U.S.-China Trade Talks: Implications For Copper Prices

Table of Contents

China's Role as a Major Copper Consumer

China's massive appetite for copper significantly impacts global prices. Its immense construction and manufacturing sectors are heavily reliant on this red metal, making it a key player in determining copper demand and price fluctuations.

Copper Demand in China's Construction and Manufacturing Sectors

China's voracious consumption of copper is driven primarily by its booming infrastructure projects and its massive manufacturing base. High-speed rail networks, sprawling power grids, and extensive urbanization efforts all require vast quantities of copper wiring and components. Similarly, the electronics, appliance, and automotive industries in China are significant consumers of copper.

- China's copper imports: In 2022, China imported over X million tonnes of copper (Source: [Insert reputable source, e.g., International Copper Study Group]), highlighting its dependence on global supply chains.

- Key industries: Electronics manufacturing, construction, power generation, and transportation account for the majority of copper consumption in China.

- Specific examples: The continued expansion of 5G networks and the growth of the electric vehicle market further fuels copper demand within China.

Impact of Trade Tariffs on Chinese Copper Imports

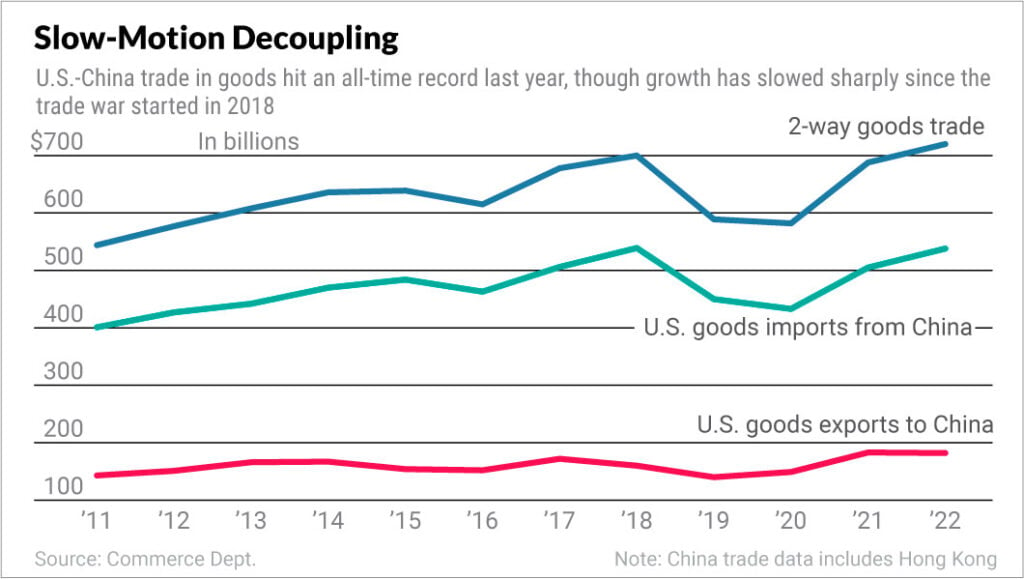

Trade tariffs imposed by the US on Chinese goods, or vice versa, can significantly affect copper prices. Increased tariffs could lead to higher copper prices for US consumers as import costs increase. Conversely, reduced demand from China due to retaliatory tariffs could depress global copper prices.

- Scenario 1 (Increased Prices): Tariffs on Chinese goods could lead to increased costs for US importers, potentially leading to higher copper prices in the US market.

- Scenario 2 (Decreased Prices): Reduced demand from China, resulting from trade tensions, could lead to a surplus of copper on the global market, depressing prices.

- Scenario 3 (Price Volatility): Uncertainty surrounding trade negotiations often results in price volatility as investors react to changing market conditions. This uncertainty can make it difficult for businesses to plan effectively.

- Material Substitution: High copper prices might incentivize the exploration of alternative materials in certain applications, impacting overall demand.

Global Supply Chain Disruptions

The U.S.-China trade relationship significantly impacts global copper supply chains. Disruptions in trade can affect copper mining, production, transportation, and ultimately, price stability.

Impact on Copper Mining and Production

Trade tensions can disrupt copper mining and production in several ways. Uncertainty can deter investment in new mining projects, while sanctions or trade restrictions can impact the transportation of copper ore and refined copper.

- Major Copper Producers: Chile, Peru, and the Democratic Republic of Congo are major copper producers, and their trade relationships with both the US and China are crucial for maintaining a stable supply.

- Transportation Costs: Trade disputes can lead to higher transportation costs and logistical challenges, increasing the final cost of copper.

- Investment Shifts: Uncertainty might cause companies to shift investment away from projects perceived as risky due to geopolitical tensions.

The Role of Speculation and Investor Sentiment

Uncertainty surrounding trade negotiations significantly influences investor sentiment and speculation in the copper market. Negative news about trade talks often leads to decreased investor confidence, impacting futures prices.

- Impact on Futures Prices: Negative headlines about trade relations often translate to a sell-off in copper futures contracts, driving prices down.

- Investor Confidence: A positive outlook on trade negotiations generally boosts investor confidence, leading to increased demand and higher copper prices.

- Hedging Strategies: Companies involved in copper production and processing often utilize hedging strategies, such as futures contracts, to mitigate the risks associated with price volatility.

Alternative Investment Strategies in Response to Trade Uncertainty

Given the inherent volatility in copper prices influenced by U.S.-China trade talks, investors need strategies to manage risk effectively.

Diversification and Risk Management

Diversifying investments across different commodities or asset classes can reduce exposure to the risks associated with copper price fluctuations driven by trade disputes.

- Diversification: Spreading investments across various commodities (gold, silver, oil) or asset classes (stocks, bonds) can help mitigate risks.

- Hedging Instruments: Futures contracts and options can be used to hedge against potential price drops in the copper market.

Long-Term Outlook for Copper Demand

Despite short-term volatility due to trade tensions, the long-term outlook for copper demand remains positive, driven by several key factors.

- Renewable Energy: The growing adoption of renewable energy technologies, such as solar and wind power, requires substantial amounts of copper for wiring and components.

- Electric Vehicles: The transition to electric vehicles is creating a significant increase in copper demand for batteries and electric motors.

- Technological Advancements: While technological advancements might reduce copper usage in some areas, the overall demand is expected to remain strong due to the expansion of other copper-intensive industries.

Conclusion

U.S.-China trade talks have a significant impact on copper prices due to China's role as a major consumer and the potential for global supply chain disruptions. The interconnectedness of global trade and commodity markets highlights the importance of understanding these dynamics. To stay ahead of the curve in the volatile copper market affected by U.S.-China trade negotiations, investors and businesses need to carefully monitor developments in trade relations and incorporate effective risk management strategies. Understanding the implications of U.S.-China trade talks on copper market dynamics is crucial for making informed investment decisions and navigating the complexities of this crucial metal's market.

Featured Posts

-

Wielkie Zamowienie Na Trotyl Z Polski Szczegoly Kontraktu

May 06, 2025

Wielkie Zamowienie Na Trotyl Z Polski Szczegoly Kontraktu

May 06, 2025 -

Venices Future Engineering Solutions For A Sinking City

May 06, 2025

Venices Future Engineering Solutions For A Sinking City

May 06, 2025 -

Nikes Latest Innovation A Fitness Brand Collaboration With Skims

May 06, 2025

Nikes Latest Innovation A Fitness Brand Collaboration With Skims

May 06, 2025 -

Post Election Australian Asset Market Predictions And Analysis

May 06, 2025

Post Election Australian Asset Market Predictions And Analysis

May 06, 2025 -

Met Gala 2025 A Look At The Potential Guest List And Celebrity Appearances

May 06, 2025

Met Gala 2025 A Look At The Potential Guest List And Celebrity Appearances

May 06, 2025

Latest Posts

-

Diana Ross Live At The Royal Albert Hall 1973 A Concert For The Ages

May 06, 2025

Diana Ross Live At The Royal Albert Hall 1973 A Concert For The Ages

May 06, 2025 -

Plan Your Trip Diana Ross Symphonic Celebration 2025 Uk Tour

May 06, 2025

Plan Your Trip Diana Ross Symphonic Celebration 2025 Uk Tour

May 06, 2025 -

Diana Ross 2025 Uk Symphonic Celebration Tour Complete Guide

May 06, 2025

Diana Ross 2025 Uk Symphonic Celebration Tour Complete Guide

May 06, 2025 -

Nile Rodgers I M Coming Out The Exclusive Party Look Guide

May 06, 2025

Nile Rodgers I M Coming Out The Exclusive Party Look Guide

May 06, 2025 -

Buy Diana Ross Symphonic Celebration 2025 Uk Tour Tickets

May 06, 2025

Buy Diana Ross Symphonic Celebration 2025 Uk Tour Tickets

May 06, 2025