U.S. Economic Slowdown: 0.2% Drop Reflects Spending And Tariff Pressures

Table of Contents

Reduced Consumer Spending: A Major Driver of the Slowdown

The significant decrease in consumer spending is a primary driver of the current U.S. economic slowdown. This decline reflects a confluence of factors that have dampened consumer confidence and reduced purchasing power.

Decreased Consumer Confidence

Several factors have eroded consumer confidence, leading to reduced spending.

- High Inflation: Persistent inflation has significantly reduced the purchasing power of consumers, forcing them to cut back on non-essential spending.

- Interest Rate Hikes: The Federal Reserve's efforts to curb inflation through interest rate hikes have increased borrowing costs, making loans for major purchases like homes and cars more expensive.

- Geopolitical Uncertainty: Ongoing geopolitical instability, including the war in Ukraine and rising global tensions, creates uncertainty and discourages spending.

Declining consumer spending is evident across various sectors:

- Retail Sales: Retail sales figures for Q1 2024 showed a noticeable decrease compared to the previous quarter, indicating a pullback in consumer purchases of goods.

- Automobile Sales: The automotive industry experienced a slump in sales due to higher interest rates and reduced consumer confidence.

The Consumer Confidence Index (CCI), a key economic indicator, has fallen significantly in recent months, further corroborating the decline in consumer spending. For example, the CCI dropped by X points in March 2024 (replace X with actual data if available). This decrease reflects a growing pessimism about the economy's future.

Impact of High Interest Rates

The Federal Reserve's aggressive interest rate hikes, aimed at combating inflation, have inadvertently dampened consumer spending and investment. Higher interest rates translate directly into:

- Increased Mortgage Rates: Making home purchases less affordable for many potential buyers.

- Higher Auto Loan Rates: Reducing affordability of new and used vehicles.

- Elevated Credit Card Interest: Increasing the cost of carrying credit card debt.

These increased borrowing costs effectively reduce disposable income, forcing consumers to prioritize essential expenses over discretionary spending, thereby exacerbating the U.S. economic slowdown. The impact of these higher rates is particularly significant for those with existing debt.

Tariff Pressures and Their Ripple Effects on the Economy

Tariff pressures, a significant factor in the global economic landscape, are also playing a crucial role in the current U.S. economic slowdown.

Increased Import Costs

Tariffs imposed on imported goods directly increase their prices for both consumers and businesses. This price increase reduces consumer purchasing power and impacts business profitability.

- Increased Prices for Consumer Goods: Tariffs on imported goods like electronics, clothing, and furniture have increased the cost of these items for consumers, leading to reduced demand.

- Higher Input Costs for Businesses: Tariffs on raw materials and intermediate goods increase production costs for businesses, potentially leading to reduced output and job losses.

For example, tariffs on steel imports have increased the cost of construction projects, impacting the housing market and overall economic growth. (Insert relevant data on specific tariff increases and their impact on import prices here).

Impact on Supply Chains and Manufacturing

Tariffs have disrupted global supply chains, leading to shortages and delays. This disruption disproportionately impacts domestic manufacturers relying on imported components.

- Supply Chain Disruptions: Tariffs have led to increased uncertainty and complexity in global supply chains, delaying the delivery of goods and increasing production costs.

- Negative Impact on Manufacturing: The increased cost of imported components and raw materials has reduced the competitiveness of American manufacturers, leading to reduced output and potentially job losses.

The manufacturing sector has been particularly vulnerable, with production in several industries experiencing a decline due to the ripple effects of tariffs. (Insert data on manufacturing output and employment here).

Other Contributing Factors to the U.S. Economic Slowdown

Beyond reduced consumer spending and tariff pressures, other factors contribute to the current U.S. economic slowdown.

Geopolitical Uncertainty

Global events and uncertainties significantly impact the U.S. economy.

- The War in Ukraine: The ongoing conflict has created energy price volatility and disrupted global supply chains, further contributing to economic uncertainty.

- Global Trade Tensions: Escalating trade disputes and protectionist policies between major economies negatively affect global trade and investment.

These geopolitical risks create uncertainty, discouraging investment and dampening economic growth.

Labor Market Dynamics

Labor market dynamics also play a role.

- Labor Shortages: In some sectors, labor shortages are constraining production and hindering economic growth.

- Wage Growth: While wage growth is positive for workers, rapid wage increases can contribute to inflation and reduced business profitability.

- Potential Labor Disputes: The possibility of widespread labor strikes or disputes could further disrupt economic activity.

Unemployment rates, wage growth statistics, and labor force participation rates provide further insights into the current state of the labor market and its contribution to the economic slowdown. (Insert relevant data here).

Conclusion

The current U.S. economic slowdown, reflected in the 0.2% contraction in Q1 2024, is a complex issue stemming from a combination of factors. Reduced consumer spending, driven by inflation, interest rate hikes, and geopolitical uncertainty, is a major contributor. Furthermore, tariff pressures have increased import costs, disrupted supply chains, and negatively impacted domestic manufacturers. Other factors, including geopolitical instability and labor market dynamics, further complicate the economic outlook. Understanding these interconnected elements is crucial for navigating this challenging period. The key takeaway is the need for a multifaceted approach to address these challenges and promote sustainable economic growth. Stay tuned for further analysis and insights as we continue to monitor this developing situation and its impacts on the U.S. economic slowdown and its potential recovery.

Featured Posts

-

Mezogazdasagi Strategiak A Kedvezotlen Alfoeldi Koeruelmenyekhez

May 31, 2025

Mezogazdasagi Strategiak A Kedvezotlen Alfoeldi Koeruelmenyekhez

May 31, 2025 -

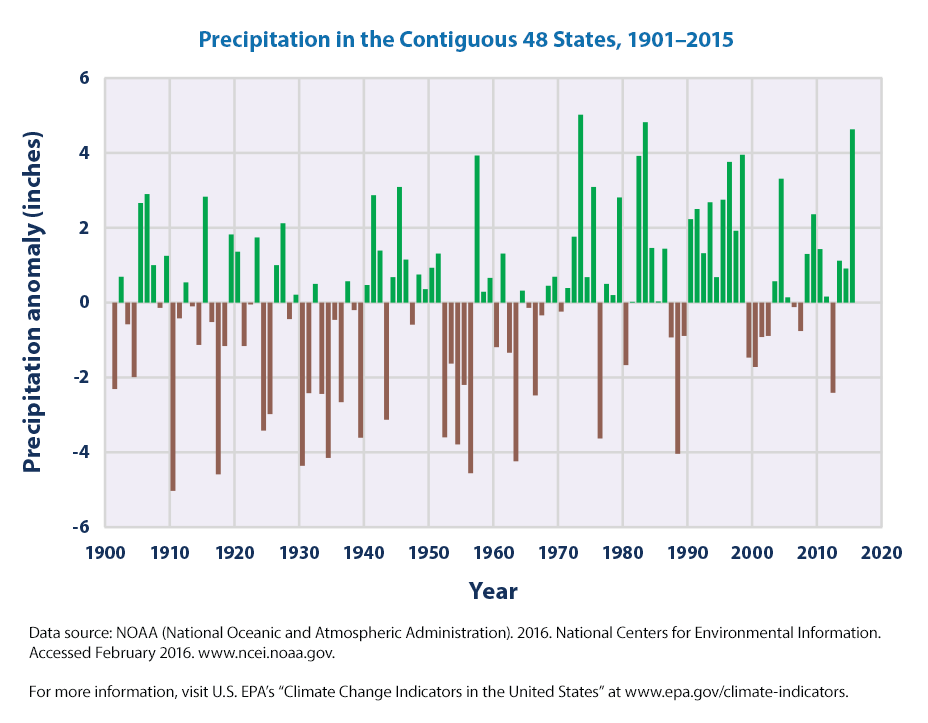

Climate Changes Effect On Rainfall Levels In Western Massachusetts

May 31, 2025

Climate Changes Effect On Rainfall Levels In Western Massachusetts

May 31, 2025 -

Alfoeldi Talajnedvesseg Kritikus Tenyezo A Hazai Noevenytermesztesben

May 31, 2025

Alfoeldi Talajnedvesseg Kritikus Tenyezo A Hazai Noevenytermesztesben

May 31, 2025 -

Bannatyne Ingleby Barwick Padel Courts Construction Update

May 31, 2025

Bannatyne Ingleby Barwick Padel Courts Construction Update

May 31, 2025 -

American Universities Face Financial Challenges Amidst Shifting Chinese Student Demographics

May 31, 2025

American Universities Face Financial Challenges Amidst Shifting Chinese Student Demographics

May 31, 2025