U.S. Federal Reserve Decision: Inflation, Unemployment Weigh On Rate Hike

Table of Contents

Inflationary Pressures Remain a Key Concern

Persistent High Inflation

The current inflation rate remains a significant concern for the Federal Reserve. Despite previous interest rate hikes aimed at curbing price increases, inflation persists at elevated levels.

- CPI data: Recent Consumer Price Index (CPI) reports show inflation stubbornly above the Fed's target.

- Core inflation: Core inflation, which excludes volatile food and energy prices, also remains elevated, suggesting broad-based price pressures.

- Contributing factors: Several factors contribute to persistent inflation, including ongoing supply chain disruptions, elevated energy prices driven by geopolitical instability, and robust consumer demand.

The impact of high inflation is far-reaching. It erodes purchasing power, dampens consumer spending, discourages business investment, and ultimately hinders economic growth. Economists are closely watching for signs that inflation is cooling, and any unexpected spikes in the inflation rate could influence the Fed's decision. Experts predict that maintaining a consistent focus on managing the inflation rate will be a key aspect of the Fed’s upcoming decision.

The Fed's Inflation Target

The Federal Reserve has a publicly stated inflation target of 2%. Current inflation rates are significantly above this goal, underscoring the challenge faced by the central bank.

- Fed's policy statements: The Fed's recent statements have emphasized the commitment to bringing inflation back down to its target.

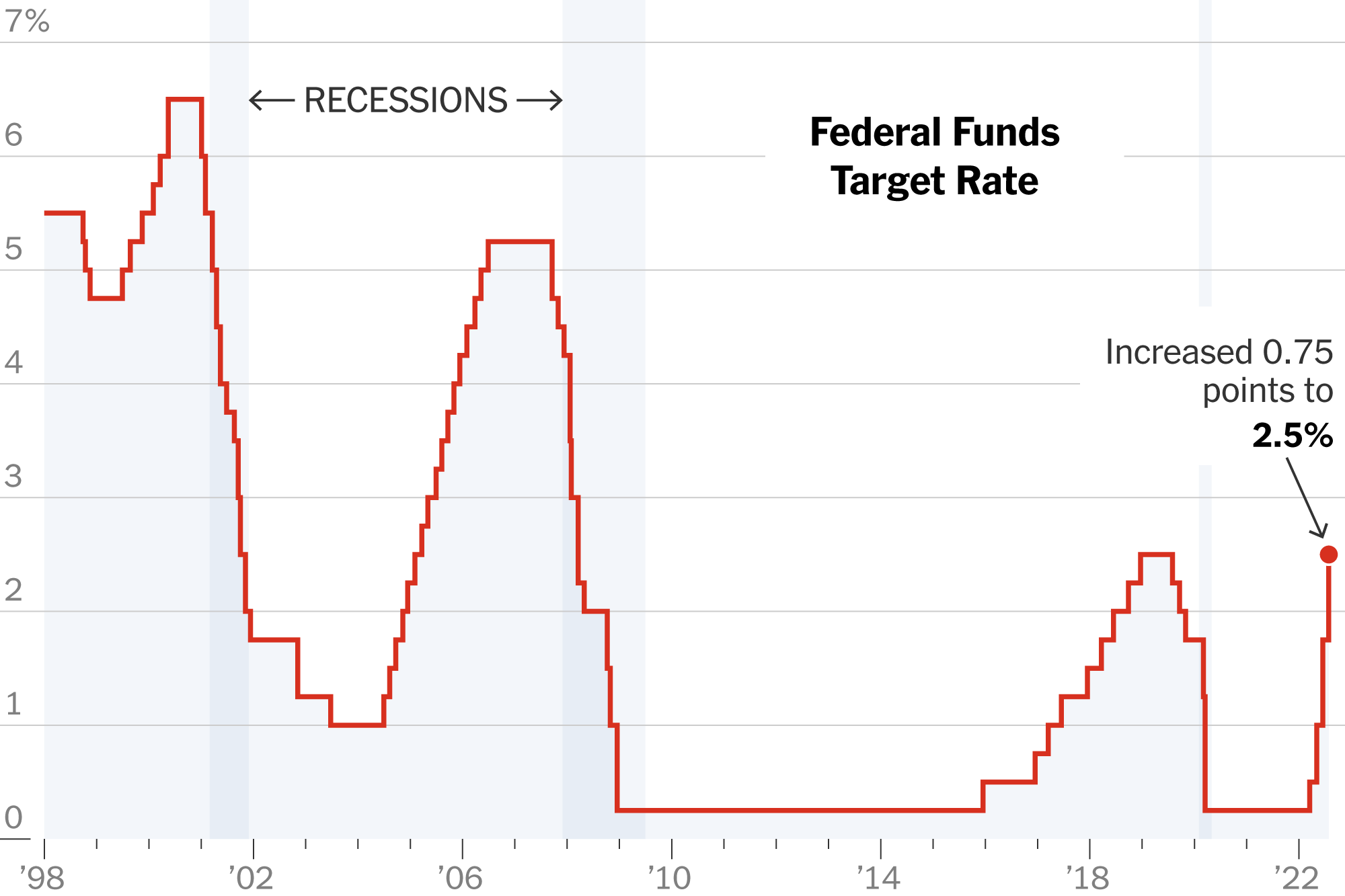

- Past actions: The Fed has already implemented several rate hikes in an attempt to cool the economy and reduce inflationary pressures.

- Challenges in reaching the target: Reaching the 2% inflation target without triggering a significant economic slowdown is proving to be a complex challenge.

The tools available to the Fed to control inflation include raising interest rates (monetary policy), reducing its balance sheet through quantitative tightening, and influencing expectations. However, each tool carries potential trade-offs, impacting different sectors of the economy. The Fed must carefully weigh the risks and benefits of each approach when making its rate hike decision.

Rising Unemployment Casts a Shadow on Rate Hikes

Job Market Dynamics

While inflation remains a major concern, the rising unemployment rate adds a layer of complexity to the Fed's decision-making process.

- Unemployment figures: The unemployment rate has been inching upwards in recent months, signaling a potential weakening in the labor market.

- Job creation numbers: Although job creation remains positive, the pace of growth has slowed compared to previous periods.

- Sector-specific employment data: Some sectors are experiencing greater job losses than others, highlighting the uneven impact of economic slowdown.

The relationship between inflation and unemployment is often described by the Phillips Curve, which suggests an inverse relationship – lower unemployment often coincides with higher inflation, and vice versa. Further interest rate hikes could lead to increased job losses, potentially pushing the economy into a recession. The delicate balance between controlling inflation and preserving employment is a central challenge for the Federal Reserve.

The Fed's Balancing Act

The Fed faces the difficult task of balancing the need to control inflation with the desire to maintain a healthy employment level. This balancing act presents several potential scenarios:

- Soft landing: A scenario where inflation is brought under control without a significant increase in unemployment. This is the Fed's preferred outcome but is notoriously difficult to achieve.

- Hard landing: A scenario where aggressive rate hikes trigger a recession, leading to a sharp rise in unemployment.

- Stagflation: A scenario characterized by high inflation and high unemployment simultaneously.

The risks associated with each scenario are substantial. Aggressive rate hikes could trigger a recession, causing widespread economic hardship. However, failing to adequately address inflation could lead to long-term economic instability. The Fed's decision will likely hinge on its assessment of these competing risks.

Global Economic Uncertainty Adds Complexity

International Market Influences

Global economic conditions significantly impact the Fed's decision-making process.

- Impact of global events: The war in Ukraine, ongoing energy crises, and supply chain disruptions contribute to global inflation and uncertainty.

- Supply chains: Global supply chains remain fragile, susceptible to disruptions that exacerbate inflationary pressures.

- Economic outlook: The overall global economic outlook impacts the Fed's assessment of the domestic economy.

The interconnectedness of the global economy means that events outside the U.S. can have significant effects on the domestic economy, making the Fed's job more challenging. The Fed must consider these global factors when making its decisions about interest rates.

Market Reactions to Potential Rate Decisions

Different interest rate hike scenarios will have varying impacts on financial markets.

- Stock market: Aggressive rate hikes could lead to a decline in stock prices, as higher interest rates increase borrowing costs for companies.

- Bond yields: Changes in interest rates directly affect bond yields, impacting the value of fixed-income investments.

- Currency exchange rates: The value of the dollar relative to other currencies can be influenced by the Fed's actions.

Investors closely watch the Fed's announcements, and their reactions can significantly impact market volatility. Understanding the potential market responses to different rate hike scenarios is critical for investors to manage their portfolios effectively.

Conclusion

The U.S. Federal Reserve's decision on interest rates represents a critical juncture for the American economy. Balancing the need to curb inflation with the risk of triggering higher unemployment requires a delicate approach. Understanding the complex interplay of inflation, unemployment, and global economic conditions is crucial for navigating this uncertain period. Stay informed on the latest developments regarding the U.S. Federal Reserve decision and its impact on the economy by regularly checking reputable financial news sources. Follow the ongoing discussion surrounding the U.S. Federal Reserve decision and its effects on the rate of inflation and employment. The implications of this Federal Reserve interest rate decision will be felt across all sectors of the economy and require ongoing monitoring.

Featured Posts

-

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse Van De Strategie

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse Van De Strategie

May 09, 2025 -

Kas Nutiko Dakota Johnson Paaiskeja Kraujingu Plintu Nuotrauku Istorija

May 09, 2025

Kas Nutiko Dakota Johnson Paaiskeja Kraujingu Plintu Nuotrauku Istorija

May 09, 2025 -

Draisaitls Outstanding Season Earns Him Hart Trophy Nomination Edmonton Oilers

May 09, 2025

Draisaitls Outstanding Season Earns Him Hart Trophy Nomination Edmonton Oilers

May 09, 2025 -

Should You Put Your Kids In Daycare A Working Parents Dilemma

May 09, 2025

Should You Put Your Kids In Daycare A Working Parents Dilemma

May 09, 2025 -

Stephen King In 2025 The Monkeys Potential To Define A Strong Year

May 09, 2025

Stephen King In 2025 The Monkeys Potential To Define A Strong Year

May 09, 2025