U.S. Government Collects Record $16.3 Billion In April Customs Duties

Table of Contents

Reasons Behind the Record-High Customs Duty Collection

Several factors contributed to the record-breaking $16.3 billion in April customs duty collection. This surge in U.S. Customs Duties reflects a confluence of economic trends and policy decisions.

Increased Import Volumes

A primary driver of the increased customs duty collection is the significant rise in import volumes. The U.S. saw a substantial increase in imported goods across various sectors, leading to a corresponding increase in the amount of duties levied.

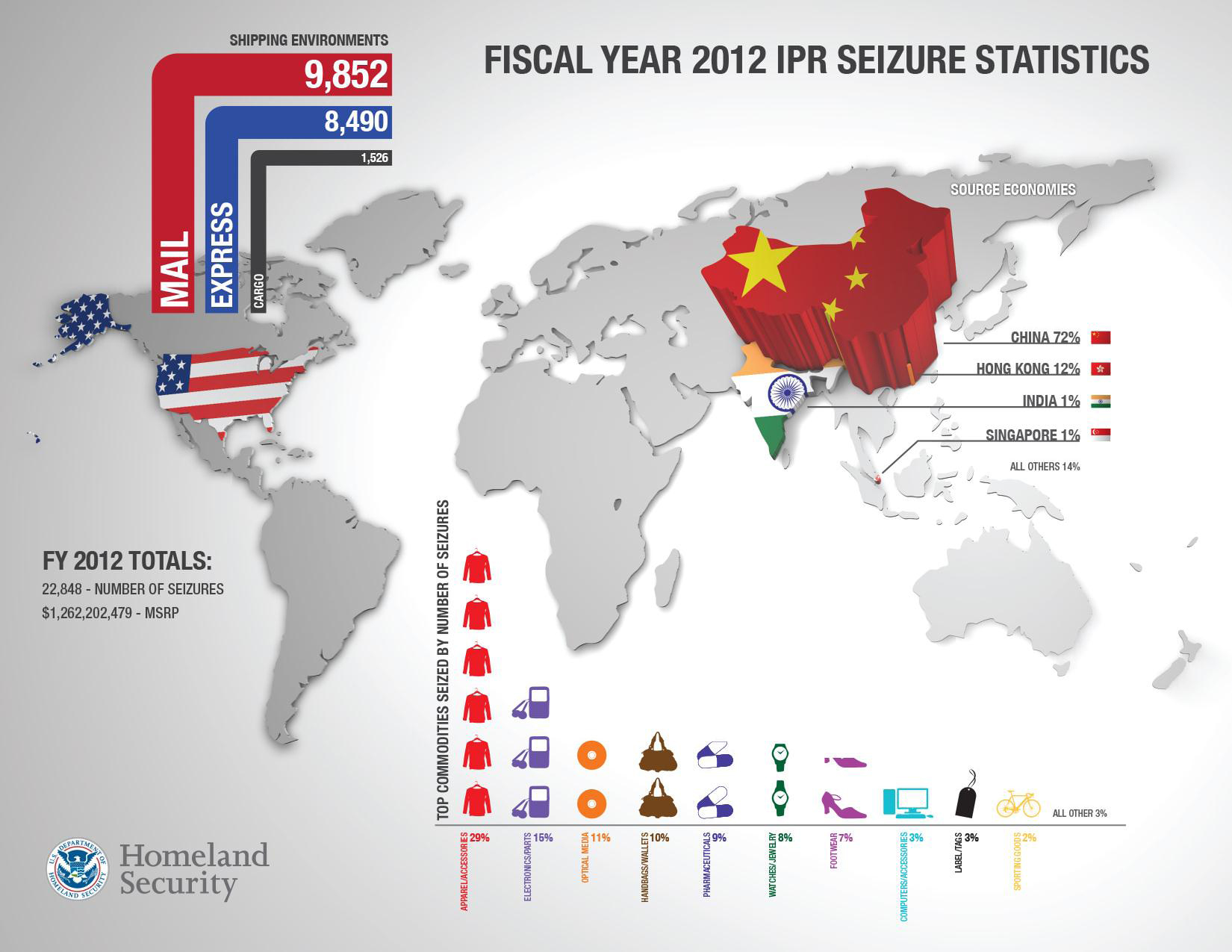

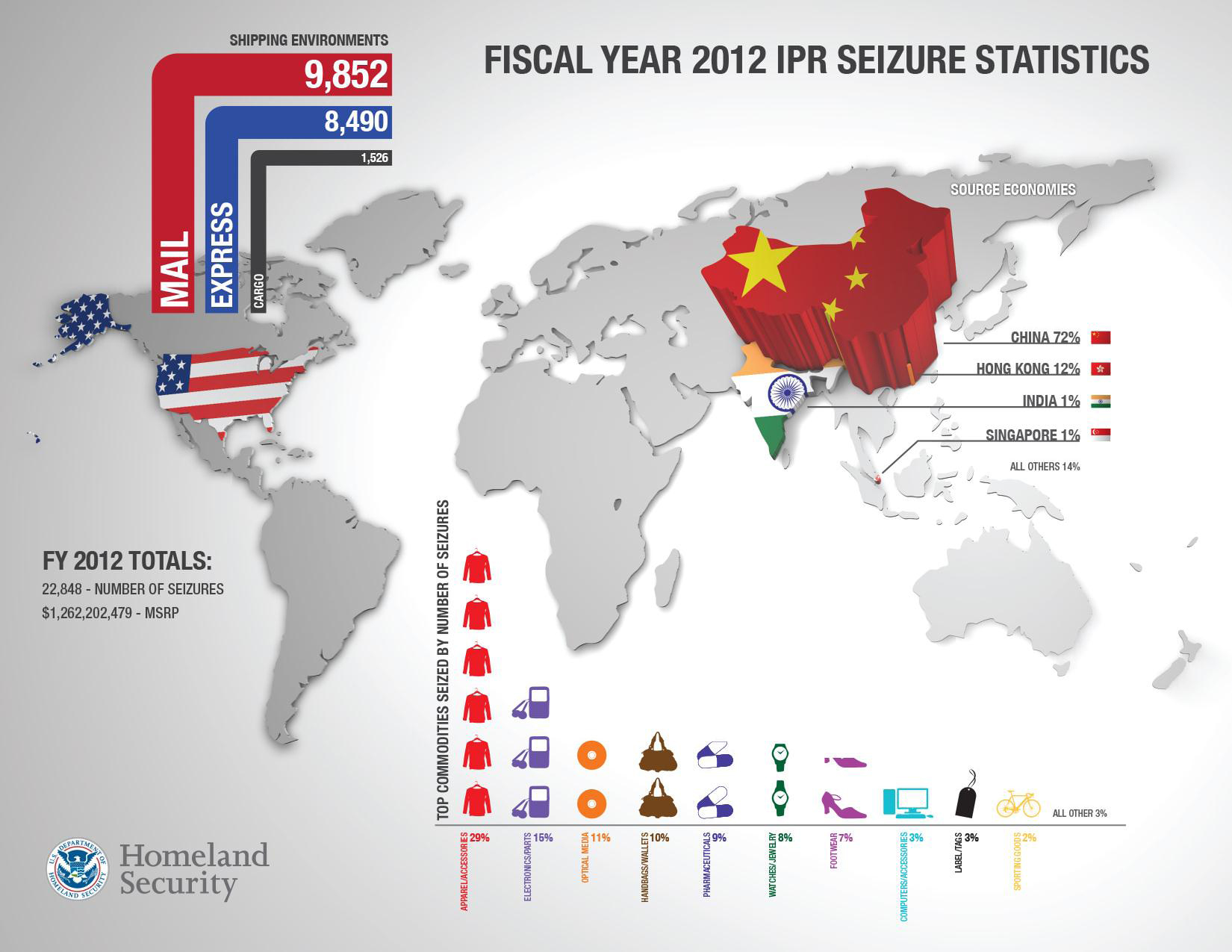

- Significant Import Growth in Key Sectors: Electronics, particularly smartphones and computer components, showed substantial import growth. Consumer goods, including apparel and household items, also contributed significantly to the increased import activity.

- Data Points: Preliminary data suggests a 15% year-over-year increase in import volume for consumer electronics and a 10% increase for apparel, contributing significantly to the overall April customs revenue.

- Increased Import Activity: This surge in imports reflects robust consumer spending and restocking efforts by businesses following supply chain disruptions of previous years.

Higher Tariff Rates

The impact of existing tariffs and trade policies cannot be overlooked. Specific tariffs implemented in previous years on certain goods continue to influence duty rates and contribute to the increased revenue generated from U.S. Customs Duties.

- Impact of Previous Tariff Policies: Tariffs imposed on goods from certain countries, particularly in sectors like steel and aluminum, remain in effect and contribute to higher duty rates.

- Duty Rate Increases: These tariffs, while impacting import costs, have directly increased the amount of customs duties collected.

- Trade Policy Influence: The ongoing review and adjustment of trade policies further contribute to the fluctuating nature of customs duty rates and the overall revenue generated.

Economic Factors Contributing to the Rise

The overall economic climate played a significant role. Consumer spending, inflation, supply chain dynamics, and global economic growth all contributed to the record-high customs duty collection.

- Strong Consumer Spending: Robust consumer spending fueled demand for imported goods, leading to increased import volumes.

- Inflationary Pressures: Inflationary pressures, while impacting consumers, also influenced import demand and, consequently, customs duty revenue.

- Supply Chain Dynamics: While supply chains are still recovering from pandemic-era disruptions, the ongoing normalization contributed to the increased flow of imported goods.

- Global Economic Growth: Global economic growth, particularly in certain key trading partners, further bolstered import activity.

Implications of the Record Customs Duty Collection

The record-breaking April customs duty collection has significant implications for the U.S. budget, businesses, and consumers.

Impact on the U.S. Budget

The surge in customs duty collection had a positive impact on the U.S. government's revenue and could help reduce the budget deficit.

- Increased Government Revenue: The $16.3 billion represents a significant contribution to government revenue.

- Budgetary Implications: This revenue stream can be allocated to various government programs and initiatives.

- Fiscal Implications: The increased revenue could potentially aid in debt reduction and contribute to greater fiscal stability.

Effects on Businesses and Consumers

While beneficial for the government, the increased customs duties can impact businesses and consumers through higher prices or reduced competitiveness.

- Increased Import Costs: Higher duties lead to increased import costs for businesses.

- Consumer Price Increases: These increased costs can be passed on to consumers in the form of higher prices.

- Impact on Business Profitability: Increased import costs can negatively affect business profitability, particularly for smaller importers.

Future Outlook and Predictions

Predicting future customs duty collection requires considering potential economic and policy changes.

- Future Trends: Future import volumes, tariff adjustments, and overall economic growth will all play a role in determining future customs duty revenue.

- Revenue Projections: Continued strong consumer spending and moderate global economic growth could support relatively high customs duty collection in the coming months.

- Policy Implications: Any significant changes in trade policies or tariff structures could significantly impact future revenue projections.

Conclusion

The record-high U.S. customs duty collection of $16.3 billion in April resulted from a combination of increased import volumes, higher tariff rates, and favorable economic conditions. This surge in U.S. Customs Duties has significant implications for the U.S. budget, offering potential relief for the deficit and impacting businesses and consumers through price adjustments. While offering a positive short-term outlook for government finances, the long-term effects necessitate careful monitoring of economic trends and policy developments. Stay informed about the latest developments in U.S. customs duties and their impact on the economy. Follow our updates to keep track of future customs duty collection figures and their significance.

Featured Posts

-

Todays News Air Traffic Controller Crisis Major Court Cases And The Rise Of Thc Beverages

May 13, 2025

Todays News Air Traffic Controller Crisis Major Court Cases And The Rise Of Thc Beverages

May 13, 2025 -

Trump Faces Backlash From Chris Packham Over Climate Change Policies

May 13, 2025

Trump Faces Backlash From Chris Packham Over Climate Change Policies

May 13, 2025 -

Kostyuk I Kasatkina Rukopozhatie Posle Smeny Grazhdanstva

May 13, 2025

Kostyuk I Kasatkina Rukopozhatie Posle Smeny Grazhdanstva

May 13, 2025 -

Horario Y Transmision Ac Milan Vs Atalanta Con Gimenez

May 13, 2025

Horario Y Transmision Ac Milan Vs Atalanta Con Gimenez

May 13, 2025 -

Community Mourns 15 Year Old After School Stabbing

May 13, 2025

Community Mourns 15 Year Old After School Stabbing

May 13, 2025

Latest Posts

-

Stream Captain America Brave New World Your Guide To Pvod Platforms

May 14, 2025

Stream Captain America Brave New World Your Guide To Pvod Platforms

May 14, 2025 -

Captain America Brave New World Pvod Streaming Guide Where To Watch Online

May 14, 2025

Captain America Brave New World Pvod Streaming Guide Where To Watch Online

May 14, 2025 -

Watch Young Son Of Scotty Mc Creerys Adorable George Strait Tribute

May 14, 2025

Watch Young Son Of Scotty Mc Creerys Adorable George Strait Tribute

May 14, 2025 -

Captain America Brave New World Disney Streaming Premiere Date

May 14, 2025

Captain America Brave New World Disney Streaming Premiere Date

May 14, 2025 -

Captain America Brave New World Digital Release And Disney Arrival

May 14, 2025

Captain America Brave New World Digital Release And Disney Arrival

May 14, 2025