U.S. And China Seek Trade De-escalation: Analysis Of This Week's Discussions

Table of Contents

Key Discussions and Outcomes of This Week's Meetings

This section examines the specific points of discussion and reported outcomes of the recent talks between U.S. and Chinese officials. We'll assess whether genuine progress was made towards resolving long-standing trade disputes and easing tensions. The level of detail available publicly may vary, so this analysis will focus on reported outcomes and their potential significance.

-

Specific Tariff Reductions: While concrete numbers remain scarce pending official announcements, reports suggest discussions centered around potential tariff reductions on specific goods. Sectors potentially impacted include technology, agriculture, and consumer products. The scale of any reductions will be a crucial indicator of the commitment to U.S.-China trade de-escalation. Analysts will be closely monitoring official statements for confirmation and specifics.

-

Intellectual Property Rights (IPR): Protection of IPR remains a major sticking point. Reports indicate discussions focused on strengthening enforcement mechanisms and providing greater legal protections for U.S. companies operating in China. The success of these discussions hinges on verifiable commitments and the implementation of robust enforcement systems. The lack of transparency around these discussions makes assessing progress challenging.

-

Market Access for U.S. Companies: Increased market access in China for U.S. businesses is a key U.S. objective. Discussions likely involved specific sectors where greater access is sought, potentially including financial services, technology, and manufacturing. Progress in this area would be a significant step towards U.S.-China trade de-escalation, but specifics remain limited at this time.

-

Technology Transfer: Forced technology transfer remains a significant concern. Discussions are expected to have touched upon mechanisms to prevent such practices and ensure fair competition. Measurable progress on technology transfer will be vital for demonstrating a genuine commitment to trade de-escalation and improved business relations.

-

Agricultural Exports: The impact of trade disputes on agricultural exports has been substantial. Discussions around increasing agricultural exports from the U.S. to China are crucial. Any agreements reached in this sector would be a visible symbol of progress toward U.S.-China trade de-escalation, boosting confidence in the process.

Challenges and Obstacles to U.S.-China Trade De-escalation

Despite positive signs, numerous obstacles remain in the path of achieving meaningful U.S.-China trade de-escalation. Addressing these challenges is critical for sustainable progress.

-

Geopolitical Tensions: The broader geopolitical rivalry between the U.S. and China extends beyond trade, creating a complex landscape. Addressing these underlying tensions is crucial for fostering a more cooperative trade relationship. Resolving this requires diplomatic efforts beyond just trade negotiations.

-

Domestic Political Pressures: Both countries face domestic political pressures that could hinder compromise and concessions. Navigating these pressures requires skillful diplomacy and a clear understanding of political sensitivities on both sides. Public opinion and political will remain major factors.

-

Verification and Enforcement: Ensuring agreements are effectively verified and enforced is paramount. This requires establishing robust monitoring mechanisms and clear dispute resolution processes. Without effective verification, the promise of U.S.-China trade de-escalation risks remaining unfulfilled.

-

Trust Deficit: Years of strained relations have created a significant trust deficit. Rebuilding trust is crucial for long-term cooperation. This requires transparency, consistent actions, and a demonstrable commitment to mutually beneficial outcomes.

-

Unresolved Disputes: Many underlying issues remain unresolved. Simply addressing immediate trade concerns doesn’t guarantee lasting peace. A comprehensive approach to addressing all outstanding issues is crucial.

Implications for Global Markets and the World Economy

The outcome of U.S.-China trade negotiations profoundly impacts global markets and the broader world economy.

-

Global Supply Chains: De-escalation would lead to stabilization and increased efficiency in global supply chains, reducing costs and improving predictability.

-

Commodity Prices: De-escalation could positively impact commodity prices by reducing uncertainty and increasing market access.

-

Inflation and Economic Growth: Reduced trade tensions can ease inflationary pressures and contribute to stronger global economic growth.

-

Investment Confidence: Reduced trade tensions can bolster investment confidence, stimulating economic activity and Foreign Direct Investment (FDI).

Conclusion

This week's discussions regarding U.S.-China trade de-escalation offer a cautious reason for optimism. While significant challenges remain, the willingness to engage in dialogue suggests a potential path towards reducing trade tensions. However, sustained progress requires addressing deeper geopolitical issues, building trust, and ensuring the effective implementation of any agreements. The future of global trade hinges on the continued commitment to U.S.-China trade de-escalation and the successful resolution of outstanding disputes. Stay informed on further developments in this crucial area by regularly checking for updates on the latest U.S.-China trade negotiations. Understanding the ongoing efforts towards U.S.-China trade de-escalation is crucial for navigating the complexities of the global marketplace.

Featured Posts

-

Ev Mandate Opposition Intensifies Car Dealerships Push Back

May 10, 2025

Ev Mandate Opposition Intensifies Car Dealerships Push Back

May 10, 2025 -

Diver Dies Recovering Sunken Superyacht Of Tech Tycoon

May 10, 2025

Diver Dies Recovering Sunken Superyacht Of Tech Tycoon

May 10, 2025 -

High Potential Season 1 When Morgans Intelligence Slipped

May 10, 2025

High Potential Season 1 When Morgans Intelligence Slipped

May 10, 2025 -

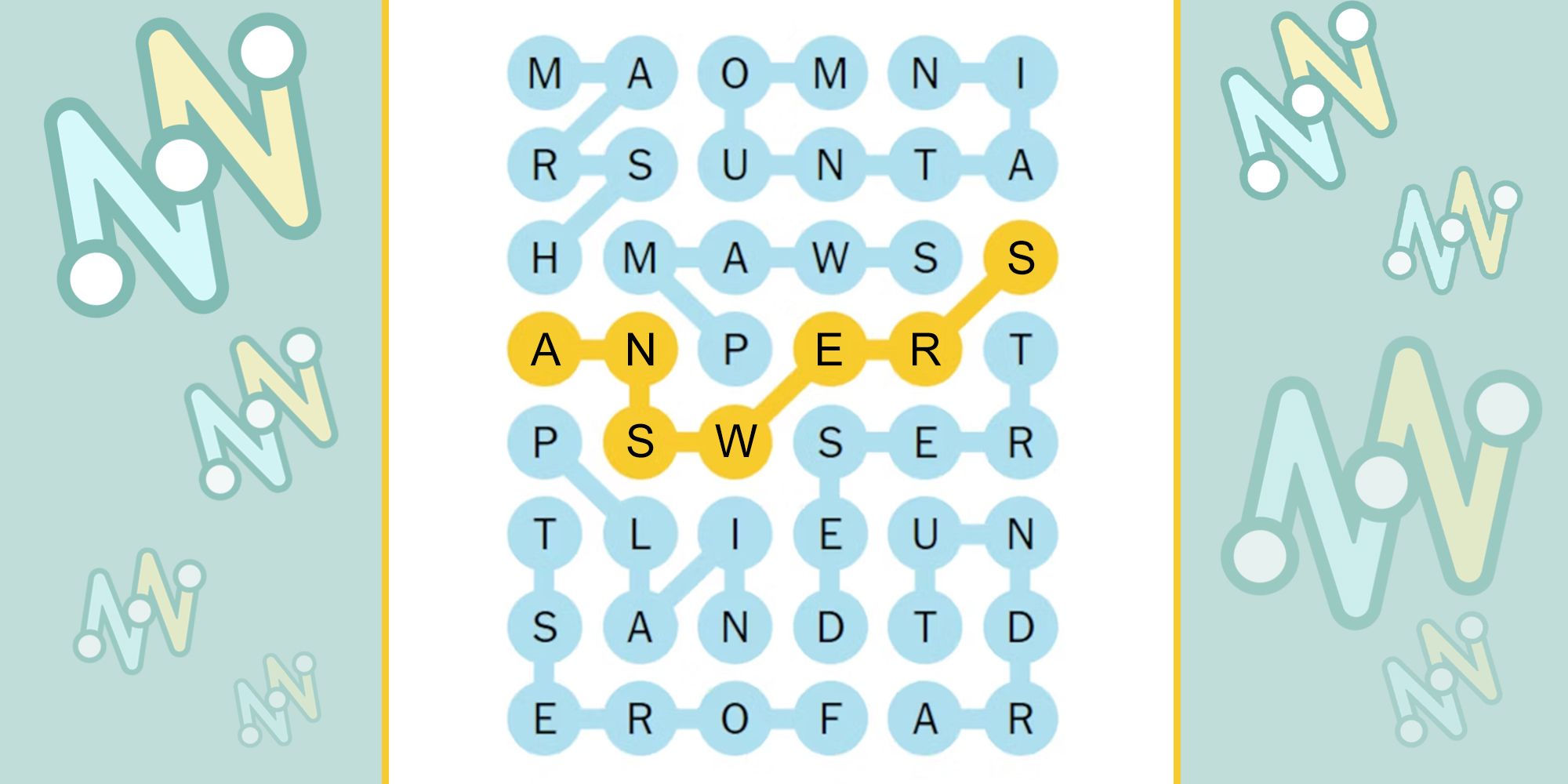

Solve Nyt Strands Game 376 Friday March 14 Hints And Complete Answers

May 10, 2025

Solve Nyt Strands Game 376 Friday March 14 Hints And Complete Answers

May 10, 2025 -

Wheelchair Accessibility Challenges And Solutions On The Elizabeth Line

May 10, 2025

Wheelchair Accessibility Challenges And Solutions On The Elizabeth Line

May 10, 2025