U.S. Federal Reserve Rate Decision: Inflation, Recession Risks, And The Next Move

Table of Contents

Current Inflationary Pressures

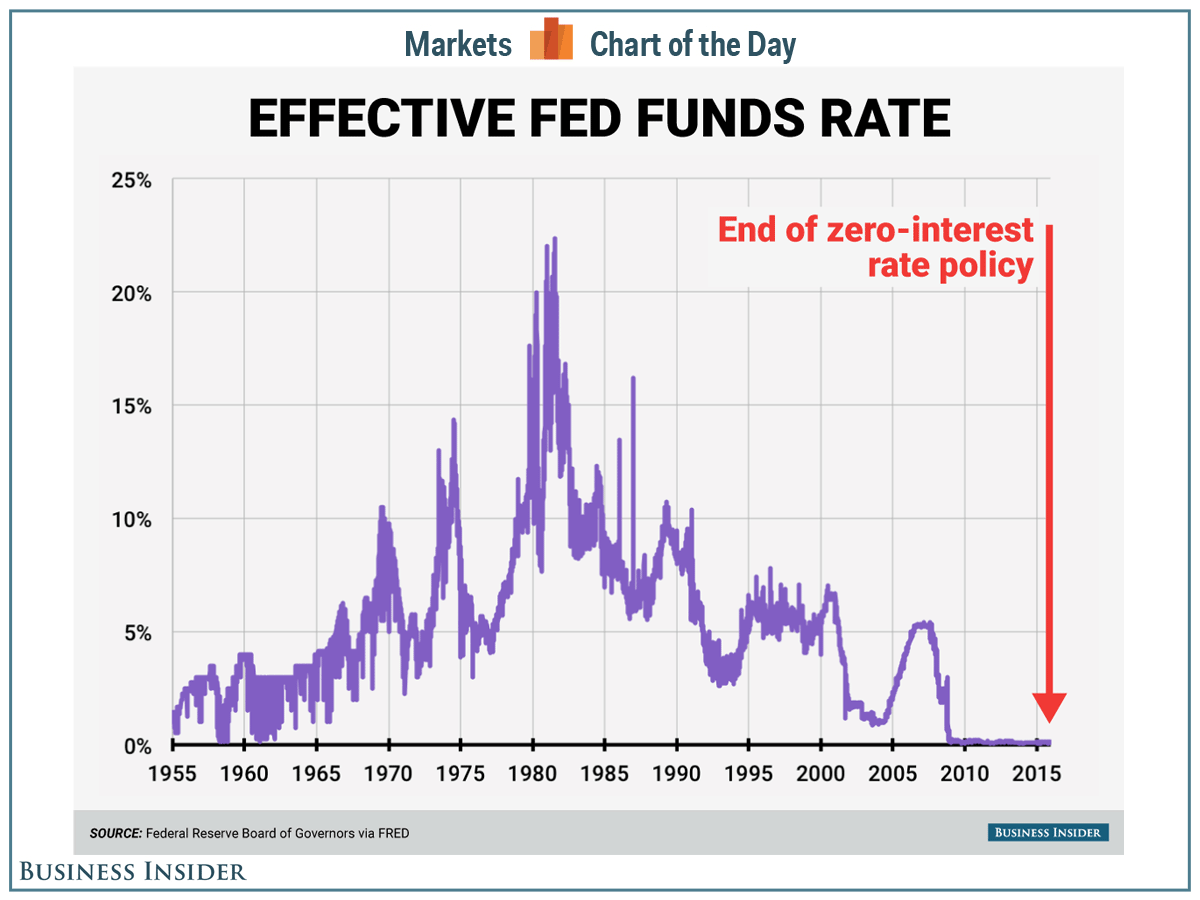

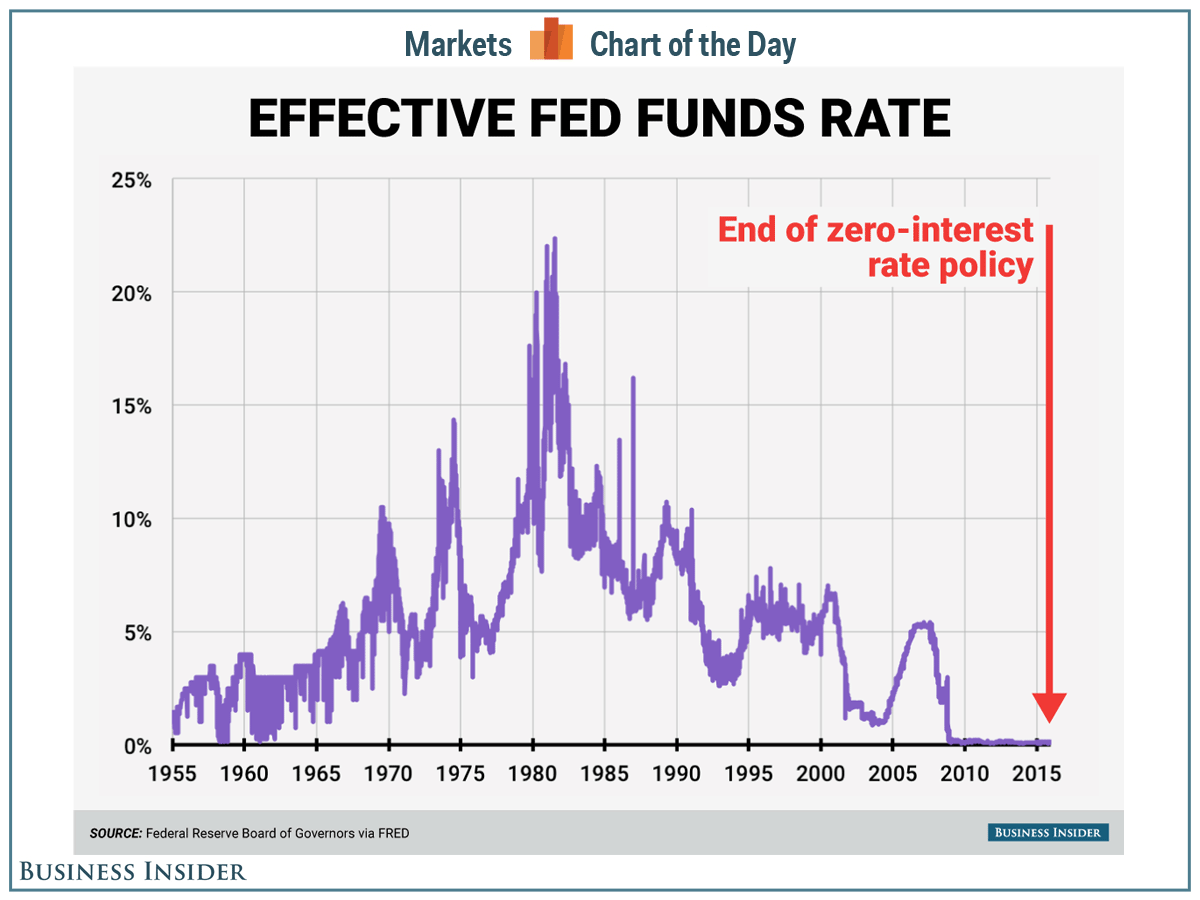

The Federal Reserve's primary mandate is price stability, making current inflationary pressures a central focus of the upcoming rate decision. Understanding the nuances of inflation is key to predicting the Fed's next move.

CPI and Inflation Expectations

The Consumer Price Index (CPI) is a key indicator tracked closely by the Fed. Recent CPI data has shown a mixed picture, with some signs of cooling but inflation remaining stubbornly above the Fed's 2% target.

- Core CPI: Excluding volatile food and energy prices, core CPI provides a clearer picture of underlying inflationary pressures. Its persistence above target raises concerns.

- Sticky Inflation: Certain sectors, like housing and services, are experiencing persistent inflation, indicating that price increases are not merely transitory.

- Market Expectations: Market participants closely watch inflation expectations, reflected in bond yields and other financial instruments. High inflation expectations can become self-fulfilling, further complicating the Fed's task.

Persistent inflation pressures generally lead the Fed to adopt a more hawkish stance, favoring further interest rate hikes to cool down the economy and curb price increases. The Fed carefully weighs the risks of persistent inflation against the potential negative consequences of aggressive rate hikes.

Impact of Supply Chain Disruptions

Supply chain bottlenecks have played a significant role in fueling inflation over the past few years. While some easing has been observed, lingering disruptions continue to impact commodity prices and overall inflation.

- Easing vs. Persistent Supply Chain Issues: While some supply chain bottlenecks have eased, others persist, particularly in certain sectors.

- Influence on Commodity Prices: Disruptions in supply chains directly impact the prices of raw materials and finished goods, feeding into broader inflation.

- The Fed's Response: The Fed carefully considers the extent to which supply-side factors contribute to inflation when determining its monetary policy response. If inflation is primarily driven by supply-side issues, the effectiveness of interest rate hikes might be limited.

The Fed's approach necessitates evaluating the interplay of supply-side and demand-side factors contributing to inflation. While interest rate hikes can curb demand-pull inflation, they have less impact on supply-shock inflation.

Recessionary Risks and Economic Indicators

The Federal Reserve's dual mandate includes both price stability and maximum employment. Aggressive interest rate hikes aimed at curbing inflation risk triggering a recession, creating a difficult balancing act for the central bank.

GDP Growth and Potential Slowdown

Recent GDP growth figures have been mixed, raising concerns about a potential economic slowdown. The impact of interest rate hikes on economic activity is a critical consideration for the Fed.

- Potential GDP Contraction: Several leading economic indicators suggest a potential contraction in GDP, signaling a possible recession.

- Impact of Interest Rate Hikes: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing investment and consumption, leading to slower economic growth.

- Leading Economic Indicators: The Fed carefully monitors various leading economic indicators, such as manufacturing PMI, consumer confidence, and housing starts, to gauge the health of the economy and assess recession risks.

The inverse relationship between interest rates and economic growth is well-established. The Fed aims to find the optimal balance between controlling inflation and avoiding a recession.

Labor Market Dynamics

The strength of the labor market is another crucial factor influencing the Fed's decision-making. A tight labor market can fuel wage growth and contribute to inflationary pressures.

- Current Unemployment Rate: The current unemployment rate remains relatively low, indicating a tight labor market.

- Wage Inflation Pressures: Strong wage growth can add to inflationary pressures, as businesses pass increased labor costs onto consumers.

- The Fed's Dual Mandate: The Fed's dual mandate requires balancing price stability with maximum employment. A very tight labor market could lead to higher inflation, necessitating further rate hikes.

A tight labor market, while positive in terms of employment, can fuel inflationary pressures, creating a dilemma for the Fed.

Potential Scenarios and the Next Fed Move

Based on the current economic conditions, several scenarios are possible for the next Federal Reserve rate decision.

Scenario 1: Further Rate Hikes

If inflation remains stubbornly high despite previous rate hikes, and the economy shows continued strength, the Fed might opt for further interest rate increases.

- Persistent High Inflation: If core inflation remains significantly above the 2% target, the Fed may feel compelled to continue tightening monetary policy.

- Strong Economic Growth Despite Rate Hikes: If economic growth remains robust even with higher interest rates, the Fed might conclude that further rate increases are necessary to curb inflationary pressures.

The magnitude of any further rate increases would likely be data-dependent, with the Fed carefully assessing the impact of previous hikes on economic activity and inflation.

Scenario 2: Pause in Rate Hikes

If inflation shows signs of slowing, and economic growth weakens significantly, increasing the risk of recession, the Fed might choose to pause rate increases.

- Signs of Slowing Inflation: A clear downward trend in inflation, particularly in core CPI, could provide the Fed with justification for a pause.

- Weakening Economic Growth: A significant slowdown in economic growth, combined with rising recession risks, could lead the Fed to prioritize economic stability over further inflation control.

A pause would allow the Fed to assess the cumulative impact of previous rate hikes on the economy before deciding on further action.

Scenario 3: Rate Cuts

While highly unlikely in the near term, rate cuts could become a possibility if the economy experiences a significant downturn and inflation falls sharply.

- Significant Economic Downturn: A sharp contraction in GDP and a substantial rise in unemployment could force the Fed to prioritize stimulating economic activity, even at the risk of higher inflation.

- Sharp Decline in Inflation: A rapid and substantial fall in inflation could create room for the Fed to ease monetary policy, facilitating economic recovery.

This scenario is contingent upon a significant shift in the economic outlook, a highly unlikely but not impossible outcome.

Conclusion

The next Federal Reserve rate decision is a critical juncture for the U.S. economy. The Fed faces a complex balancing act between combating persistent inflation and mitigating the risks of a recession. Understanding the interplay of inflation, economic indicators, and labor market dynamics is crucial for anticipating the Fed's next move. While predicting with certainty is impossible, analyzing current trends offers valuable insights. To stay informed about future Federal Reserve rate decisions and their impact on the market, continue following reputable financial news sources and expert commentary. Stay updated on the latest developments in the Federal Reserve rate decision process and its implications for your investments and financial planning.

Featured Posts

-

Edmonton Oilers Draisaitl Injury Update And Playoff Chances

May 09, 2025

Edmonton Oilers Draisaitl Injury Update And Playoff Chances

May 09, 2025 -

F1 Facing Crisis Jeremy Clarkson Offers A Potential Solution

May 09, 2025

F1 Facing Crisis Jeremy Clarkson Offers A Potential Solution

May 09, 2025 -

Uk Government Considers Visa Restrictions For Specific Countries

May 09, 2025

Uk Government Considers Visa Restrictions For Specific Countries

May 09, 2025 -

Man Uniteds De Ligt Inter Milans Surprise Transfer Pursuit

May 09, 2025

Man Uniteds De Ligt Inter Milans Surprise Transfer Pursuit

May 09, 2025 -

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 09, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 09, 2025