U.S.-China Trade Optimism Fuels Gold Price Decline As Traders Book Profits

Table of Contents

Easing Trade Tensions and Their Impact on Gold

Gold often serves as a safe-haven asset, its value rising during times of economic uncertainty and geopolitical instability. The inverse relationship between trade optimism and gold prices is well-established. As anxieties surrounding U.S.-China trade relations ease, the demand for gold as a safe haven diminishes, leading to a price correction. Recent positive developments in trade negotiations have contributed significantly to this trend.

- Reduced Tariffs: The easing of trade tariffs between the U.S. and China has reduced uncertainty for businesses and investors, lessening the need for a safe haven like gold.

- Increased Trade Volume: A rise in bilateral trade between the two economic giants signals a healthier global economic outlook, further reducing the appeal of gold as a hedge against risk.

- Positive Statements from Government Officials: Optimistic statements from both U.S. and Chinese officials regarding the future of trade relations have boosted investor confidence and reduced risk aversion.

- Impacts on Investor Sentiment: The overall improvement in the trade landscape has shifted investor sentiment towards riskier, higher-return assets, diverting funds away from gold.

Profit-Taking in the Gold Market

Another key factor contributing to the gold price decline is widespread profit-taking by traders. After a period of substantial gains, many traders have chosen to secure their profits, leading to increased selling pressure in the gold market. This is a common occurrence in any market experiencing a significant price rally.

- High Gold Prices in Recent Months: Gold prices had reached relatively high levels in recent months, making profit-taking a logical strategy for many investors.

- Traders Locking in Profits: A significant volume of gold was sold by traders looking to capitalize on recent gains, contributing directly to the price decline.

- Potential for Further Price Corrections: Further profit-taking could lead to short-term price volatility and even more price corrections.

- Impact on Market Liquidity: The increased trading activity associated with profit-taking can impact market liquidity, potentially exacerbating price fluctuations.

Alternative Investment Opportunities

The improved outlook for the global economy, driven in part by reduced U.S.-China trade tensions, has made alternative investment opportunities more attractive. Investors are increasingly shifting their focus towards assets offering potentially higher returns, such as stocks and bonds.

- Rising Stock Market Indices: Strong performance in major stock market indices globally reflects increased investor confidence and a willingness to take on more risk.

- Increased Bond Yields: Rising bond yields provide an alternative to gold for investors seeking income generation.

- Investor Diversification Strategies: Investors are likely diversifying their portfolios, reducing their allocation to gold and shifting towards other asset classes.

- Reduced Demand for Safe-Haven Assets: The reduced demand for safe-haven assets like gold is a direct consequence of improved economic sentiment and increased risk appetite.

Future Outlook for Gold Prices Considering U.S.-China Trade Relations

While the current trend points towards lower gold prices, the future remains uncertain. The continued progress in U.S.-China trade relations will be a major determinant of gold's price trajectory. However, other macroeconomic factors will also play significant roles.

- Potential for Price Rebound if Trade Tensions Resurface: Any resurgence of trade tensions could trigger a renewed safe-haven demand for gold, potentially leading to a price rebound.

- Impact of Global Economic Growth on Gold Demand: Strong global economic growth could reduce the demand for gold, while a slowdown might increase it.

- Role of Central Bank Policies on Gold Prices: Central bank policies, particularly interest rate decisions, can significantly influence gold prices.

- Long-Term Outlook for Gold Investment: The long-term outlook for gold remains dependent on a multitude of factors, making definitive predictions challenging.

Conclusion

The recent decline in gold prices is primarily driven by two interconnected factors: easing U.S.-China trade tensions and widespread profit-taking by traders. The improving trade relationship has reduced the safe-haven appeal of gold, while profit-booking has added to the downward pressure on prices. While the current trend suggests lower prices, the potential for future volatility remains high. Stay informed about the evolving U.S.-China trade relationship and its impact on gold prices. Monitor the gold market closely to make informed investment decisions regarding U.S.-China trade and gold price fluctuations. Consider diversifying your portfolio based on the latest developments in U.S.-China trade and gold market trends.

Featured Posts

-

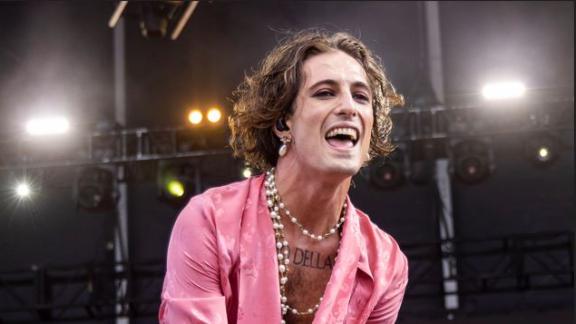

Damiano Dei Maneskin Il Suo Primo Album Da Solista

May 18, 2025

Damiano Dei Maneskin Il Suo Primo Album Da Solista

May 18, 2025 -

Exploring Metropolis Japan A Guide To Its Urban Landscapes

May 18, 2025

Exploring Metropolis Japan A Guide To Its Urban Landscapes

May 18, 2025 -

Auto Dealers Double Down Renewed Opposition To Electric Vehicle Mandates

May 18, 2025

Auto Dealers Double Down Renewed Opposition To Electric Vehicle Mandates

May 18, 2025 -

Mlb Dfs May 8th Sleeper Picks Value Plays And Hitter Projections

May 18, 2025

Mlb Dfs May 8th Sleeper Picks Value Plays And Hitter Projections

May 18, 2025 -

Rain Delayed Game Paris Homer Lifts Angels Over White Sox

May 18, 2025

Rain Delayed Game Paris Homer Lifts Angels Over White Sox

May 18, 2025

Latest Posts

-

Urgent Safety Concerns 9 Nyc Area Bridges Investigated Post Baltimore Collapse

May 18, 2025

Urgent Safety Concerns 9 Nyc Area Bridges Investigated Post Baltimore Collapse

May 18, 2025 -

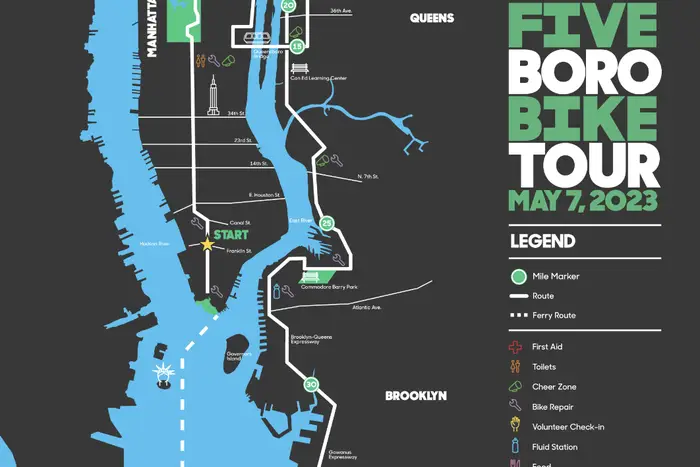

Navigating The Five Boro Bike Tour Route Preparation And Tips

May 18, 2025

Navigating The Five Boro Bike Tour Route Preparation And Tips

May 18, 2025 -

Woman Assaulted In Brooklyn Groping And Simulated Sex Act

May 18, 2025

Woman Assaulted In Brooklyn Groping And Simulated Sex Act

May 18, 2025 -

Brooklyn Bridge City Hall Subway Station Stabbing Rush Hour Attack

May 18, 2025

Brooklyn Bridge City Hall Subway Station Stabbing Rush Hour Attack

May 18, 2025 -

Five Boro Bike Tour A Cyclists Guide To Nycs Main Thoroughfares

May 18, 2025

Five Boro Bike Tour A Cyclists Guide To Nycs Main Thoroughfares

May 18, 2025