact on international trade competitiveness was debated, with some arguing that it could either enhance or weaken the US's position in the global market.

Conclusion

Trump's tax bill represented a significant piece of legislation with far-reaching consequences. Its passage prospects were shaped by complex political dynamics, and its potential economic impact was a matter of ongoing debate. While proponents touted its potential to stimulate economic growth and job creation through tax cuts for individuals and corporations, critics raised concerns about increased national debt and worsening income inequality. Understanding the interplay of these factors is crucial for comprehending the bill's potential long-term effects on the U.S. economy.

Call to Action: Stay informed about the latest developments regarding Trump's Tax Bill and its impact on the US economy. Further research into the specific provisions and their potential consequences is crucial for understanding the long-term effects of this significant piece of legislation. Continue to follow the news and engage in informed discussions about Trump's Tax Bill and its ongoing legacy.

Featured Posts

-

Grocery Prices Soar Inflations Latest Victim

May 22, 2025

Grocery Prices Soar Inflations Latest Victim

May 22, 2025 -

Michael Bays Outrun Video Game Adaptation Cast And Crew

May 22, 2025

Michael Bays Outrun Video Game Adaptation Cast And Crew

May 22, 2025 -

Cassis Strong Response Switzerland Denounces Pahalgam Terror

May 22, 2025

Cassis Strong Response Switzerland Denounces Pahalgam Terror

May 22, 2025 -

News And Speculation Surrounding Blake Livelys Alleged Involvement

May 22, 2025

News And Speculation Surrounding Blake Livelys Alleged Involvement

May 22, 2025 -

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 22, 2025

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 22, 2025

Latest Posts

-

Lancaster City Stabbing Victims Condition And Police Appeal

May 22, 2025

Lancaster City Stabbing Victims Condition And Police Appeal

May 22, 2025 -

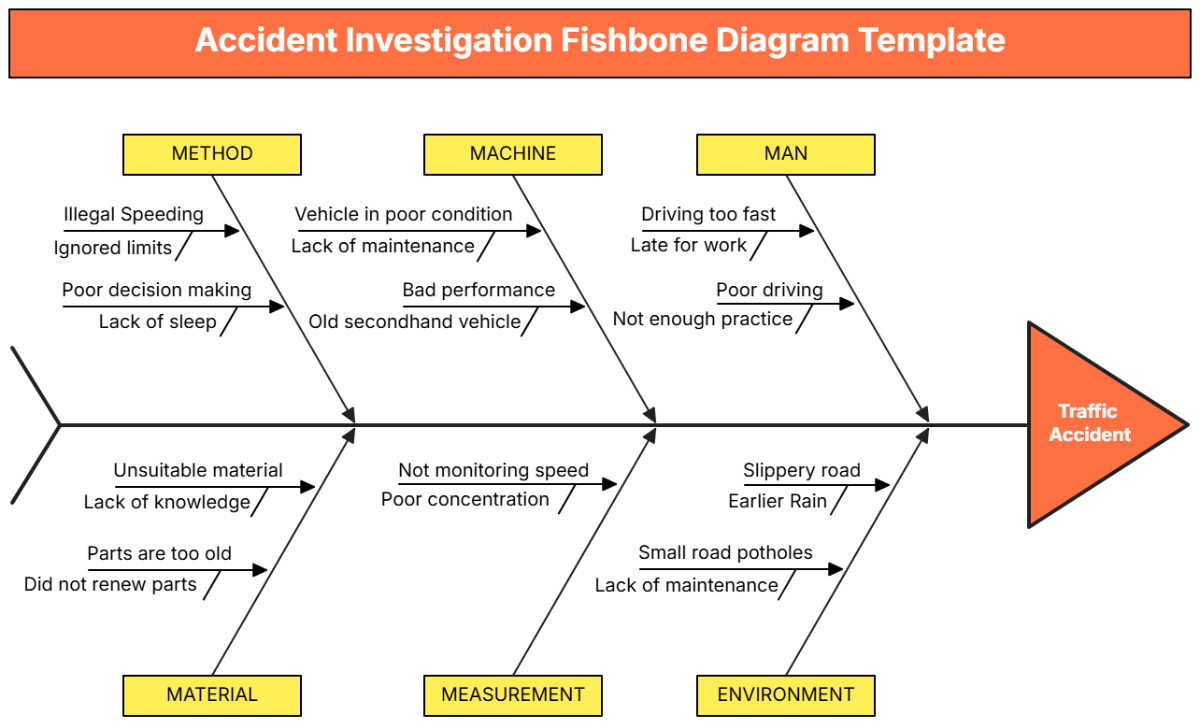

Route 15 On Ramp Closure Accident Investigation Underway

May 22, 2025

Route 15 On Ramp Closure Accident Investigation Underway

May 22, 2025 -

Serious Crash Closes Route 15 On Ramp Drivers Urged To Find Alternate Routes

May 22, 2025

Serious Crash Closes Route 15 On Ramp Drivers Urged To Find Alternate Routes

May 22, 2025 -

Lancaster City Stabbing Community Reacts To Violence

May 22, 2025

Lancaster City Stabbing Community Reacts To Violence

May 22, 2025 -

Route 15 On Ramp Closure Impacts Commuting Latest Updates

May 22, 2025

Route 15 On Ramp Closure Impacts Commuting Latest Updates

May 22, 2025