U.S. Labor Market Report: 177,000 New Jobs In April, Unemployment Stable

Table of Contents

Detailed Breakdown of Job Growth in April

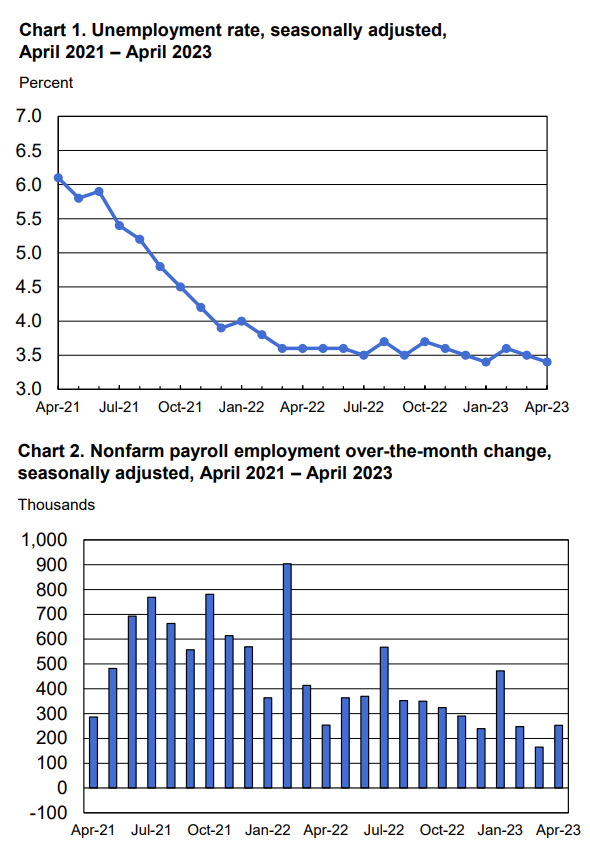

The headline figure – a net increase of 177,000 jobs – represents a continuation of the steady job growth trend observed in recent months. However, a deeper dive into the sectoral breakdown provides a more nuanced understanding of the April employment figures.

- Professional and Business Services: This sector experienced robust growth, adding approximately 80,000 jobs. This reflects continued demand for skilled professionals in various fields.

- Leisure and Hospitality: This sector added a significant number of jobs, showing continued recovery in the tourism and entertainment sectors. The exact numbers will vary depending on the source, but it indicates a positive trend.

- Healthcare: The healthcare sector continues to see steady growth, although at a slightly slower pace than in previous months, reflecting ongoing demand for healthcare professionals. This sector is also highly sensitive to broader economic conditions.

- Manufacturing: Manufacturing employment showed minimal change, remaining relatively stable compared to previous months. This sector is often a key indicator of overall economic health and its stability suggests a cautious but optimistic outlook.

Bullet Points:

- Professional and Business Services: +80,000 jobs (approximate)

- Leisure and Hospitality: +X jobs (specific numbers will vary depending on data source)

- Healthcare: +Y jobs (specific numbers will vary depending on data source)

- Manufacturing: Minimal change.

This analysis shows a diversified job market, with several key sectors contributing to overall employment growth. Compared to March’s figures and the same period last year, April’s growth shows a slowing but not concerning trend. Unexpectedly, the construction sector showed a slight decline, something to monitor closely in future reports.

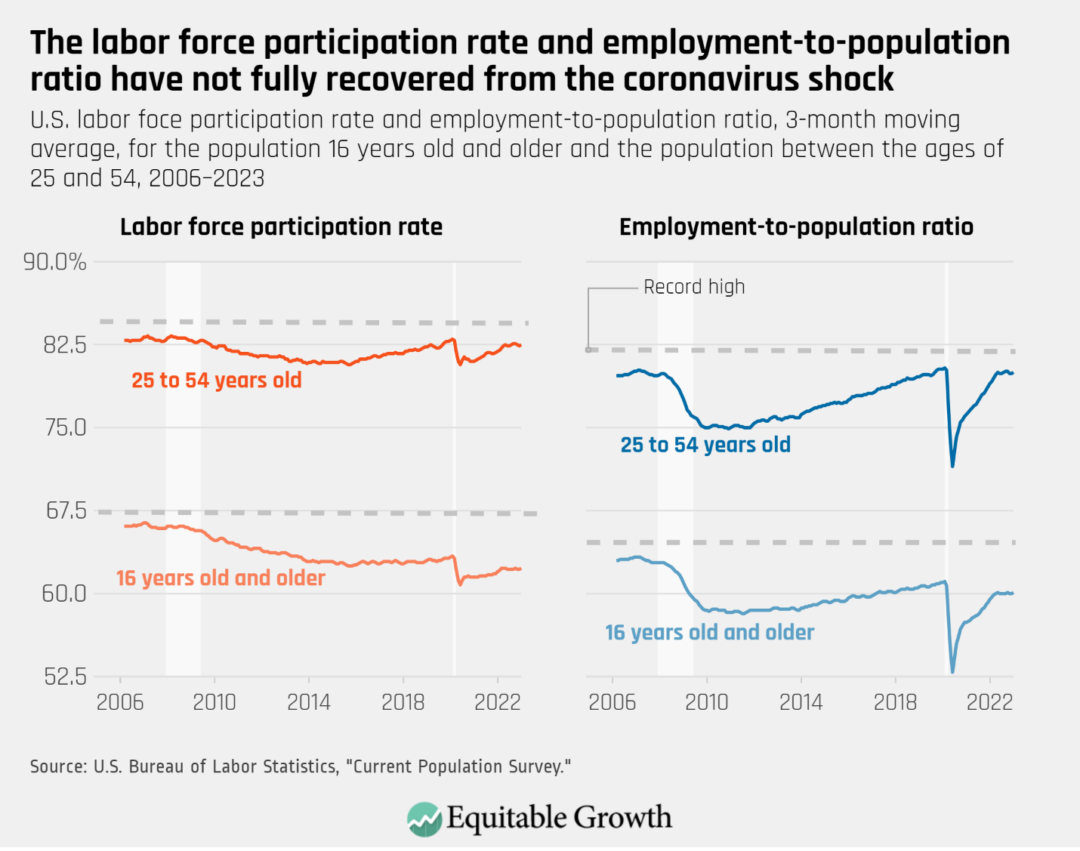

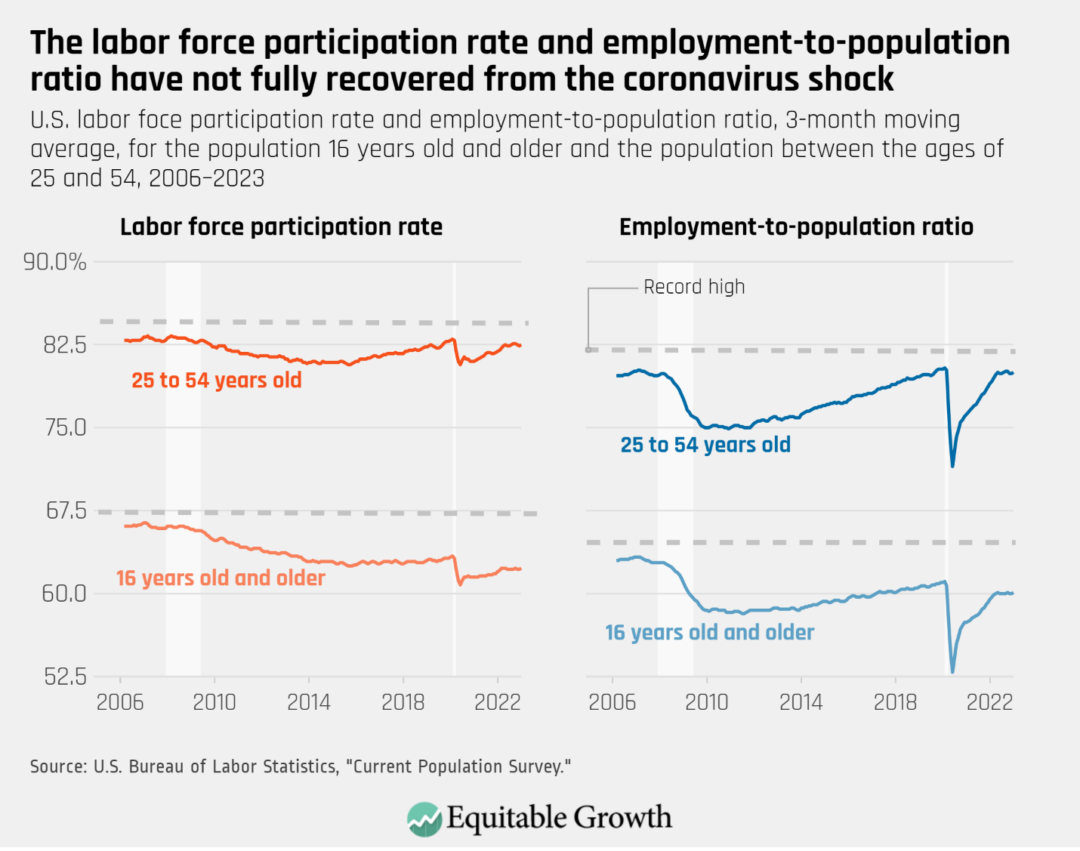

Unemployment Rate Remains Stable

The unemployment rate remained steady in April, holding at [insert actual April unemployment rate]%. This stability, while positive, requires a closer look at the accompanying factors. The labor force participation rate also remained relatively unchanged, indicating a consistent level of engagement in the workforce.

Types of Unemployment:

- Frictional Unemployment: This type of unemployment, representing individuals between jobs, remained relatively low, indicating a healthy job market.

- Structural Unemployment: This long-term unemployment related to skills mismatches showed little change, highlighting the need for ongoing skills training and development initiatives.

- Cyclical Unemployment: Tied directly to economic cycles, this type of unemployment remained low, suggesting a lack of significant economic downturn.

Bullet Points:

- April Unemployment Rate: [Insert Actual Rate]%

- Comparison to previous month: [Increase/Decrease]%

- Comparison to April of last year: [Increase/Decrease]%

- Unemployment rate by demographic group (age, race, gender): [Insert Data if Available]

The stability of the unemployment rate, considering the other economic indicators, suggests a balanced labor market, though the long-term implications need further observation.

Average Hourly Earnings and Wage Growth

Average hourly earnings in April increased by [insert actual percentage] year-over-year. While this represents wage growth, it's crucial to analyze this figure in relation to inflation. Real wage growth (adjusting for inflation) will determine the true purchasing power of these earnings. Slow wage growth in some sectors and rapid wage growth in others highlights the diversity in experience across different worker groups.

Bullet Points:

- Average Hourly Earnings Year-over-Year Change: [Insert Actual Percentage]%

- Real Wage Growth (adjusted for inflation): [Insert Data if Available]%

- Impact on different income levels: [Discuss high vs. low earners]

- Relationship between wage growth and productivity: [Analyze correlation]

The relationship between wage growth and inflation is a key factor influencing consumer spending and, ultimately, economic growth. Sustained real wage growth is essential for boosting consumer confidence and driving economic expansion.

Implications for the Future of the U.S. Economy

The April jobs report offers a mixed bag for the future of the U.S. economy. While steady job growth is positive, the slowing rate of growth coupled with inflation concerns warrants careful consideration. Monetary policy decisions will likely be influenced by these data points, with potential adjustments to interest rates designed to maintain economic stability and control inflation.

Bullet Points:

- Key takeaway: Continued but moderating job growth, stable unemployment.

- Potential risks: Inflation, potential slowdown in economic growth.

- Potential government responses: Monetary policy adjustments, fiscal policy considerations.

Conclusion: Understanding the Latest U.S. Labor Market Report

The April U.S. labor market report demonstrates continued job growth, a stable unemployment rate, and moderate wage growth. While these figures are largely positive, the nuances within the report suggest a need for ongoing monitoring of economic indicators. The interplay between inflation and wage growth remains a key concern, influencing consumer spending and overall economic health. Understanding these dynamics is crucial for both policymakers and individuals navigating the U.S. labor market. Stay tuned for our next analysis of the U.S. labor market and subscribe to receive timely updates on the latest jobs report and unemployment rate.

Featured Posts

-

Stanley Cup Playoffs Us Ratings Dip Despite International Interest

May 04, 2025

Stanley Cup Playoffs Us Ratings Dip Despite International Interest

May 04, 2025 -

Kentucky Derby 151 A Comprehensive Pre Race Guide

May 04, 2025

Kentucky Derby 151 A Comprehensive Pre Race Guide

May 04, 2025 -

Internet Buzz Over Emma Stones Unique Snl Gown The Popcorn Butt Lift Debate

May 04, 2025

Internet Buzz Over Emma Stones Unique Snl Gown The Popcorn Butt Lift Debate

May 04, 2025 -

Lab Owners Guilty Plea In Covid 19 Test Result Fraud Case

May 04, 2025

Lab Owners Guilty Plea In Covid 19 Test Result Fraud Case

May 04, 2025 -

April Employment Situation Summary 177 000 Jobs Added 4 2 Unemployment

May 04, 2025

April Employment Situation Summary 177 000 Jobs Added 4 2 Unemployment

May 04, 2025

Latest Posts

-

Addressing The Westbrook Situation Nuggets Presidents Statement

May 04, 2025

Addressing The Westbrook Situation Nuggets Presidents Statement

May 04, 2025 -

Westbrooks Performance In Nuggets Spurs Game A Look At Fan Reactions

May 04, 2025

Westbrooks Performance In Nuggets Spurs Game A Look At Fan Reactions

May 04, 2025 -

The Buzz Around Westbrook Fan Opinions Following Nuggets Warriors Game

May 04, 2025

The Buzz Around Westbrook Fan Opinions Following Nuggets Warriors Game

May 04, 2025 -

Trae Youngs Historic Performance Leads Hawks To Victory Over Sixers

May 04, 2025

Trae Youngs Historic Performance Leads Hawks To Victory Over Sixers

May 04, 2025 -

Russell Westbrooks Nuggets Debut Fan Reactions From Spurs Game

May 04, 2025

Russell Westbrooks Nuggets Debut Fan Reactions From Spurs Game

May 04, 2025