U.S. Jobs Report: 177,000 Added In April, Unemployment Holds At 4.2%

Table of Contents

Detailed Breakdown of Job Growth in April

Sector-Specific Analysis

The April job growth wasn't evenly distributed across all sectors. While some industries thrived, others experienced slower growth or even contraction. The strongest job creation was seen in professional and business services, reflecting continued growth in the consulting and financial sectors. The leisure and hospitality sector also added jobs, suggesting a continued recovery in the tourism and entertainment industries. However, the manufacturing sector witnessed relatively sluggish growth, and some construction jobs were lost. This uneven job creation highlights the nuanced reality of the current economic climate.

- Professional and Business Services: Experienced significant job growth, driven by increased demand for consulting, financial services, and other professional expertise.

- Leisure and Hospitality: Showed positive job growth, indicating a recovery in the travel and entertainment industries after the pandemic.

- Manufacturing: Saw moderate job growth, indicating a steady, but not booming, manufacturing sector.

- Construction: Experienced a slight decline in jobs, potentially due to rising interest rates and material costs.

[Insert chart/graph visualizing job growth across different sectors here]

Geographic Distribution of Job Growth

Job growth wasn't uniform across the country. Coastal states, particularly those in the Northeast and West Coast, generally experienced higher job growth rates compared to some Midwestern and Southern states. This disparity may be attributed to factors such as varying industry concentrations, regional economic policies, and the ongoing impact of the pandemic. Further research into state-level jobs data is crucial for understanding these regional differences and tailoring economic policies effectively.

- Coastal States: Generally experienced higher job growth rates.

- Midwestern and Southern States: Showed more modest job growth rates.

- Regional disparities: Highlight the need for region-specific economic analysis and policy adjustments.

Wage Growth and Inflationary Pressures

Average Hourly Earnings

Average hourly earnings increased by [insert percentage here] in April. While this signifies some wage growth, it's crucial to consider this figure in the context of inflation. When compared to the current inflation rate of [insert inflation rate here], the real wage growth might be significantly lower or even negative, potentially impacting consumer spending and overall economic growth. This raises concerns about the potential for a wage-price spiral, where rising wages lead to further price increases, creating a self-perpetuating cycle of inflation.

- Real wage growth: Needs to be considered in relation to the inflation rate to determine actual purchasing power.

- Inflationary pressures: The relationship between wage growth and inflation is a key factor influencing economic stability.

- Wage-price spiral: A potential consequence of rapid wage growth coupled with high inflation.

Impact on Consumer Spending and Economic Growth

Wage growth, or the lack thereof, directly influences consumer spending, a major driver of economic growth. If real wages are stagnant or declining, consumers may reduce spending, impacting businesses and potentially slowing economic expansion. Conversely, substantial real wage growth could boost consumer confidence and lead to increased spending, fueling economic growth. Monitoring consumer spending patterns is essential for forecasting future economic trends.

- Consumer confidence: Closely tied to real wage growth and overall economic outlook.

- Economic growth: Highly dependent on consumer spending and business investment.

- Predictive modeling: Analyzing the relationship between wages, inflation, and consumer spending can help forecast future economic performance.

Interpreting the Unemployment Rate and its Significance

Labor Force Participation Rate

The unemployment rate alone doesn't tell the whole story. The labor force participation rate – the percentage of the working-age population actively employed or seeking employment – provides additional context. A low participation rate could mask underlying issues in the labor market, such as discouraged workers who have given up searching for jobs. Analyzing both the unemployment rate and the labor force participation rate offers a more complete picture of labor market dynamics.

- Unemployment figures: Should be interpreted in conjunction with the labor force participation rate for a comprehensive understanding.

- Discouraged workers: Individuals who have stopped searching for employment due to lack of opportunities.

- Labor market health: Assessed through a combination of unemployment and labor force participation data.

Long-Term Unemployment

The April Jobs Report should also examine the issue of long-term unemployment. Individuals who have been unemployed for an extended period often face significant challenges re-entering the workforce. These challenges highlight the need for targeted job training programs and initiatives to assist long-term unemployed individuals in finding suitable employment. Addressing long-term unemployment is crucial for maintaining a healthy and inclusive labor market.

- Job seeker support: Programs and initiatives are crucial for helping long-term unemployed individuals find work.

- Employment challenges: Understanding the obstacles faced by long-term unemployed individuals is essential for effective policymaking.

- Skills gap: Addressing skill mismatches through training programs can help reduce long-term unemployment.

The April U.S. Jobs Report: Looking Ahead

The April U.S. Jobs Report presents a complex picture of the current labor market. While the addition of 177,000 jobs is positive, the uneven distribution across sectors, the impact of inflation on wage growth, and the persistence of long-term unemployment all warrant attention. Future U.S. Jobs Reports will be crucial for monitoring these trends and assessing the overall health of the U.S. economy. The coming months will offer further insights into the sustainability of job growth and the trajectory of inflation. Staying informed about these economic indicators is vital for individuals, businesses, and policymakers alike. To stay updated on the latest employment trends and future U.S. Jobs Reports, follow reputable economic news sources and government websites. Understanding the nuances of these reports is key to navigating the ever-evolving economic landscape.

Featured Posts

-

Star Players Injury Casts Shadow Over Nuggets Thunder Game

May 05, 2025

Star Players Injury Casts Shadow Over Nuggets Thunder Game

May 05, 2025 -

Patrick Beverley And Russell Westbrook The Story Behind The Viral Post

May 05, 2025

Patrick Beverley And Russell Westbrook The Story Behind The Viral Post

May 05, 2025 -

2025 Streaming Wars Fox And Espn Enter The Fray With New Services

May 05, 2025

2025 Streaming Wars Fox And Espn Enter The Fray With New Services

May 05, 2025 -

Jean Silva From Upset Victory To Ufc Contract

May 05, 2025

Jean Silva From Upset Victory To Ufc Contract

May 05, 2025 -

Jan 6 Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 05, 2025

Jan 6 Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 05, 2025

Latest Posts

-

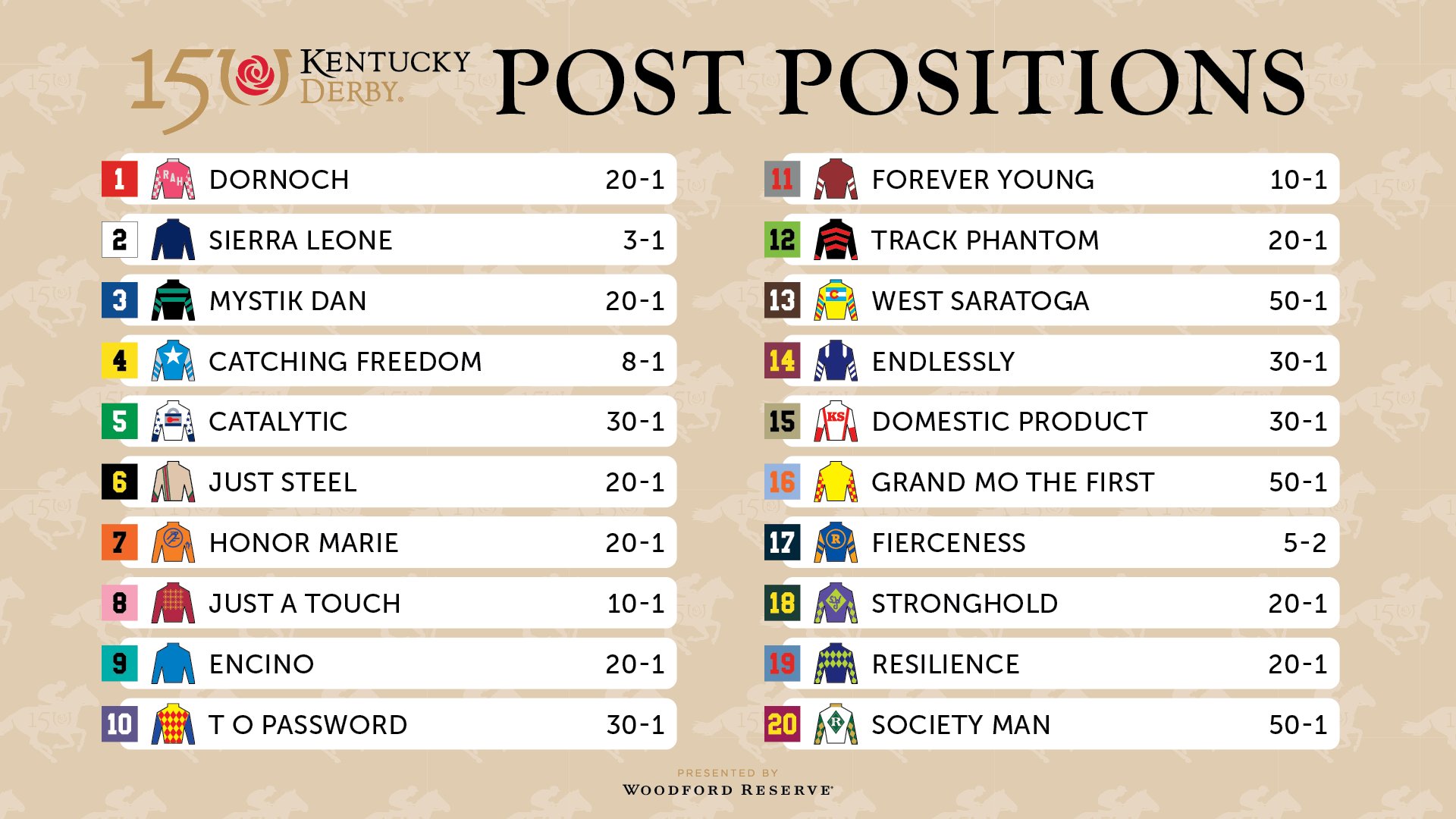

How To Watch The Kentucky Derby 2025 Online A Comprehensive Guide To Streaming

May 05, 2025

How To Watch The Kentucky Derby 2025 Online A Comprehensive Guide To Streaming

May 05, 2025 -

Georgetowns New Kentucky Derby Festival Queen A Celebration

May 05, 2025

Georgetowns New Kentucky Derby Festival Queen A Celebration

May 05, 2025 -

Watch The Kentucky Derby 2025 Online Pricing Availability And Streaming Services

May 05, 2025

Watch The Kentucky Derby 2025 Online Pricing Availability And Streaming Services

May 05, 2025 -

2025 Kentucky Derby Festival Queen Hailing From Georgetown

May 05, 2025

2025 Kentucky Derby Festival Queen Hailing From Georgetown

May 05, 2025 -

Unlocking The Tampa Bay Derby 2025 Odds Field Analysis And Kentucky Derby Prospects

May 05, 2025

Unlocking The Tampa Bay Derby 2025 Odds Field Analysis And Kentucky Derby Prospects

May 05, 2025